Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

Mo’ money, less problems: Identifying legit add backs to earn more for your biz

By Quiet Light

Want more buyers to ogle your business for sale? Add backs on seller discretionary earnings are an important (but uber-confusing) way to entice buyers to check out your business. Quiet Light’s Joe and Mark sat down to define what add backs are and when they’re legitimate so you can stop leaving money on the table.

Getting granular with seller’s discretionary earnings

The double-edged sword that is add backs

Level 2: Necessary, one-time expenses

Level 3: The gray area where everyone gets confused

Breaking it down: 8 add back case studies

In the words of the Notorious B.I.G., mo’ money usually comes with mo’ problems. But in the case of selling your business, mo’ money is a good thing.

Whether you’re planning to exit your biz in one year or twenty, it’s not a bad idea to earn more money.

Right? Businesses thrive on profit.

The good news is that bigger earnings don’t just put more money in your pocket today; they can give you a bigger price tag once it’s time to put your business up for sale.

Roll in fat stacks just like ole B.I.G. by selling your biz for more money.

Listen to the Source of this Post:

This blog post is based on a podcast episode that we recently recorded. Listen to the full episode here:“Well duh,” you might think, “But how can I sell my business for more money?”

Add backs on seller discretionary earnings are one way to, as B.I.G says, “get, get money.”

Quiet Light’s very own Joe Valley and Mark Daoust sat down to chat about skyrocketing your exit earnings with add backs.

It’s about mastering the dance between your P&L, SDE, and a few other important acronyms.

What are add backs?

You’re gonna learn to love add backs.

An add back is an expense that you add back to your business profits.

In plain English, that means it’s an expense that will go away once you sell the business.

This means the buyer will actually get more value for the business than what they might see on your profit and loss statement, or P&L.

Add backs sweeten the pot and make your business listing more irresistible to potential buyers.

Of course, the real purpose of an add back is to give these buyers a better idea of the kind of ROI they’ll see once they buy the business.

Expenses like travel, one-time expenses, and other line items (that I’ll get to in a sec) can qualify as add backs because these are costs that won’t transfer to the owner.

Because those costs won’t transfer over to the new owner, it means you’re putting more cold, hard cash in their pockets through the sale.

Adding expenses back makes this more apparent, so buyers don’t have to do a ton of math wizardry to figure it out.

That said, add backs aren’t always cut and dry.

As Biggie Smalls once said, “I like the life I live, because I went from a negative to a positive.”

It’s important positively know whether an item is a legitimate add back or not.

Getting it wrong could deceive buyers or get you too little money from your business sale.

Let’s do neither of those things, ‘kay?

Getting granular with seller’s discretionary earnings

Joe and Mark sat down to talk shop about all things add backs on the Quiet Light podcast.

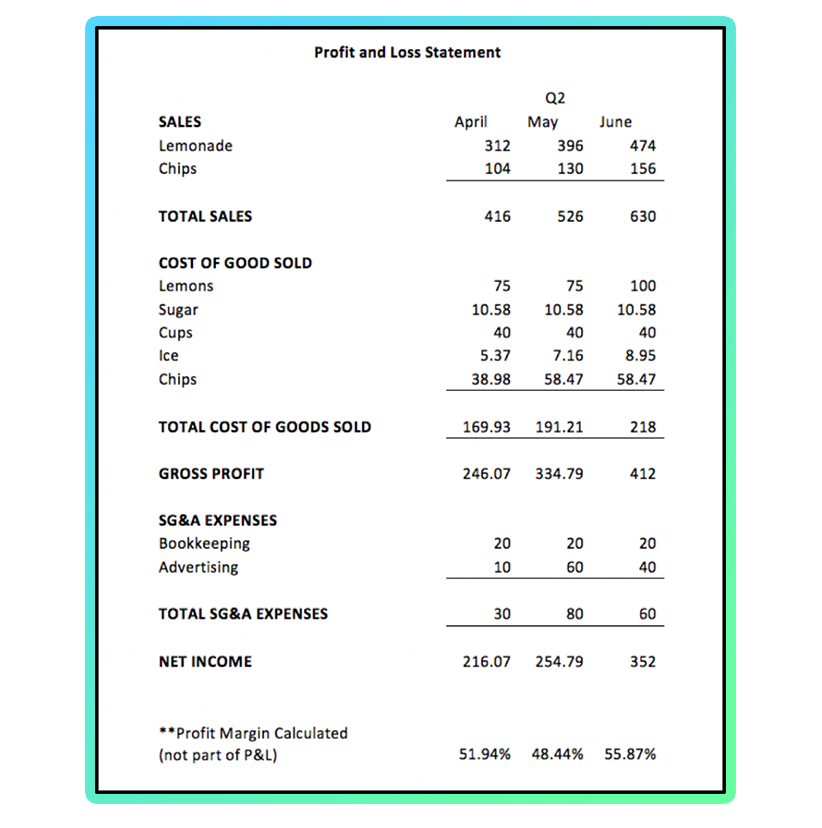

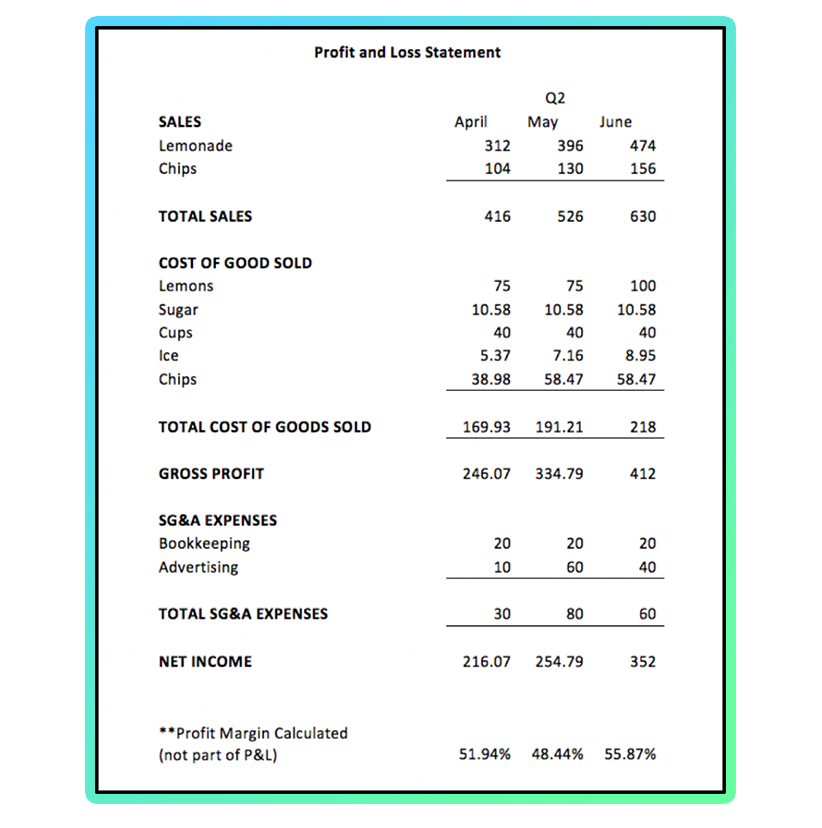

Add backs are visible on your P&L statement, which potential buyers check out to determine if they want to pursue your business.

You’ll have an income line at the bottom, which represents your 12 trailing months net income.

But wait, this number is only one piece of the puzzle!

Buyers see this number in addition to your add backs so they can understand what the seller’s discretionary earnings (SDE) looks like.

This just shows your pre-tax profit.

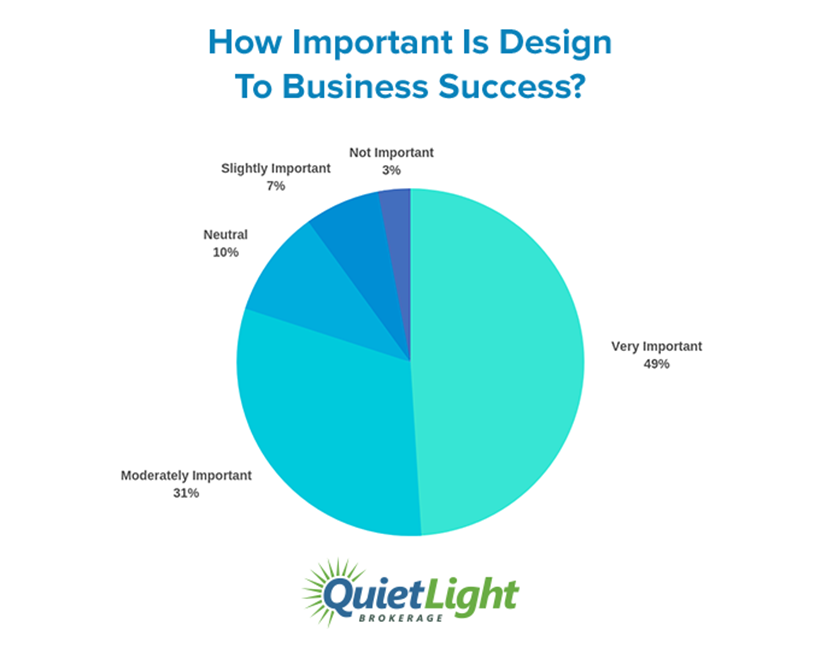

After they know the SDE, the buyer multiplies that figure by your multiple (2x, 3x, etc.) to understand the true potential of your business.

The double-edged sword that is add backs

Add backs truly are a double-edged sword.

Done right, add backs show off your business in all its blingin’ glory.

Buuuut if you do add backs wrong (or take advantage of them), you risk scaring off potential buyers.

“Your buyers are intelligent people that are going to be thorough and diligent,” Joe says.

Abusing add backs is like stuffing a push-up bra: you’re bragging about something that isn’t there.

You need to not only get your add back formula right, but know what counts as an add back and what doesn’t.

You have to know when add backs on seller discretionary earnings are legit or BS.

Both buyers and sellers need to know how to calculate SDE.

Some people think, “Ah, I can make an argument for this add back, so it totally counts.”

But nope, that’s not right at all.

You can’t approach add backs as a free for all because there’s an actual definition and formula for calculating SDE.

“Some people approach this almost as if it’s a free for all, as if it’s who can make the best argument,” Mark notes.

We have to take off our Badass Outlaw Entrepreneur hats and follow the rules here. “There is an actual definition for SDE and there are rules to follow,” Mark says.

Remember, the purpose of add backs on seller discretionary earnings is to help buyers.

Your goal is to help them understand the ROI on buying this business, not adding your RV to the SDE to artificially tip the scales.

There’s nothing wrong with hustling like our BFF B.I.G. (“I live every day like a hustle.”), but there’s a time and place for it.

Three types of add backs

Although there are general rules for add backs, you still have to look at them on a case by case basis.

Often it comes down to the nuances of a business to decide whether an add back is warranted or not.

That said, you’ll encounter three different types of add backs in the wild safari that is P&L statements.

These add backs start out simple and black and white, but then get more complex and advanced as you look deeper into the business.

As B.I.G. said, “You think big, you get big.”

Don’t let the complexity of add backs turn you off. It’s important to understand this financial stuff if you want to have more cash in hand when you sell your business.

Level 1: The obvious stuff

Let’s tackle the easy part first, shall we?

Level 1 is the obvious expenses that (almost) always count as an add back.

These add backs tend to be regular expenses.

This includes things like accounting costs as well as owner salary.

Now, you might wonder, “Why in the world are you adding back someone’s salary?”

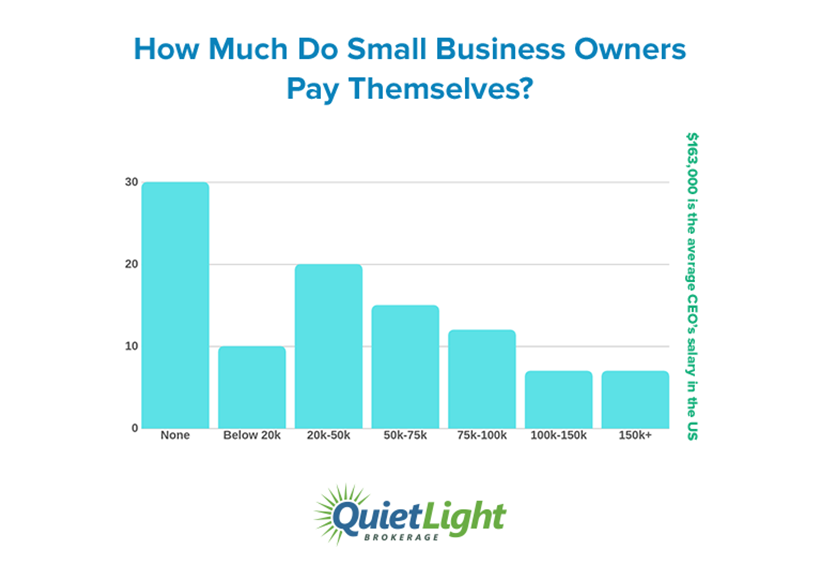

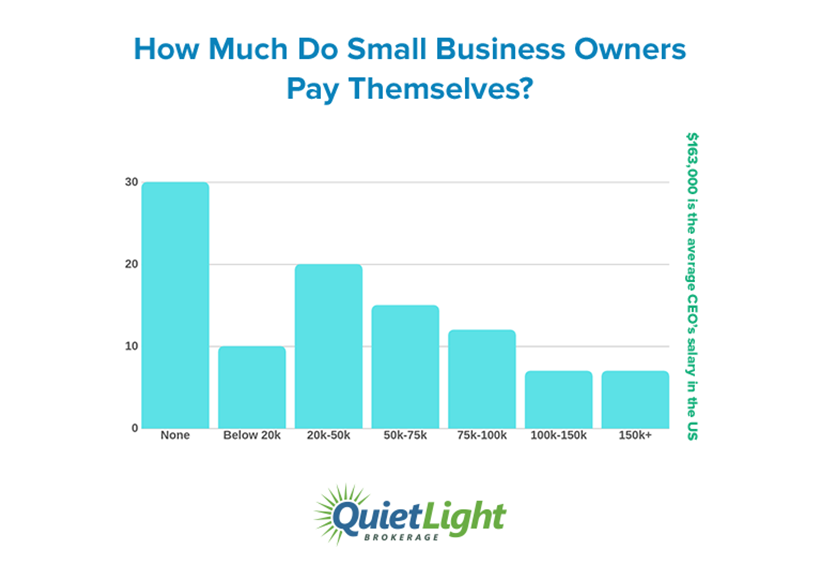

That’s because your salary is discretionary; you choose how much to pay yourself. “There are certain owner benefits that you get as the owner of an internet-based business,” Joe says.

This is the reason why owner-CEOs often make hundreds of thousands and even millions of dollars (can you blame them?).

But there are some owners who don’t draw a salary from their business at all; it’s all discretionary.

The big, fat exception here is when you have more than one owner drawing a salary from the business.

You can’t add back everyone’s salary in this way, so you have to be reasonable here.

If you have two full-time founders, you should only add back one of their salaries.

If you have two part-time founders, it’s generally okay to add back both salaries into the equivalent of a full-time salary.

So hey, as B.I.G. says, “Learn to treat life to the best, put stress to rest.”

Eliminate the stress by understanding these simple level 1 add backs as a definitive black and white area.

Level 2: Necessary, one-time expenses

Easy enough so far, right?

Level 2 add backs on seller discretionary earnings are also relatively simple.

These add backs are different because, instead of the recurring expenses in level 1, level 2 are necessary one-time expenses.

This includes purchases like:

- Trademark

- Copyright

- Patents

- Legal expenses/lawsuits

- One-time professional services, like hiring an accountant to import your books into an accounting software

Although these add backs are a one-time thing, they still have a significant impact on your business’s value.

For example, trademarks are hella valuable even if you only renew them every now and then; they totally count as an add back, so be sure to add them.

Level 3: The gray area where everyone gets confused

Ah, it’s time for the big enchilada: level 3.

“For level three, math and logic begets math and logic. This is where we get into the interpretation of different expenses,” Mark says.

This is the type of add back that confuses everyone, brokers included.

Even the Quiet Light team has had hearty disagreements over these add backs.

These add backs are in a gray area where it isn’t so straightforward as to whether the expenses are legit or not.

At this point, it’s all about your interpretation of these sticky, weird expenses.

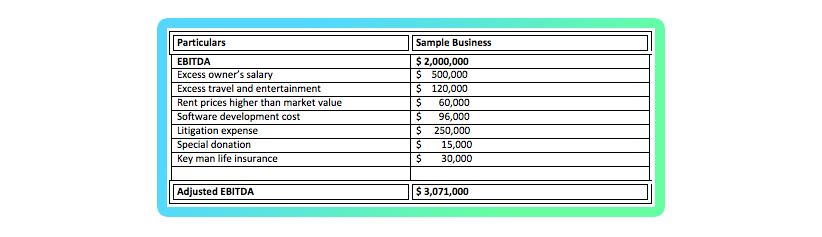

Breaking it down: 8 add back case studies

In fact, these situations are so wonky that it’s best to look at them as case studies.

Let’s dissect a few situations to see what counts as legit add backs on seller discretionary earnings.

#1: Trade shows and mastermind fees

Should you add back the costs of trade show attendance and mastermind group fees?

Generally speaking, these costs wouldn’t count as add backs because they’re something you do at your own expense.

“The choice to go to an event; that’s an expense that doesn’t carry forward,” Joe says.

However, the good ole gray area pops up here.

You might be able to count events and group memberships as an add back if they’re an essential component of your business model.

For example, if you’re an advertising agency and you built your brand by going to these events regularly, it could count.

Another way to look at this is to consider if an expense is for personal development versus business development.

If you do personal development by sending your content writer to MozCon to learn about SEO, it probably isn’t an add back (sorry).

The key to add backs on seller discretionary earnings is knowing the history of the business.

Do you do this event every year?

Have you done it at least for the past 2-3 years?

Use reason, math, and logic to determine if that trade show fee really, truly counts.

That said, if the annual fee for the mastermind is $500, is it really worth it to add that back in the first place?

Sometimes it’s best to pick your battles here.

Buyers will debate any add backs that they disagree with, so you want to be sure your add back is demonstrating real value.

As Notorious B.I.G. says, “Stay far from timid. Only make moves when your heart is in it.” If an add back doesn’t feel right, then it probably isn’t.

#2: The credit card rewards aficionado

Let’s say you have a rewards credit card for your business.

You put tens of thousands of dollars of advertising costs on that card.

You decide, “Hey, I work hard! I’m going to use these cashback points on a trip for my family.”

This can count as an owner benefit, which would be a level 1 add back.

That is, it wouldn’t show up on your P&L and would be an add back.

But wait! You need to look at your multiple to determine if it’s worth your time adding it back or not.

“You have to pick your battles on this,” Mark warns.

Case in point: Quiet Light once had a business listed at a 4x multiple.

The owner earned $25,000/year using reward points, which means that bumped his valuation up by $100,000.

That’s no small sum!

When deciding whether to add these back, look at the total sum. If it’s only $1,000, it might be better to leave it alone.

You also have to consider the consistency.

If this is a long-term part of your business model, these charges would count as add backs on seller discretionary earnings.

#3: The fancy website redesign

Unless you really dig your 1997 Angelfire website, you’re probably going to redesign your website every now and then.

But hey, it’s no small feat to overhaul a website.

It can cost up to $40,000 to create a new website. So does this count as an add back or not?

The answer is on your P&L. How often do you do a redesign?

For example, let’s say your business is 8 years old. In the last 12 months, you haven’t redesigned your website.

If that’s the case, this is 100% an add back.

Now, this gets tricky if you’re redesign-happy.

You would need to see how often the site has been redesigned.

Estimate when it will be redesigned again in the future, adjusting the amount of the add back to give a fair reflection to the buyer.

#4: Physical product development

Product development is the lifeblood of eCommerce.

That’s why smartphone companies are always releasing the latest, greatest tech: it keeps them competitive and makes consumers go gaga to buy more stuff.

But do these costs count as an add back on seller discretionary earnings?

Generally speaking, no.

Product development is what happens over the natural course of running a good business.

It might count as an add back if you do a large, one-time burst of energy to design a product.

You also might have an add back on your hands if you spent a ton of money designing a product mold, although that’s kind of unusual.

But as Biggie Smalls says, “Whatever you’re going to do, just do it for a reason.” Make sure product development add backs add value to your buyer; have a solid reason behind it if you choose to do an add back.

#5: SaaS product development.

Physical products are one thing; what about product development for, say, SaaS businesses?

Do you get those sweet, juicy add backs when your product is in the cloud?

Nope, sorry.

Maintenance, new features, and upgrades don’t count as add backs because they’re just a part of running a SaaS business.

You could qualify for add backs if you built a product from the ground-up or if you completely switched technology stacks.

#6: Overpaid relatives

Quiet Light once had a client who hired his brother to do customer service. The brother earned $20/hour to work 20 hours a week.

I’m sure you can see where this is going.

Did the brother actually work those 20 hours a week?

Nope. The dude was working more like 5 hours per week because most of his work involved automated, canned responses.

The problem is that he was grossly overpaid for this work.

How do you add back the salary of someone who’s clearly earning more than they should?

Quiet Light figured it out by looking at the market rate.

You can hire a good virtual assistant for roughly $10/hour. They were generous by still estimating the brother’s salary at 20 hours a week at $10/hour.

After looking at his salary, it was a sizeable number, so it made sense to add back the brother’s salary.

However, the number needed to be, y’know, fair, so that’s why the Quiet Light team adjusted it to market averages.

This shows an interested buyer the expense and return they can expect when they hire a VA to take over the work after the sale.

“Your brother loves you, but I’m going to suggest that he fire you,” Joe recalls saying to the overpaid sibling (who didn’t get fired, if you were curious).

#7: Lowering the cost of goods

Once upon a time, Quiet Light client Mike Jackness was selling his company.

He was able to renegotiate the cost of his goods down by $1.60 per unit.

Not bad, eh?

In this situation, it counted as an add back because it influenced the buyer’s potential ROI once they bought the company.

To determine a fair number for add backs on seller discretionary earnings, Quiet Light put on their Mathematician Hats.

If the client sold 1,000 units a month and saved $1.60 per unit, that’s $1,600 a month. Over a period of 10 months, that’s $16,000, which is a huge number.

It gets even bigger if you multiply the amount saved by the business’s multiple. If you save $16k at a 3x multiple, that’s a $48,000 add back.

As B.I.G. said, that’s “sicker than your average” when it comes to boosting your business’s value.

Just make sure that your supplier will give the same favorable terms to the new buyer. Nothing sours a good add back faster than bad contracts.

#8: Reduced fees

Joe once worked with a client who managed to reduce his fees per product sold.

This had a tremendous effect on the business because he was using Amazon to pick, pack, and ship.

With the change in packaging, the client went from a level 5 to a level 4.

That’s Amazon-speak for “we’ll charge you way less money to mail this stuff because it’s smaller.”

So, instead of paying the $5 fee, the client was now paying a $4 fee.

He was able to add that back because it’s an expense that disappeared, sweetening the deal for the potential buyer.

The bottom line

Mo’ money isn’t mo’ problems when you know what counts as a legit add back. Remember, the point of add backs is to give the buyer an idea of their expected ROI.

Follow Mark and Joe’s process to standardize your add backs on seller discretionary earnings so buyers can make their own assumptions.

Of course, it’s not always easy looking over these wonky add back situations. Brokers and sellers have to use strategy and discretion to figure out what approach is best.

“It doesn’t matter if you increase your discretionary earnings by 10% or if you increase your multiple by 10%. The result is going to be the same,” Joe says.

It all comes down to chatting with your broker and choosing a strategy that works best for your business.

At the end of the day, shoot for the stars. Improve your numbers and make your business irresistible to potential buyers. Add value wherever possible to get more folks interested in your biz.

Have a question about an add back? I can’t blame you one bit; this stuff is confusing.

Quiet Light loves a good debate, so shoot over your add back questions here. Oh, and they’ll even toss in a free valuation, if that’s your thing.