Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

3 Bad Habits Commonly Committed By Internet Business Buyers

By Quiet Light

Buying an online business is hard work. Not only is it difficult to find good websites for sale, but it is equally difficult to compete with all the other buyers who are looking for a quality internet business to acquire.

While I understand how difficult it is for people to find, negotiate, and finish a good acquisition, I also see many buyers who have habits which make their search less productive.

I want to address some of those habits, how to avoid them, and why they hurt your search for an acquisition.

Look Beyond the Asking Price Multiple

It’s very easy to get wrapped up in how much someone might be asking for their business. You might even look at a business and its asking price and immediately think “this guy is insane – I’d never pay that much for a business”.

But the problem with being overly focused on multiples is that, as a metric, they are really pretty limited. They don’t tell you too much about the business itself.

I’ve written before about how the industry needs to be less focused on multiples as a metric, although I’ll admit that QLB still is a part of this problem.

For most buyers, when you see a multiple, what you are looking at is a ratio of the asking price to the expected earnings of the business for sale. The multiple is supposed to give you a general idea of your expected ROI. But this ratio assumes that the last 12 months of earnings is an appropriate baseline for earnings expectations.

Let me give a couple of examples to show why this is problematic.

How Does a Multiple Look When Something Bad Happens To a Company?

In a recent blog post, Bryan O’Neil pointed out a common mistake buyers make in valuations, which is they do not pay attention to the current earnings of a business. Rather, they look at the historical earnings of the business. The problem with that is online businesses can change rapidly.

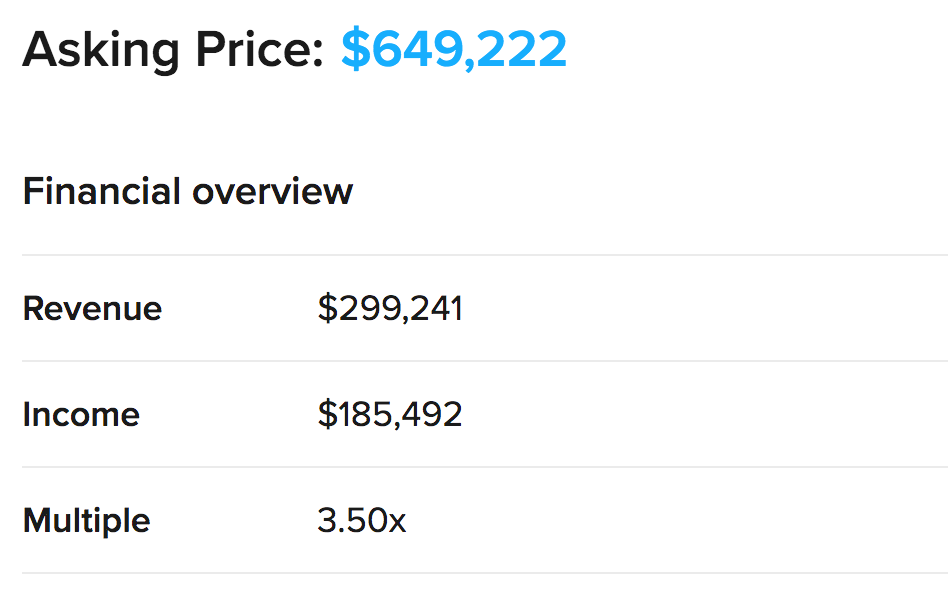

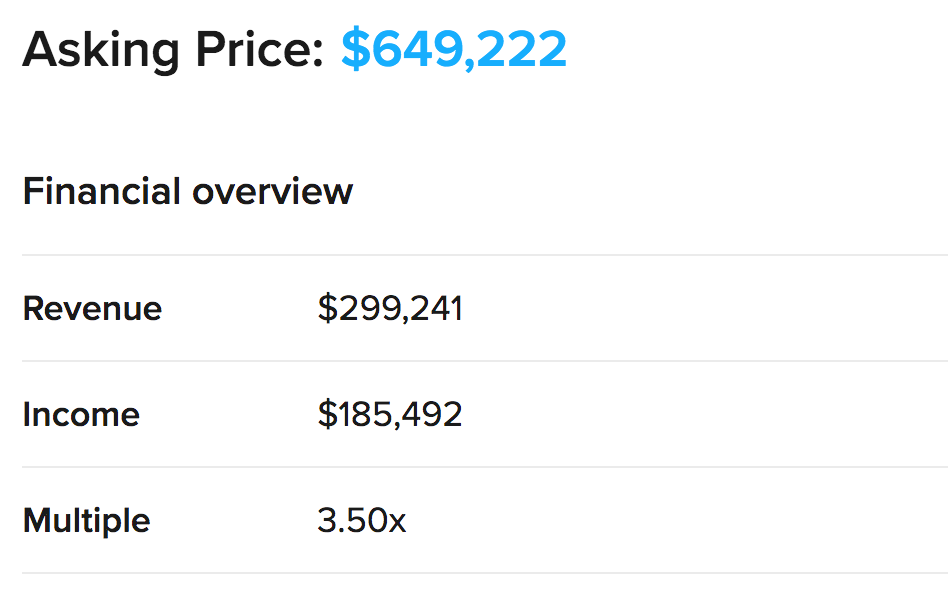

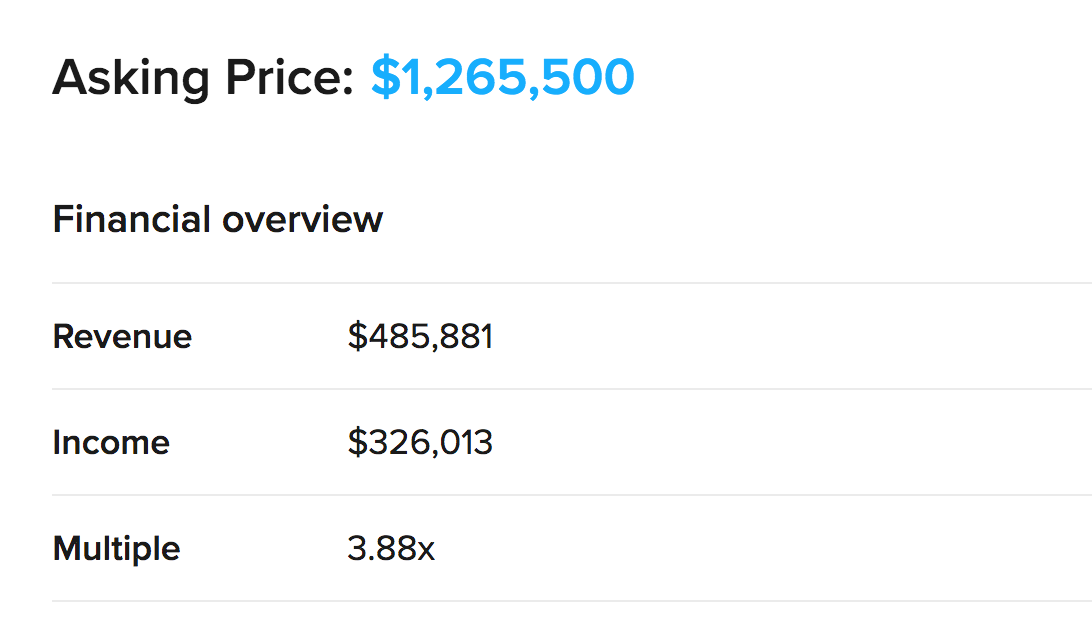

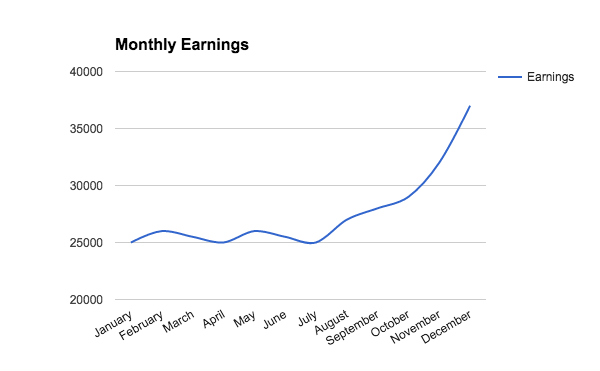

Multiples, unfortunately, are not able to show these recent changes. Take a look at the financial summary below:

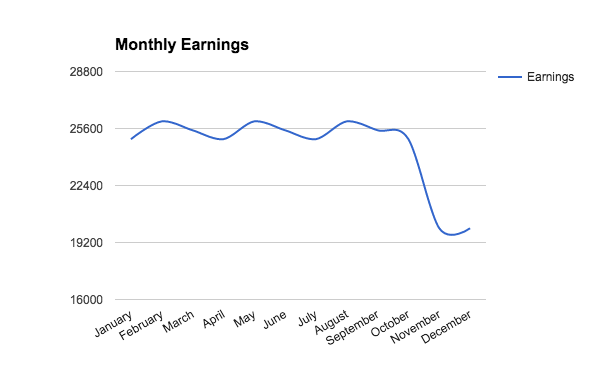

At first glance, this looks like a great deal! The business only has a multiple of 2.04x! But if we look at the monthly earnings for this business, we see a graph that looks like this:

Obviously, something happened. This is easy to see when you dig in deeper, but you have to get past the multiple to see this.

When Something Great Happens To An Online Business

Of course, most buyers don’t care too much if a business has a low multiple. Where you can develop a bad habit is if you rule out a website for sale just because the multiple is too high.

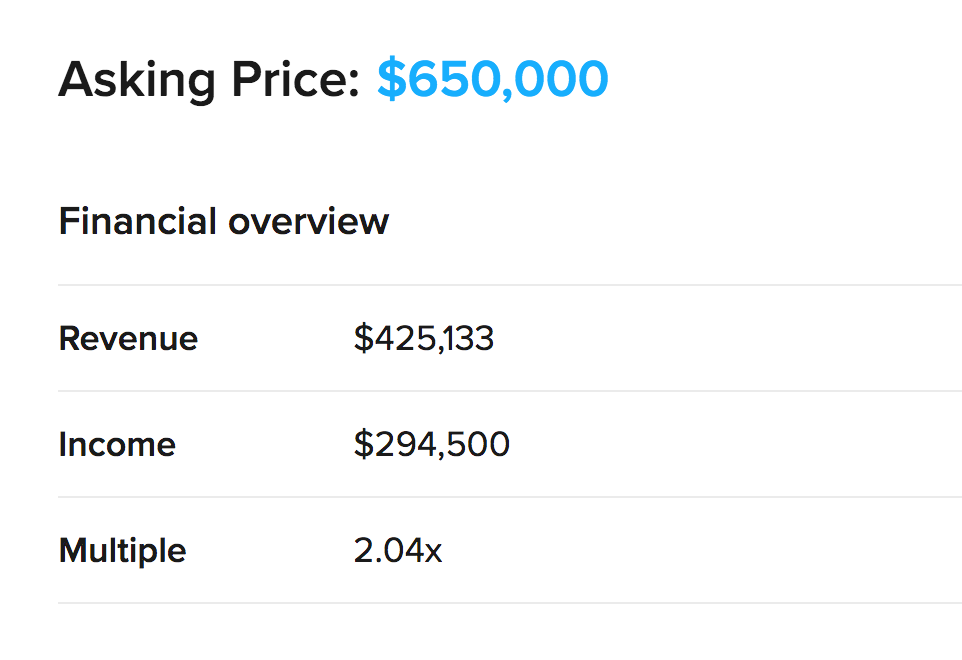

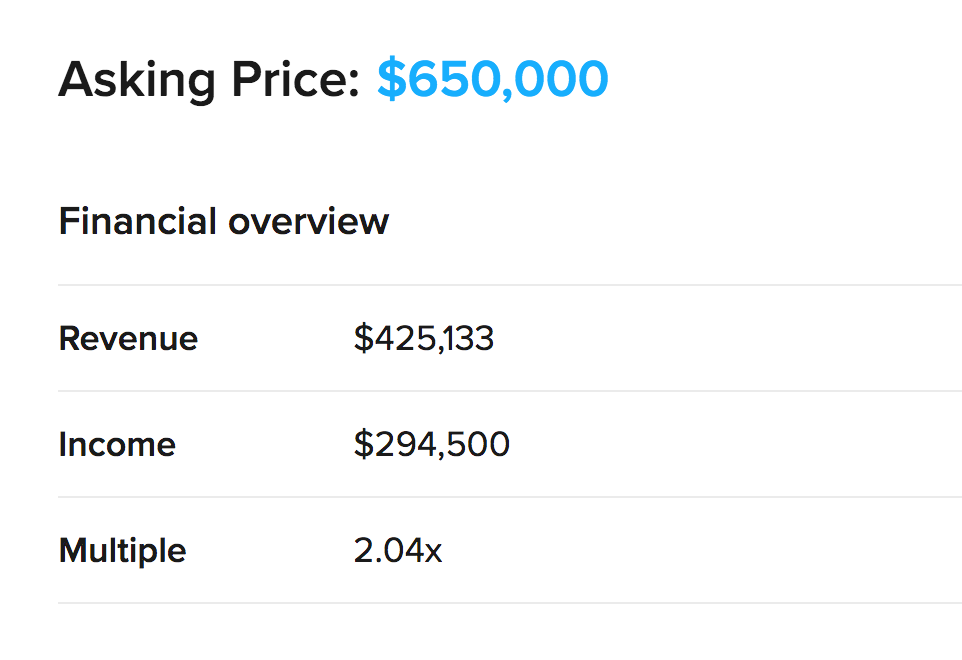

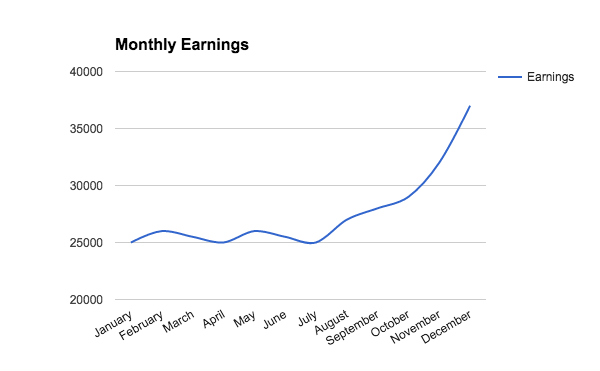

Using the example above, a multiple tells only one small part of the story. Take a look at the example below:

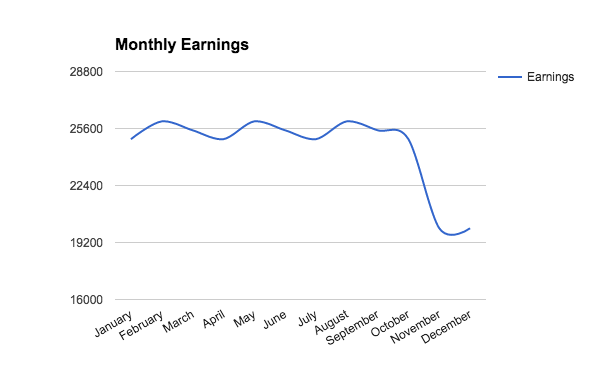

For many buyers, this business would be ruled out just because the multiple is high. But, once again, if we dig deeper into this business’s earnings, we see more detail:

You should always investigate a business with a growth curve like that to see what is happening.

Since the market tends to punish business owners who have multiples that are ‘too aggressive’, this business – with its extremely high 3.88 multiple – is probably a better deal than the first business with a 2.04x multiple.

How To Look Beyond a Multiple

So if the bad habit is to get too tied up in the upfront multiple, what should you do? Ignore the multiple completely?

Not at all.

Multiples are still a useful metric, but they should be used to set expectations about what you do or do not want to consider pursuing. If you see a business with a high multiple, there is likely a strong reason behind that – and if you see a business with a low multiple, there is also a reason for that.

Keep Your Buying Criteria Well-Balanced

I am a big fan of using a criteria checklist when looking for an acquisition.

But there are two bad habits you can fall into which will turn your buying criteria into a hinderance rather than a help.

- Creating a buying criteria list that is too strict and too unrealistic for the market.

- Creating a buying criteria list that is too loose and doesn’t narrow the market at all.

Really good, solid businesses often do not last long on the marketplace.

In 2016, a group of businesses listed on Quiet Light Brokerage received their first offer within the first 30 days of being publicly listed for sale.

Having a solid buyer checklist can help you quickly identify what you should aggressively pursue and what you should pass on.

An Example Of Buying Criteria That Is Too Strict

A common mistake we see from buyers is buying criteria that is overly strict and, frankly, often unrealistic. For example:

- Earnings between $100,000 – $150,000.

- Asking Price below $250,000.

- Owner open to financing at least 50% of purchase price.

- Must be in the medical, home remedy, or organic niche.

- Ideally should carry their own branded product.

- Have a history of at least 5 years.

The problem with strict criteria is it assumes you know exactly what you want and how you want to achieve those desires.

Don’t get me wrong: it is not a bad thing to have a plan. It is also a good thing to identify the key things you need to execute that plan.

But you need to leave room for alternative routes to achieve your goals. In science, this is is called psychological flexibility, and it is linked to greater success in the workplace and in your personal life.

Buying Criteria That Is Too Loose Is Useless

On the other end of the buying criteria spectrum, you need to be careful not to have criteria that is too loose.

I recently attended a presentation of a professional website investor who showed his firm’s buying criteria. The criteria was so loose that it left me wondering what type of business wouldn’t fall into their criteria.

Creating a list of your needs and wants in a potential acquisition should help you filter through listings. If your buying criteria is too loose, it won’t serve to help your search in any way.

Create a Criteria that is Well Balanced

Bruce Nolop spent 35 years as an investment banker and executive with Pitney Bowes and E-Trade Financials. In his role as the Chief Financial Officer of Pitney Bowes, he helped develop an acquisition process that Pitney Bowes used and developed over 70 acquisitions.

The result of these acquisitions: 25% growth in revenue and a substantial increase in organic growth.

- Stick to adjacent spaces. For this rule, Bruce retells how Michael Jordan embarrassed himself by leaving basketball for a stint as a baseball player. His lesson: stick to acquisitions that align with your core competencies. If you are looking for your first acquisition, don’t jump into a totally new environment. Identify your strengths and look for a company where you an utilize those strengths.

- Bet on portfolio performance. Within the online business acquisitions space, there has always been some discussion as to whether it is better to buy big, or to buy small. Bruce argues for buying smaller businesses and betting on your portfolio performance.

- Have a defined leader to execute the strategy. I wrote an article before about how I acquired an e-commerce business and completely failed in that acquisition. One of the key lessons I learned was how important it was to have an execution strategy in place following the sale. For Pitney Bowes, their checklist required that they have a manager dedicated to the post-close execution. This is a good example that shows how your acquisition criteria does not have to be entirely dependent on your seller.

- Be clear on how the acquisition should be judged. For Bruce’s team, they made the essential realization that “not all acquisitions could be held to the same yardstick”. This is a huge lesson for buyers of online businesses. But even though there isn’t one yardstick, there should be consistent guidelines.

- Don’t shop when you are hungry. This is generally a lesson if you are grocery shopping, but the consequences can be much greater if you are looking for an online business acquisition.

The criteria above worked well for Pitney Bowes, but yours will probably differ. What you should take away from the above criteria is the mix between strictness and flexibility. Not all of their criteria was dependent on the selling company. In fact, 3 of their 5 rules were dependent on their position to handle the acquisition.

Don’t Be Overly Critical Of a Seller’s Business

There are a couple of obvious reasons why you might want to offer some criticism of a seller’s business.

First, many sellers have an inflated view of how good their business actually is. This might be because they are trying to sell you on acquiring what they built, but for many sellers, they like to focus on the wins rather than the losses.

Second, if you point out a few flaws in a seller’s business, you might be able to position yourself for a better price.

At least that’s the thought some buyers have.

It’s easy to overdo criticism of a seller’s business. Joe Valley wrote about this recently in this blog post, and he related his experience when selling his business:

When I sold a business of mine in 2010, I had two possible buyers. One was rude and downright obnoxious, and obviously I took an immediate disliking to him. He spent quite some time telling me all the things that were wrong with my business. I found myself thinking, “then don’t buy it. Go away, leave me alone, I don’t want to talk with you anymore”.

He was tearing down something I had built and something I was very proud of. If he made me an offer, I would have likely rejected it outright, simply because I didn’t like him.

Adopt a Better Habit: Be Likeable

The business you are evaluating may not be perfect. The person selling their business probably already knows their business needs some work. But they don’t need you explaining all the mistakes they made or opportunities they missed.

In the vast majority of cases, a seller wants to see you succeed, and they want to see you excited about working on what they built.

If you are looking to get the best price possible, you’ll get a lot more mileage out of being the person your seller personally prefers to work with than explaining all the reasons why their business is a bad investment for you.

Conclusion

Finding and buying an online business is hard work. Because the process is complex, there are a lot of things that can go wrong.

That’s why it’s so important to avoid common bad habits. These habits will only make finding and finishing an acquisition more challenging.

Comments are closed.

Hello! Great article to help buyers consider more variables. I would add to the Pitney list, not only to not shop when you’re hungry, but don’t underestimate how long it could take you to learn an entirely new industry.

Absolutely. Whenever you see a listing that says “Owner works 10 hours per week”, count on it taking at least twice that much time for you. They know the industry and the business, you do not.

Don’t buy when you’re hungry – now that’s a sound advice 🙂

But joke aside, hunger can somewhat cloud your judgement. Also, I liked how you suggested to establish a good relationship with seller, because you can get a better price if he or she sees that you’re excited to continue where they’ve stoppped.