Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

The SBA Loan Requirements You Need To Know

By Quiet Light

There are numerous reasons to buy a business with an SBA loan. For many, understanding SBA loan requirements is the first step in the acquisition process.

One question inevitably arises when a potential buyer approaches the marketplace. What is the best way to finance a new business acquisition?

For many, Small Business Association (SBA) loans are an appealing option that offers many benefits for buyers. For one, a well-structured loan allows new owners to leverage their capital more effectively. They also broaden the pool of sellers available to them.

This article will explore the benefits and requirements associated with SBA loans. By doing so, our intention is to provide you with the tools you need to make an informed decision about whether or not SBA is the right path for you.

Purpose of an SBA loan

In the context of buying a business, an SBA loan provides capital for a buyer to purchase a business without needing to finance the entire deal on their own.

The purpose of SBA loans is to give individuals access to capital and encourage small business growth. Part of this includes aiding entrepreneurs in the business acquisition process.

Before diving into the numerous benefits that SBA loans provide, it’s important to understand how they work.

How SBA Loans Work

First off, contrary to what many business owners believe, SBA is not a financial institution that funds business loans. Rather, the SBA is a government agency that secures loans for its participating lenders. Those lenders must follow the agency’s strict guidelines and requirements. We’ll cover those requirements in later sections.

Therefore, small business owners do not work with the SBA when applying for an SBA loan. Instead, they apply with an approved SBA lender, and then the lender applies with the SBA to secure the loan. Once the SBA agrees, the lender is responsible for dispersing the funds and collecting the debt payments.

With the pandemic affecting many small businesses, some owners are turning to the SBA for disaster assistance. Information in this article may be helpful for understanding general SBA loan procedures. However, it primarily focuses on loans that are intended to finance business acquisitions.

Benefits of SBA Loans

SBA loans provide a few key benefits for both buyers and sellers:

- Buyers can invest less money up front, giving them greater leverage on their investment.

- Buyers can typically make a quicker return on investment (ROI).

- Sellers can usually get paid in full at closing.

- SBA loans make more deals possible, which provides greater opportunity for both buyers and sellers.

Increased Buying Power

SBA loans can be used to finance up to 90% of the total purchase price in a business acquisition. This means the seller can often invest significantly less money upfront.

For example, let’s say a buyer is preparing to purchase a business that is valued at $500,000. Without an SBA loan or other financing help, they may be required to pay the entire $500,000 at closing—a hefty price for many new owners.

However, with an SBA business loan, they can pay as little as a 5% down payment, which would be just $25,000 in this instance.

This provides the buyer with significantly greater leverage on their investment. They are receiving the same asset by investing just 5% of the purchase price at closing. This leaves rest of their capital available for other investment opportunities.

Quicker ROI

Using an SBA loan also allows the seller to make a significantly quicker return on their investment compared to not using a loan.

For example, if the above-mentioned online business was valued based on a 3X multiple. If the business continues to perform at the same rate, it would take three years for the buyer to earn back their investment.

On the other hand, let’s say the buyer uses an SBA loan and is only required to invest a 10% down payment. In this case, would take slightly less than four months to recoup their investment. This is assuming that the business earns $500,000 over three years, which equals about $167,000 per year, or $13,900 per month.

It’s important to note that this example does not take the interest rate into account, which will incur additional costs over the loan term.

In the second scenario, the buyer doesn’t need to hand over the entire purchase amount at closing. Instead, they can invest up to 95% of that capital to quicken the growth trajectory of the business. The new owner can choose to launch new product lines, increase advertising budgets, or hire more employees. Depending on the opportunities they are facing, they can use that extra money in whatever way will yield the greatest return.

Of course, the buyer will also need to factor debt service payments into the business’s monthly budget. The owner of the above-mentioned business may need to budget $8,000 to $10,000 per month for debt payments. The exact amount will depend on the loan term and interest rate.

SBA loans can help sellers get paid in full at closing

Seller financing can be an acceptable arrangement for some sellers. However, most will greatly prefer to get paid in full immediately.

With an SBA loan, both parties can often have their needs met. Buyers can invest less money upfront. Sellers can typically receive the entire purchase price at closing.

From a lending industry perspective, the many advantages of SBA loans lead to one clear outcome: SBA loans make more deals possible.

Obviously, a buyer or seller’s decision to enter into an asset purchase agreement is dependent on the deal terms. A lot of buyers will hesitate if they’re required to pay the full purchase price upfront.

Financing Options

Without an SBA loan, many buyers would be forced to invest the entire purchase price at closing, a prospect that some would be unable or unwilling to do. Alternatively, the buyer may need to seek investor financing or seller financing, both of which have their own challenges.

Many sellers may choose to hold onto their business if they learn that they’ll need to extend seller financing in order to sell.

With an SBA business loan, the two parties can more easily come to a desirable agreement. Although SBA deals often take longer to close, they can also often be more successful.

SBA Loan Requirements

In broad terms, there are three primary criteria that the SBA looks for when determining an applicant’s loan eligibility.

- The business applying for the loan must have sufficient cash flow to repay the loan.

- The borrower must be a qualified business buyer.

- The buyer and seller must adhere to the SBA’s deal structure requirements.

Let’s break each of these down into more detail.

Cash Flow Requirements

First of all, the SBA will want to know that the business in question has enough cash flow to make each monthly payment that it will owe on the loan. To make this determination, the SBA will look at the business’s debt-to-income ratio.

Currently, one of the SBA loan requirements is for the business to have a debt-to-income ratio of 1.25. This means that the business needs to earn at least $1.25 for each dollar owed on the loan in a given time period.

The SBA often requires three years of U.S. tax returns to verify income information. Additionally, the SBA may account for the owner’s salary and other benefits when calculating the debt-to-income ratio.

If the buyer has another business or other commitments that require capital, the SBA will take those into account as well. Essentially, the SBA will seek to ensure that the business can repay the loan, even after all other expenses have been subtracted from the business’s earnings.

Is the Buyer Qualified?

Next, the SBA will look at the individual business owner to determine if they are a qualified buyer. Areas they may examine include:

- The buyer’s income and expenses.

- Their credit score.

- How much money they’re investing in the deal.

- Their real estate assets.

- Any recent debt they’ve taken on.

- Their resume.

As mentioned above, SBA loan requirements go beyond the business in question. Typically, they’ll seek information about the applicant’s holistic financial situation.

On the other hand, if you’re unemployed and have another business that is hemrigeoning money, that could set off some alarms with the SBA. Before applying for an SBA loan, it can be very helpful to ensure that you have a reliable income and your expenses are under control.

As with almost any kind of loan, your personal credit score will also be examined. Not surprisingly, the higher your score, the more likely it is that you’ll be approved and will receive a lower interest rate. A score below 690 will not be acceptable in most cases.

Down Payment Requirements

Next, the SBA will want to know how much money you intend to invest in the deal. SBA loan requirements state that the borrower to invest at least 5% of the purchase price, but it’s not unusual for buyers to put down more.

If you hold at least 25% equity in real estate property, that can serve as collateral and increase the chances that your loan will be approved.

While the SBA doesn’t require applicants to secure the debt with real estate assets, certain lenders do have this requirement. It’s important to note that the SBA limits secured assets to only include real estate and not other forms of assets. This ensures that a borrower doesn’t end up losing other property if they default on the loan or are forced to seek loan forgiveness.

Recent Debt

Recent debt is another factor that can influence loan acceptance. If you’ve recently taken out a different loan, the SBA will want to know how it will affect your ability to make payments on your SBA loan. If it appears that other loans will ‘compete’ to receive monthly debt payments, the SBA loan will likely be denied.

Buyer’s Resume

Lastly, unlike with many other loans, acceptance for an SBA loan can be based partly on the applicant’s resume.

If you have extensive experience and a successful track record in the industry in which your new business operates, that could increase your chances of being accepted for the SBA loan.

For example, let’s say you’re an Amazon seller who has built three million dollar Amazon stores. The SBA will likely be more willing to secure a loan for you to purchase a fourth Amazon business. Of course, the assessment of someone’s resume is highly subjective. Therefore, a strong history of success is no guarantee that a loan will be approved.

You must use an allowable deal structure in SBA financed acquisitions.

In addition to verifying the business’s financial performance and your own personal qualifications, the SBA will also want to ensure that the acquisition is taking place within an allowable deal structure.

The following deal structure requirements affect both the buyer as well as the seller. Therefore, it’s important that both parties are familiar with these guidelines. Both parties must be willing to enter into an agreement that is compatible with them.

Allowable SBA deal structures include:

- Full purchases of businesses by qualified buyers.

- All cash purchases (including the cash injected by the SBA loan).

- Deals that combine owner financing with SBA financing.

- Deals that involve consulting agreements.

Need an SBA Loan to Buy an Online Business?

Visit Our Partner Page to Learn About Acquisition Lending Options Available to Quiet Light Clients

Full Ownership Transfer

If all of the other requirements are met, the SBA typically approves loans for deals in which the entire business is transferred from one party to another. In other words, the SBA likes deals in which 100% of the equity changes hands from the seller to the buyer.

All-Cash Purchases

The SBA also approves loans for deals in which the entire purchase price is paid to the seller in cash. Typically, this means that the buyer pays a certain percentage of the purchase price, and the SBA loan covers the remainder.

Between the SBA loan and the buyer, the seller receives 100% of the acquisition price in cash at the time of closing. Of course, most sellers love this proposition.

Seller Financing

Sometimes, there is a margin between the amount that the buyer puts down and the amount covered by the SBA loan. If this occurs, the seller can extend seller financing terms. Selling financing allows the buyer to pay the seller a portion of the purchase price over time.

When this happens, the buyer assumes two different debts—one to the seller, and another to the SBA lender.

Consulting Agreements

Lastly, the SBA also approves of deal structures in which consulting agreements are involved. In entrepreneurship, it’s typical for one owner to provide consulting services to another when a business is changing hands. The SBA realizes this and allows consulting to be a part of the agreement in the deals it finances.

There are several deal structures that the SBA will not approve of

SBA disallowable deal structures include:

- Partial buyouts or partial equity acquisitions.

- Performance-based financing deals.

- Deals that include long-term, expensive consulting agreements.

- Deals that include employment agreements.

- Earn-outs.

In short, the SBA likes deals that are clean, clear, and simple. If a deal doesn’t match that description, it will likely not be approved.

Partial Buyouts

In a partial buyout, the buyer purchases only part of the business. This leaves the other part under the ownership of the seller. Deals of this nature can be beneficial to both parties in certain circumstances. At the same time, they can also introduce risks and the potential for disagreement down the road. The SBA will not finance a deal of this nature.

Performance-Based Financing

Performance-based financing deals are another structure that is not allowed under SBA lending guidelines. When deals are contingent on certain performance metrics being met, both parties assume risk and uncertainty, which decreases confidence in lenders.

Also, performance-based financing deals are typically more complicated and less clear, which the SBA doesn’t like.

Long-Term or Expensive Consulting Agreements

Long-term, expensive consulting contracts are not allowed when applying for an SBA loan. Similar to the previous deal structures, acquisitions that include these sort of consulting agreements are often more complicated.

Expensive consulting agreements can also reduce the business’s cash flow, which can threaten the buyer’s ability to make their monthly loan payments. For the same reasons, employment agreements are also not allowed.

Earn-Outs

Lastly, the SBA prohibits earn-outs when SBA financing is involved. These are similar to partial buyouts and performance-based financing—they require ongoing cooperation between the buyer and seller, are riskier, and more complicated.

Essentially, you should always try to keep the deal structure simple and clear when using SBA financing to acquire a new business.

The last section of this article has more information about how loan amounts are determined, as well as what the repayment requirements are for SBA loans. But first, let’s discuss the various types of SBA loans.

Types of SBA loans

The SBA offers several different types of loans for small businesses, which are listed below. The SBA offers several different types of loans for small businesses. It can be helpful to have an overall understanding of the various types of SBA loans. However, business acquisitions generally rely on 7(a). We’ll cover that one last.

- Microloans

- Real estate and equipment loans

- Disaster loans

- General small business loans: 7(a)

Microloans

The SBA microloan program is designed to provide entrepreneurs with access to capital in order to help them get their business off the ground. The maximum microloan amount is $50,000, although the average is only $13,000.

Businesses can use an SBA microloan for working capital, equipment and machinery, inventory, supplies, furniture, and fixtures. This type of loan follows the framework we talked about earlier. The SBA secures the loans for private lenders, who then disperse and collect the funds from business borrowers.

Real Estate and Equipment Loans

As the term implies, real estate and equipment loans (CDC/504) provide financing for fixed assets such as equipment and real estate.

The requirements and process for obtaining a real estate and equipment loan has some key differences from loans for online businesses. For more information, check out this page on the SBA website.

Disaster Loans

An SBA disaster loan provides businesses with low-interest capital. It is only for financing repairs following a declared disaster. Many different kinds of entities can qualify for these loans. These include for-profit companies, non-profit organizations, renters, and homeowners.

Lastly, the SBA offers general small business loans: 7(a).

SBA 7a Loans

Within the category of an SBA 7a loan, there are several different types. The primary differences between many of them are in regard to their maximum loan amount, the percentage of the deal that they’ll cover, and the length of time they take to process.

One of the uses of SBA 7(a) loans is to purchase businesses. As discussed, there are strict requirements that borrowers must meet in order to be eligible for these loans. Once a buyer has determined that they qualify, it’s time to get clear on what the loan amount will be and how it will be repaid…

Repayment requirements for an SBA loan

Structuring a deal with an SBA loan is a multidimensional process. Not only do buyers need to ensure that both they and the business they’re buying meet SBA’s requirements, but they also need to understand what portion of the deal will be financed through SBA in order to negotiate favorable terms with the seller.

The first question is obvious: how is the SBA loan amount determined?

Determining an SBA Loan Amount

Generally, the SBA will conduct an independent valuation of the business in question in order to determine what they believe it is worth. If you’re a potential buyer, hopefully SBA’s valuation will provide a similar number to the purchase price offered by the seller.

If there is a discrepancy between the seller’s listing price and the value reported by the independent valuation, then the SBA will choose to extend the loan based on the independent valuation. Of course, this can leave a margin between the amount covered by the loan and the amount owed to the seller.

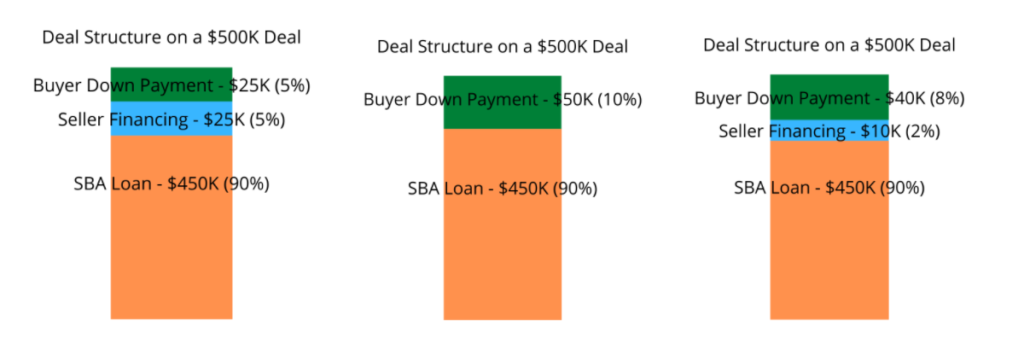

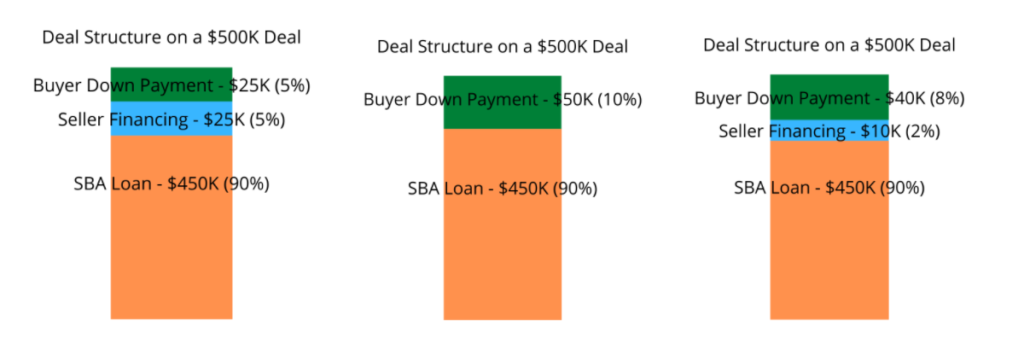

For example, for a business that costs $500,000, the buyer may pay 5%, and the seller may offer seller financing for the other 5% (assuming the bank will pay 90%). The buyer may also pay the entire 10%, or any proportion between 5 and 10%. Here are a few different ways an SBA deal can structured based on these requirements.

Seller Financing Requirements

Although seller financing is by no means a requirement, it is often desirable by lenders as it provides a clear incentive for the seller to ensure that the transition is successful. Therefore, it is not uncommon for sellers to finance part of the deal, even if it’s a small minority of the total purchase price.

In addition to the financing allocation requirements listed above, there are few additional provisions that govern the repayment of SBA loans:

- Seller financing is put on a minimum two-year standby.

- The SBA loan takes the first lien position on all business assets.

2-Year Standby

If an SBA deal involves seller financing, the terms must include a minimum two-year standby for any payments made to the seller. This is to ensure that there is enough cash flow for the buyer to comfortably make each monthly payment to their SBA lender over the duration of the payment term.

Not surprisingly, many sellers aren’t in favor of this requirement and sometimes refuse seller financing for this reason. Even without seller financing, the buyer is still getting a pretty great deal if the SBA loan covers 90% of the purchase price.

Buy a Profitable Online Business

Outsmart the startup game and check out our listings. You can request a summary on any business without any further obligation.

First Lien Position

Second, SBA loans require that the SBA lender take the first lien position on all business assets. This allows the lender to have first priority to liquidate the business’s assets in the event that the business goes into receivership.

Of course, as an online business owner, you never want to imagine your company crashing into the ground. However, the SBA knows that not all business acquisitions they help finance will be successful, so they ensure that their lenders are first in line to get paid if liquidation becomes necessary.

If the business owner still owes money on the debt after the business’s assets have been liquidated, the SBA lender can seek personal real estate assets that were used to secure the loan. As mentioned, real estate assets are not necessary to secure the loan, just optional.

Final thoughts

There are certainly a lot of SBA loan requirements when financing an acquisition. However, the process is rather straightforward once you understand the elements at play.

For some buyers, going through the process may be unnecessary, especially if they have the capital or the seller is willing to accept seller financing. For others, an SBA loan will allow them to close deals that would otherwise not be possible.