Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

A Tale of Two Transactions: What NOT To Do When Buying A Business

By Quiet Light

Karl Selle knows how to buy an online business—he learned the ropes the hard way. The handyman-turned-entrepreneur went through hell and high water to finalize a long acquisition after issues with a lender. Hear Karl’s story and learn what not to do when it’s time for you to buy a business.

The seller’s side of the story

How to do biz acquisition without the delays

Know how to navigate SBA loans

Don’t obsess over the wrong things

Entrepreneurs are lots of things. They’re witty, adventurous, daring, and creative.

But one thing that they are not is patient, especially when it comes to a business acquisition.

If you want to know how to buy an online business without losing your mind, you have to learn the art of patience.

But even then, both buyers and sellers want to know, “How long until this is over?”

I’d love to give you a simple answer, but like many things in the gray-area world of business, it depends.

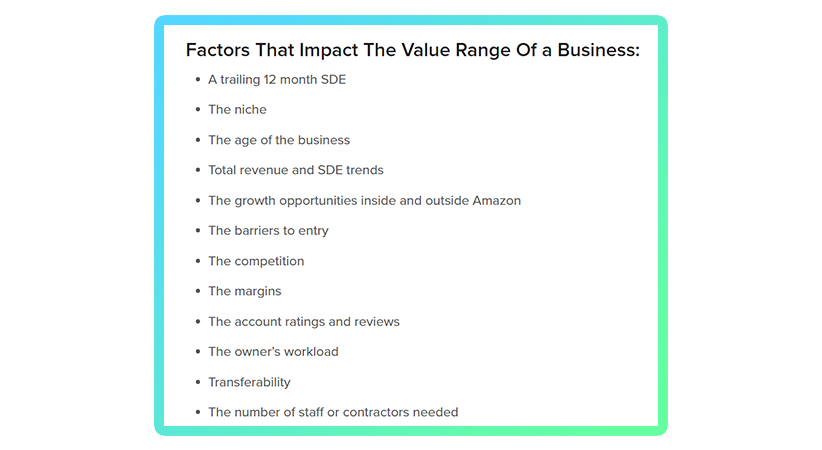

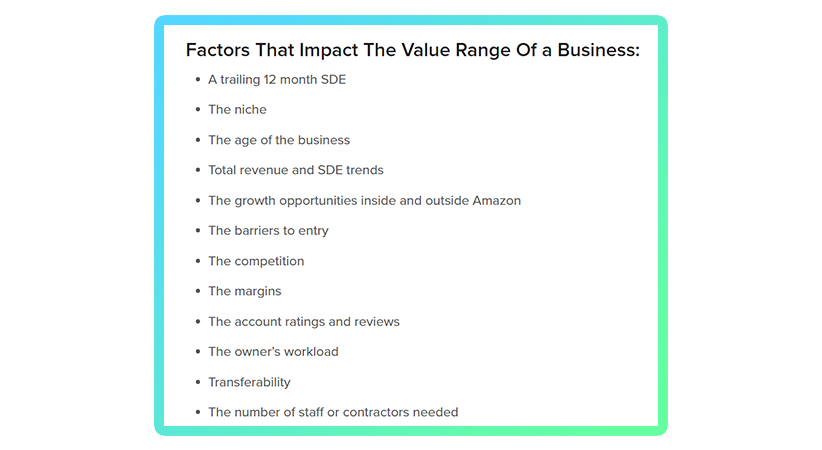

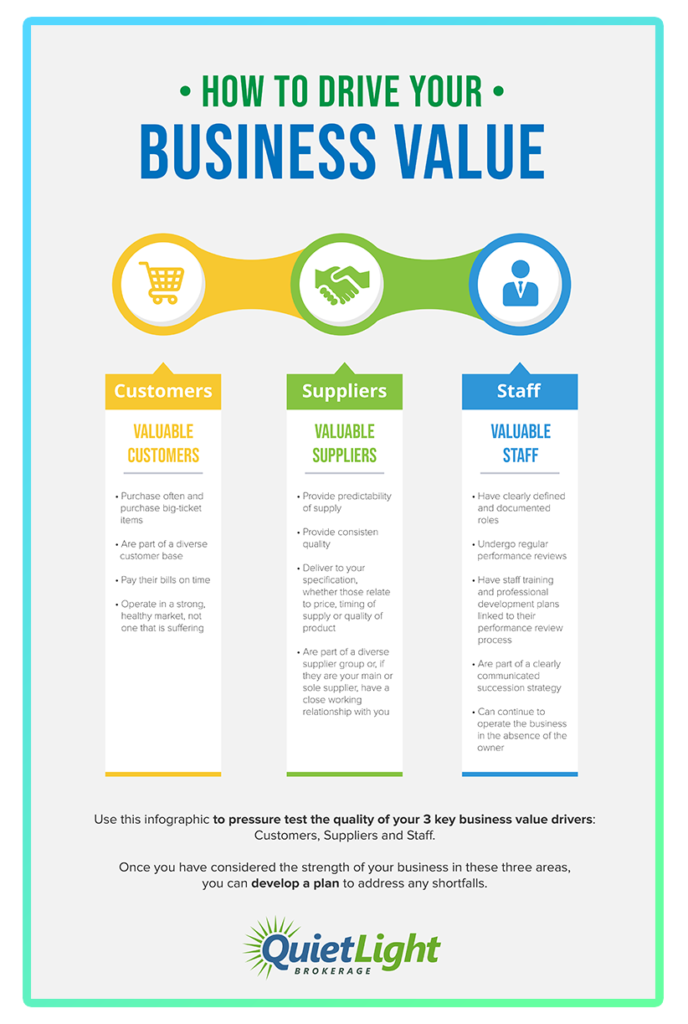

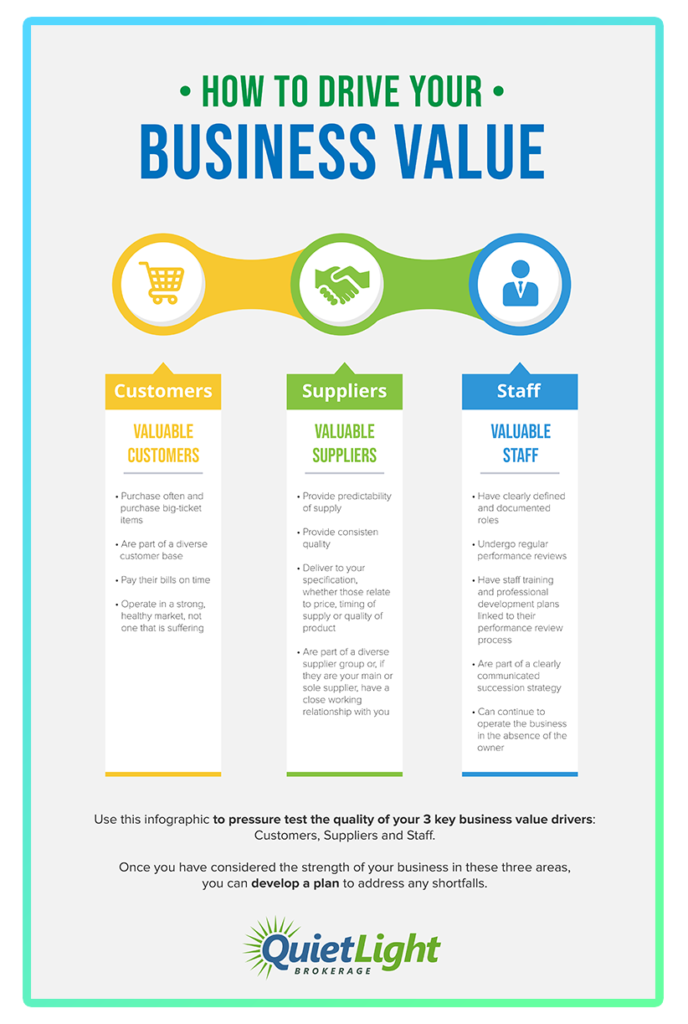

Upfront summaries and multiples will only tell you so much about a business. After all, a multiple is one tiny, measly data point.

You’re buying a complex asset, which means the process and timeline is going to depend on a lot of factors.

Of course, your choices as a business owner can speed up or hamper a business deal.

Today we’re sitting down with Quiet Light client, Karl Selle, who went through one of the longest acquisition deals probably ever and still came out a winner.

Karl’s big enough to share his story and fess up to where he went wrong. Let’s use Karl as a case study to learn more about the business sale process and, hopefully, avoid Karl’s experience altogether.

Hear Karl’s story, cringe, and see what lessons you can apply to your situation once it’s time to sign the dotted line.

Listen to the Source of this Post:

This blog post is based on a podcast episode that we recently recorded. Listen to the full episode here:How to buy an online business

Let’s get a high-level view of this deal before diving into the juicy details.

Karl took seven and a half months acquiring a business from Quiet Light’s client, Kevin. This was, by far, the longest deal QLB has ever been involved in.

Why?

It came down to a few odd situations and well-intentioned mistakes.

Karl made an error on his SBA lender application, so we had to do the process not once, but twice.

And yes, it was painful for everyone, especially our seller.

Fortunately, the seller, Kevin, was a real sport. He and Karl had formed a good relationship during the sales process.

Even though the first deal fell through, Kevin hung in and was patient.

When the deal fell apart, Karl and Kevin were able to amicably go back to the drawing board.

In fact, their relationship was so damn amicable that, although the business value increased by a ton (and we mean a ton), Kevin let it go for a fraction of its true value.

Wow.

Keep in mind that a deal of this length is unusual. Many deals are closed within a few months, but Karl’s case was special.

But after killing plenty of trees with reams of paperwork, everyone walked away with a deal they were happy with.

We’ve got plenty of teachable moments in this story, so let’s back up.

Everything all starts with young, ambitious Karl and a handyman service.

Karl’s story

Karl Selle didn’t go to college right out of high school. Instead of taking on mountains of student debt, Karl started working as a handyman.

When he was getting his start, Karl worked for free for contractors, learning about plumbing and electrical on the job.

If you needed something smelted or painted, he was the dude for the job.

After learning how to build a house from the ground-up, Karl created a profitable handyman business.

But hey, handyman work is hard. You get sweaty and dirty. For someone as enterprising as Karl, he knew he wanted something more.

While he was knee-deep in electrical work, Karl would listen to self-help books and podcasts. He first heard about Amazon businesses while tiling a bathroom.

“A lot of my mentors don’t know me. I get them in books. I find them in podcasts. I read blogs. There’s a lot of free information out there. I’ve never taken a course, but I feel like I’ve done pretty well,” Karl says.

After checking out The 4-Hour Workweek, Karl consulted with a local Amazon pro who was earning millions on the platform.

Instead of approaching the guy for free advice, Karl offered to do handyman work in the Amazon pro’s house in exchange for pointers.

“I was great at electrical work. I knew he needed work for his house and I thought he could do a little trade with me,” Karl says.

From tiling to acquiring

After consulting with the Amazon seller and finding tons of great content on YouTube, Karl wanted to take the plunge with Amazon.

I wish I could tell you that he succeeded right out of the gate, but that’s not what happened.

Karl and his partner lost their shirt on their first Amazon project, tallying $10,000 in credit card debt.

But sometimes you have to fall on your face to succeed. The next product Karl did, he did it right.

As the product grew, Karl created a business around it.

When it was all said and done, the biz grew to earn $6 million in gross sales.

That’s a big change from tiling floors and rewiring ceiling fans.

At this point, Karl was ready to move onward and upward.

It might seem like a big leap to go from building homes to building a business, but in reality, the two are pretty similar.

You start with a good foundation, create a structure, and sometimes have to adjust as you go.

Just as he learned to be a handyman, Karl learned how to build a business by getting his hands dirty. There’s less literal dirt when you’re building an Amazon business, though.

From this experience, Karl learned not only how to grow a business from scratch, but how to buy an online business with finesse.

At this point, Karl wanted to acquire an even bigger business. That’s when he got in touch with Joe at Quiet Light Brokerage.

The seller’s side of the story

While Karl was growing his Amazon biz, Quiet Light started working with business owner Kevin in 2017 to sell his business.

But things weren’t looking great.

The biz didn’t have sexy, appealing growth figures. Business slowed and, in response, Kevin cut prices to stay competitive.

Well, sales and revenue increased, but the margins dried up.

The growth rate was only 1-2% and no buyer would touch the biz with a ten-foot pole.

Kevin was hesitant to implement new growth strategies.

After all, do you want to make a ton of changes before you list your business?

Right or wrong, the decision to stagnate turned away buyers. The business sat on the market for four months without selling.

Uniting buyer and seller

But don’t worry, Kevin saw the light.

After not selling the business the first time around, he decided to implement growth strategies.

And this business grew like a weed, guys.

Over the course of nine months, the business saw a 25% increase in year over year growth in revenue and discretionary earnings.

Several buyers ogled over the numbers, but our pal Karl won the bid.

Aside from the kickass numbers (who doesn’t like money?), Karl found Kevin’s business attractive for three reasons.

Concentrated SKUs

Karl liked that the business had high revenue and a small amount of SKUs.

This meant the business didn’t need a lot of hand-holding. Karl could manage everything without hiring help, keeping his costs low.

Good reviews and ratings

The products had great reviews on Amazon and the ratings were killer.

The SKUs also had great historical keyword ranking, which is important when you sell on a platform.

Personable seller

The numbers added up, but there was one more ingredient: the seller, Kevin.

Karl knew how to buy an online business, and in his experience, he knew the deal hinged on the seller’s disposition.

The two hopped on the phone and Karl liked that Kevin was a straight shooter.

The business ticked all the boxes for Karl, and the two came to a mutual agreement.

He cracked his knuckles and got down to business with the paperwork.

The oops moment

If you want to learn how to buy an online business, sometimes experience is the best teacher.

This deal dragged on because of a mistake with paperwork.

Karl used an SBA loan to buy the business from Kevin.

Three to four months into the process, the paperwork was all wrong and the deal went sideways.

For an SBA loan, you need to declare your assets on paper.

Karl declared two rental properties on this paper (y’know, to avoid fraud and all).

The problem was that Karl didn’t legally own these properties. He had paperless handshake deals that wouldn’t stand up in court.

Since he technically didn’t own the properties, the lender flagged this as deception.

Even though Karl came from a place of transparency, he was still in danger of committing fraud.

Oh, the irony.

Karl technically lied on the application, and lenders don’t take kindly to that.

The bank couldn’t do the loan and the deal fell apart.

The biz deal—take two

Karl and Kevin were pissed about losing so much time to a paperwork error.

But instead of throwing their hands in the air and giving up, the duo calmed down and came back to the negotiating table.

“I think the seller saw I had been moving extremely quickly the entire time, even though the lender had been dragging their heels,” Karl says.

There was an issue, though.

In the time spent negotiating the deal, the value of the business increased substantially.

There was no way the biz would sell for what Kevin had asked for originally.

Although Kevin and Karl wanted to find a way to make things work, Quiet Light actually told Kevin not to sell to Karl.

Sorry, Karl.

The business’s value had shot up by $400,000 more than what it was worth when under LOI.

Kevin liked Karl, though, and sympathized with his situation. He did raise the price, but only by $150,000.

Karl agreed and found a different lender for Round Two.

The minute the lender gave him the green light, Karl immediately sent 50 documents to them, hoping to speed up the process.

And some of these documents are 20 pages long, so that’s a ton of crap to sift through. But it’s his lightning-quick reaction that expedited the second deal.

Thanks to quick responses and a lot of work, Karl’s second shot at the deal closed within two months.

How to do biz acquisition without the delays

Karl’s experience shows how errors and miscommunications can cost you the deal.

Or, if you do manage to squeak by with a deal, errors will increase the time and money you spend executing everything.

We like Karl, but don’t make his mistake.

Follow Karl’s tips to learn how to buy an online business without the painful delays.

Know how to navigate SBA loans

SBA loans are a necessary evil for buying a business, whether you want to acquire a small mom and pop shop or a $5 million Amazon business.

But before you make a deal with the shadowlords at the bank, know what you’re getting yourself into.

First of all, know what lenders mean when they say, “Oh yeah, we can get this done in 30 days!”

They don’t mean you’re going to have the keys to the business in your hand in 30 days.

The bank actually means they can get a confirmation letter (LOI) for the deal in 30 days.

After signing that letter 30 days out, it can take another 90 days after that to actually close the deal.

So you aren’t looking at one month to close with an SBA lender; it’s more like four.

You might be able to speed up this process if you’re getting an SBA loan at the end of the calendar year, though.

They’re trying to meet numbers and quotas, so they might be able to chug some coffee and crank out the paperwork with extra motivation.

Keep the ball in the lender’s court

Karl was able to expedite the second transaction after learning how to play with lenders.

Progress screeches to a grinding halt once the lender’s legal team gets involved.

You don’t want to hold anything up on your end because the lender will take their sweet time.

Paperwork gets tied up so much on the lender’s end that you don’t want to be the one delaying things.

And hey, don’t be afraid to check in with your lender.

Be the squeaky wheel to make sure they’re making progress instead of putting you on the backburner.

I mean, don’t be rude or pushy. These people are giving you a lot of money, after all.

Don’t obsess over the wrong things

A lot of buyers look at multiples to quickly determine if a business is worth the investment.

But here’s the thing: multiples aren’t the best way to determine that a business is thriving.

Multiples are a good metric to get a general idea, but we shouldn’t treat them as gospel.

In Karl’s scenario, the business was performing so well that it went from a 2.8 multiple to a 2.55 multiple.

It looked like the multiple was going down, and that was true, but the business was earning so much that Karl could have instant equity after the purchase.

Karl recommends that buyers look beyond multiples.

Look at a potential business from the perspective of growth and opportunity, not a weird obsession with certain KPIs.

Buddy up to your manufacturer

Karl believes that every buyer needs to have a good relationship with their manufacturer.

And this isn’t a relationship over email, mind you. He’s talking about real, face to face relationships.

That means hopping on a plane, going around the world, and chatting with the people making your products.

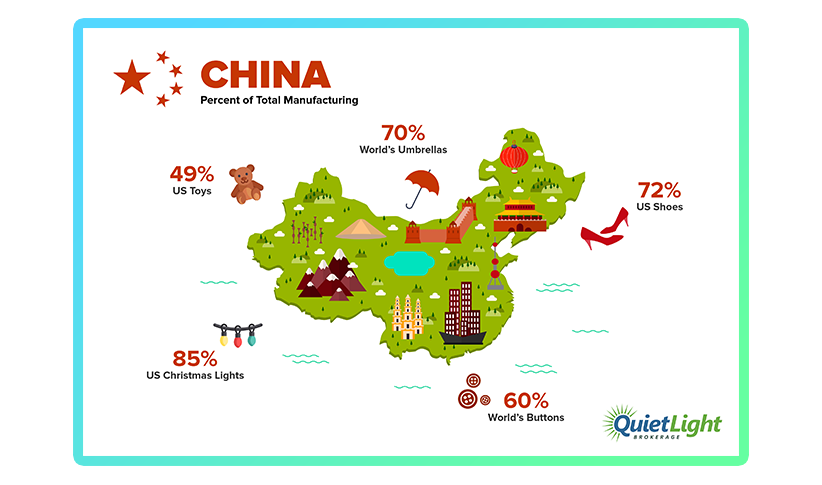

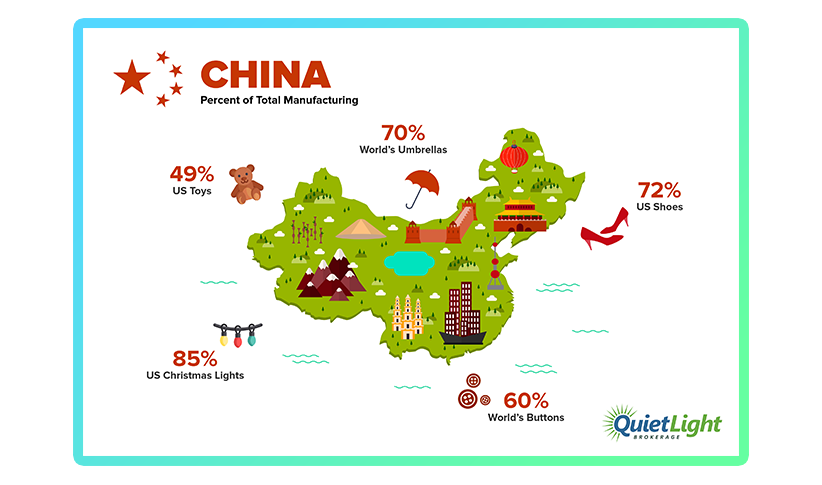

Many manufacturers are based in China, and that’s the case for Karl.

In his experience growing businesses, he’s realized that you’re faceless to these manufacturers when you’re overseas.

Even if you order tons of stuff, they won’t value your business as much.

But if you invest in a face to face relationship? That changes things, big time.

Personal relationships are very important in Chinese culture, and they’re also good for business.

So much so that if you make a mistake, your manufacturer will turn the other cheek.

Often they’ll even let you negotiate terms, which isn’t an easy thing to do when you buy from China.

Flex your Guanxi

The Chinese have a special word for business relationships: Guanxi.

You forge Guanxi through in-person relationships. The more Guanxi you have with a manufacturer, the more seriously they take your business.

To build Guanxi, you meet the manufacturers, give gifts, and spend time with them. Go out for drinks and cigars; talk about family and work.

“Chinese manufacturers are extremely honored to have an American guest come to their homeland. They like seeing that you care enough to see the facility they spent so much time developing,” Karl says.

Manufacturers will often take you on tours of the city and the plant. Sometimes they’ll even offer to pay for your expenses and give gifts to your family.

They aren’t buttering you up; this is an essential part of building relationships and it’s normal in Chinese culture.

If you aren’t comfortable receiving gifts, now’s the time to get over it.

“I was uncomfortable receiving so many gifts, but I knew I needed to receive them to develop a two-way relationship,” Karl says.

Once you invest in Guanxi, you get into a gray area where favors flow more freely from your manufacturer.

This gives you room to negotiate on terms and price. And hey, you build your network and friend circle in the process.

Traveling to China

But don’t hop on a plane to visit your manufacturer if you’ve only just started a relationship.

Chat with them via email and phone calls before you go to visit.

You need to prove you’re a reliable customer for at least a few months to earn your manufacturer’s trust. Then you can make plans to visit in person.

Once you’re ready to go, remember that traveling to China is very safe. Karl goes at least once a year, but he says you can get away with going every two years.

Plan to spend at least a week there and it will make a huge difference in your manufacturer relationships.

The bottom line

Despite the drama, Karl’s business is thriving today. He approached the deal from a growth mindset and walked away a winner.

After running the new products past his supplier, he cut costs from $16.50 per unit to just $9.05 per unit. The EBIDTA increased from 80-90% from this decision alone.

Karl’s first thought was, “Holy crap, this can’t be real.”

Remember, there’s a light at the end of the tunnel.

Learning how to buy an online business isn’t intuitive. You might make mistakes along the way, and that’s okay. In fact, mistakes are essential to becoming a better entrepreneur.

Learn from experience and from people like Karl to get the speediest, best deal for your business.

Get more cheddar in your pocket by being patient and persistent. Don’t forget to invest in relationships and scale smart to make the most of buying your next cash cow.