Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

Seven Ways An Effective FBA Bookkeeping Strategy Will Increase Your Profitability

By Ian Drogin

Effective bookkeeping is essential for Amazon sellers. It may not be something that most business owners enjoy doing, but it has a significant impact on success and profitability. Many believe that sound bookkeeping is one of the most important elements of determining long-term growth.

In this article, we’ll be discussing seven primary reasons why you, as an Amazon seller, should be attentive to bookkeeping. We’ll also share valuable strategies for cutting out complexity and making the process as easy as possible.

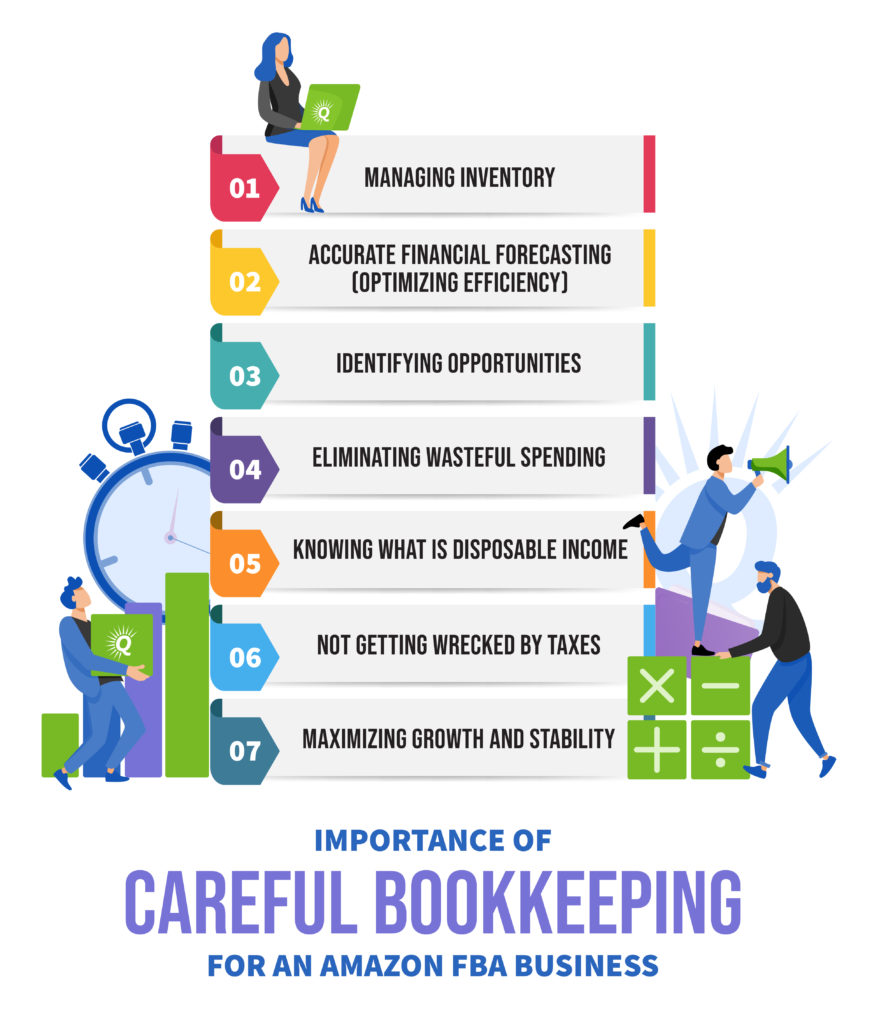

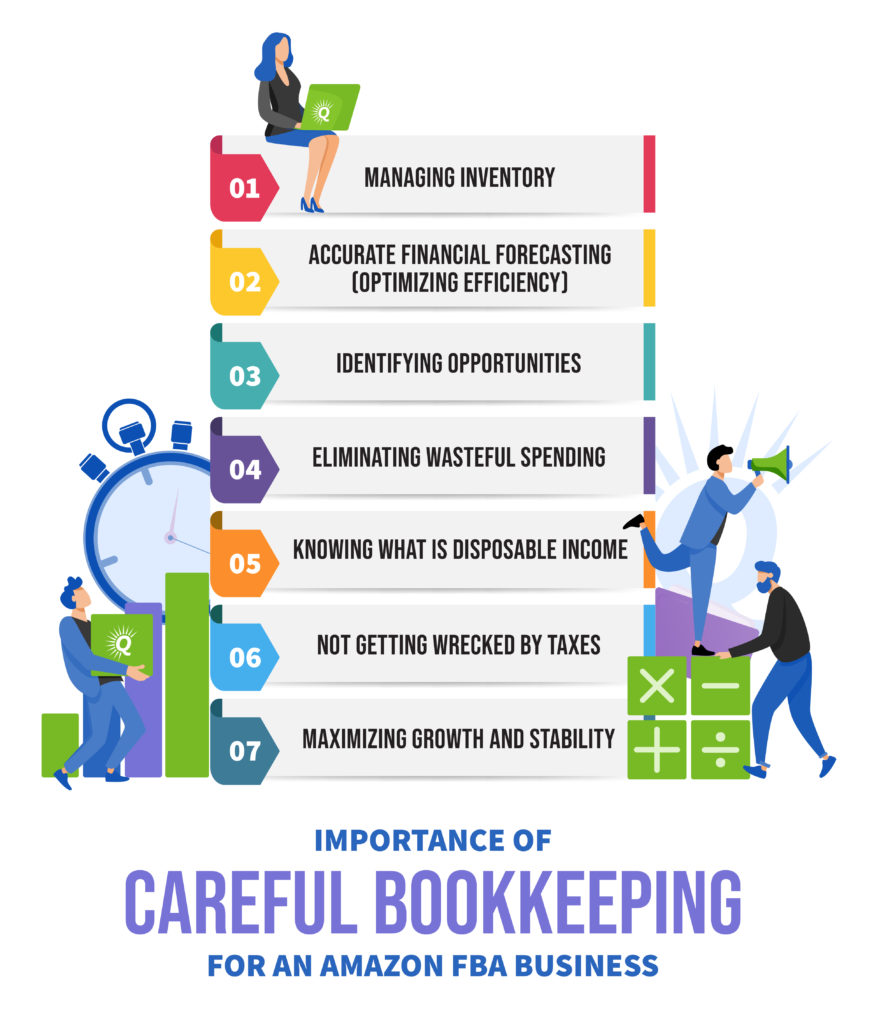

Importance of Careful Bookkeeping For An Amazon FBA Business

Implementing detailed and accurate bookkeeping in your business is like turning a flashlight on in a dark jungle at night. The snakes might still be there, but now you can avoid them and stay on the right path.

It’s common for a lot of Amazon sellers to ignore bookkeeping, at least when they’re first getting started. Often, developing products, managing contractors, and setting up supply chains receive the majority of sellers’ attention in the beginning.

However, the consequences of not having an effective Amazon bookkeeping system quickly present themselves. As an Amazon FBA business grows, the close consideration of financials becomes increasingly essential.

Here are seven reasons why implementing an effective bookkeeping system is fundamental for a successful Amazon Business.

1. Managing Inventory

All sellers need to manage inventory for success. Bookkeeping is the tool that allows success.

At first, for anyone with an Amazon seller account, inventory management is a pretty simple process. You place an initial order, wait for your inventory to arrive, and then start selling. With just a few products in your Amazon account and low sales volume, the stakes are fairly low.

As your FBA business grows, so does the possibility of mistakes and errors. With several SKUs having different sales volumes and production lead times, the variables to track increase exponentially.

Effective bookkeeping allows Amazon sellers to make calculated, data-driven decisions for inventory management. Instead of using gut instincts or “napkin math” techniques, inventory purchases can be informed decisions with hard facts that are systematically gathered and presented.

By doing so, FBA inventory management allows sellers to avoid or minimize two potentially harmful outcomes:

- Storing too much inventory

- Inventory stockout

As an Amazon seller, both of these can dramatically hurt your business.

Storing too much inventory ties up working capital and reduces the capital efficiency of your business. It can lead to unnecessary long-term storage fees from Amazon and even harm your seller account.

Storing too little inventory can obviously lead to the opposite problem: running out of stock.

If that’s ever happened to you, you already know how painful it is to miss out on revenue because you failed in the timely order of inventory, especially since your competitors are likely gaining traction.

If this happens during a peak sales period, it’s doubly as painful.

Sound bookkeeping can help you maintain healthy inventory levels, avoid Amazon’s long-term storage fees, and reduce the chances of being OOS (out-of-stock).

2. Accurate Financial Forecasting (Optimizing Efficiency)

What will your business bank account look like in two, three, or even five months from now?

If you can’t answer this question with a high degree of certainty, there’s a good chance you have room to improve your Amazon bookkeeping practices.

If you can accurately track all of your revenues and expenses on your balance sheet, it becomes easy to predict the future and make decisions accordingly.

Most Amazon businesses have many different expenses, as well as several product revenue streams via Amazon transactions. Without accurate bookkeeping, it can feel like there’s an almost random thread of deposits and withdrawals entering and leaving your business account.

When you implement effective Amazon bookkeeping practices, all of your cash flow, as well as revenues and expenses are clearly laid out in a well-organized dashboard. They tell a lucid story of the past, which is used to make accurate predictions of the future.

There’s something very empowering about looking at your computer and immediately knowing each product’s revenue, ad costs, each FBA fee, your software expenses, contractor invoices, and more…

3. Identifying Opportunities

Often, the gold is in the details.

One of the exciting things about clear financials is their ability to reveal opportunities within your business; opportunities that you may not have noticed all on your own.

Let’s say that you run a moderately profitable FBA business with several SKUs. You have an approximate idea for how much revenue each one generates, as well as their Cost of Good Sold (COGS), but have little knowledge beyond that.

Implementing an effective bookkeeping system can reveal new insights and possibilities. For example, perhaps one of your SKUs has a much lower Advertising Cost of Sale (ACoS) than the others, leading to a much higher margin than the rest. Empowered with that knowledge, you can determine why that’s the case, thereby replicating its success with new product lines.

Clear financials can uncover numerous other metrics, each of which can shed light on various opportunities. Knowing each of your products’ ACoS, COGS, sales volume, returns, Amazon seller fees, storage fees, and each referral fee allows you to recognize what strengths you should capitalize on within your FBA business.

4. Eliminating Wasteful Spending

Just as sound bookkeeping can help you identify opportunities, it can also allow you to find and eliminate wasteful spending.

A lot of ecommerce business owners like to focus on the big picture, and this is a great thing in many ways. Indeed, being a visionary and thinking about the larger elements at play is probably what provides the courage to set out on a unique path.

However, as entrepreneurs, it is easy to overlook small details that add up over time and become big expenses. For many FBA sellers, as soon as bookkeeping procedures are implemented, wasteful spending becomes painfully clear.

Why do so many businesses have wasteful spending?

Just like people, a business’s needs change over time. Maybe the business required certain software or services at one point which are no longer relevant. Or, perhaps an ad campaign did really well six months ago, but now its ACoS is through the roof.

When you first set up a bookkeeping system, expect to look at your finances the first month and say: “Oh geez, why am I still paying for that software I haven’t used in eight months? And, wow, I definitely need to take another look at some of my ad campaigns!”

Simply put, sound financials make it easy to pinpoint and eliminate wasteful expenses, thereby increasing profitability.

5. Knowing What Is Disposable Income

When you’re starting out as an Amazon FBA seller, it can be easy to look at your bank account after a couple of months and think, “Awesome, my account just increased by X dollars! Maybe I should go on a nice trip or buy a new car…”.

But what happens when it’s time to order more inventory, launch new products, or deal with an unexpected expense?

A lot of new Amazon sellers fall into the trap of viewing their business like an ATM machine. They realize it’s producing a profit, so they start withdrawing money without thinking about how that will impact their growth strategy.

Of course, e-commerce businesses require that you reinvest part of your revenue for it to sustain itself. If your goal is growth, you probably need to reinvest a significant portion of your profit as well. If you’re not examining your process for withdrawing money from your business, you can quickly wind up in trouble…

Effective bookkeeping shows you how much money should stay in your business, and how much you can safely withdraw to use as disposable income.

6. Not Getting Wrecked By Taxes

Many Amazon FBA sellers loathe (and fear) doing their taxes. If you haven’t been planning ahead each month, your income tax can end up being financially damaging and extremely stressful when it comes time to review your annual income statement and pay up.

This is especially true for sellers who are transitioning from being W-2 employees and aren’t familiar with withholding their own taxes.

Like all outgoing money in your business, it’s essential to track your tax burden, including your sales tax liability. An effective bookkeeping system can ensure that you’re setting aside the right amount of money each month for your impending tax bill.

Without a clear system, it can be easy to fall into a similar trap as do sellers who withdraw too much money from their business for disposable income. If you fail to plan for taxes, you’re probably in for a rude awakening next April.

7. Maximizing Growth and Stability

When you manage the expenses and revenues of your Amazon store, allocate capital efficiently, take advantage of opportunities, and eliminate wasteful spending, there is one predictable outcome – you maximize capital efficiency in your business.

Maximizing your capital efficiency is almost synonymous with maximizing growth.

Bookkeeping allows you to optimize capital efficiency, which in turn, allows your FBA business to experience faster growth and reduced risk.

Maximizing growth and stability make it possible to reach your revenue and profit goals quicker and with greater confidence. It also makes your business more desirable among potential buyers…

Growth and risk are two of the Four Pillars of Value that determine how much your business is worth. So, in other words, bookkeeping doesn’t just allow you, as the business owner, to get the most out of your investment of time and money, it also makes possible a more successful exit if you ever decide to sell.

Tax Considerations for Amazon FBA Bookkeeping

First of all, if you’re selling on Amazon, you should speak with a CPA or accountant about your individual tax situation. Generally, it’s best to work with one who specializes in Amazon or e-commerce accounting.

The same tax laws that apply to other businesses typically apply to Amazon sellers. However, there are a few key elements of which to be aware of regarding the process of preparing taxes for an FBA business. These include:

- For qualifying individual sellers, Amazon provides a 1099-K at the end of the year

- The 1099-K includes annual unadjusted gross sales

- If operating out of your home state, you likely need to file Schedule C or form 1040

- You must file for and pay sales wherever you have sales tax nexus (meaning wherever your business has a physical presence)

Amazon typically will send you all related documents to pay your Amazon marketplace taxes.

What You Need To Know About Form 1099-K

For qualifying individual sellers, Amazon provides a 1099-K which includes your unadjusted gross sales for the completed year. One item to note is that Amazon only includes revenue on the 1099-K for orders that have shipped. In other words, if a product is sold at the end of December but doesn’t ship until January 1st, it will not be included in the 1099-K for the previous year.

To receive a 1099-K, you must have at least 200 individual transactions and $20,000 in sales. If your revenue or transaction quantity are under that, the 1099-K likely doesn’t apply to you.

What You Need To Know About Schedule C And Form 1040

If operating your business from your home state (like most sellers do), you’ll also need to file Schedule C or form 1040. Because different forms apply to different states and situations, it’s best to consult with a professional accountant.

If you’re insistent upon not using an accountant, then be sure to do thorough research and use accounting software such as Quickbooks or Xero.

Where Do You Need To Pay Sales Tax?

Sales tax laws vary from state to state, but generally, you need to pay sales tax wherever you have sales tax nexus. The definition of that term varies between states (another reason to hire an accountant), but it typically is the connection between a location that has taxes (such as a state) and your business – this law has been updated to account for current methods of “working” such as remote operations).

For example, if you’re operating your business from New York but have inventory in Florida, you would likely have nexus in both states.

How Do You Handle Sales Tax?

To collect sales tax and adhere to all sales tax compliance requirements, you’ll need to apply for a sales tax permit in each state in which you have nexus. Once your application is reviewed, you’ll receive instructions on how and when to file.

Different states have different filing deadlines. Typically, they’ll be monthly, quarterly, or annually.

Common Deductions for Amazon FBA Business

Like all businesses, there’s a long list of possible deductions that you can claim as an FBA seller. Of course, the percentage deduction varies by category. Some common Amazon business deductions include:

- Home office

- Software subscriptions

- Amazon fees

- Business travel

- Cost of Goods Sold (COGS)

- Amazon and e-commerce education expenses

- Shipping costs

- Business meals and entertainment

- Advertising

- Consulting fees

- Contractor fees

- Employee salaries

Top Tools To Help You With Amazon FBA Bookkeeping

Not surprisingly, there are some pretty powerful and helpful tools to make bookkeeping a lot easier for your Amazon FBA business.

Two popular accounting software for Amazon sellers are Xero and Quickbooks.

Setting Up Accounting Software For Your FBA Business

Both Xero and Quickbooks allow you to connect your various accounts directly to the software in order for it to automatically create real-time dashboards of what’s happening in your business. From advertising to inventory, to revenue, it’s all tracked and monitored in one place.

Even though such accounting software services can handle a lot of the heavy lifting, setting things up requires a deep understanding of bookkeeping basics, as well as e-commerce and Amazon FBA accounting practices.

For these reasons, we recommend that sellers don’t view accounting software as an alternative to hiring a qualified accountant. For owners who truly want to have a firm grasp on the books, both of these have immense value.

Not surprisingly, a lot of Amazon sellers get started without software and then later decide to implement it.

Hiring A Bookkeeper To Set Up Your Books

When you hire a bookkeeper, one of the first things they’ll do after connecting your accounts is to go through and retroactively organize your financial records to caste your books. Depending on the complexity of your accounting, this can take a bit of time.

A lot of bookkeepers will charge a setup fee to connect your accounts, create dashboards, and provide you with an orientation. Then, they’ll charge a monthly fee to perform routine reviews and updates, as well as answer any of your questions.

A bookkeeper is different from an accountant in that a CPAs main focus is to import and reconcile P&Ls on a monthly basis. CPAs file tax returns and help with tax mitigation.

CPAs aren’t always experts in inventory reconciliation, and they don’t necessarily have experience recasting your books with accrual accounting on a monthly basis for everything, including COGS. It’s vitally important to use a professional than understands e-commerce accounting and bookkeeping practices.

How To Avoid Common Mistakes In Amazon FBA Bookkeeping

One of the most common Amazon bookkeeping mistakes is simply failing to do it. Not setting up a bookkeeping process is, in itself, a big mistake.

Another common mistake among Amazon sellers is using cash accounting instead of accrual.

Why Accrual Accounting Is Important For Amazon FBA Businesses

Accrual accounting empowers you to make smarter decisions by providing you with more accurate and useful information.

There are a few key reasons why accrual accounting is better than cash accounting when running an FBA business:

- It avoids the appearance of “lumpy” earnings

- Its more accurate

- Makes it easier to identify trends

- Increases the value of your business

In the beginning, a lot of Amazon business sellers are tempted to start off using cash accounting to track each Amazon order due to its simplicity. With a cash basis, owners with a basic understanding of accounting can often do their books themselves.

However, the simplicity of cash accounting comes with some serious costs…

Avoid “Lumpy Earnings” By Using Accrual Accounting

For e-commerce businesses, cash accounting leads to the appearance of “lumpy earnings” in your financial statements.

For example, let’s say you purchase $200,000 of inventory in March. That inventory lasts for three months until you need to reorder in June. Let’s say that your average monthly sales volume is $180,000.

If you use a cash basis, your books will show a $20,000 loss in March since you paid $200,000 for inventory and only made $180,000 in sales. Then, for April and May, your books will show $180,000 in revenue and zero in COGS.

If this cycle repeats for the next three months, you’ll show another $20,000 loss in June followed by two months of $180,000 profit in each month. If you put your financials on a graph, they’ll appear to have odd “lumps” based on when you ordered inventory.

Accrual Accounting Is More Accurate

Cash accounting works fine for some businesses, but not for those that have inventory.

If your inventory purchases have your books showing a $20,000 loss in one month and a $180,000 profit the next, you’re obviously not getting a very accurate picture of what’s happening within your business.

With accrual accounting, revenues and expenses are recorded when they are incurred, not when cash changes hands. For example, if you make a $200,000 inventory purchase in March and it lasts for three months, that expense of $200,000 will be recorded based on when that inventory is sold. If it’s sold over three, that $200,000 expense would be split up over that period.

Of course, this leads to a more accurate picture of what’s actually happening.

Accrual Accounting Allows You To Identify Trends More Easily

Since cash accounting obscures your true profit margin, it’s difficult to identify the trends that are taking place within your business.

Accrual accounting removes the uncertainty surrounding inventory management and paints a clear picture of what’s really going on. Any changes to your revenues, expenses, and margins are clearly depicted in monthly statements that are prepared on an accrual basis.

Accrual Accounting Increases The Value Of Your FBA Business

Accrual accounting increases the value of your business for two primary reasons:

- Financial clarity

- Accurate COGS

It’s not surprising that buyers love to understand what’s happening in businesses that they’re considering acquiring. If they glance at the financials and can’t identify important trends or they get confused by lumpy earnings, they’re not going to be impressed.

Even if you’ve built an amazing FBA business, it’s going to be a lot more difficult to sell if most people can’t understand its story.

Additionally, due to how COGS are reported, accrual accounting will typically show higher earnings for your business at any given time.

For example, if you’re using cash accounting and you have $150,000 of inventory sitting at Amazon’s warehouses, your earnings will be reduced by $150K (since cash accounting will include that expense).

With accrual accounting, the $150K inventory purchase will not be included, since it has not yet been incurred. This will lead to a $150K bump for your earnings, which will obviously have a dramatic effect on the valuation of your FBA business.

Conclusion

From any angle, effective bookkeeping for your FBA business is an absolute necessity, especially if you want to scale.

Having a basic understanding of accounting might be sufficient for getting started, but most experienced entrepreneurs recognize the value of having a professional caste their books on a monthly basis. With the right dashboards and strategies, Amazon seller bookkeeping can serve as the foundation for growth, stability, and clarity.