Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

6 Mistakes to Avoid During Website Valuation

By Bryan O'Neil

This could be either because they want more money or because they genuinely feel their website deserves more love than they think it is getting.

Mike Handelsman noted this in his list of 10 mistakes people make when selling their business:

Far too many sellers go into the selling process with the confidence that they will get top dollar for their business simply because they believe that is what it’s worth. In the real world, valuation is based on quantifiable criteria, not the owner’s personal estimation of worth.

There is a lot of misinformation about how to correctly value an online business. So today, we’re going to take a look at the common errors made during the valuation process, and how we can avoid them in the future.

Error Number 1 : Looking At Historical (As Opposed To Current) Earnings

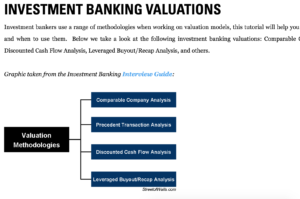

There are many different types of valuation methods used when selling a business. In the traditional business brokerage world, valuation methods are broken up into four types of valuations: comparable company analysis, precedent transaction analysis, discount cash flow analysis, and leverage buyout/recap analysis.

The website brokerage industry mostly relies on a blend of the first three types of analysis and refers to this approach as the “earnings multiplier approach”. The key to this approach is calculating the seller discretionary earnings (referred to as “SDE”) of a business for the previous 12 months.

[note color=”yellow” width=”40″ align=”right” title=”Dealing with a Lost Revenue Stream”]

Since you should only value your current earnings, what should you do if you lose a revenue stream just before you sell the business? Should you value your business off the actual last 12 months?

Unfortunately, this can’t be counted towards your current earnings if it is no longer available for the next owner. The same principle holds true if you have a revenue stream which does not transfer to a new owner.

[/note]

SDE is not something that an accounting program will automatically calculate as it depends partially on how you run your business. Jason wrote a helpful article explaining how to calculate SDE.

Some sellers and brokers are more focused on how much a business has historically made. But when it comes to calculating the value of an online business, you should look at only the trailing 12 months of SDE.

The goal is to try and take a snapshot of the business’s earnings as it stands today, not as it will be or once was.

Error Number 2: Over-Valuing Traffic & Other “Soft” Assets, Such As Social Media Accounts

It would be easy for an online business owner to point to their large social media presence and say “look at the large following I have – that has value!”.

Social media IS valuable. It is the modern currency when it comes to driving a regular stream of visitors to the online business.

But things like Twitter and Facebook traffic are already contributing to the site’s revenue by sending visitors to the site to buy the product. The traffic is, therefore, influencing the earnings. This is covered more extensively in our detailed guide to website value. The same would also apply to things such as mailing lists, unique content pages, and vendor and advertiser relationships.

So to attempt to place a separate value on these “soft assets” would be in effect counting them twice.

Error Number 3: Not Pricing In The Owner’s Time

Whilst the SDE method allows for one owner’s salary to be added back, there’s a big difference in the valuation of a business that requires an hour a month of its owner-operator’s time and one that requires the owner to work on it 40 hours a week.

As a result, multiples range widely between businesses that require heavy owner-operation and those that are near-passive. Therefore, before selling, the priority should be to turn your business into a near-passive one, so the new owner has to do very little. This will increase the business’s appeal, and therefore value.

To do this, it’s almost always a good idea to replace as many of the owner’s responsibilities as possible prior to selling, and benefit from selling a “near-passive” business. This can be done by delegating as many tasks as possible, either to other company staff, or to outside freelancers. Tasks can also be automated using online tools and software.

Error Number 4: Focusing On The “Potential” Of The Business

Many business owners like to go on and on about “potential”. But any potential that hasn’t been tapped into is really worth very little. To say a business has good potential in a particular area is, at the end of the day, just words. Truly good growth opportunities do add to the valuation multiple, but not nearly as much as they would if they were actually already carried out.

Take a look at the table below which shows how a business owner might think about adding a new revenue stream to their business. In the example below, a business owner who sees an opportunity to double their bottom line might think that the business suddenly becomes worth twice as much.

But this is not the case. When you are looking at increasing your bottom line through a potential area of growth, your valuation does go up with the multiple, but not with the earnings. So in this example, we might be able to increase the multiple from a 3x earnings to a 3.5x earnings.

| Est. Earnings | Assumed Multiple | Est. Value | |

|---|---|---|---|

| Current Valuation | $100,000 | 3 | $300,000 |

| Seller Assumption | $200,000 | 3 | $600,000 |

| Actual Valuation | $100,000 | 3.5 | $350,000 |

If I were advising a client who believed their bottom line would double in the next 12 months, I’d strongly advise them to hang onto the business for those 12 months so they could realize the growth in their valuation.

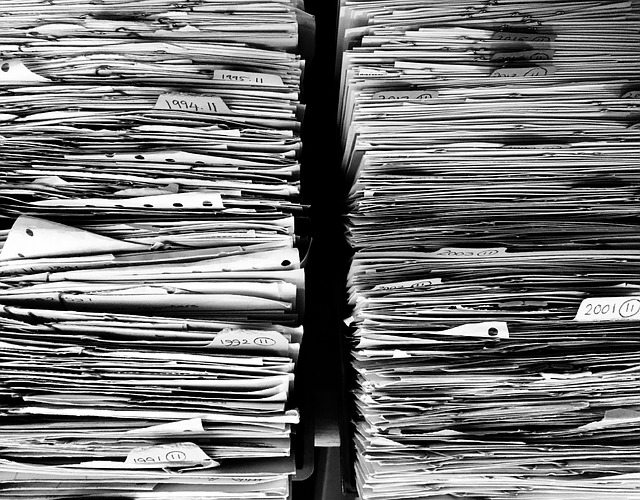

Error Number 5: Messy Books Or Unverifiable Revenue Sources

If a portion of a site’s revenue can’t be adequately verified then this portion of the revenue, for valuation purposes, doesn’t exist. This means keeping receipts and invoices to back up every single cent.

It’s extremely important to keep the books in order, make sure that both income and expenses are clearly separated from personal financials, as well as those of other businesses/companies, and that every penny of earnings can be traced back to its source and verified. Just remember, not every bookkeeper actually knows how to keep clean books (there are a lot of bad bookkeepers out there). Be sure to interview your bookkeeper and vet them through an interviewing process.

Getting these documents together is a long process, and those who start exit planning early (at least 6-12 months prior to the sale) come out of it as the biggest winners with the biggest payday.

Error Number 6: Over-Valuing Short-Term Growth

Take a look at the image to the right taken from a business we worked with several years ago. In this business, they had a one-time event which resulted in a massive growth in earnings, but this was not necessarily sustainable.

Enormous growth just before selling can often seem like a “desperation move”, where the seller has exhausted all that they have just to push the numbers up, while in reality this is not sustainable in the long run.

If a new, great growth opportunity is identified then having it stabilize pays a lot higher dividends (in terms of valuation) than listing the business for sale right away. This would be an ideal situation where temporarily holding onto the business may be better than immediately selling it.

Conclusion

Valuing a website may seem a little random to some people, but there is an actual method to it. If you have a qualified and skilled broker, they will make sure that everything that should be included will be, and anything unreliable and untested is excluded.

What other valuation mistakes have you seen?

Comments are closed.

Great article Bryan! Sellers and Buyers…each point above has value and comes into play more often then you may think. I do valuations everyday hear “it has so much potential” much too often. Those that take that potential, apply some action and open paths to growth vs. those who don’t get more value. Buyers love paths to growth that are already open and that they can step into. And with regard to Error No. 5 – good clean books add tremendous value in the entire process. Not just in dollars, but in ease of listing, due diligence and value. Not to be funny or wise…but excel is not accounting software and those who use it will get more value by hiring a bookkeeper to add everything to Quickbooks, Xero or bench before listing their business for sale.

Great tips for what to look for Bryan.