Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

Want the Inside Track to the Best Deals? Do This.

By Quiet Light

This just in…it’s still a seller’s market.

And online business is still highly competitive and getting more crowded by the minute.

Meanwhile, one of the best ways to grow your money right now is to skip the startup phase and cut right to the chase of running a profitable business through acquisition.

But where do you begin if it’s your first time buying an online business?

If you think you’re ready to take that leap, but don’t have a background in finance or tons of connections, it can be hard to know the answer. And it’s easy to assume there’s a secret inside track to the best deals.

As it turns out, it’s a bit like sailing.

Listen to the Source of this Post:

This blog post is based on a podcast episode that we recently recorded. Listen to the full episode here:The first few times I went sailing with my dad growing up were harrowing experiences.

We weren’t sailors. He was a farmer.

Although our farm sat a stone’s throw from the Chowan River, neither one of us had ever set foot on a sailboat that I knew of.

But he’d ended up with a 29’ cruiser and needed me as a deckhand.

Dad’s many years of coaching football made him an odd combination of really laid back (you win some, you lose some) and highly exacting (you’re pouring that glass of water wrong). He was all about the doing, never the talking.

If he didn’t already know how to do something, he’d figure it out. If I didn’t already know how to do something, I should’ve figured it out five minutes ago.

Action? Yes. Discussion? No.

The way to learn how to sail was to get in the boat and push away from the dock.

In his mind most everything was ruled by logical, universal principles, and the best way to figure those out was to encounter them first hand.

Most people will tell you the same thing about entrepreneurship – the best way to learn is to start a business. And likewise, the best way to learn about buying an online business is to jump in and start looking.

Things move incredibly fast right now, so starting out on the right foot makes all the difference…

Is there an inside track to the good deals?

Not exactly, but there are definite ways to improve your chances as a buyer.

Jump in but be prepared for the search, get to know the people involved, and follow these inside tips from two seasoned brokers and successful entrepreneurs, Mark Daoust and Joe Valley.

Tip #1: Review Lots of Listings, and in Detail

Tip #2: Provide Brokers with Great Feedback on Listings

Tip #3: Treat the Search for the Right Deal as a Full-Time Job

Tip #4: Line up Financing Ahead of Time

Tip #5: Face-to-Face and One-on-One Go a Long Way

Tip #6: Create an Acquisition Checklist

Tip #7: Respect the Need for Speed

Tip #8: Leave a Lasting and Likeable Impression

Tip #9: Let Brokers in on Your Plans

Tip #10: Put More Focus on the ROI than Price

Tip #1: Review Lots of Listings, and in Detail

According to Joe, the more listings you can view during your search, the better. But he stresses the importance of educating yourself by looking at each listing in detail.

As a new buyer, the time you put in with the details of one listing now can have a great impact on your overall grasp of future listings.

It’s a good example of power laws at work, where small efforts now have a cascading effect overall.

Buying an online business takes time and patience.

For each listing, digest the financials and take in the complete picture of the business, its operations and its history. Joe says the work you put in will be time-consuming, yes, but well worth it.

Two reasons this piece of advice is the one he gives most often:

- You’ll be less likely to summarily dismiss a deal too quickly and for the wrong reasons.

- You’ll be more likely to recognize the right fit for you when it shows up.

Clearly, like most things, the more time and effort you put in, the more you’ll get out.

Tip #2: Provide Brokers with Great Feedback on Listings

A central principle in math is that anything times zero is still zero – no matter how complicated or simple the problem.

As a buyer, you may have just a vague idea, or you may picture the perfect business for you in detail. You may know exactly the type of business you’re looking for and what you plan to do with it.

But if a broker who sends you a listing doesn’t know that, they can’t help you. The process goes nowhere.

Mark’s advice is that when a broker sends you a listing, and it’s not for you, don’t leave it at that with zero feedback.

Let them know your thoughts, so they can begin to learn what you’re looking for. Let them know what you like and ultimately don’t like about a listing. And be specific.

Is the price out of your range? Are the margins too tight? Are you hoping to avoid employees right now? Are you looking for a team already in place?

Did it miss one of your must-haves or raise a red flag? That’s information the broker can use to help you, and having that information will be important when a new business comes across his or her desk.

Tip #3: Treat the Search for the Right Deal as a Full-Time Job

Serious buyers, according to Mark, devote serious amounts of time and energy to the search for the right business.

Eventually they put processes in place to filter through listings and narrow them down.

When Royce Yudkoff, who teaches a course on small business acquisition at Harvard Business School, was on the podcast, he made the same point.

He said he’d never seen an entrepreneur accomplish the search successfully as a part-time side gig.

He and colleague, Richard Ruback, teach students in their class at HBS to expect to devote about 14 months to the search – and then another 4 months on the deal itself.

The right business for your unique situation almost never falls into your lap.

As Mark puts it, “it’s work to find the right business.”

When you treat it like work, devoting the same energy you’d devote to running a business, you’ll have more success.

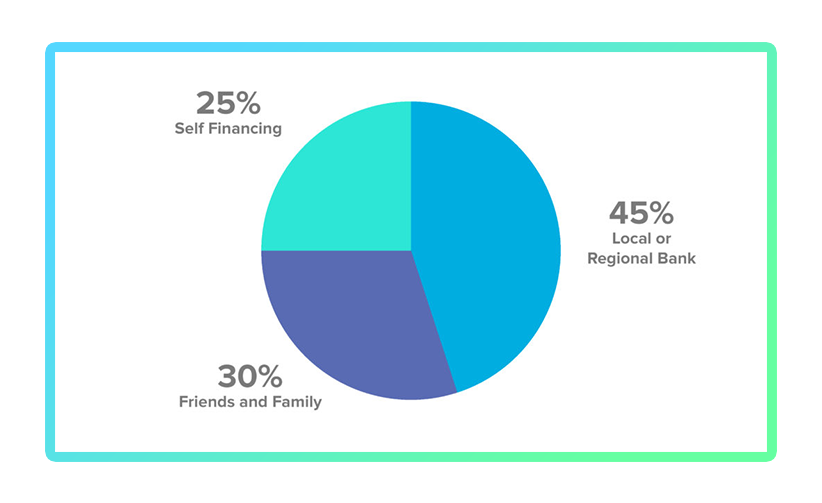

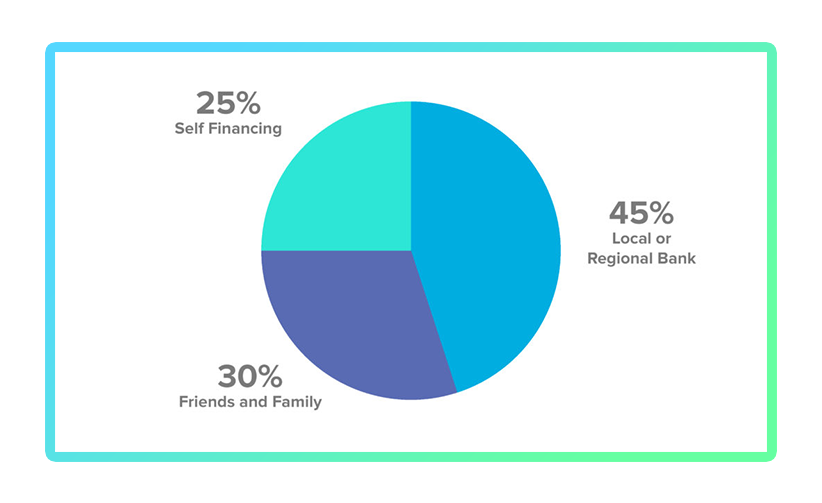

Tip #4: Line up Financing Ahead of Time

When the right business does come along, there’s usually no time to waste.

For instance, Joe describes an 8-figure listing this past year that had 100 inquiries in its first few days on the market.

The buyers are lined up right now, ready and waiting for the right deal, so preparing your financial approach ahead of time is essential.

Are you prepared to purchase inventory? Will you need to add staff? If you’re using an SBA loan, are you pre-qualified?

Are you expecting seller financing? Unless it’s a large deal, it’s best not to.

A Rollover for Business Start-ups (ROBS) can be a great way to purchase a business debt-free using a 401(k). Is your retirement account eligible?

When a broker has that information from you ahead of time, it raises their confidence in you and your ability to follow through with a deal.

It’s that kind of information that puts you top of mind when they come across a new listing.

Tip #5: Face-to-Face and One-on-One Go a Long Way

As most podcasters will tell you, something as simple as hearing your voice can greatly streamline the process of building trust with someone who otherwise doesn’t know you.

It’s true in business acquisition as well.

When you go beyond an impersonal template email sent to brokers and others in the industry, you’re much more likely to make an impression and stand out in their minds when a deal comes along that might be a fit.

The concept of availability bias applies.

Whether you’re reaching out to a broker, lender, seller, or anyone else involved, Mark and Joe advise that the more human your interactions the better:

- Record and send a personal video along with an email to introduce yourself.

- Attend online business conferences, meet people in person, and expand your network.

- If you’re located in the same city, make time to meet over coffee.

It pays to remember that business is relationship-based, even in the online space.

Personal contact can be more beneficial than many people realize, and by building your personal network, you increase your chances of success.

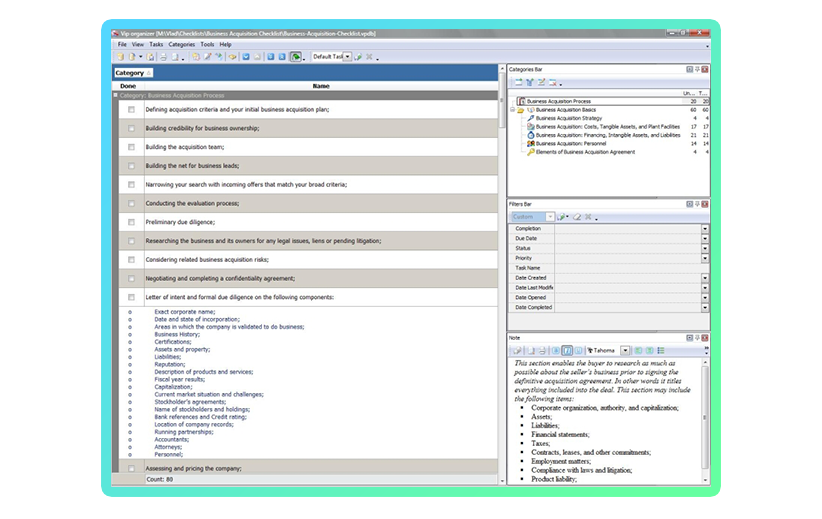

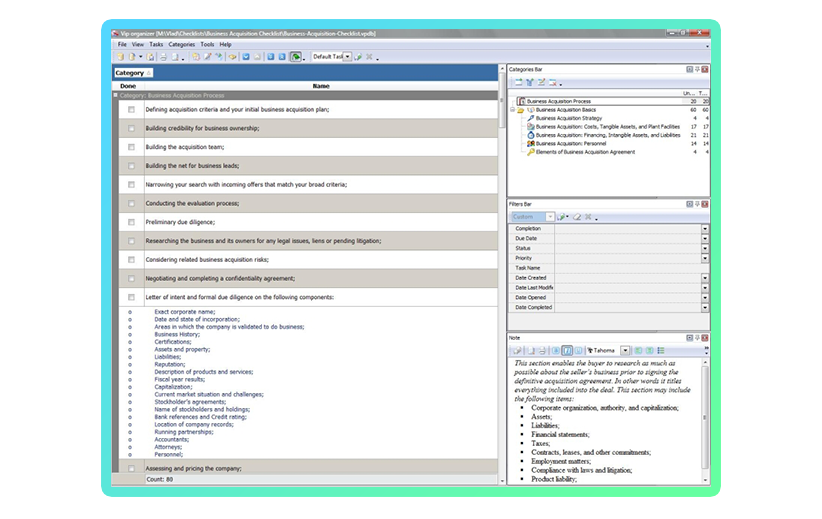

Tip #6: Create an Acquisition Checklist

The butterfly effect says that small changes in initial conditions can have massive downstream effects. When you’re buying an online business, it’s definitely the case that actions you take early on can affect the end result dramatically.

Joe points out that experienced portfolio buyers often prepare an acquisition checklist to help streamline the search for the right deals.

This document makes a great place to start in your own search as well. It’s the sort of advanced prep that shows brokers and sellers that you’re a serious and diligent buyer and instills trust.

As well, the more you know what you’re looking for, the greater your chances of finding it.

According to Joe, most buyers modify the checklist as the search progresses.

If it’s too narrow, you can broaden it as you go, or vice versa. But often the end is in the beginning. And starting out with clarity of purpose will have a major impact on the search process going forward.

Tip #7: Respect the Need for Speed

In nature, the Red Queen Effect says you can’t stand still in a competitive space or you’ll actually fall behind.

In business this means you have to keep innovating. In business acquisition, this means you have to keep moving.

According to Mark, those who respond to a listing in the first 24 hours after receiving it will have an advantage.

This doesn’t mean you should make rash decisions, he says, but that you won’t have time to put off a decision. Letting a listing sit idle in your inbox could mean an opportunity lost.

And back to Tip #5, if you’ve already met the broker with the listing, you’ll be ahead of the game when it comes to moving the process forward and scheduling a call with the seller.

In this particular economic climate, especially, with private investment funds getting bigger by the day, money waits for the right deal.

Again, if a business comes along that’s a match to your needs, you’ll want to act fast.

Tip #8: Leave a Lasting and Likable Impression

Once you get to the conference call with a seller, Joe has one critical piece of advice: “Make sure that when the call is over, that seller doesn’t want that call to end.”

In other words, make sure that the impression you leave on the seller is positive and memorable.

You want them to want to sell their business to you.

And before a conference call happens, the same goes for the brokers. When they hear about a great opportunity, what will make them think of you?

Joe points out that brokers are only human, and being likable matters.

Furthermore, humans all share a narrative instinct that makes us “storytelling machines.” We automatically construct meaning out of events in our lives through narrative.

People think in stories. And this can be an advantage if you take the opportunity to control the narrative that people associate with you and your name.

This doesn’t have to be elaborate. Joe and Mark both have stories about buyers who left a lasting impression on the seller just by showing kindness and appreciation.

Showing respect for the seller’s story goes a long way.

The story of integrity is a powerful one always.

Tip #9: Let Brokers in on Your Plans

This tip from Mark is another reminder that brokers are humans. They enjoy their work, and part of the fun is finding out about you and your business plans.

Part of the excitement behind this work is watching those plans unfold after an acquisition and seeing fellow entrepreneurs succeed with a new business.

To stand out as a buyer, let brokers know what you’re up to.

What kind of expertise will you bring to a business, and what other businesses are you a part of?

What are your plans for the business you’re searching for, and how does it fit into your overall strategy?

These details will put you top of mind, and will help brokers and other intermediaries help you. At the end of the day, every deal is a team effort.

Tip #10: Put More Focus on the ROI than Price

They’re not just Mark and Joe’s favorite words to hear, but the sage advice of some of the most experienced buyers:

“Be willing to overpay for a great business.”

By all accounts, when the business that’s right for you comes along, one that fits into your plans and will give you a great return, the nickel-and-dime approach will be counterproductive.

Much smarter to make an offer at the top of the range for that business and then get busy growing revenues and making a profit on your investment.

Consistently we’ve heard from successful multiple-time buyers on the podcast, that if it’s a great asset, it’s worth it to pay more.

At the end of the day, for the first-time buyer, deal flow is key.

The more deals you look at, the more you’ll begin to distinguish the good investments from the bad.

That means you’ll have to head out to open water and earn your sea legs so to speak. Meet people face-to-face, and know what you’re looking for as you search for the right business.

It’s always a good idea to be a nice person and help people help you, and the universal principles apply.

It turns out my dad was right about sailing for the most part.

We had our moments, and I stood out on the bow wrestling with the jib in 35 knot winds more than once.

There were some terrifying times, and there was that long hot day we waited for hours for a tow off of an unexpected sandbar.

But truth be told, those were some of the best times, certainly the most memorable.

And if you asked me the best way to learn to sail today, I’d say this…

Get in the boat and push away from the dock.