Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

Exit in style, not in flames: 3 steps to plan the perfect business exit

By Quiet Light

Starting a business is one thing, but how do you go about ending your role in a business? Savvy entrepreneurs plan for their exit long before they intend to step out of their business. But hey, it can be a challenge to know how to exit plan. That’s why Quiet Light Brokerage sat down with John Brown, CEO of BEI, to pick his brain about the nuances of exit planning. Get your butt in gear and plan for your exit right now, whether you intend to leave in one year or ten.

John’s journey to exit planning

3 steps to start exit planning

Every entrepreneur remembers the day they founded their business.

Rooted in optimism and a dash of “hell yeah,” founding an online business is a great adventure for brave entrepreneurs.

But every adventure has to end.

Have you ever given serious thought to what happens when you don’t want to run your business any more?

Are you really going to be selling Amazon plushies for the rest of your life?

Probs not.

But should you really call it kaput with your business and let it fizzle out once it’s time for you to retire?

No! You pumped hours of hard work, tears, and money into this biz.

Don’t let your business fizzle and die. You’ve got a sellable asset on your hands, especially if you’re running an eCommerce or Amazon business.

The point is that we can’t always see the road ahead.

You might be pumped to do Amazon FBA today, but in five years it could be a different story.

That’s why every entrepreneur should have an online business exit strategy.

A good exit strategy details when and how you’ll step away from the business.

It not only helps you earn more money when you choose to sell your online business, but also increases your business’s performance.

However, the key is to know what you have right now before you can move forward. You can always chat with the folks at Quiet Light to understand your existing resources before pushing ahead with a sale.

No matter if you want to leave the business in one year or 10 years, it’s a good idea to set it up right from the start.

A little bit of work right now will save you from heartache once you decide to exit the business.

John’s journey to exit planning

Nobody knows online business exit strategy better than John Brown, CEO of the Business Enterprise Institute (BEI).

BEI is one of the oldest and largest providers for exit planning education in North America.

Oh, and John literally wrote the book on exit planning, so this guy definitely knows his stuff.

John’s story is interesting because he didn’t originally set out to do exit planning. He actually went to school to become a lawyer.

While he was attending law school in Wisconsin, his parents decided to sell their business and retire to Florida.

As people of the bitterly cold north are wont to do.

Unfortunately, the sale was a disaster.

“My parents ended up selling their business and it didn’t turn out well. It was an absolute bust,” John says.

His parents sold their business on a promissory note and, within a year, the business crumbled.

John’s parents sold their livelihood and got very little proceeds from the sale of their business.

This had a huge effect on their retirement and John was pissed, to say the least.

At the time he wasn’t in a position to help his parents, but their experience made him particularly passionate about helping small business owners.

From law to exit planning

The phrase “exit planning” didn’t even exist at the time, so John acted like a good little lawyer and started practicing in Denver.

“This was long ago enough that the term ‘exit planning’ hadn’t been coined yet,” John says.

But because of his parents’ experience, John knew he wanted to give legal help to small business owners.

Over time, he developed a law firm that represented just business owners.

With 20 attorneys under his wing, half of John’s firm was for transactional M&A while the other half eventually became a planning firm.

After exit planning became a thing in the 1980s, John’s planning team began helping biz owners implement a plan to leave their business on their own terms.

Although most of John’s clients were transferring the business to a family member, he also got a lot of experience in third-party transfers.

Over time, BEI developed a process for exit planning.

Instead of working with the business owners themselves, John now teaches financial planners and other professionals how to help their clients create an online business exit strategy.

What is exit planning?

Exit planning might seem sort of like planning your own funeral, but like planning your own funeral, it’s a smart thing to do.

Otherwise you’ll end up with a sparkly pink casket—or a buyer who destroys all of your hard work.

Exit planning is a shock of reality to the high-flying entrepreneurial lifestyle.

It acknowledges that all business owners will, at some point, have to leave their business.

“Business owners all have to leave at some point. They may die, they may go bankrupt,” John says.

An online business exit strategy helps you create a plan to exit the business on your terms.

Of course, the goal of an exit plan isn’t to dress up a bad business to make it more sellable.

That would just be putting lipstick on a pig, after all.

“We’re trying to work a pig into a beautiful stallion,” John jokes.

Actual exit planning takes that stinky, messy pig and transforms it into a beautiful thoroughbred stallion.

This is about building muscle waaaay before you plan to leave your company.

In fact, good exit planning is done so far in advance that John likes to call it “pre-exit planning.”

If you want to get a good deal when you eventually exit the business, you have to start exit planning the moment you create your business.

And no, I’m not exaggerating. That’s what you need to be doing.

That’s because an exit plan will help you build a business with the end in mind.

If you want to earn $50 million for your business but don’t put in the work to build a $50 million business, you’re going to be totally bummed when you get just $5 million upon exit.

With an exit plan, you have a very clear path to scaling your business to $50 million, putting more money in your pocket both today and upon your exit.

Translation: exit planning gives you more money today and tomorrow and builds a better business.

What’s not to love?

The four common exit paths

Not all exits are alike.

Depending on your situation, you’ll choose an online business exit strategy that works for you.

While there are plenty of exit options out there, John says he sees entrepreneurs choose three common paths.

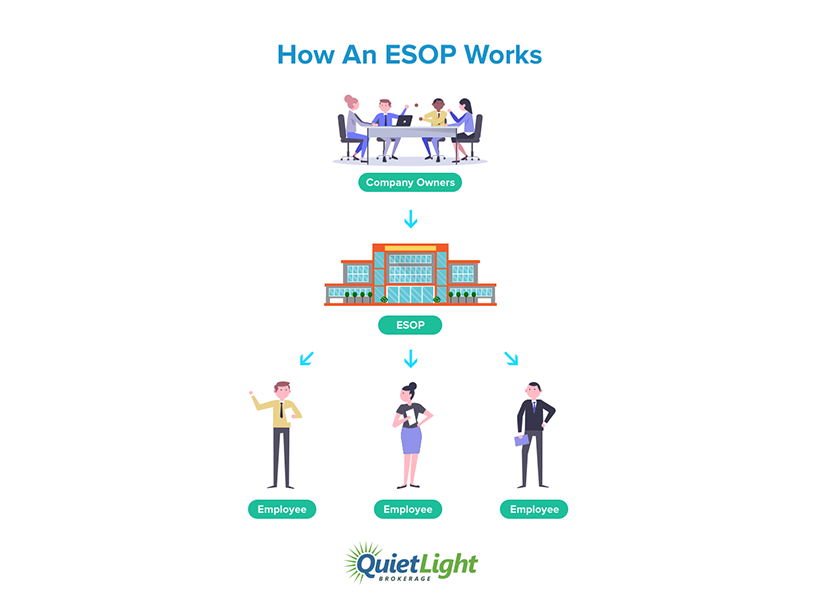

Employee stock ownership

Just 1% of all John’s clients use this option.

This is when you create a stock ownership plan for your employees, indirectly giving employees control over the company.

This is a good option if you want to leave a lasting legacy or have built a community around your brand. This has some kickass tax advantages, but it can be pretty complicated to do.

Transferring to kids and family

25% of all John’s clients transfer their business either to their children or to a family member.

This is a good option because you can start transitioning out of the business sooner rather than later.

You can control the business today until you reach certain milestones, eventually transferring the company over time.

This is a good way to make sure your knucklehead relative knows how to run the business before you hand over the keys to the kingdom.

Transferring to a third party

29% of John’s clients transfer their business to a third party. This is the perfect way to get the most bang for your buck when you decide to exit the business.

If you don’t have family involved in the business and want to make a clean break with a ton of money in your pocket, this is a great option.

Some business owners also choose to transfer ownership to existing business management, too.

3 steps to start exit planning

Whichever option you choose, you have to start exit planning early.

As in, like, yesterday, if I’m honest.

But don’t worry. If you haven’t done your exit planning yet, you can still take care of it.

Follow John’s steps to create an exit plan that doesn’t leave a bad taste in your mouth.

Step 1: Set your goals and timeline

This is not the time to be a wishy-washy entrepreneur.

You can’t create an exit plan if you’re just winging it, y’know?

You need to have some semblance of a plan.

How much money do you want to get from your business when you sell? Who’s going to get the business? When do you want to leave?

Something flowery like, “I want to exit in five years” isn’t enough.

“I want to leave on August 8, 2024, and earn $10 million for my business sale” is the kind of goal that moves the needle.

Set a SMART goal that’s specific, measurable, and clear. This is what will help you create a very specific online business exit strategy that gets results.

Step 2: What are your resources?

Second, John recommends that business owners take stock of your resources and compare those resources to your goal.

If you want to earn $10 million from a sale, what are you earning right now?

If it’s $6 million today, that means you have a $4 million gap to fill in the span of a few years.

[[[“Owners can’t do any planning if they don’t know what the heck they have, and what the heck they want to do.”]]]

Don’t let the numbers discourage you. This is the first step to making changes that will get you to your $10 million figure.

At this point, you’ll want to consult with your broker, financial planner, or banker to help you brainstorm some new ways to get in the black more quickly.

Step 3: Use value drivers

“But how do I get back in the black?” you might wonder. Great question! John has the answer.

The third step to better exit planning is using value drivers to grow your business’s cash value.

After chatting with the M&A community for a few decades, John has narrowed it down to three value drivers that every business owner needs to leverage.

Improve internal operations

Let’s say you’re a farmer buying a barn.

Are you going to buy a barn that’s semi-functional and covered in peeling paint? Or the freshly cleaned and painted barn next to it?

You’re going to want to clean, new barn that’s ready for use.

Buyers want the same thing from your company.

Long gone are the days when buyers were okay with buying a trash fire of a company and overhauling the operations themselves.

Ain’t nobody got time for that.

Today, buyers don’t want to spend thousands of dollars overhauling your internal operations.

“Buyers don’t want to spend thousands ripping out the old operating system,” John says.

Always optimize and improve your operations before you even think about selling.

Good operations make your business much more appealing and valuable to buyers because it’s more likely to give a faster return on their investment.

Diversify the company

Are you dipping your toes into a very small pool of buyers or suppliers?

That’s a recipe for disaster and decreases the value of your business.

You never want your brand to be dependent on a small group of customers.

“Make sure the company’s not dependent on any small group of customers or clients,” John says.

Diversification is the best way to future-proof your business, even if you’re in a niche industry.

Find new ways to reach different audiences, widening and diversifying who buys your products.

If you can, shake things up with your suppliers and vendors, too.

Variety is the spice of life, and when it comes to your online business exit strategy, it can put more money in your pocket, too.

Increase business transferability

The final value driver is creating a business that’s easily transferable.

If you’ve created a great business with you, the owner, at its center, it’s not going to transfer well once you step away.

“Smaller businesses where the owner is in charge of everything are generally not transferable,” John says.

For example, Quiet Light once had a client who wanted to sell his SaaS business.

Well, as it turns out, the owner was actually the product developer, too.

Because of this, Quiet Light realized the business was essentially unsellable, because the business wasn’t transferable without the owner.

Buyers want minimal interruptions to cash flow. If you’re the craftsman behind the business, cash flow will grind to a screeching halt if you leave.

As an online business, you might have a model where you’re the center of the universe, running the biz alone or with a few VAs.

This is why it’s important to have some kind of management structure, so the buyer knows that they’ll have support once they buy the business.

Look at your business and figure out how to make it more transferable.

“The owner can’t be the craftsman in the business,” John says.

If you can’t take a week off work without serious interruptions to cash flow, you need to reconsider your model for a clean exit in the future.

John’s biggest deal-killers

You can’t plan for everything in life, but good exit planning will put you on the straight and narrow for exiting your business gracefully.

That said, John notes that two things kill business deals, and they come down to seller behavior.

If you want your online business exit strategy to mean anything, avoid these two big blunders.

Goal-less owners

The biggest deal-killer is when owners don’t know what they want to do.

Do you want to retire after exiting the business? How much money do you want from the sale?

Heck, how much money do you need from the sale to make it worth your while?

John’s had clients take their business to market, realize the going rate is much less than they thought, and they pull out of the deal.

This kind of pisses people off, so it makes it hard to re-enter the market later, which really shoots you in the foot.

Overinflated valuations

A business isn’t just a business for most of us. It’s a product of a lot of hard work.

Although it may be a vehicle to make a living, your business is like a child.

And, like their children, most people tend to overvalue their business. Heck, some people who have never even spoken to a broker think their business is worth a 20x multiple!

“Some owners have an overinflated concept of what their business will sell for,” John says.

You can go around telling everyone that your business is worth $10 million, but that won’t make it true.

Unless you sit down and look at the numbers, you have no clue what your business is actually worth.

Many business owners don’t do that, though, and significantly overvalue their business. They go to market with a huge, pie in the sky number that goes over like a fart in church.

Instead, take steps right now to grow and protect the value of your business.

Use the years you have left in the business to leverage value drivers and make that big number a reality.

Ride into the sunset

Once upon a time, John had a client named Carl.

Like many entrepreneurs, Carl decided he had enough of his business and wanted to sell ASAP for $5 million.

Of course, Carl was off on his valuation. His brand was only worth $1 million.

The other problem was that the business depended on Carl to run smoothly. If he left, the business would essentially die.

No buyer would touch the business.

John told Carl that, if he wanted to earn $5 million, he had to create a plan to build a $5 million business over the next six years.

Carl took a gamble and realized he had to make changes if he wanted to exit with a ton of cash in his pocket.

Carl, a dude from Colorado, hired a hot-shot executive from the Netherlands to come in and overhaul the brand.

John worked with Carl and the new exec to design an exit strategy to give portions of ownership to the exec every year, provided the company hit cash flow performance standards.

After 7 years, the business had blown up. Carl was able to sell not for $5 million, but for $38 million.

This is just one of the many success stories from exit planning.

If you haven’t created an online business exit strategy yet, today’s the day, my friend.

Don’t leave your exit up to chance. Create a plan so you can exit not in flames, but in style.