Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

Private Equity Might Be Right for Your Exit Strategy: Here’s Why

By Quiet Light

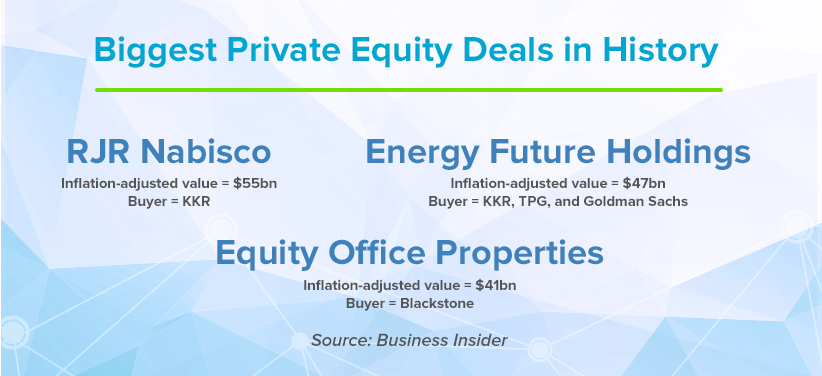

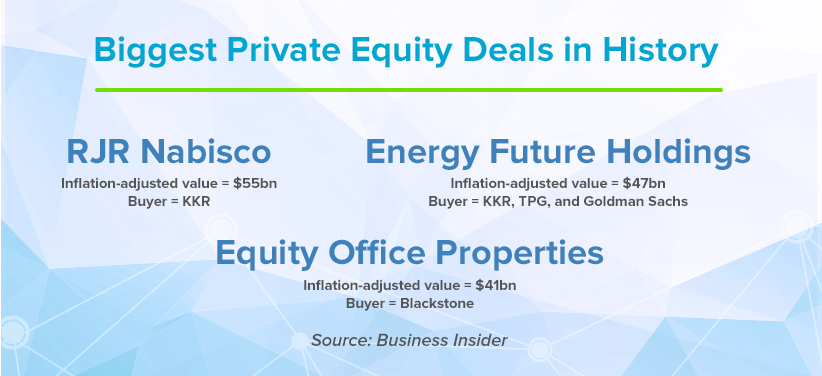

The wild times of buyouts like RJR Nabisco’s in the 80’s may be over, but it’s still an interesting moment in time for private equity investing.

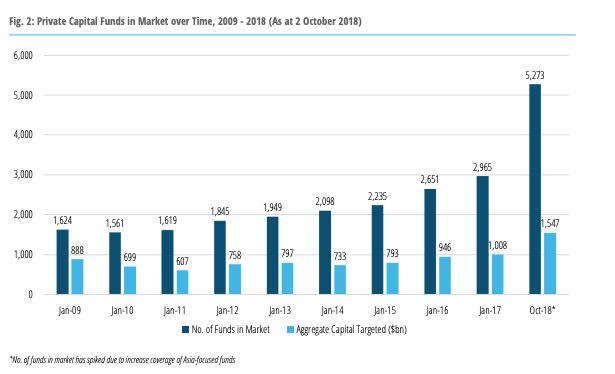

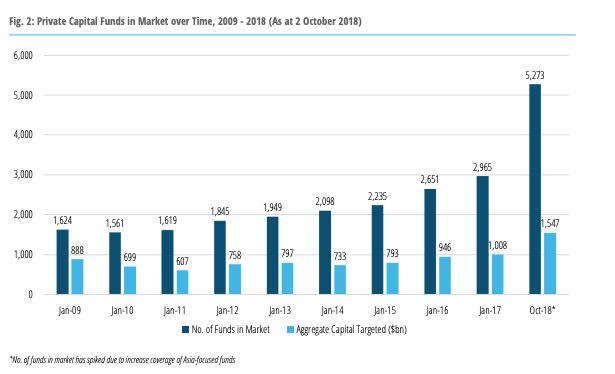

Fund raising of private capital in general has increased at break-neck speed over the last few years.

(Note: Private capital is an umbrella term that includes private equity funds, as well as venture capital and other private investments.)

Although we saw a bit of a slow down in 2018, we also saw 11 of the top 100 largest ever private capital funds close this year.

With the overall uncertainty in the markets right now, private investments have great appeal.

Listen to the Source of this Post:

This blog post is based on a podcast episode that we recently recorded. Listen to the full episode here:But, at the same time, that huge influx of capital tends to drive deal prices up and dampen the expected performance a bit.

In private equity in particular, the number of funds, as well as capital raised, seems to keep growing.

According to the research firm Preqin, there are currently 3,922 private equity funds in the market seeking a total of $956bn globally.

It’s a lot of dough.

Andy Jones from Private Equity Info explains the boom this way:

“There are a couple of macro-economic factors that are happening that are making this a sort of sustained seller market… Money’s cheap right now…but consequently those people with money are looking for where they can get a better return on their capital…so they’re looking at the alternative assets space.”

He goes on to say that the major influx of businesses into the market due to Baby Boomers retiring hasn’t actually happened, at least not at the expected rate…

Therefore, “On the one hand you have money trying to chase deals, and on the other hand you have fewer deals. That’s what’s creating this sustained seller’s market where valuations are high.”

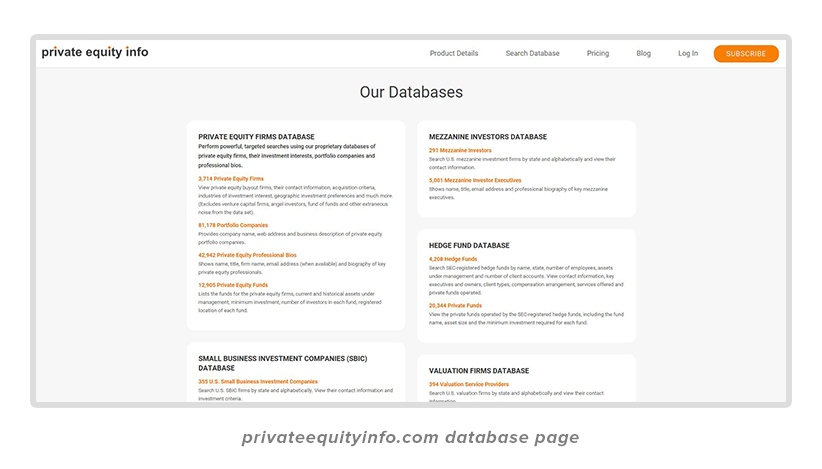

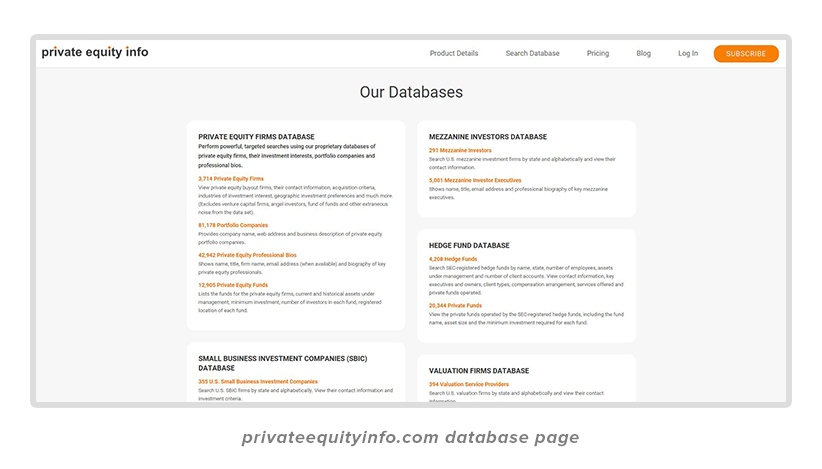

Andy started privateequityinfo.com, an M & A research database, fourteen years ago combining his engineering and investment banking backgrounds into one Austin-based company.

This week with his help, I set out to answer two questions:

As a business owner planning for a future exit, should Private Equity be on your radar?

And if so, what do you need to know?

Let’s tap into Andy’s vast knowledge to find out, and along the way, we’ll take a look at what the 2018 trends he’s seeing in private equity have to tell us about this current seller’s market.

In this post:

What is a Private Equity firm?

Is a PE firm the right buyer for your company?

How do you find the right firms?

How PE firms create value where you can’t

What is a Private Equity firm?

For our purposes, a private equity firm is an investment firm that raises capital and then invests that capital by purchasing equity in existing companies.

The firm then seeks to produce a return on investment over the next 5-10 years in several ways:

- Growth – Growing revenues

- Profitability – Increasing margins

- Value – Increasing multiples

Firms can typically accomplish all three by infusing cash, institutionalizing operations, and taking advantage of economies of scale.

Apparently, they can also avail themselves of certain tax advantages through an often-aggressive use of debt.

And they do all this at speed.

Are the returns for investors really that much better than the stock market at the end of the day?

It turns out the answer to that is entirely complicated.

These firms create value primarily by treating the companies in their portfolio as investment vehicles (think spreadsheets), not pet projects or a lifetime of blood, sweat, and tears.

In a Harvard Business Review article from many years ago, Felix Barber and Michael Goold made the point that, “the fundamental reason behind private equity’s growth and high rates of return is something that has received little attention, perhaps because it’s so obvious: the firms’ standard practice of buying businesses and then, after steering them through a transition of rapid performance improvement, selling them.”

In other words, PE firms never take their eyes off the prize – a fast exit. They can’t afford to.

This bit of truth brings up some interesting questions…

Does private equity have the long-term interest of a company in mind when making decisions or changes?

That’s debatable. Many say no and have history to back them up, but it does stand to reason that a stronger company should make for a more valuable exit.

Are short-term profits the goal?

Definitely.

If you look to retain equity as part of the deal with a PE firm, will the transition go smoothly?

It seems to me that would mostly depend on whether or not your goals for the company align with theirs.

According to Andy, if your goal, in that case, is a second profitable exit in just a few years, that could work out nicely.

And finally, does any of this set a PE firm apart from any other buyer of your business? Not necessarily.

Is a PE firm the right buyer for your company?

I’m guessing most of our readers aren’t at risk of a hostile takeover, but if you’re looking for an exit, a private equity firm could turn out to be the right buyer.

And if you have a company in major growth mode, considering the number of funds out there, you’re probably already getting emails.

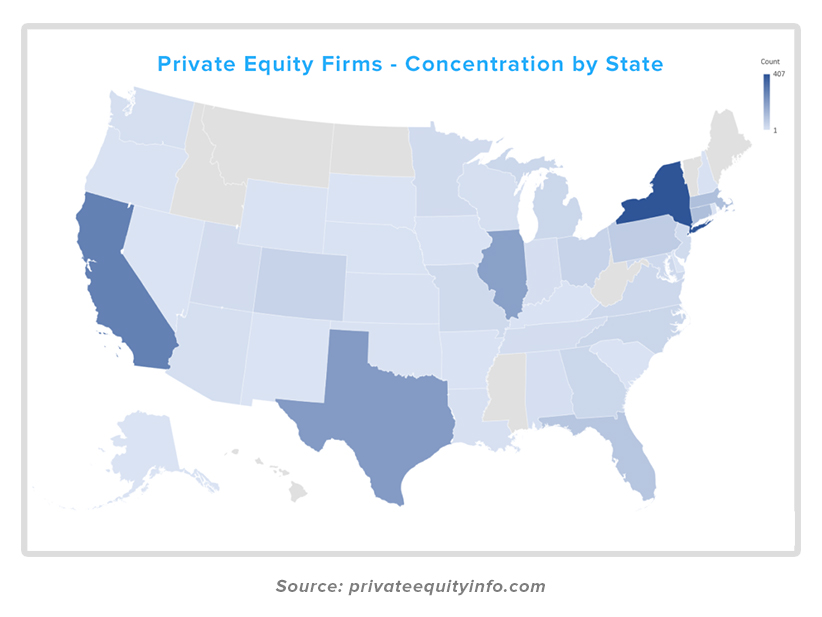

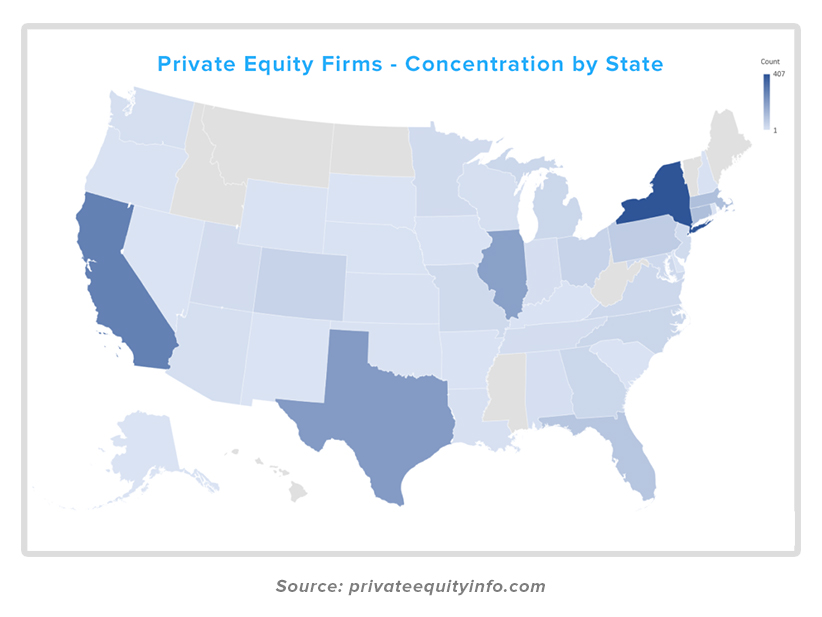

One thing to be aware of, according to Andy is that there are a huge number of firms out there ranging in size from the seven figures to the billions.

And that includes firms who specialize in every industry.

Most upper-middle-market firms are looking to acquire companies with a $10-25MM EBITDA (Earnings before Interest, Taxes, Depreciation, and Amortization).

However, firms do exist who look to acquire companies in the $1-5MM range.

To understand the size requirements of private equity firms, Andy explains, as well as to answer the question of whether or not your company would be a contender, consider that the firms exist to deploy funds.

And to generate ROI with those funds relatively quickly. Smaller deals just don’t make sense for the most part.

If your company is in the $1-5MM range, you’d be considered primarily as an add-on deal.

This means a firm has already invested in a large “platform” company in your industry, and now looks to “bolt on” similar smaller companies to streamline operations, take advantage of economies of scale, and expand multiples.

How do you find the right firms?

The best way to find the firms in the market for a business like yours is to look for those firms who’ve already make a platform investment in your industry.

Once you find firms who’ve done deals involving larger companies that are very similar to your own, you’re on to something.

These firms have great incentive to consider your company as an add-on.

Databases like Andy’s allow you to perform keyword searches and make it much easier to find the firms you may want to keep on your radar.

Even if you’re not planning for an exit in the near future, it’s a great strategy to keep up with that kind of information, stay informed, and build your knowledge of the market for businesses like yours.

Later on, the more information you have going into a deal, the better.

Besides the more typical PE firms with funds usually in the hundreds of millions, another type of firm to be aware of is what Mark Daoust calls “micro-funds.”

These firms have funds to deploy in the $10-20MM range. According to Andy, they’re usually looking to buy only one or two companies, so databases like Private Equity Info don’t track them.

What PE firms look for

If you’re planning for an exit in the future, with so much money currently waiting around, and valuations higher than ever, the future may be now.

It helps to know what type of deal these firms are searching for, aside from the size of the target acquisition.

One of the things that makes a company more appealing to a PE firm, Andy explains, is a seller who’s not looking to cash out completely but wants to stay on and retain a minority stake of usually 10-20%.

A strong management team in place willing to stay on in a profitable company, can make the firm’s job that much easier.

Andy puts it this way:

“If they’re interested in your company because of its industry, its size, its growth trajectory and its promise going forward, they want that management to stay on, and they want them properly incentivized and aligned.”

Sounds promising.

He goes on to explain that this type of arrangement gives you two exits…

One when you exit the majority of your ownership and your business is acquired, and then a second when the firm exits down the road and you cash out on the remainder of your stake.

After the private equity firm has built value into the company and expanded multiples, your second exit can be as lucrative or even more lucrative than the first.

The firm will take what you built and combine it with their resources to create sometimes massive value that didn’t exist before. (see the free money point below)

Even if the years in between might be fast and furious, considering ways to structure the deal which allow you to share in that value sounds like smart business to me.

What do these firms like to see in a company overall?

- Stable cash flow

- Strong track record of growth

- Scalability

How PE firms create value where you can’t

Andy points out that a private equity firm just isn’t under the same restrictions and limitations that a typical business owner has built in.

Growth tends to eat cash, and that cash has to come from somewhere.

PE firms will infuse that capital, but they can also afford to take more risk with it.

A single company will be folded into a larger and diversified portfolio of investments once acquired, and no private equity firm will have all its funds tied up in one place the way founders often do.

The stakes are actually lower for the firm in that sense, and with that comes the freedom to take risks that founders may not be willing to take.

Andy points out that the growth you can attain as an owner, and therefore the value you can build, is mathematically limited.

A PE firm has the money to remove those limits, but they also have an entirely different mentality and set of capacities from the get-go.

As I mentioned earlier, they can’t afford to take their eye off the prize…

They’re under a strict time limitation that most founders are not.

And they have strict efficiency goals.

Plus they have access to free money by virtue of folding your company into a bigger balance sheet.

How so?

As Andy explains, multiples at the time of valuation increase substantially as the sizes of companies increase.

A $50MM company will trade at a much higher multiple than a $1MM company will.

Therefore, even without changing a single thing, once PE firms employ the bolt-on strategy and add a smaller company to a comparable larger one, the value of that smaller company automatically increases.

Boom – free money.

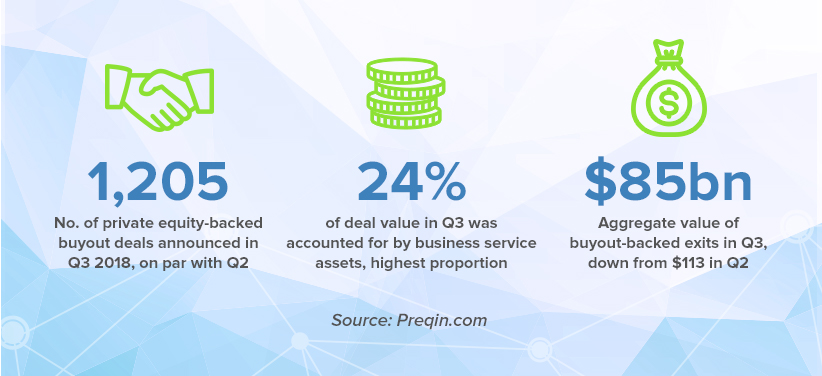

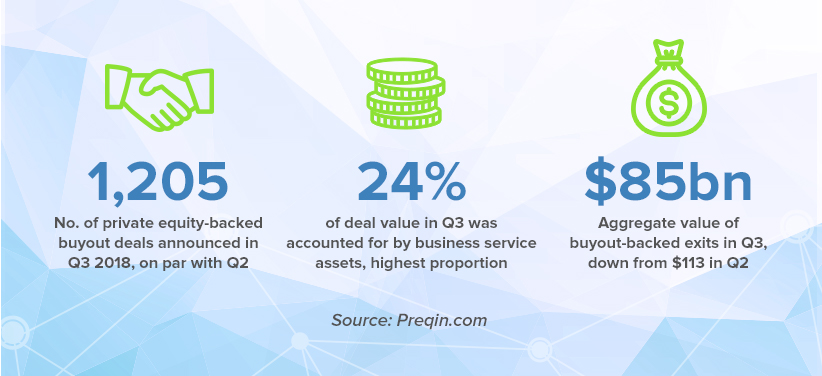

2018 Private Equity Trends

Andy’s site privateequityinfo.com is full of interesting data analysis, but one of the metrics that he sees as and an indicator of what’s happening in the market right now is the average holding period.

With PE firms, the goal is to exit relatively quickly and see a healthy ROI in a short time.

That’s exactly what makes it a risky investment with the potential for high yield. 3-7 years is the typical target time frame.

At Private Equity Info, they look at that metric every six months and compare the data.

Right now that median holding period sits at 4.8 years. That means the companies exited during 2018 were held for just under 5 years.

When times are sluggish, the average holding period is longer.

When the market is going at full throttle, companies are held for less time. During previous boom times in 2000 and in 2008 (before the crisis), that median holding period was 3.0 and 3.5 years respectively.

Andy says that holding periods of 4 years or less are, “indicators of exuberance in the market.”

And that he sees that 4.8 figure continuing to decline.

It makes sense. Interest rates are down. PE firms have more and larger funds than ever.

Buyers have money to invest and they’re looking to alternative assets for a higher rate of return.

What does it all mean?

It means valuations are high right now, and of course, that won’t last forever.

Knowledge is power, and Private Equity for sellers is a viable option worth careful consideration.

With risk often comes reward, and PE firms have the ability to leverage risk to create massive value.

If you can partner with them and you have the stomach for it, it can pay off.