Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

5 Lessons Learned from the Seller’s Side of a Lifetime-Event Sale

By Quiet Light

If you’re planning to sell a business, you have a thousand questions, and foremost is usually, “what factors will drive the value of my company?”

Our own Mark Daoust has broken down the answer to this complex question into a straightforward model of four pillars upon which every company’s valuation is built:

- Risk

- Growth

- Transferability

- Documentation

Beyond that, most sellers want to know, “what should I expect?” As in, “what am I getting myself into?”

And for some of us, “how do I get out of my own way, so I don’t screw up the deal?”

This week, Joe Valley interviewed serial entrepreneur Ramon Van Meer, who recently exited his growing content site in an eight-figure sale, to get the seller’s perspective on a deal of that magnitude.

Reflecting on the wild ups and downs of the last year, Ramon says he’ll take what he learned from this process and use it going forward.

Which is not surprising… When you hear the road he’s taken to get where he is today, you know he’s the kind of guy with the strength of character to keep moving forward.

Even where others might stop to appreciate their own climb, he’s leaving the ladder up ready to help the next person.

Listen to the Source of this Post:

This blog post is based on a podcast episode that we recently recorded. Listen to the full episode here:- How do you handle multiple offers?

- How do you know if you’re getting the best price, and what if you realize you’re not?

- What happens when the deal hits a major snag?

- And, after a sale like that, what’s next?

Some of his answers may surprise you.

I’ve picked out the five critical lessons Ramon reports learning from the recent sale of his company.

These lessons should help anyone planning to sell a business to better position themselves for a successful deal in the future and perhaps even a life-changing exit.

Here’s what Ramon takes away from this deal that he says will give him a leg up on the next:

Do Your Due Diligence on the Buyer

Know Where the Money Is Coming From

Be Prepared to Manage Expectations and Emotions

Know Your Value and Have the Records to Back it Up

Understand the Basics of an Asset Purchase Agreement

Do Your Due Diligence on the Buyer

With competing offers on the table, as is often the case in this seller’s market, the heat was on Ramon to choose the best opportunity.

One lesson he learned through the experience… Know your buyer.

How likely is the buyer to follow through with the deal?

A false start will cost time, and that delay may cost money.

How well do you work together?

Transferring business ownership takes time as well, and you’ll likely need to work with this individual for many months.

The more you investigate a buyer’s situation and motivation up front, the easier your decision will be.

If you’re planning to sell a business in the near future, it can be helpful to break the large pool of potential buyers into two categories:

- Strategic buyers – These buyers set out to fold your business into a larger overall plan. They may intend to consolidate several businesses in your industry. On the other hand, they may set out to diversify their position by entering a new market or offering a complimentary service.

- Financial buyers – These buyers generally look for profitability and either stability or high-growth potential. They may be individuals or a group of investors. Some may want to keep management on and stay relatively hands-off, while others may be looking for complete involvement in operations.

Either way, the more open the exchange of information between you, the better decision you’ll make, and the better chance you have of closing a deal.

If your business ultimately won’t meet a buyer’s goals, the sooner all parties discover that fact, the more time you’ll save later.

General characteristics to look for in a buyer:

- Experience

- Reputation and business relationships

- Track record of success

- Long-term employees

How will you get to know a potential buyer?

- Phone and/or online meetings

- In-person meetings

- Online profiles

- Company information/financial reports

Your due diligence as a seller will take time and patience, but according to Ramon will certainly pay off in the end.

Know Where the Money Is Coming From

A buyer isn’t the only one looking to reduce risk when it comes to a successful acquisition.

As a seller, you’ll want to reduce the risk of getting into a deal that ultimately never goes through.

Dead deals mean your time and effort lost.

One way to do that? To the best of your ability, follow the money.

Knowing if there are investors involved and who those investors are will help you judge the stability of the situation.

What are the contingencies?

Commercial and SBA loans can be a drawn-out complicated process for the buyer.

Are there family members or partners involved that you should meet?

Know the source of funding for both a down payment and any deferred payments.

Will the buyer depend on revenues for future payments?

Your goal is not to harass potential buyers, but to gain as complete a picture of the financial side of the deal as possible when matching your own situation and goals to the right buyer.

Evaluating the financial status of the buyer comes with the territory when planning to sell a business.

If you offer seller financing, is the collateral sufficient? What are their future plans for your business? Do those plans include an adequate and realistic amount of early working capital?

In Ramon’s case, his eventual buyer took the time to introduce him to investors backing the deal.

This transparency as well as professionalism increased his confidence in that buyer and set his mind at ease even when major setbacks occurred later on.

Be Prepared to Manage Expectations and Emotions

If you’re planning to sell a business, you’ll eventually be called on to manage the expectations of your own employees, investors, and even family members.

And managing emotions, your own as well as others, throughout the inevitable ups and downs of the process can be one of the biggest challenges.

As Joe points out this week, that balancing act is one your broker will often be experienced and adept at handling.

In the case of Ramon’s deal, Joe ended up helping him navigate through two major let downs along the way to a successful and more-profitable-in-the-long-run sale.

When it comes to expectations on both sides should the deal go through, these are some of the issues you may want to explore up front:

- Does the buyer plan to keep on current employees?

- Who are the stakeholders on the buyer side?

- What major changes, if any, does the buyer have planned?

- What are the expectations of the buyer’s investors and the plans to achieve them?

- What involvement is the buyer looking for from you the seller after acquisition?

- Does the buyer understand your biggest goals and concerns from the sale?

- Is the buyer’s current company culture (if any) a fit?

- What is the buyer looking for from the transition?

Again, your goal as the seller, if best-case-scenario you have competing offers, becomes to match the buyer’s goals and strategy with your desired outcome as best as possible.

And to remember that the right fit doesn’t always equate to the highest bid.

Know Your Value and Have the Records to Back it Up

If you hang around us at Quiet Light for long, you may get tired of hearing this…

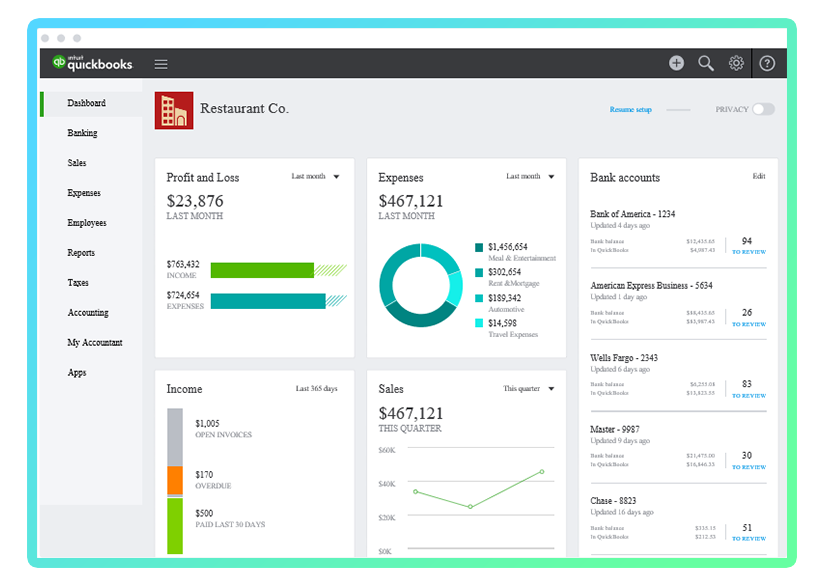

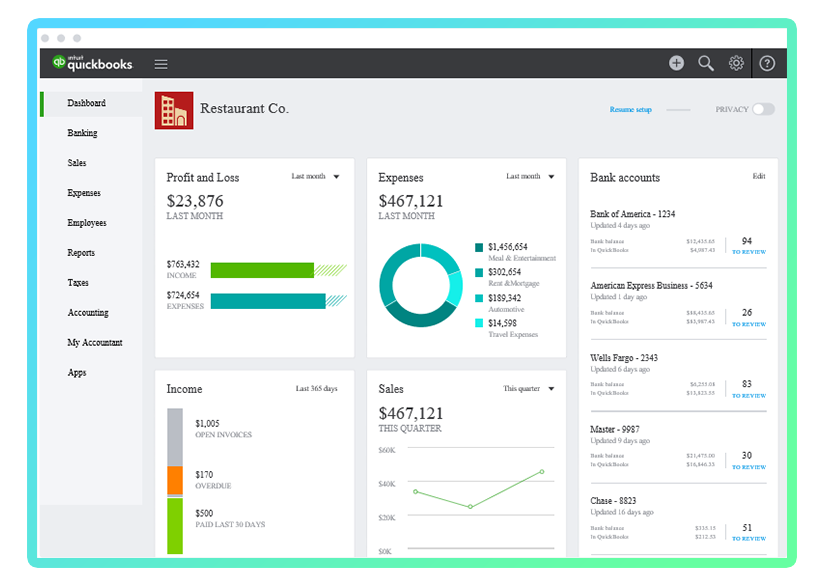

Clean books are essential if you’re planning to sell a business.

As I’ve written about before, your financials will tell the buyer the story of your business.

Ramon advises that you make sure ahead of time that that story is complete and can be easily read by an outsider.

For him, that meant painstaking time spent separating transactions from accounts that combined more than one website.

Going forward, he says, he’s set up separate LLCs for each of his sites so that any future buyer can analyze the numbers thoroughly.

It helps to put yourself in the buyer’s shoes when maintaining your accounts and keeping records.

What trends will they want to look at? How will they want to see expenses broken down?

What major events in your business will they want to analyze more closely?

Which financial reports will help them do that?

As Ramon points out, a lack of clean financials can prevent a deal from going forward altogether.

Investing in the dark is not an advisable strategy, so shedding light on your business’s accurate financial picture will be essential to buyers and their investors.

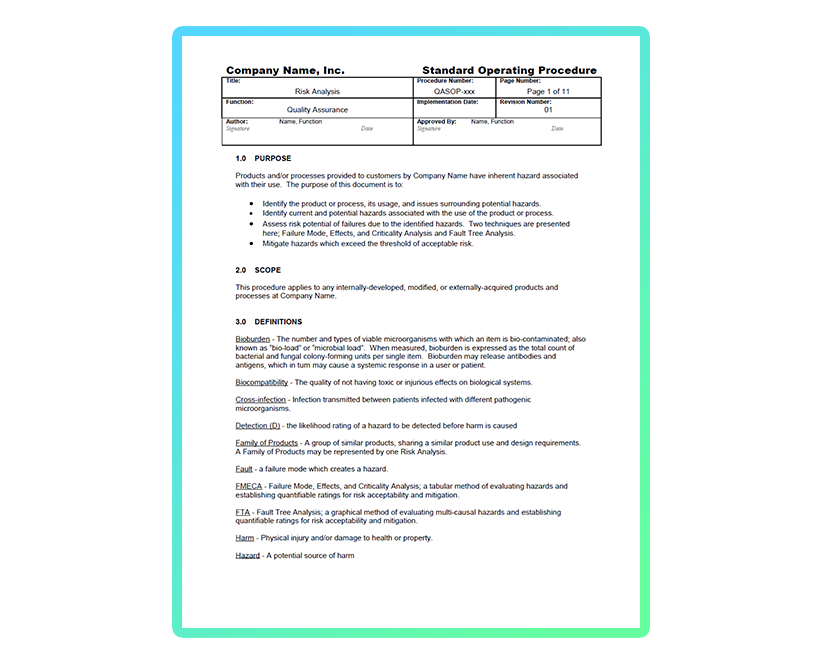

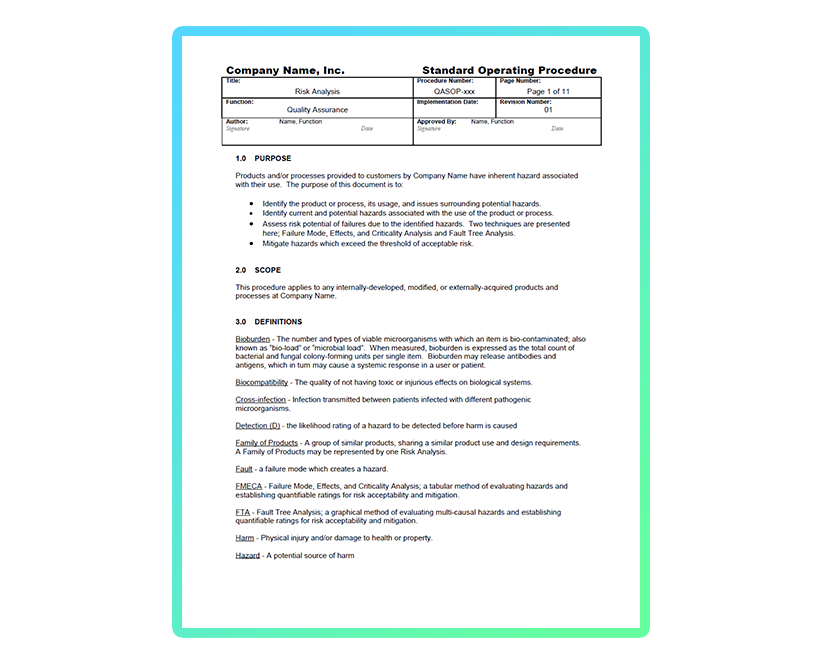

Establishing clear and consistent procedures around your record keeping now will pay off later if you’re planning to sell a business in the future.

In fact, any procedures you can document now may add value in the long run.

Another matter of advanced preparation relates to recognizing the opportunity you have to offer buyers.

In Ramon’s case, the value of his business continued to skyrocket months after he settled on an asking price.

When you’re coming up with that figure, be thorough with your homework.

Some points to consider now if you’re planning to sell in the future:

- Your business’s financial performance as compared to industry benchmarks

- Your business’s position relative to competitors

- Your business’s bargaining power with advertisers or suppliers

And some relevant questions to ask yourself now:

- How diversified is your customer base?

- Your suppliers or advertisers?

- How diversified is your customer acquisition strategy?

- How have recent events in the economy affected your industry?

- Who would be the ideal purchaser of a business like yours?

Understand the Basics of an Asset Purchase Agreement

Ramon makes a great point about the role of attorneys and legal advisors in a deal of that magnitude…your attorney’s job is to protect you, while the buyer’s attorney’s job is to protect them.

The problem arises when this conflict of interest leads to an impasse.

Ramon’s advice is to know as much as possible about an asset purchase agreement, so you’ll know when to be flexible and when to stand firm.

Experience taught him that a certain degree of flexibility is called for.

That doesn’t mean you cave in to impatience and throw caution entirely to the wind, but that you learn to recognize when legal counsel is being overly protective of your interest to the detriment of a profitable deal.

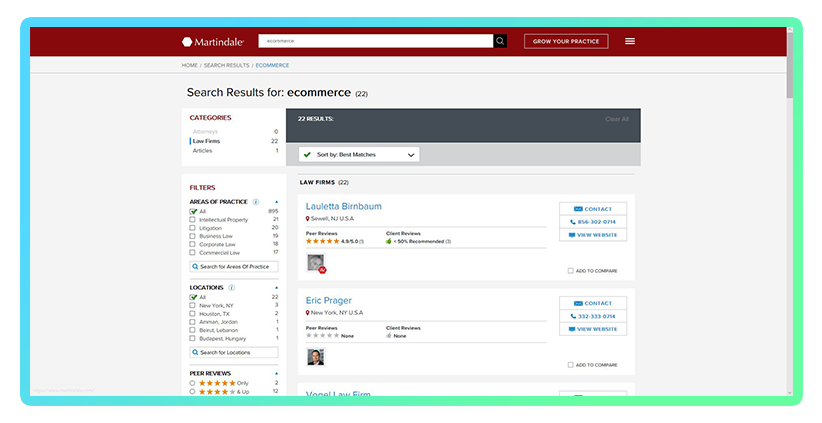

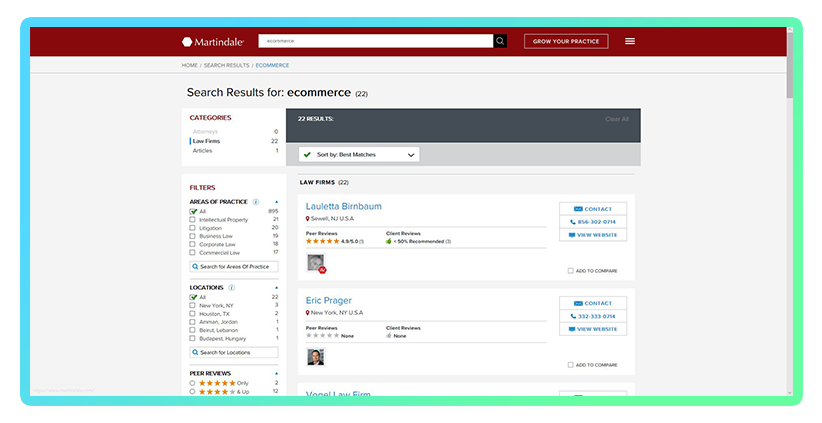

Ramon’s advice in this area is to find an attorney who’s familiar with the sale of businesses, not just in the online space, but in your particular niche as well, whether that’s Saas, ecommerce, or in his case content.

He stressed the importance of familiarizing yourself with an asset purchase agreement ahead of time.

Overall the purpose of this legal document is to:

- Identify all assets being purchased

- Lay out the terms under which the business’s assets are transferred

- Delineate the rights and responsibilities of both the seller and the buyer

You can find examples of website asset purchase agreements online, but the basic elements that such a document will contain normally include the following and more:

List of assets: The agreement will spell out all domains, email lists, trade names, social media and other accounts, content (including videos and podcasts), and inventory included in the sale as well as any relevant assets not included.

Payment terms: This section determines number of payments, amounts, and dates to be paid, to whom and how.

Seller’s obligations: Obligations of the seller such as non-compete agreement, delivery of specific financial documents, revenue payments, debt payments, and everything related to the transfer of the business are detailed here or in separate sections.

Representations and warranties by the seller: Here the seller warrants that the business is in good standing with no pending lawsuits or other threats looming on the horizon, that all assets are owned lien-free, etc. This is where all crucial information about a company is disclosed to the buyer.

Seller’s conditions: This section identifies any contingencies to the sale.

For your protection as a seller, the accuracy of all representations and warranties is critical to you, not just to the buyer.

Most lawyers advise that you do more representing as a seller and less warranting, because representing entails stating facts as you know them at the present, while warranties involve promises about the future and may have certain obligations attached to them.

Clearly, the complexity of this document, and the work cut out for your lawyer, will increase in direct proportion to the size of the deal.

While we tend to associate due diligence with buyers, Ramon’s experience with a lifetime-event sale is a great lesson in due diligence for sellers.

Preparation is key.

Transparency on both sides is key.

And knowing your buyer.

Choosing a buyer whose goals align with your site, and who will be comfortable and reasonable to work with over a period of many months, increases the chances that the deal will close.

Ideally, when it comes time to finalize and sign it, the asset purchase agreement will reflect a fair and balanced approach by both parties.

That way as a seller, the only question you’ll have left to answer will be, “What’s next?”

As we’ve heard on the podcast before, it’s a surprisingly important question.

For his part, after achieving every website owner’s version of the American dream, Ramon Van Meer has plans to help other entrepreneurs do the same.

As his experience proves, the path to a life-changing sale will test what you’re made of.

In Ramon’s case, he passed that test with flying colors, and now we can all benefit from the lessons learned along the way.