Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

How to Sell your UK Business in the US with Minimal Taxes

By Quiet Light

US buyers face a glut of competition when they want to acquire their next eCommerce business. But have you ever thought about looking across the pond for your next venture? That’s right: it’s entirely possible to buy a business in the UK as a US buyer. Don’t jump into this deal without planning, though. Thanks to UK business tax rules and other legal weirdness, you can lose your shirt if you aren’t careful. But don’t let that stop you. Whether you’re a US buyer or a UK seller, learn from Quiet Light client Joe Harwood’s experience selling his UK-based business to a US buyer.

How To Sell A UK Business To A US Buyer

The Juicy Benefits Of Buying Across Borders

How To Prepare Your UK Business For Sale

Aside from a few spats in the distant past, the UK and the US have gotten along swimmingly for years. We couldn’t be more different culturally, but our shared language and history give Americans and Brits enough to chuckle about at the dinner table.

But what happens when you want to share a board room table with your compatriots from across the pond?

For eCommerce or Amazon business owners, jumping from the US to the UK seems like a natural choice. But tax policies make that easier said than done. For example, if you have the cajones to do an asset sale in the UK (which is crazy-popular in the US), you’re looking down the barrel at a 45% tax rate.

No, that’s not a typo. A 45% tax rate.

Tack on differing trade and business policies and it’s understandable that many UK eCommerce owners think their businesses are downright unsellable. Selling to UK buyers is hard enough; selling to an international buyer from the US sounds downright impossible.

But we’re not here to get mired in the “maybes” and fears of business transactions. To be a successful entrepreneur, you’ve got to grab life by the horns. That’s what online business entrepreneur Joseph Harwood decided to do. This UK biz owner decided he needed to sell his eCommerce business. He partnered with Quiet Light Brokerage for what turned out to be a long yet educational process.

Whether you’re a buyer or a seller, there’s a lot to be gleaned from Joe’s experience. See how he got into selling his UK business and what both buyers and sellers can do to move the process along more quickly—without getting raked across the coals by the tax man.

Listen to the Source of this Post:

This blog post is based on a podcast episode that we recently recorded. Listen to the full episode here:Joe’s Story

Joe Harwood had grown a successful eCommerce business, but once his firstborn son was on the way, he decided it was time to sell the business. As he soon learned, it’s no easy feat selling a seven-figure business while preparing to become a parent.

What was different about Joe’s business is that it sold a Q4-focused product. Although sales spiked mostly in the latter part of the year, Joe knew his numbers and saw very aggressive growth trajectory for his business.

Now, because he was selling a Q4 product, it made his business a little more risky. Most of Joe’s sales happen in a very short period of time at the end of the fiscal year, which would make it harder to find a buyer.

Joe’s other problem was that, as a UK-based business, the tax situation was royally effed. He needed to sell his business, but there was no way he wanted to lose 45% of his sale to the UK business tax rate. “UK sellers are skeptical about selling an eCommerce business because of the tax situation,” Quiet Light Founder Mark Daoust noted in his interview with Joe.

After working things out with Quiet Light, Joe opted to do an earn-out deal instead of an asset sale (which the UK taxes like crazy). With an earn-out deal structure, Joe would sell his business and get payments based on the business’s performance. By doing this, Joe increased his business’s multiple and also reassured buyers that he was confident in the health of his business.

Now, earn-outs aren’t the right option for many sellers, but it worked out in Joe’s favor. The key is to find a trustworthy buyer to grow the brand, so you know that you’re going to get a fat check in the mail as the biz grows over time. “You have to trust that your buyer will be able to grow the business,” Mark confirms.

This is a gross simplification of the process, of course. There was plenty of trial and error and a hefty learning curve that made Joe’s transaction very unique. But if you want to sell overseas, it’s a process that you have to understand.

UK Businesses: Sell Abroad!

UK business owners are often hesitant to sell their business. That’s because, in the UK, if you sell your business as an asset deal and take those funds as personal income, you’re taxed like mad. The threshold is £100,000, after which the government wants 45% of your earnings. Yeowch. “The big fear is doing an asset deal and then having to take your funds as income, which is taxed heavily,” Joe says.

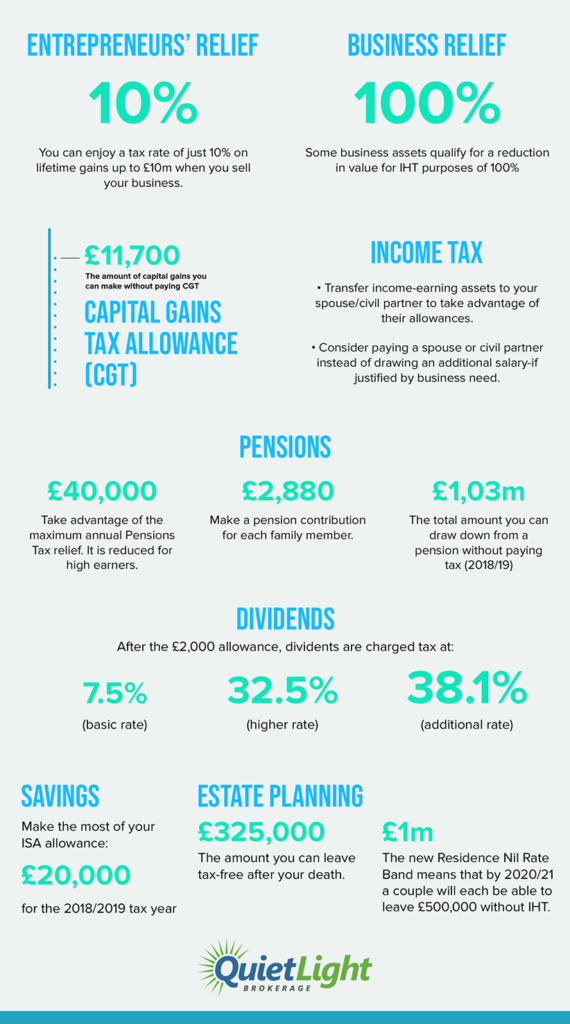

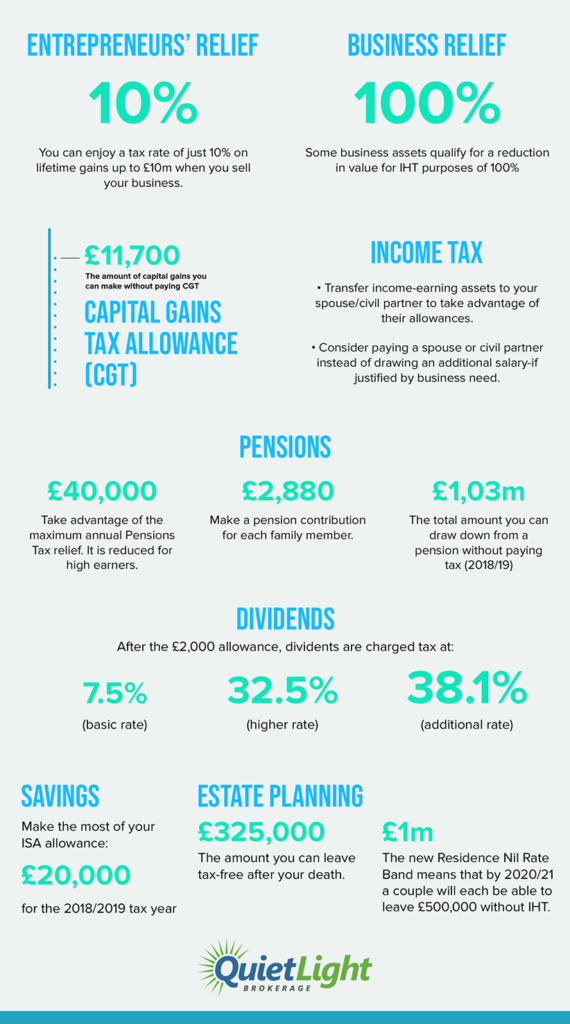

So this gives UK business owners a reason to pursue different deal structures, like seller shares deals. In the UK, the threshold for this is up to £10 million and is taxed at just 10% thanks to something called entrepreneur’s relief.

On the buyer’s side, US buyers are often hesitant to buy a business entity in a foreign country. It’s totally doable, but the learning curve scares a lot of people off. And this isn’t just for doing business with the UK. It applies to Canada, Australia, and plenty of other countries. “It requires complex structuring because you’re buying an entity in a different country,” Joe says.

How To Sell A UK Business To A US Buyer

The thing is, the process isn’t scary if you know what you need to do. Fortunately, Joe laid out his plan for other entrepreneurs to follow in his footsteps. Here’s how Joe sold his UK-based business to a US buyer.

1. Look At Stock Deals

When Joe first contacted Quiet Light, he suggested doing a stock deal. As a US-based company, it was new to them. Other US-based brokers flat-out refused to work with Joe once he said he needed a stock deal. That’s because yes, there’s a learning curve, but also because the brokers knew it would be a challenge to find buyers.

But hey, Quiet Light likes challenges. They helped Joe set his deal structure up for an earn-out instead of an asset sale to avoid crushing UK business tax rates.

2. Hire US And UK Advisors

The second thing Joe did was hire savvy advisors on both sides. If you’re doing an international deal, you can’t just have US-based advisors. You need help from professionals in the other country that help you avoid nasty fines, fees, and delays.

Your situation will be unique, but you should at least have a tax advisor, legal counsel, and a contract advisor for both sides. Don’t let the bill scare you away either. This will shield you from liability moving forward. And, frankly, avoiding fees and delays will outweigh the bills. Trust me, the advisors pay for themselves by helping you avoid problems down the road.

By partnering with the right advisors for his seven-figure business, Joe was able to avoid a 45% UK business tax. That alone saved him a ton of money, paying for the advisors with the savings, and then some. “That can be a significant savings if you’re seeing earnings well into the six figures,” Mark says.

Of course, there are some advisors (like Quiet Light’s David Newell) that are familiar with both sides. But even then, it’s best to talk shop and in-depth strategies with advisors from both countries—just to be safe.

3. Find The Right Buyer

It’s really hard to do an earn-out or seller shares deal if you have the wrong buyer. The buyer is the key to selling your UK-based eCommerce business in the most efficient way possible.

I won’t lie: it took Joe more time and effort to find a buyer. But once he found his buyer, he knew he struck gold. You need to find a buyer that has foresight to understand the value and direction of your business. It’s okay for buyers to turn down your business; it means they aren’t the right person to take your business, anyway.

“I don’t think it would have been as easy to move forward if I wasn’t as confident with the buyer,” Joe says. If you’re struggling to find the right buyer for your business, Joe did these three things to connect with his buyer.

Find A Buyer Willing To Take A Risk

Some investors are willing to take on more risk than others. Because Joe was based in the UK and sold a Q4 product, he knew he needed to get a buyer on board that was ready to take a risk. It’s all about finding someone who can see the risk and understand what they’re getting into. “It was critical to get a buyer to the table who was ready to take on risk,” Joe says.

Highlight The Upsides

That said, make sure the upsides outweigh the risk to your buyer. Joe worked with Quiet Light to structure his deal so it preemptively answered any potential objections a buyer would have to the deal.

“The offset to risk is an upside,” Mark explains. This made it way easier for potential buyers to see the upside (and stacks of dollar signs) for Joe’s business.

The deal was beneficial to Joe because he was going from a 45% to a 10% UK business tax rate. Nice score, Joe!

However, there were also benefits to the buyer that Joe made sure to highlight. Joe’s deal structure also generated tax savings on cash generated by Joe’s business, giving the buyer an immediate benefit, too. “This lets the buyer cash in on the upside without risking all the money on it,” Mark says.

By selling the company’s inventory and cash back to the buyer, it’s counted as working capital, which is taxed at just 10%. This allowed the buyer to save money and for Joe to get liquid cash out of the business without relying on dividends.

Be Vocal About Your Needs

A lot of buyers just weren’t right for Joe. They wanted him to be super-involved with the UK business after the transaction. The dude just had a baby and definitely wasn’t looking to get entangled with a salaried job.

By saying from the start that he didn’t want to be involved in the business, Joe was able to avoid buyers who needed more of a commitment. Joe didn’t waffle on his needs or cave in; he knew what he needed and stood firm, even though it meant waiting longer to sell his business.

After an in-depth search, Joe found the perfect buyer. Thanks to their good relationship, both Joe and the buyer were able to work together and grow the business, which is good for everyone involved in the deal. “There’s always a buyer out there for what you’re selling,” Joe adds.

The Juicy Benefits Of Buying Across Borders

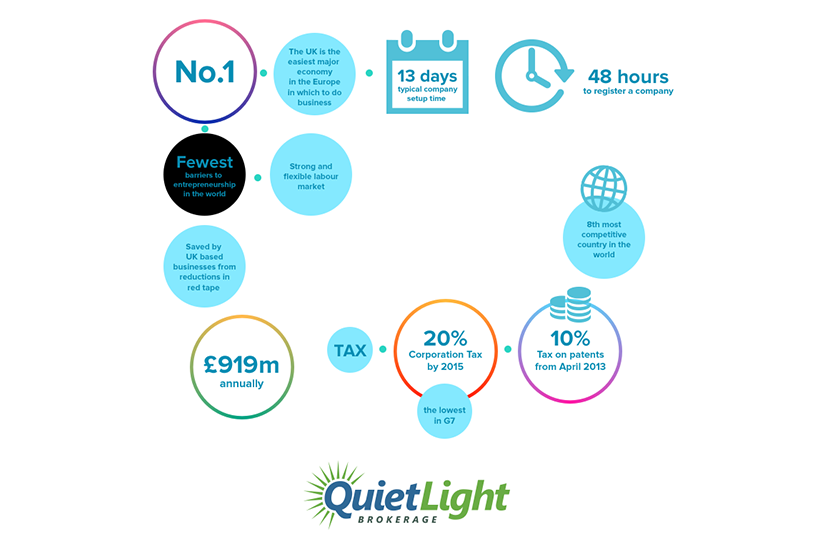

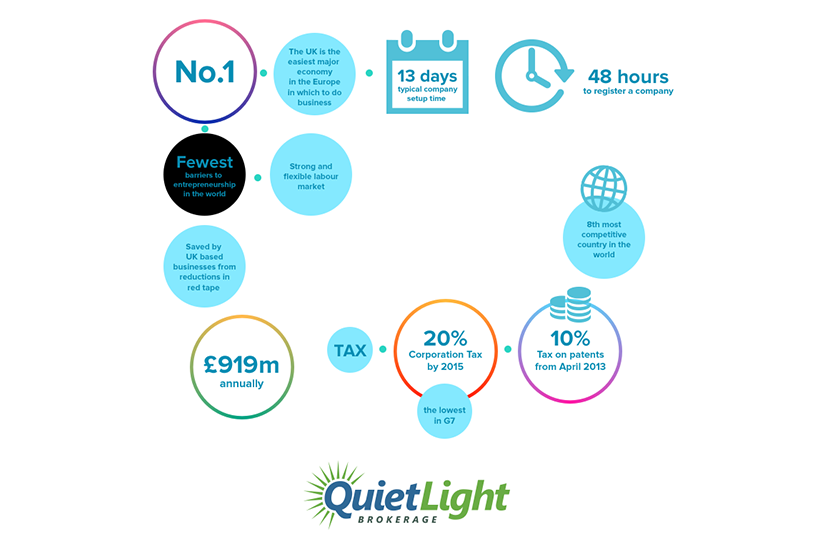

Okay, so now we know it isn’t impossible to buy a UK-based business as a US entrepreneur. Joe’s transaction came with a number of awesome UK business tax advantages, both to him as the seller and to his buyer. If you’re looking to acquire a company, it’s time to look at the UK market. As a US entrepreneur, you stand to win in 3 big ways when you look to buy overseas.

1. Smaller Pond, Tastier Fish

Don’t you just hate when you want to buy a company and it gets snatched up by another buyer? Yeah, that’s probably not going to happen if you’re shopping in the UK market. As a buyer, you have a competitive advantage because there aren’t as many buyers looking at UK businesses for sale. “Joe’s buyer bought a business where a lot of other buyers weren’t even looking,” Mark says.

Large brokerage firms don’t even have the UK on their radar. They don’t want to do stock deals and usually outright refuse to do them, anyway. That means you’ve got a lot of opportunity to snag a UK business for sale, pal.

Instead of looking at US-based companies that require you to move at lightning speed, you have the luxury of time when you’re buying in the UK. It’s at a more comfortable pace that lets you make sure the company is right for you.

2. Potentially Lower Your Effective Tax Rate

Nobody likes paying taxes, especially when those taxes eat nearly half of your profits. The good news is that, as a buyer, you could lower your effective tax rate by purchasing a UK-based business.

Normally when you buy an Amazon business based in the US, you buy it as an asset, set up a new LLC, and are taxed at 37%. By purchasing from the UK, you can potentially pay fewer taxes. “Joe had tax advantages personally as a seller, but he also introduced tax advantages to the buyer’s side of the equation,” Mark says.

Remember to chat with your tax advisor, of course, because every business is different. With that said, you can structure the deal to go from the normal effective tax rate of 37% to anywhere from 21 – 26%, depending on where you’re operating from.

Because you’re moving the company to the US and won’t have people working for you in the UK, you don’t have permanent establishment in that country. That means you take your effective tax rate from 37% to 26%. With an 11% savings on a seven-figure business, that’s a whole lot of cheddar.

3. One Time Setup, Lots Of Future Opportunities

Once you learn the process of buying in the UK, it’s easy as pie to do this process in the future. There are so many amazing companies based in the UK. By putting in the work now to set up the right process, you have a vehicle in the UK to acquire more properties in a tax-friendly way. Pave the way today so you can score more UK businesses for sale.

So don’t worry. All of your hard work won’t be for naught. You’ll spend some time setting things up and perfecting your process, but as a buyer, the long-term benefits greatly outweigh the hassles. “You now have a vehicle in the UK to acquire some of these properties,” Mark confirms.

How To Prepare Your UK Business For Sale

Now let’s switch gears. We’ve touched on how US buyers can purchase a UK company and why it’s a very, very smart idea. But what about UK sellers? How can you prime your business to be more appealing to international buyers?

You might have never thought about selling your business before. Joe certainly didn’t for the longest time. This process showed him it’s possible to sell a UK business, provided you’ve got your ducks in a row. Consider these 4 factors to prepare to sell your UK-based eCommerce business.

1. Build Your Cash Reserves

The thing about selling your business is that you can’t just wake up one day and decide to sell. The decision to exit is something that you really should be planning on for at least a year, if not longer.

At a minimum, Joe suggests that you build your cash reserves at least a year before selling. That’s because, thanks to Joe’s process, you can pull that money out of the business at a very tax-efficient rate when you list your UK business for sale.

Remember, Joe did this by selling company inventory and cash back to the buyer, which counted as working capital. This allowed him to get more liquid cash in-hand. If you rake in more cash for the business before the sale, you’ll be able to pull those pounds out at a more favorable tax rate once you leave, thanks to the working capital taxation rules. Not bad, eh?

2. Have Your Numbers In Order

The decision to sell isn’t something to be taken lightly, especially if you want to get a fair price for your business.

Always have your numbers in order before you go to sell. Know your way around a balance sheet and clean up your profit and loss (P&L) statements. Do all of this before you even list your business.

Once a buyer is interested, you’ve already got your numbers cleaned up and ready to go. Don’t make a buyer wait on your or your accountant to clean up the numbers; it delays the deal and makes you look unprofessional.

3. Wrangle Your Inventory

Where is all of your stuff? How much inventory do you have? Where are you keeping it?

It’s time to get your inventory management out of a notebook and into a software. This makes it easier to transfer to a buyer, and it’s a huge deal. In fact, transferability is one of the four pillars of business value.

Inventory management can also help you better manage your inventory and predict cash flow, which buyers need to see when you list your UK business for sale.

Be prepared to pull these numbers at any time to show your buyers. Digitize everything so it’s quick and painless.

4. Bring On Good Advisors

Obviously you aren’t in the market for a “bad” advisor, but this is still an important thing to remember. Joe stresses the importance of getting a good team on your side for selling your business.

When you decide to sell your UK business, it’s going to be a learning process. You need people on your side, whether it’s a great broker or bookkeeper or lawyer, to be in your corner when the going gets tough.

Because this can be a complex process, good advisors help you avoid expensive and painful blind spots that you might not have considered. And money isn’t an issue here, either. Good advisors help you save gobs of money and time, paying for themselves when it’s all said and done.

The Bottom Line

The UK eCommerce market is rife with opportunity for entrepreneurs that have the cajones to jump in and roll up their sleeves.

As a US-based buyer, that means you stand to win a lot when you shop across the pond. Thanks to lower competition and favorable tax rates, you’ll bulk up your portfolio without the BS.

For UK-based sellers, it’s all about nailing down your process. Borrow Joe’s process by finding the right buyer, hiring both UK and US advisors, and looking at stock deals. Before you sell, remember to build your cash reserves, know your numbers, manage your inventory, and get good advisors on your side.

The UK has more to offer than tea and scones. Both US and UK entrepreneurs stand to win by shaking hands across the pond. Dip your toe into international acquisition deals like Joe’s to center (or centre, if you’re in the UK) your efforts on growth, no matter borders.