Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

Can You Still Bootstrap a Startup In 2018?

By Quiet Light

Around October of last year, phrases like “the end of the startup era” began cropping up in blog posts and on sites like Techcrunch.

There Jon Evans declared, “Big businesses and executives, rather than startups and entrepreneurs, will own the next decade; today’s graduates are much more likely to work for Mark Zuckerberg than follow in his footsteps.”

It’s tempting to believe that, but bootstrapping your way to entrepreneurial success is still an attractive option despite the struggle.

As mind-boggling technology like AI and big data on the scale of the IoT become ubiquitous, they also seem more likely to be manageable or accessible to only the biggest players.

And the funding that made Airbnb and Uber possible has all but dried up for the rogue venture, right?

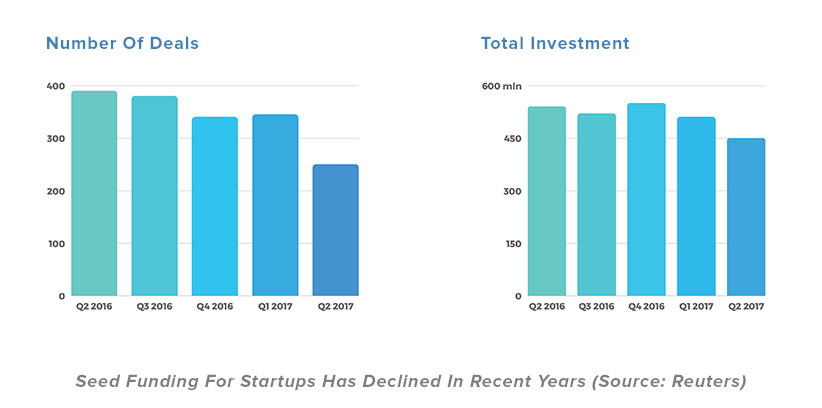

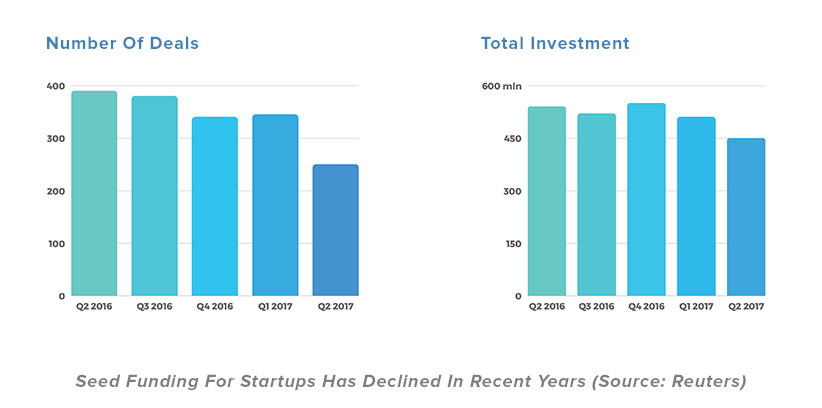

Seed funding has been trending down for the last couple years, it’s true.

VC-backed funding has long been considered the only viable path to true start-up success.

Except it’s not. Look at the proof.

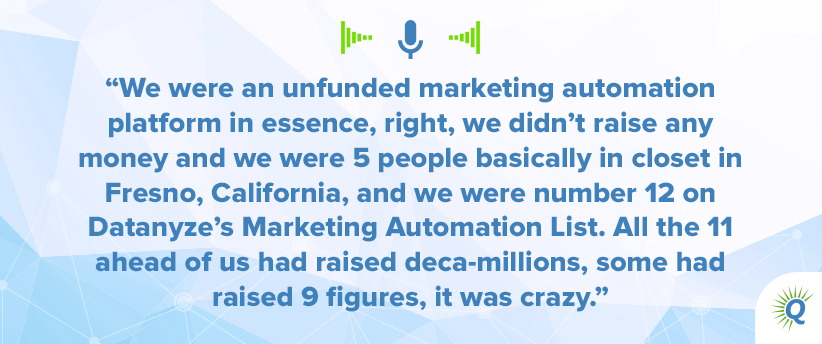

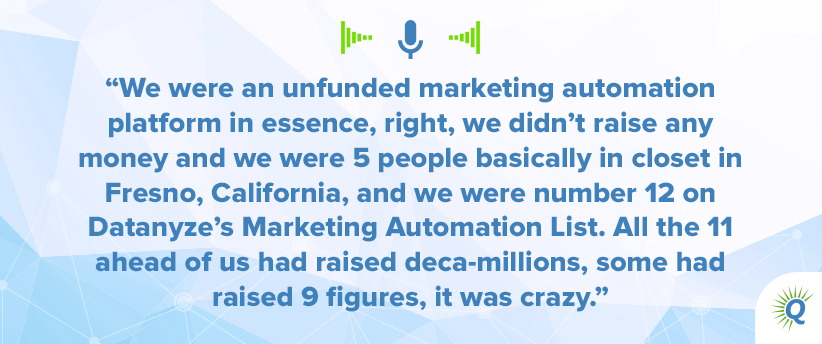

Rob Walling is a serial software entrepreneur who’s founded several SaaS apps, a conference for Self-funded startups (MicroConf), and also blogs, writes books, and runs a couple of podcasts – Startups for the Rest of Us and

Zen Founder, which he hosts with his wife Sherry.

He built his SaaS start-up, Drip, an email marketing automation software, without funding.

After 4 years of relentless focus on the product, the founders sold it to Leadpages for somewhere in the tens of millions.

Rob is not only a great success story in SaaS, but also a huge proponent of bootstrapping your start-up, especially for software.

No one would say that starting without funding is easy.

In his book, The Hard Thing About Hard Things, Ben Horowitz refers to, “the struggle to build something out of nothing” in what turns out to be a fit description of bootstrapping a SaaS startup.

According to Rob and others who have done it, it’s still possible – as long as you set out to design an elegant solution to a real problem and you’re willing to fight the battle of the bulge and win.

By bulge, I mean the temptation to take on too much and sacrifice the laser-like focus that has made startups like Drip a success story rather than another faded memory.

So, for those of us who have still faith that the Frightful Five (Apple, Amazon, Facebook, Google, and Microsoft) are not going to drive the future alone…

Here’s why bootstrapping can still be the best way to go.

Listen to the Source of this Post:

This blog post is based on a podcast episode that we recently recorded. Listen to the full episode here:There Are Advantages in Bootstrapping

Necessity will always be the mother of invention, and when you grow a company without the advantages of massive funding you’re forced to get creative. And you learn to solve problems quickly.

There’s nothing like the possibility of running out of cash to push you to make the most of the resources you already have.

And the ability to improvise is a skill that, once learned, shapes you into a better all-around business person.

Here are some of the opportunities disguised as constraints, brought on when you’re bootstrapping, that will build your entrepreneurial muscles and set you up for success.

You’re More Likely to Stay Product Focused

You Know Your Numbers and Your Customers

You Have to Be Strategic About Growth

It Forces You to Get Niche

Drip launched in 2013 as a basic email-capture pop-up that fed into existing programs like Aweber and MailChimp. Later they added autoresponders, broadcast, and a whole host of marketing automation features.

One of the things that founder, Rob Walling, is a big proponent of is starting small with a tight niche.

Nobody wants to be a solution searching for a problem and starting with a very specific niche market is a great way to avoid that.

What are the benefits of a niche? It forces you to focus, and it’ll help you get to product-market fit without going broke.

Starting with a niche can help you build momentum.

As long as you address a narrow problem within the niche that someone will pay you to solve, you can start generating cash flow and expand out from there.

It’s generally accepted that it takes about 18 months to get to product-market fit in SaaS, so that cash flow early on can be essential.

Some, like Rob, have found that a B2B niche is easier in many ways than B2C.

What makes B2B attractive? When dealing with business customers:

- They have less price sensitivity

- They’re easier to reach

- They tend to require less support

You’re More Likely to Stay Product Focused

To hear it told, VC money can be exhilarating but distracting.

Stories have piled up for years about startups that couldn’t get off the ground because they tried to please too many people and do way too many things at once.

When asked, “If you could only focus on one thing, what would it be?”

Most successful startup founders say some version of this – delivering value to the customer.

It really all begins and ends with the product.

When you’re funding the project on your own – without a product you have no cash. So that focus tends to be built into the equation.

In the case of Drip, Rob and Derek Reimer, his co-founder, started with a simple product (albeit with some pretty complex coding behind it at the time).

Then they continued to add features to that core product that served their current customers. It was an additive process, involving increasingly complicated code, but they never changed direction.

Drip provides a great example of how maintaining your focus doesn’t mean you can keep it simple by any means.

The way that Google has focused on search, for instance, is the perfect example. When you explore a full solution to a single problem, you can get into pretty deep waters.

Ultimately, the more deeply you can go into solving one problem in one area, the better.

You Know Your Numbers and Your Customers

Besides product focus, if you fund a startup on your own, you’re likely to keep a close eye on the critical metrics that keep your business going.

And you’re likely to keep in closer contact with your customers.

At Drip, Rob paid close attention to customer development from the beginning.

Before rolling out some of Drip’s key features, he’d already built an audience for his work and tested his idea for the software.

He knew that the business would live or die by its churn rate, and also knew he wanted to keep the price point at $50 and above.

As time went on, he kept in close contact with customers, even emailing those customers who left to find out why and what needs had gone unmet.

That combination of knowing and measuring the numbers that mattered most and deeply exploring exactly what Drip’s customers needed won big in the end.

With a SaaS app, MRR is important, but churn rate is critical.

Gross margins tend to be high in software, but operating margins can kill you.

When you keep an eye on your margins and monitor your expenses, you ultimately create a more sustainable company with a higher value.

When you’re self-funding, business can be closely tied to your own personal brand, so founders are less likely to take their hands off the wheel when it comes to the details that really add up to a solid and valuable company.

You’re Forced to Move More Quickly

VC-funded startups can become cumbersome things.

While everybody in the startup world sings the praises of staying agile, something tells me that’s hard to do when multiple millions of dollars are involved.

When you’re bootstrapping, staying lean is a way of life. And it’s still the best way to develop a product.

When you pull it off, you’re likely to have the advantage of speed.

Once again, the key is that laser-focus that makes a founder truly effective and makes a company valuable.

With fewer people, the decision-making process can be highly streamlined and product management can actually be manageable.

One of the things that anyone who followed Drip’s journey noticed at the time was their ability to push out new features at an incredibly fast rate.

What does Rob credit that speed to now?

- The small number of developers.

- The emphasis on the product and putting out good solid code from the beginning.

- The safeguards in the form of unit-test coverage they had in place.

A popular way to stay lean and keep your priorities in order as you grow is to use the OKR goals method (Objectives and Key Results).

Regardless of the method, keeping some sort of framework in place to hone in on your top priorities becomes especially key when the funding comes from you and the product you’re creating rather than an outside source.

It Forces You to Hire Wisely

Rob has a few tips from his experience with his various ventures over the years when it comes to hiring:

- Approach the job description as a sales letter – present the problem and your company as the solution.

- Present your differentiator – what makes your company unique?

- Hire for best fit over greatest skill set – personality matters.

- Find the best person to do the job – even if that person is remote and several time zones away.

Again, when going it alone in terms of funding, a founder has less leeway with money (compensation), but more control.

That ability to build a team that works well together and that emphasis on fostering a healthy work environment can make your company more efficient in the short term and more valuable in the long term.

The quality of the work will be higher. And as a result, the product will be better.

You Have to Be Strategic About Growth

A startup is a company that’s meant to scale from the very beginning. As Todd Belveal has pointed out, you’re building for hundreds of thousands of customers at minimum, not 500.

That means you have to have a growth strategy from the get-go, and at some point you’ll face the decision of whether to take on funding to scale or sell.

Growth requires cash, and software success can be incredibly expensive. Most SaaS apps are created to scale at the outset but doing that costs money later.

Many people who build companies out of thin air from the sweat of their own brow understandably resist the idea of an exit plan and harbor the concept that it’s somehow a cop-out to have one.

In reality, a good exit plan makes for a good company – and increases its value considerably. Ideally, it should be part of your growth strategy.

I’ll venture to say it’s impossible to plan ahead too much.

And even if you don’t plan to leave the company, planning for future cash requirements and a future that doesn’t rest solely on your own shoulders makes good sense.

In the case of Drip, they built a product of such value, the buyers came looking for them. Rob and Derek ended up with 5 suitors before eventually choosing to go with Leadpages.

And because they’d gone it alone without VC funding, the founders went into the acquisition with control over their own futures.

At the end of the day, funded or not, every good company is made up of the same basic components – like a solid customer acquisition strategy and a kick-ass product.

Arguably though, creating that product without venture capital can force your hand in many ways and bring out the leanest, savviest business owner in you.

The once venture-funded Facebooks and Apples just might be the wave of the future, but as Alan Kay is sometimes quoted as saying, “The best way to predict the future is to invent it.”

He’s the same man who once made this compelling argument for what sounds a lot like the world of being an online entrepreneur: computing is just a fabulous place for that, because it’s a place where you don’t have to be a Ph.D. or anything else. It’s a place where you can still be an artisan. People are willing to pay you if you’re any good at all, and you have plenty of time for screwing around.

Sounds like a formula for success.