Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

These Financial Metrics are Critical When Valuing a Business

By Quiet Light

When records are well kept, every decision a business owner makes is quantified and etched permanently into its financials.

Learn to read those financials properly, and you can trace the story of a business not only back through its past but also forward into the future.

If you’re planning to sell a business, what story do your financials tell? And has anything been left out?

And if you’re a buyer, how do you spot a business whose financials tell the right story of a profitable investment?

To answer those questions, let’s take a look at some of the key financial metrics that make up that story, what they tell you about the financial health of a business, and how to use them to evaluate your own or another business as an investment.

First, Why Clean Financials Matter

What the Past Tells You About the Future: Trend Analysis

The Story of Profitability

Expense Analysis: The Devil in the Detail

Cash Flow is Not the Whole Story

The Story of Opportunity

Listen to the Source of this Post:

This blog post is based on a podcast episode that we recently recorded. Listen to the full episode here:

Why Clean Financials Matter

Clean financials sound nice. But what are they exactly?

Back to our story analogy: Clean financials present a story which is crystal clear and easy to read.

Business and personal accounts stay separate.

And while separate books are good, separate tax ID’s are even better.

Ideally, financials show enough detail both for the business owner/team to make sound decisions and for an outsider to evaluate the business as an investment.

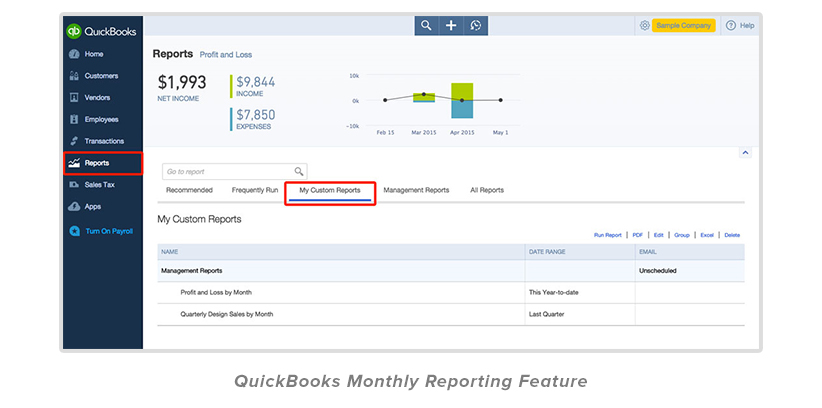

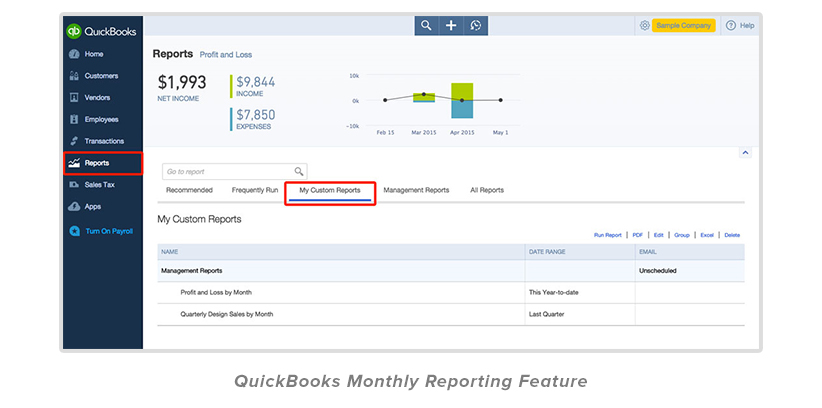

That means numbers are kept accurate, and reports are available in as close to real time as possible. For some businesses and areas within a business that means monthly, but for others it may be as often as daily.

When you don’t have clean financials, you sacrifice the trust and confidence of any potential buyers and make the story of your business difficult to impossible to read.

To put it simply…

Avoid this:

- Entering guestimates into your records in place of specific numbers.

- Getting months behind in reporting.

- Lumping expenses together into too-broad categories. (the more specific you get, the better.)

Do at least this:

- Keep separate records for the business with consistent reporting over time.

- Track revenue with expenses.

- Establish clear procedures around record keeping and financial controls.

This is ideal:

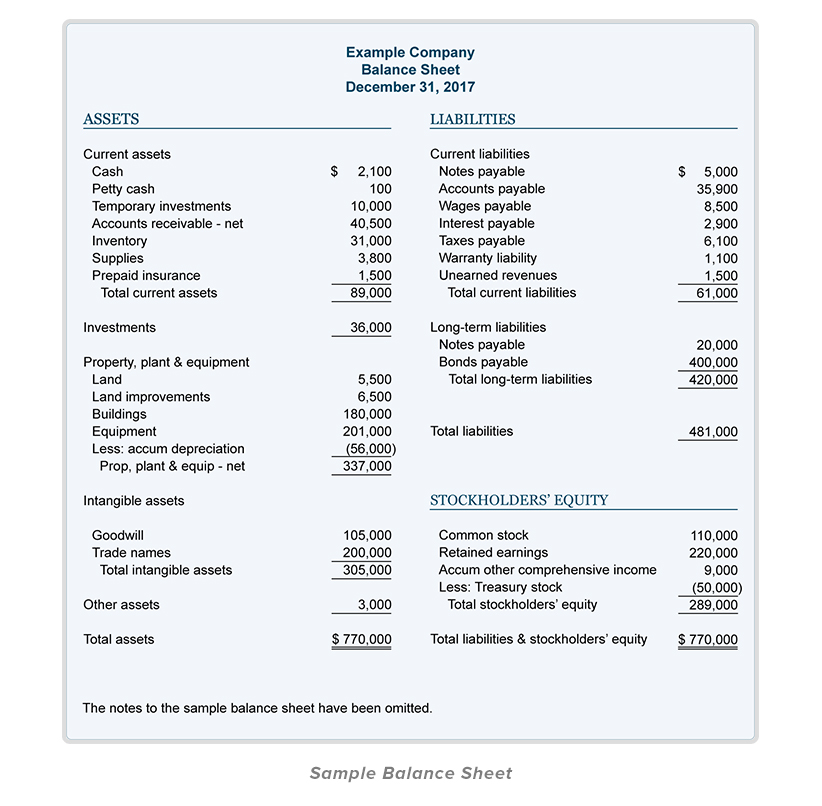

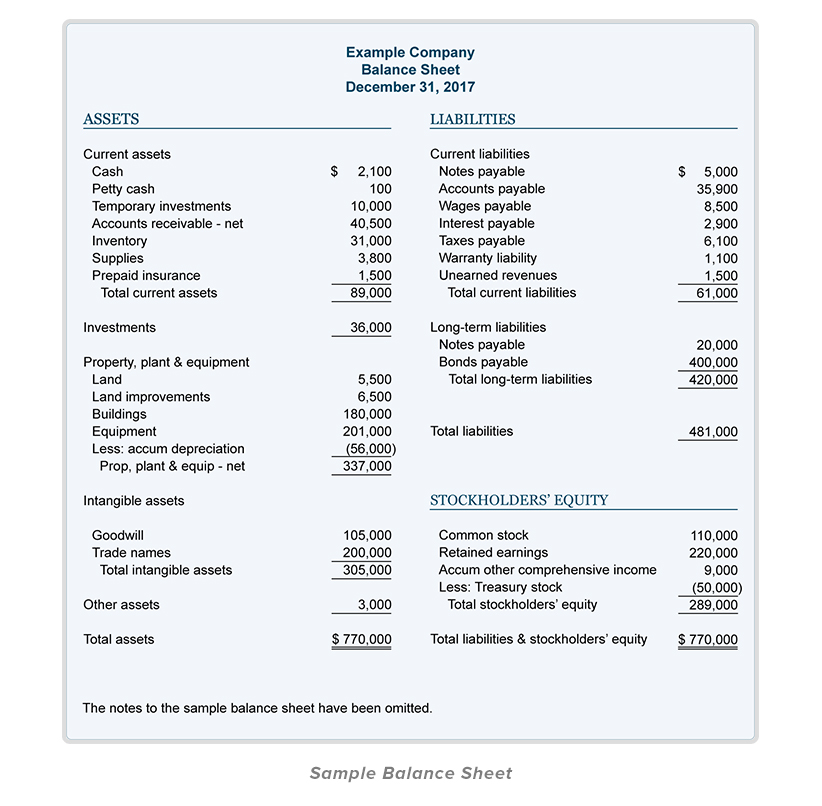

- Have monthly income statements, balance sheets, and cash flow statements available.

- Have established Key Performance Indicators (KPIs) for different areas of your business.

- Update and track performance against these relevant KPI’s.

In the event of an acquisition, the more transparent you can be about your business, the more faith the buyer will have in it and the smoother the process will go.

Clean financials facilitate conversations around the value of your business.

Remember that buyers will always want proof, and that proof is in the numbers.

Before making the investment, they need to be able to read the story of your business in such a detailed way that they can imagine themselves running it.

What the Past Tells You About the Future: Trend Analysis

Financial metrics are numbers that you can influence by making changes to business processes.

As such, they help you evaluate the potential of a business in these areas:

- Revenue

- Profitability

- Risk

Whether you’re growing a business or looking to acquire one, the question must be answered: Where is this business headed?

The trends found in your revenue data can help answer that question.

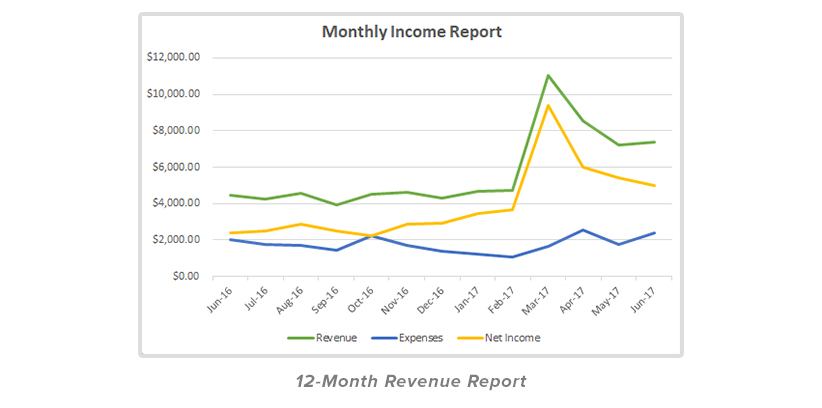

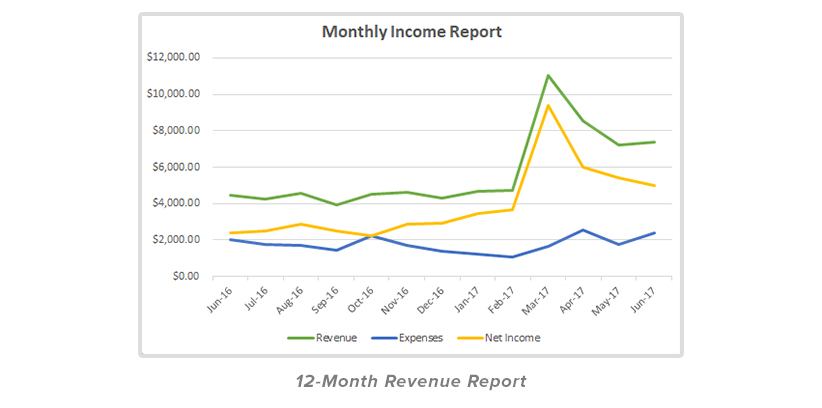

One glance at any business’s revenue over the last 12 months, and you’re probably engaging in trend analysis instantly.

Are sales up or down?

If sales are down consistently from one month to the next, it seems reasonable to assume this business may be headed for trouble.

That’s a quick and simple month-over-month analysis.

But a more detailed analysis will tell you a more thorough and much more interesting story than that.

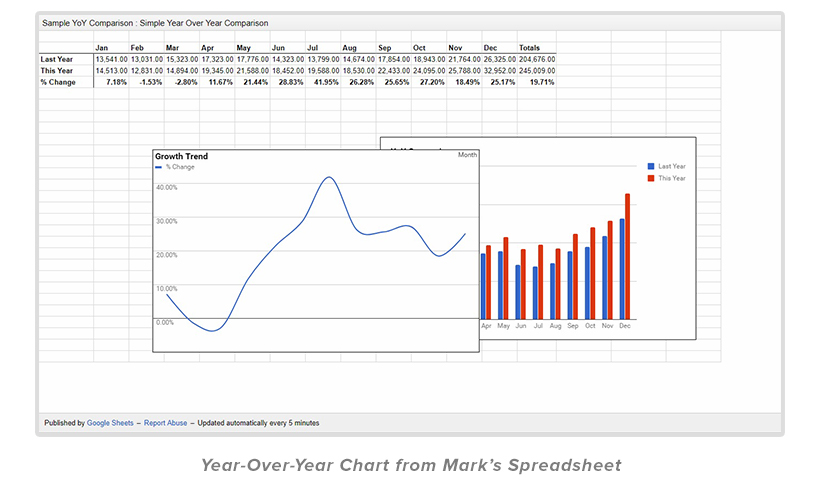

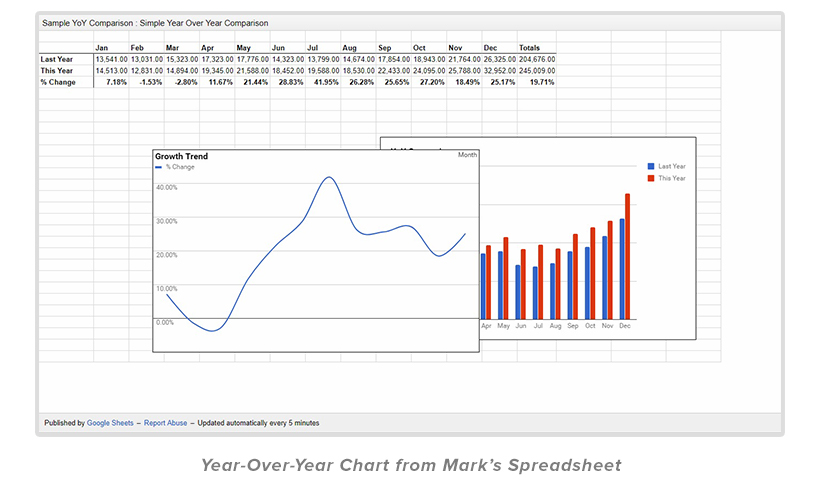

A year-over-year comparison will:

- Show the presence or absence of seasonality of your sales.

- Compare one year’s performance to the next.

- Allow you to measure the percent change in growth from one year to the next.

While the month-to-month analysis gives you a quick snapshot of a business, the year-over-year analysis gives you a more complete picture.

With a month-to-month analysis you’re making assumptions.

With the more detailed analysis, you’re getting closer to the truth.

While the numbers alone don’t tell you the whole story, they help you uncover the right questions to ask.

That’s the goal with any financial metrics.

Some questions that might come up when you look at the percentage growth in sales over time:

- While this business shows sales growth this year, why are revenues increasing at a slower pace than last year (the percent growth is decreasing)?

- Or, while revenues have increased, why has the percentage growth stayed flat?

To visualize business metrics like this, you can keep it simple with Excel or Google sheets (see Mark’s template here), or get a little more advanced with data visualization software like Grow, Tableau, or ClicData.

The Story of Profitability

While revenue metrics relate to sales, profitability metrics relate to the efficiency of your business model and processes.

Why is monthly recurring revenue (MRR) such a beautiful thing? Because it’s more efficient; it’s revenue that doesn’t require ad spend.

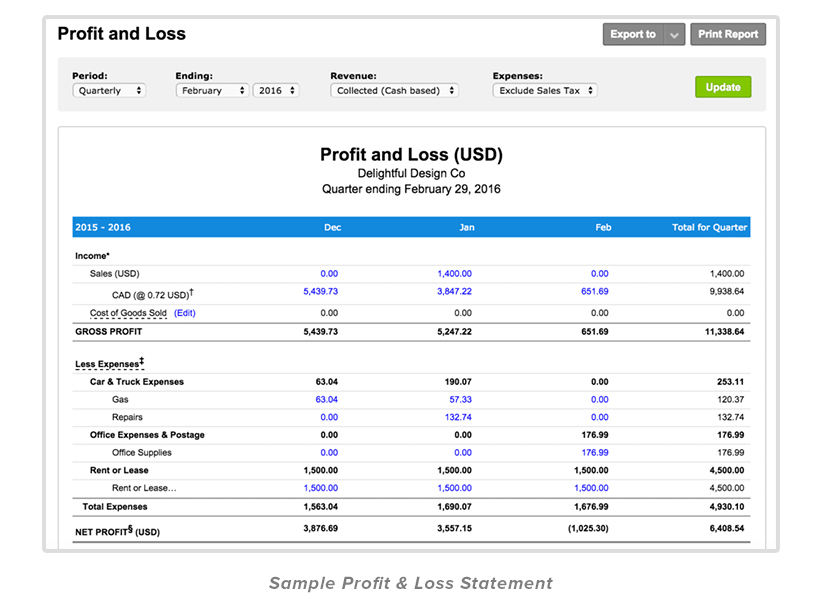

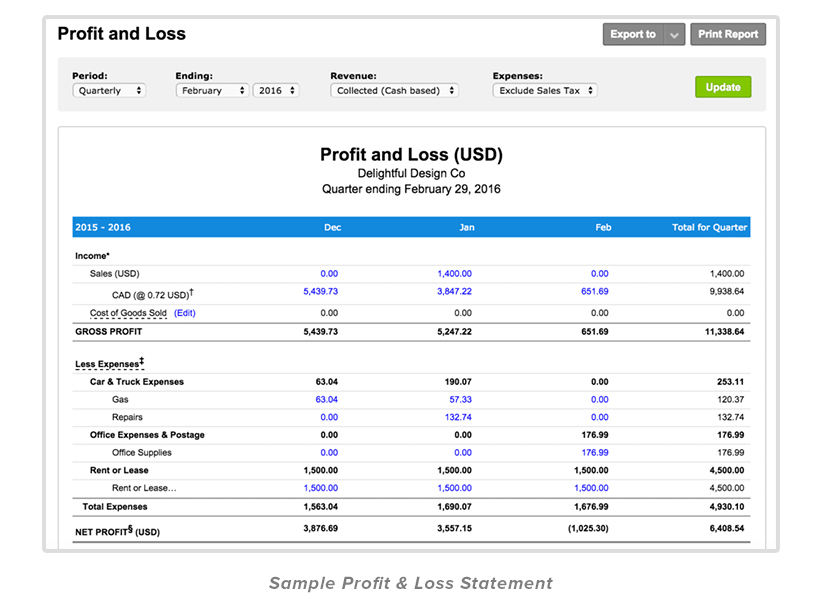

Take a look at this basic Profit & Loss statement (P&L).

One critical metric found here is the Gross Profit Margin.

While Gross Profit = Revenue – COGS (Cost of Goods Sold),

Gross Profit Margin = Gross Profit/Revenue.

Your Gross Profit Margin tells you how much profit you make on each dollar earned before expenses.

While it’s not a true indicator of profit (Net Profit Margin is), it tells you a lot when evaluating the value of a business and helps you ask the right questions:

- How do this company’s margins compare to industry averages?

- Is the pricing strategy sound?

- How is the profitability of this industry holding up over time?

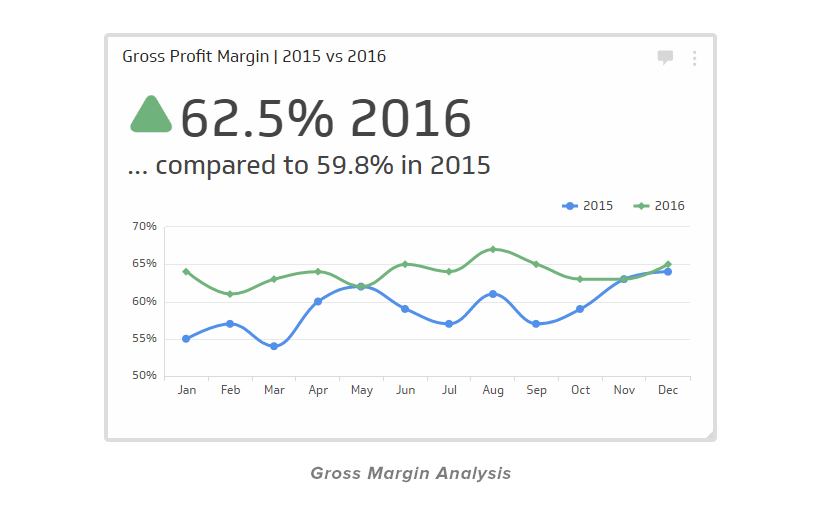

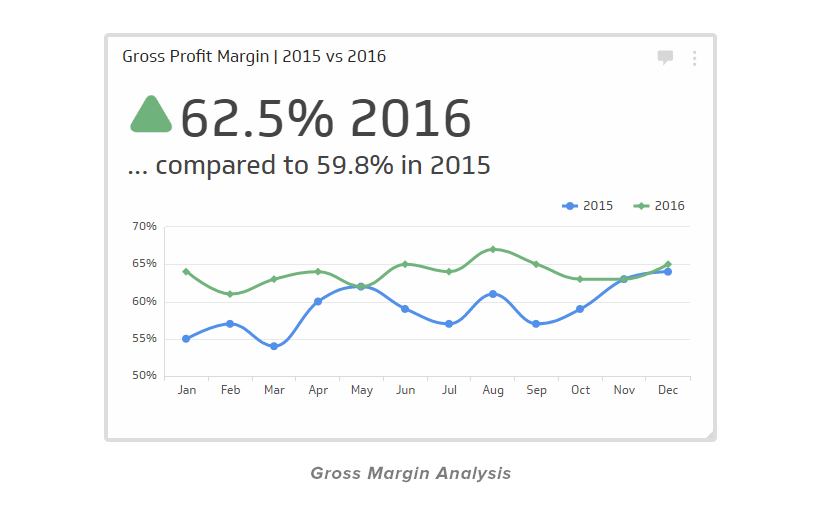

Another revealing analysis: plot the monthly profit margins over time as with revenue above, compare them year-over-year, and look for trends.

Are the margins holding steady? Again, this type of comparison can lead you to ask the right questions, either of yourself as a business owner if you’re growing your business or of a seller if you’re acquiring one.

Very tight gross margins (under 20% for instance) bring risk, as they’ll leave you with less working capital to cover unexpected expenses or manage growth.

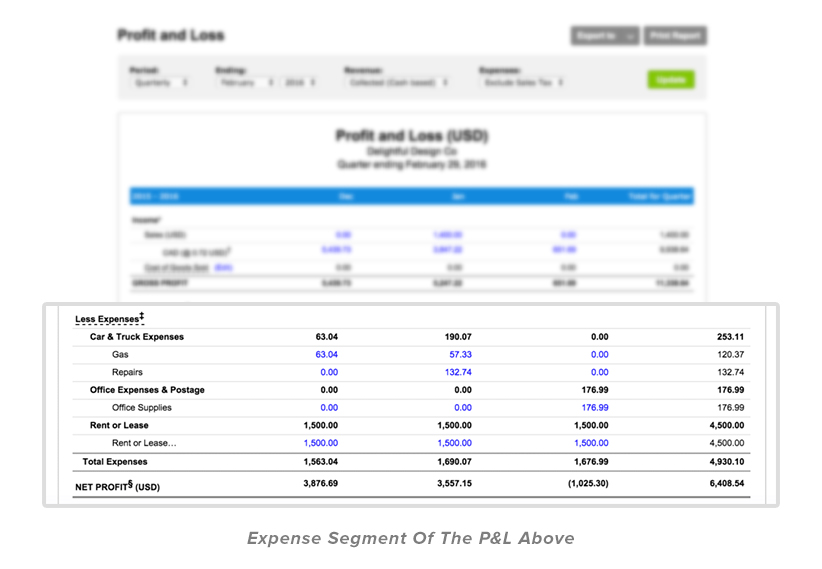

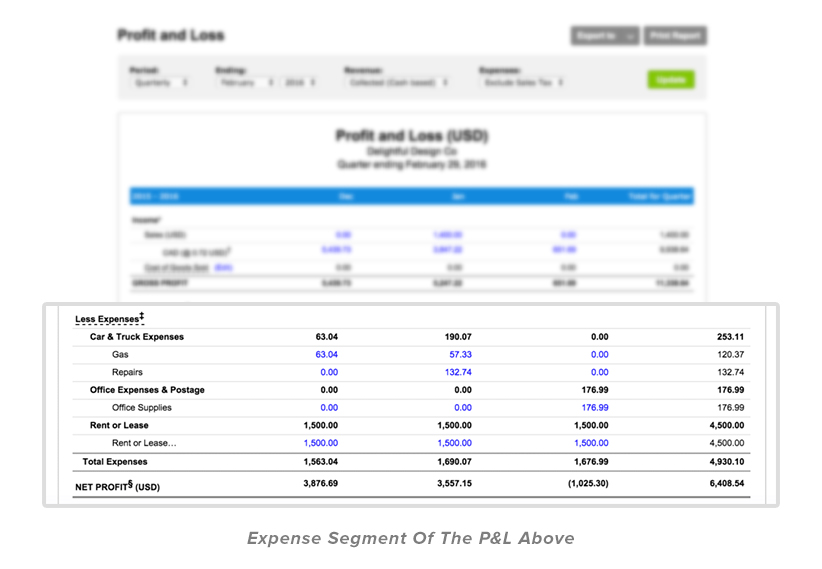

Expense Analysis: The Devil in the Detail

Moving down the income statement, it’s a good idea to look at expenses at the most granular level of detail.

Taking an expense category such as advertising at face value is a terrible idea.

What are the ad channels and how do the expenses for each channel break down percentage-wise?

Is ad spend heavily weighted in one channel? That could indicate an opportunity to expand, or it might raise a red flag.

Your operating margin takes into account expenses beyond COGS. Operating margin = Operating Profit/Revenue.

The number alone, however, is not as useful as the number compared to your industry norms.

A company with lower operating margins than its competition points out more questions that need to be asked:

- Is money being wasted on advertising that’s not bringing sales?

- Have sales slowed so that they’re no longer keeping up with expenses?

Drilling down to look at operating margins at the product level will reveal more information about a company’s pricing and sales strategy.

Cash Flow is Not the Whole Story

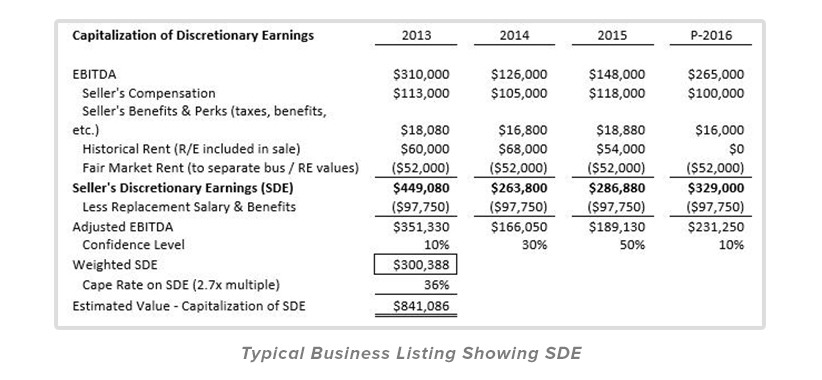

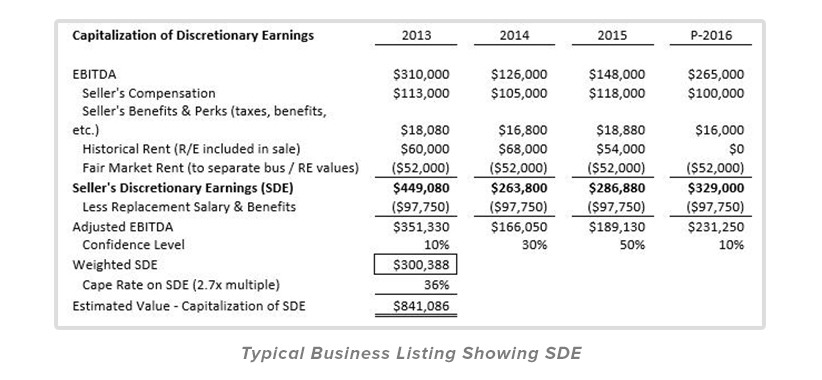

While Seller’s Discretionary Earnings (SDE) are important, the number alone means very little.

Again, you must drill down to the details and allow the business financials to tell you what questions to ask.

As a seller, it’s important again to recognize the danger of keeping incomplete records that won’t allow the buyer to do just that.

From a buyer’s perspective, if a seller cuts expenses in the months leading up to putting a business up for sale, SDE goes up. But at what cost to the overall health of the business?

Looking closely at the P&L and performing trend analysis points you in the right direction as a buyer.

As a seller, having accurate and detailed numbers that tell the complete story will better position your business and showcase its value to the buyer in a way that engenders trust.

Which brings us to Risk Metrics.

Risk Metrics help you recognize and reduce the dangers that lie ahead in any business.

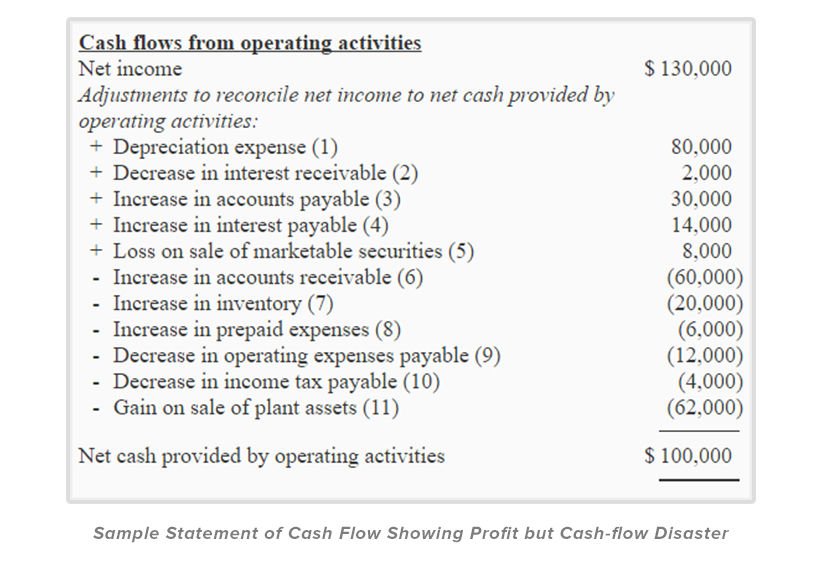

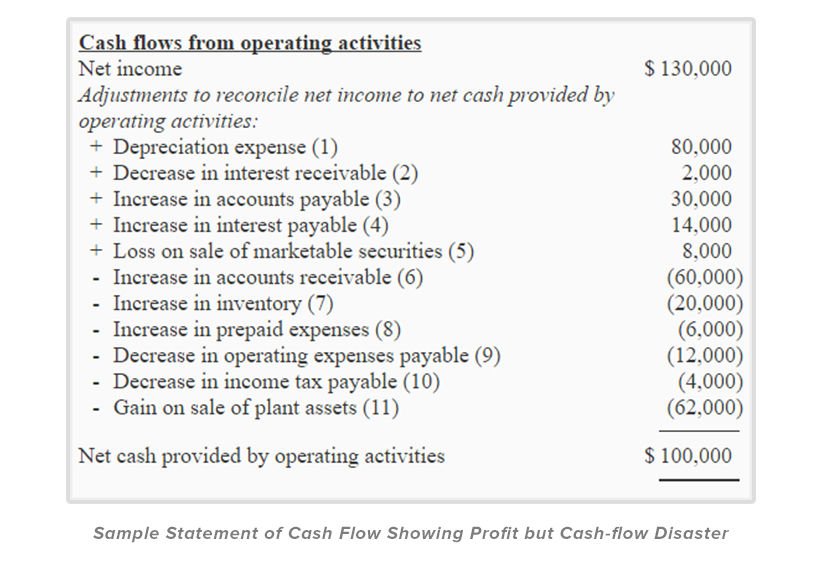

Net Cash Out is another useful trend to look at over time: Is the company gaining or losing cash overall?

Highly profitable companies have died due to lack of cash.

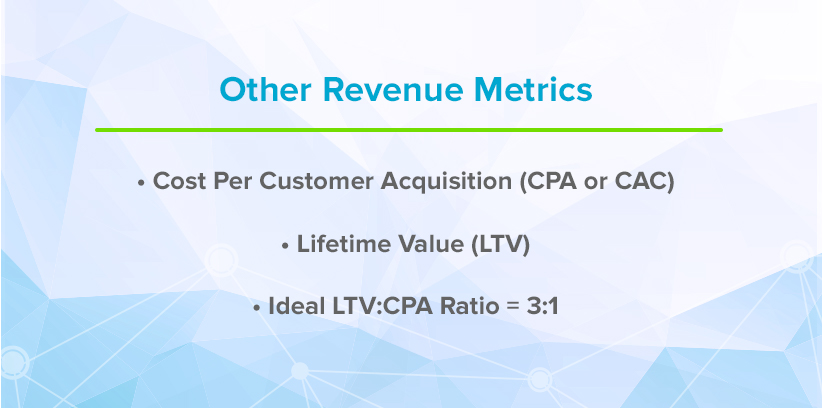

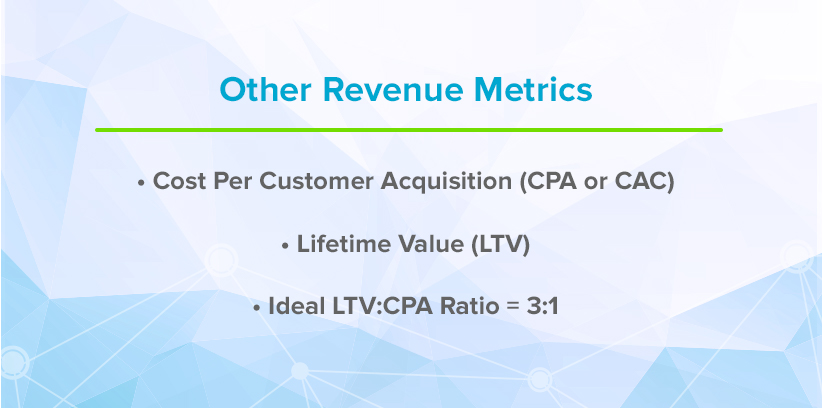

For businesses with a subscription model, like many SaaS companies, a critical risk metric to look at is Churn Rate.

Churn Rate is the rate at which new subscribers fall off within a year (or less depending on the business model).

While long term recurring revenue customers mean a company isn’t dependent on new conversions which lowers risk, a high churn rate can be a problem.

A high churn rate indicates a risk that the pool of new customers may be shrinking and will eventually dry up.

Again, look at the trends.

If that churn rate is trending up, it will become harder to maintain revenue growth or hold steady. That’s critical information to have.

The Story of Opportunity

While as a business owner/seller it may seem counterintuitive to be transparent about inherent risk or past setbacks when presenting your business as an investment, one of the key takeaways from the podcast this week should be – the more transparent you can be the better.

At the end of the day, financials are just information.

Buyers come to the table with different motivations.

Some may be looking for stable profits that won’t eat up cash, while others may be looking to capitalize on a massive growth opportunity with an influx of cash.

By presenting the full story of your business as it is with accurate and specific numbers, you can attract the right buyer who’s ready to take off and run with it.

If you’re a buyer, there’s often a great deal of opportunity hidden in those numbers if you know where to look.

Are there untapped sales channels?

Is there useless ad spend that will likely bring enormous ROI when applied to a better channel?

Are there better more highly-targeted audiences?

As Mark and Joe pointed out in the podcast this week, drilling down to individual SKUs can also reveal massive potential that may not be reflected in the asking price.

An important consideration is whether revenue tracks with expenses or not. Remember this distinction in accounting methods as it can be major:

- Cash method: Revenue and expenses are recorded when they’re actually received.

- Accrual method: Revenue and expenses are recorded when the transaction occurs (this requires tracking accounts receivable and accounts payable).

Books kept on a cash basis can harbor hidden profits.

Other common areas of opportunity?

- Better manage inventory

- Reduce marketing expenses through better targeting

- Adjust the pricing strategy

- Set up systems to respond to real-time data

Business will always be a numbers game.

Those who most closely analyze the numbers and drill down to the details win — because they spot the opportunities as they arise.

But don’t miss this key step when it comes to analysis – you have to be ready to act on the results.

Your financial metrics are of little use if you don’t make changes to your business processes that accomplish these three things:

- Grow revenues

- Increase profitability

- Decrease and manage risk

This may seem daunting, but here’s a simple challenge: Choose one area of your business today and decide to track the numbers more closely. After 30 days drill down into the details and see what opportunities you can find there.