Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

Importance of Business Valuation for Exit Strategy Planning

By Quiet Light

- If you don’t know the value of your business, it’s hard to plan your exit and retirement.

- You know what’s in your 401K, right? It’s just as important to look at your business as a valuable asset that helps you work toward your future goals.

- Exit planning makes your business more stable, future-proofs your living, helps you live on your own terms, earn more for your business, and find efficiencies.

- But you have to get an accurate valuation to lay the groundwork for a proper exit plan.

- Quiet Light uses a three-step valuation process: 1) cleaning up the financials, 2) analyzing your metrics against the 4 Pillars Of Growth, and 3) normalizing your P&L.

Day to day operations are important, but it takes more than tactical thinking to run a successful business. Short-term thinking will get you a few months down the road, but you need a long-term approach too. Many entrepreneurs focus on their short-term growth goals, but they often come at the expense of long-range planning. Instead of focusing too much on the here and now, it’s time to change your mindset. After all, acting is better than reacting.

Look ahead to plan the future of your business. That means planning for an exit right now, even if you have no intention of selling.

Unfortunately, entrepreneurs often don’t think about their exit until it’s too late. And that’s understandable: exit planning can feel like a huge frustration for entrepreneurs. The thing is, you still need to plan for your exit now. We can’t see the future, but it’s important to plan your business as if you’ll sell it eventually.

Entrepreneurs who invest in smart exit planning see 5 significant benefits to their lives and businesses.

5 Reasons You Need An Exit Plan

Create A More Stable Business

If someone is willing to buy your business for a high multiple, it’s because they see a profitable business with year over year growth. But a profitable business exit means the business is profitable while you own it, too. It’s a win not only for your buyer, but also for you during the stretch of time that you still own the company. “When you plan to sell, even if you decide not to sell your business, the result of that is a more stable business,” says Quiet Light’s Mark Daoust.

When you grow with the intention to sell (even if you don’t actually sell), you’ll build a more stable business in the process. A stable business means:

- Your financials show year over year growth.

- You can identify and act upon consistent growth opportunities. This means you can add new product lines, overhaul your website, or change your marketing strategy.

- You can manage cash flow without worrying about too much or too little inventory.

- You have a team of trained employees who work off of clear, documented processes in an SOP.

Put simply, you’re creating more growth paths for your future self and a potential buyer with exit planning.

Listen to the Source of this Post:

This blog post is based on a podcast episode that we recently recorded. Listen to the full episode here:Future-Proof Your Business

“You really don’t know what the future holds,” Mark says. You probably don’t want to sell your business right now, but what about in 2 – 5 years? Market forces change quickly, and the business you love today could run into problems with:

- Organic rankings

- Facebook Ads

- Amazon terms of service

- Increased competition

We see so many entrepreneurs who are unprepared to sell their business, and they wish they had planned in advance. That’s not to say you can’t focus on the here and now, of course. A good entrepreneur has a firm grasp on the demands of the present, like your competition, inventory and ad spend.

But you have to also look at long-term tasks. That means tackling the tasks we often put off, like negotiating manufacturing agreements, hiring support staff and giving them clear SOPs, and adding more SKUs.

When you future-proof your business, you’re boosting its value. “Value” means something different to everyone, but it often looks like:

- An early retirement.

- Investing in larger projects down the line.

- Inventing bigger, better products.

You can’t do any of this unless you’ve built a sellable asset from the start. That’s why entrepreneurs do exit planning: you get a clear path to your future. “The benefit is income potential. But this can’t happen if you build an asset that can’t be sold,” Mark says.

Live On Your Own Terms

Entrepreneurs have the opportunity to generate income in a way that people in cubicle jobs just can’t. But when you leave the corporate world, you’re trading stability for freedom.

Business is fraught with landmines, especially for entrepreneurs. Before you know it, you’ve created a business you can’t escape from.

Fortunately, if you build a strong business now, it means you get more financial and career stability down the road. Since you work for yourself, that’s critical. When you lay the foundation for a stable business, that means you get to live on your terms. “Exit planning also gives you financial flexibility for the future,” Mark says. That means:

- Setting your own schedule.

- Spending more time with your family.

- Doing only the tasks you enjoy doing—and delegating the rest.

- Pursuing other interests and goals.

You can live life on your own terms as an entrepreneur, but not without a little forethought. Exit planning gets you there.

Increase Your Earnings

If you boost your business’s value today and continue growing that value, you set yourself up to potentially earn more once you sell your business. After all, buyers will pay more for a business that is profitable, easily transferrable, and growing.

Good planning begins with a valuation, so that you see what areas you excel in, and which need work. And it’s okay not to be perfect. Identifying areas of friction now help you build toward your goals. In fact, entrepreneurs who understand the levers of business value and plan accordingly can: position themselves to:

- Increase the multiple buyers will offer.

- Transition to a post-sale life and hand the reigns to the new owners more easily. “When you have a clear vision of the business’s value and an eventual exit, it’s easier to go forward,” adds Quiet Light’s Joe Valley.

- Receive more offers, and often a higher price for the business.

If you ever choose to sell, exit planning helps you make the small tweaks that can lead to huge bucks.

Find More Efficiencies For Your Business

What’s great about exit planning is that you don’t actually have to leave your business. Instead, it helps you think in terms of running your business more efficiently. That means looking for wasteful spending or trends that affect your profitability. “The numbers tell a story,” Mark says.

For example, if you look at three years’ worth of P&Ls, you might see your gross margins have gone from 60% to 52%. That’s a trend you can identify and address.

Quiet Light once worked with a client who used exit planning to find efficiencies in his business. Because of that, he was able to:

- Charge shipping on items over a certain dollar value. This added $180,000 to the business.

- Negotiate the cost of goods sold, saving $2 per unit. This added another $200,000.

The client found $380,000 in value, which means he’s now at $680,000 for seller’s discretionary earnings. This put him a lot closer to his exit goal than he thought. Fortunately, he gets to enjoy the fruits of his labor. If he decides to sell, that’s great, but if not, he’s created a streamlined, profitable business in the process.

Exit planning helps you find areas of opportunity that you might overlook. You can find these avenues for growth and then replicate them with the right exit plan.

3 Steps To Increase The Value Of Your Business

The first step to a healthy exit is something entrepreneurs and brokers love: valuations. You can’t plan your exit if you don’t know your growth prospects, and all growth starts with your valuation.

Ideally, you should plan your exit at least 12 months in advance. If you have 24 – 36 months on your side, that gives you even more time to make larger exit goals. Running a business can be like steering a yacht; sometimes it just takes longer to turn. With time on your side, you can make big changes, stabilize, and collect good data to prove your value to a potential buyer.

The best part about getting a valuation is that they’re free to you. A good broker will say that your business is worth $X today, but if you make certain changes and wait a little bit, you could add more value to your business.

We break the process into three steps. Here’s what you can expect during a free business valuation.

Clean Up The Financials

You need clean financials for an accurate valuation. To start, you need a profit and loss (P&L) statement for the last 12 months, minimum. Ideally, this should go back as far as you can, all the way to your most recently reconciled month. “I’m going to look at January of 2020 versus January of 2019, 2018, and so on,” Joe says.

Your broker will use the P&L to look at:

- Growth trends

- Advertising costs as a percentage of revenue

- Seasonality and trends

But even if you have clean P&Ls that are ready to go, make sure you’re using monthly, not quarterly, P&Ls. Monthly P&Ls are ideal for business valuations because they have more detail.

Plus, if you do sell your business, a buyer doesn’t want to wait until the end of the quarter to see your data. “Most buyers want updated numbers. If they have to wait two more months, that’s going to extend your timeline and introduce further risk,” Mark adds.

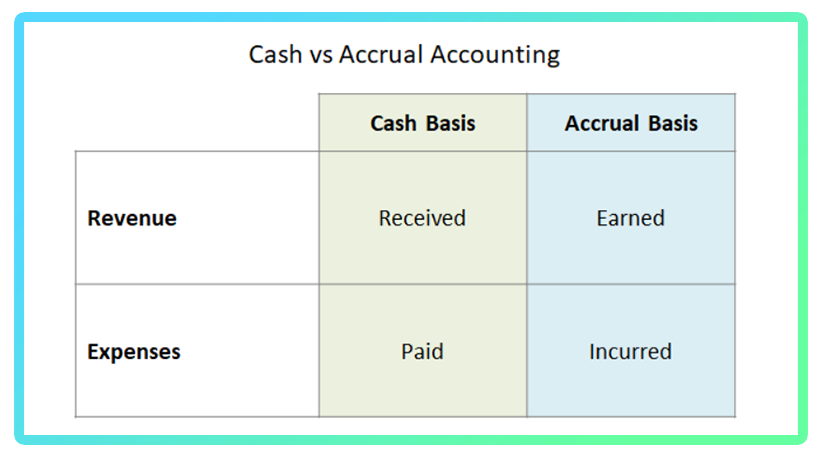

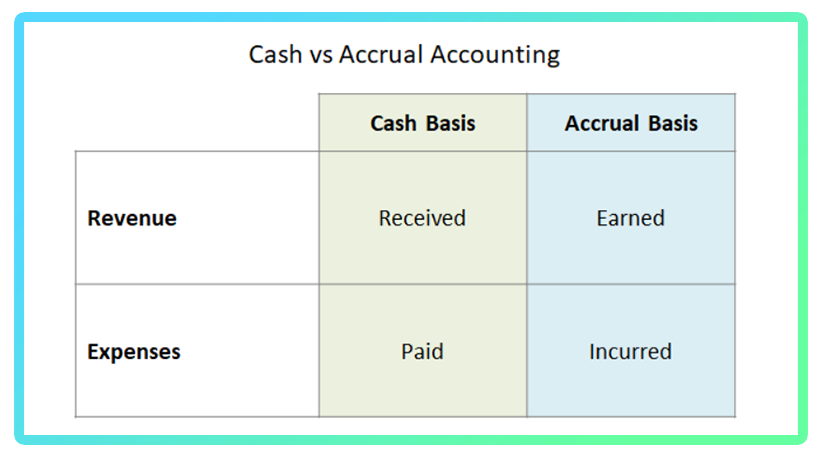

In addition to a clean P&L, you want to make sure you’re accounting on an accrual basis, not a cash basis. Cash basis is simpler to track and maintain: you record cash when you earn it and expenses when you pay them. In other words, you record a transaction when the cash hits (or leaves) your bank. Most entrepreneurs start off with cash basis since it’s more intuitive.

However, cash basis doesn’t account for things like accounts receivable and accounts payable. Accrual basis accounting, on the other hand, records revenue and expenses when they were earned, not when you received the money.

For example, you earned $50,000 on products sold in February. With a cash basis, that money might not hit your books until March. So it looks like you were insanely profitable in March, when in reality, it was revenue earned in February hitting your bank account.

But with an accrual basis, the money is recorded in February, not March. This gives you a better idea of how much money you actually earned that month. Accrual basis gives you a more realistic idea of your cash flow, giving you a clearer picture of the long-term.

While you can track your eCommerce business on a cash basis, and many entrepreneurs prefer that method for tax purposes, for a valuation you need to use an accrual basis.

If you enter accrual basis data into a software like Quickbooks, it’s easy to flip it back to cash basis. But it doesn’t work the other way around. We love QuickBooks, but the software can’t switch from cash to accrual; it can only do accrual to cash.

Does this sound confusing already? That’s because it is. Don’t try to DIY your accrual basis accounting. When in doubt, hire a CPA for taxes and an eCommerce bookkeeper for your P&Ls.

Monthly P&Ls and accrual basis accounting are the most accurate way to value your business. Say you’re doing $1 million a year in inventory. If your revenue figures are off by just 1.5%, that’s $15,000. If you sell your business at a 4X multiple, that’s $60,000 that won’t be in your business when it’s time to sell.

Understand The Four Pillars Of Value

After looking over your books, your broker should normalize your P&L. The Quiet Light team then analyzes your business based on the Four Pillars Of Value. This is a more holistic view of your business as a valuable asset. During this process, we apply a buyer’s perspective to your valuation.

Growth

First, you want to evaluate your growth prospects. You need to build a profitable business with plenty of upsides. If you ever want to sell your business, you should show off your growth prospects to get a more competitive buyer pool.

To boost growth:

- Turn your weaknesses into an opportunity. If you don’t have a marketing department, that’s one place you could start.

- Use your data to back up your growth potential for accurate trends.

- Understand the metrics that drive your valuation, and chart your own growth against your goals.

Risk

The second step is to evaluate the level of risk in your business. The more risk in your business, the less it’s usually worth. It also means your business isn’t set up for long-term stability. “People will discount much more aggressively when they start to see problems,” Mark adds

If you earn 90% of your revenue from a hero SKU, it’s a huge liability for your business. One change in Google’s algorithms will destroy your ROI. Amazon could remove a product line for one reason or another. These are single points of failure where your business is too reliant on one factor.

Age is another component of risk. Buyers like to see businesses around 24 months old, but at least 12 months old. This shows you’re an established business, but that there’s still room for growth. 24 months isn’t a hard-and-fast rule, but it’s a good target.

Transferability

The more transferable your business, the better its value. But entrepreneurs often overlook transferability. Can someone take over your business tomorrow without seeing a significant decline? Or is there a huge learning curve with your business? If so, you have a transferability problem.

You can make your business more transferable by:

- Writing detailed SOPs.

- Diagramming your business with a tool like LucidChart.

- Watching your brand. Don’t name the business after yourself; that could take you from a 3.2X multiple to a 1X multiple, putting less money in your pocket.

Documentation

How are your business’s records? Are your finances clean and easy to understand? You’ll get a lot of information about your documentation during the P&L process. Entrepreneurs can boost the documentation in their business by:

- Keeping their business and personal bank accounts separate.

- Hiring an experienced bookkeeper to handle your financials.

- Tracking the right metrics. This includes cost per acquisition, customer churn rate, customer lifetime value, average order value, ROAS or ROI, gross margin trends, or contribution margins.

Generate A Valuation

After considering your financial metrics and how you stack up against the 4 Pillars of Value, the Quiet Light team will create a more detailed P&L for your valuation.

In addition to a normalized P&L, we’ll also work on an addback schedule. These are expenses that won’t carry over to the buyer. With clearly defined addbacks, a buyer can get a better sense of what the real owner benefit you get from your business.

From there, a multiple is applied that reflects a number of factors that buyers are looking for. These include:

- The size of the business

- How it adheres to the Four Pillars

- Type of business

- Certain eCommerce businesses are in popular verticals while others are niche-specific

- Content sites, affiliate marketing sites, SaaS business, and other online businesses have their own variables that affect multiples

- Seasonality

And just like that, you have a good idea of your business value. With this knowledge, you have a much more detailed look at where you’re succeeding, and where you could do better. All of this adds up to having something really essential: the knowledge to take concrete steps to grow your business with your long-term goals in mind.

Whether you’re thinking about selling in six years or six months, that level of understanding is a powerful tool that every entrepreneur should have.

A Proper Valuation Is Just The Beginning

You don’t have to sell your business if you want to plan your exit or get a valuation. Find efficiencies in your business, know why you’re valuable, and identify what’s holding you back. “Ultimately, we’re running these businesses to make money and to be profitable,” Joe says.

Your business is your most valuable asset. You have to know what drives the value of that asset. Sell to whoever you want, whenever you want, but make sure your numbers are right. Find the elements of friction in your business with a valuation. This will lay the roadmap to grow the value of your business so you can double-down on what works.