Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

3 Phrases Brokers Use To Convince You To Sell Your Online Business

By Quiet Light

Finding a good, quality website whose owner is ready to sell is quite difficult. Marketplaces tend to self-balance based on supply and demand, and the current marketplace has settled into a position that discourages owners of high quality websites from selling.

Because of this, when a good website comes across a broker’s desk, it can be tempting to press the business owner into selling. Brokers need to self-check their motivations to ensure that they are working in the best interest of their clients.

Unfortunately, however, a lot of the brokers in this industry aren’t terribly concerned about the interest of their clients. They just want to retain clients. For owners of high quality websites who are investigating a potential sale, this can make their research somewhat perilous. Some brokers will see these unsure potential sellers as prospects that need to be sold on the benefits of putting their business up for sale rather than consulting with the potential seller to help the seller obtain their goals.

The lies and exaggerations brokers use, however, are somewhat predictable if you know what to listen for. Even so, you should seriously think twice before NOT using a broker to arrange the sale of your website. You just have to know the warning signs that the broker you are considering may not be on the up and up.

Here are three phrases or sales pitches that should make you question whether the broker you are talking to is truly honest.

“Is Your Website for Sale? I Have a Buyer Who Expressed Interest”

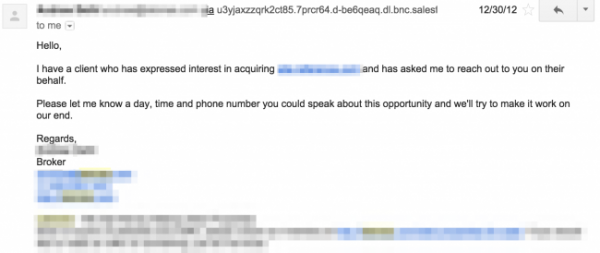

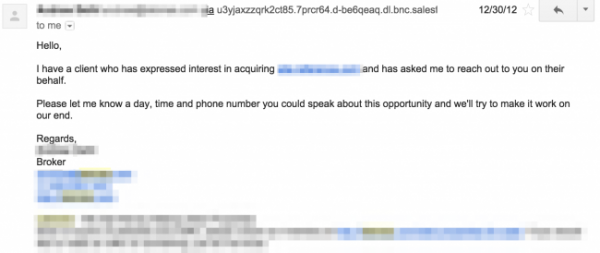

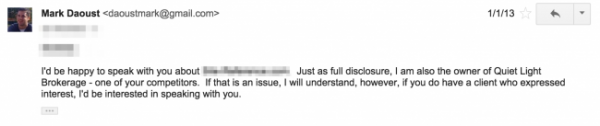

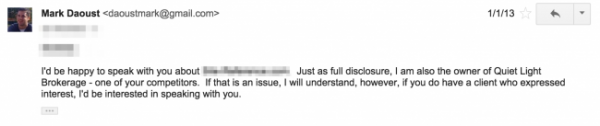

A few years ago, I received the following email from a competing broker in regards to another website I owned:

Needless to say, I was quite surprised since it was no secret that I owned Quiet Light Brokerage. Of course, I knew why I received this email: the broker was searching for new “inventory”.

Emailing website owners directly is a common practice among brokers and buyers. Quiet Light Brokerage found its first clients through one to one outreach, and I have recommended in the past that buyers use a direct approach to speed up their search for a potential acquisition

But what is so insidious about this particular email is the lie that this broker told: “I have a client who expressed interest in acquiring…”

Let’s be clear: this is a lie.

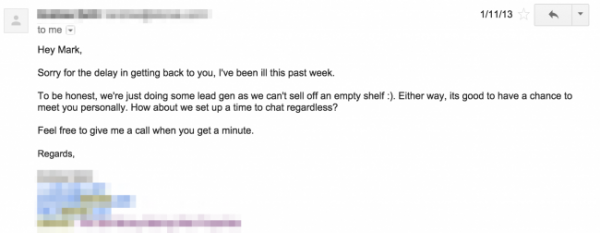

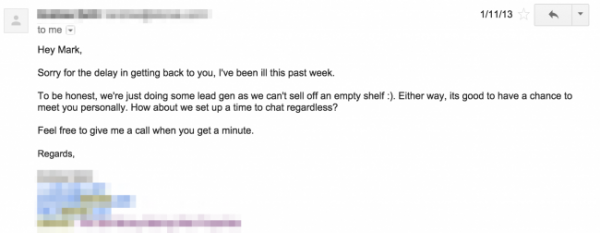

I thought it would be fun to respond to the broker, so I wrote this:

I was shocked when he responded quite candidly that there was no buyer, he was just doing lead generation. What was shocking was the cavalier response as if everyone in the industry lied their way into their client’s trust:

What Should You Do If a Broker Approaches You?

As I said earlier, emailing for prospects isn’t unethical. Business owners need to do lead generation, and you never know when someone has a website that they largely ignore and would be glad to exchange it for some cash. In our early days, we helped several website owners unload websites that would have otherwise been shut down.

But if a broker tells you upfront that they have a buyer who is interested in your website, they are lying.

But What If You Approach The Broker?

This lie has a flip side to it as well: what should you make of a broker who tells you they have an interested buyer before the broker has had a chance to evaluate your business?

There is a good chance that broker is also lying to you in order to get you to sign. Once again, the line between honesty and dishonesty is subtle.

A good broker should always be thinking of potential buyers for their clients and their prospects. It becomes second nature for most brokers to match up buyers with a prospect’s business, even before they have had the chance to evaluate your business. So a broker may legitimately say that they have a few buyers who might be a good match, but if the broker says they have an interested buyer, that is most likely a big fat lie.

“What Do You Think Your Website Is Worth?”

During the initial evaluation process, it is common for both the broker and for a potential seller to talk about the price of the business. If you are in the position of being the seller, however, pay attention to what the broker does with any pricing information you provide them.

A favorite game brokers play in order to retain more clients is to agree to list a client’s website at whatever price the client wishes, even if there is no reasonable possibility of finding a buyer at that price. Why would they agree to list a business at a price that isn’t possible to get? There are two main hopes:

The market will wear you down. The market is a brutally honest place, and even if you went into the sale of your business hoping to get $1,000,000, if every offer you receive is for $600,000, it’s possible you will adjust your hopes.

This hope on the part of dishonest brokers plays into the phenomena of sunk time fallacy. Because you have already spent time working with buyers, and because you already brought yourself to the mental position of being ready to sell, you adjust your criteria to account for your lost time. After all, if you are receiving strong offers for your business, it may not be what you originally wanted, but it is better than abandoning your future plans and going back to the life you prepared yourself to leave.

They might get lucky. On a very rare occasion, a buyer will pay a very high price for a business. The very first business I sold on behalf of a client was ridiculously overpriced (although I really didn’t know better at the time).

Getting lucky is a good thing, though, right? Not really. If a buyer drastically overpaid for your business, there is a strong likelihood that they do not know what they are doing. This will increase the chances of failure on their part, and also increase the chances that you’ll be dealing with the business long after the sale has closed.

In addition, overpricing a business can often lead to lower offers. Smart buyers know that an overpriced business is likely to receive fewer interested buyers. This gives them leverage to offer lower prices and possibly pick up a deal.

“I Have Some Private Equity Firms That Will Pay More Than Market Price”

Several years ago I represented a business for a client that I had done repeat business with in the past. When he asked if I would help him sell one of the businesses he bought from me several years prior (and was set to make a return of over 100% in appreciation), I had no idea that I would face competition from other brokers (after all, he wasn’t broker shopping).

But another broker happened to email him at random using our first lie. Since this broker told him that he had a buyer who inquired about his website, my client agreed to do a phone call.

On that call, my client told that broker what he thought the market would pay for his website. The broker agreed wholeheartedly that my client had an accurate view of the market value of his business. But, he said, there were some private equity firms he knew that where paying far more for his type of business.

This lie is particularly insidious because it feels so safe. For my client, what harm could there be? Even if the private equity firm decides to pass on buying your business, at least the broker agrees your market price is obtainable. It’s a win/win, right?

Except that it’s not really a win/win. A broker who is willing to lie just to get you under contract is likely to lie to you about anything, and also lie to potential buyers which could put you in a precarious position. The broker in question was lying to my client, and fortunately my client was an experienced enough buyer to sniff this out. He also knew this other broker through his activity as a buyer and didn’t trust him.

You’ve Built Something Valuable. Protect That.

Building a valuable online business is hard. It takes a lot of work and a lot of time. When you come to the end of your duration as the owner of a business, don’t give away value by partnering with a broker who is willing to lie to you in your first interactions.

Pay attention to the subtleties of what your broker says. Keep a few details (like your desired price) private until you really know if you can trust your broker. Finally, always remember that your business is yours, not the brokers. A broker should be privileged to be chosen as your partner during the last chapter of your ownership.

Have you had a broker lie to you? What did they say? How did you know it was a lie?

Comments are closed.

Great article. It’s these kind of tactics that are going to bring in government regulators.

I could name a broker right now that is very visible in this industry that I took off of my list because of their BS valuations. Some are very high and others just ridiculous. I first thought these guys were out of touch. Then I figured it’s cognitive dissonance that they are taking advantage of, which is basically similar phenomena to sunk time fallacy that Mark describes. It works by the same principles. When you face fierce competition and you are up for quick sale (especially when playing as a buyer in a sellers’ market) then cognitive dissonance is a beautiful phenomenon you can take advantage of. It doesn’t work when dealing with a (smart) broker, because they know all the tricks in the book, but it can very well work when dealing with a seller directly and when dealing directly, your name is not at stake as opposed to broker’s. But then some brokers don’t give a rats ass about it and play the game nonetheless. But by doing that I can’t see them attracting 7 figure deals long-term like Mark does. And that’s the difference between Mark and them.

Thanks, McSpike. Yes, I think anyone in the industry could name a few firms that follow these practices. It’s a shame, too. Like Chuck said, it’s these sorts of practices that are going to bring heavy regulations into the industry and make buying an online business overly complex.

Actually I think the regulation won’t come from the government and if it does it won’t have such an effect the government would want. This is an international market. FE runs from UK, Empire Flippers from Philippines, Flippa (Deal Flow) from Australia… Just like the FTC disclosure regulation for bloggers is BS – I for one don’t have that published on any of my sites (I don’t have to abide by US laws). I also don’t pop up cookie warnings, because they are silly and just like the FTC regulation they don’t serve its purpose – they don’t work – because governments don’t get the net. Whoever drags government into this industry may also have motives contrary to what the clientele may think. I say let the market decide while you keep on spreading awareness on your blog.