Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

Calculating EBITDA

By Ian Drogin

As a business owner, it’s essential that you keep a close eye on your EBITDA. Not only does it reflect the health and trajectory of your business, but it also plays a crucial role when it comes to business valuation. If you know how to calculate EBITDA yourself, you’ll be in a much better position to make informed decisions that improve the success of your business.

In this article, we’ll discuss how to calculate EBITDA. We’ll also discuss why EBITDA is such an important metric to track.

Purpose of Calculating EBITDA

Before diving into how to calculate EBITDA, it’s important to understand why it’s important.

There are two primary reasons why EBITDA is important in your online business:

- Helps you make smart business decisions

- Plays a crucial role in determining your business’s value

Buy a Profitable Online Business

Outsmart the startup game and check out our listings. You can request a summary on any business without any further obligation.

Making Smart Business Decisions

EBITDA is an important measure of your business’s success. Of course, it’s not the only metric that matters, but it certainly reflects key elements of its financial performance. When you understand the levers that determine EBITDA, you’re able to make smart decisions that maximize profitability and enterprise value.

Many owners like to view EBITDA on a monthly basis, enabling them to recognize trends, identify changes, and forecast the future.

Unlike net income, EBITDA does not account for non-operating expenses such as interest, taxes, depreciation, and amortization. This allows you to understand the performance of your business’s core financial performance on a deeper level.

Understanding EBITDA in Business Valuation

In addition to helping you make smart decisions as an owner, EBITDA is also a key element in business valuation. If you ever choose to sell your business, your EBITDA will be carefully examined.

When you sell your business, expenses such as interest, depreciation, and amortization will not be transferred to the new owner. As such, these expenses are not factored into the valuation process. This makes EBITDA a more accurate number to base your valuation on than net income. EBITDA is also used when calculating free cash flow.

“In addition to helping you make smart decisions as an owner, EBITDA is also a key element in business valuation.”

It’s important to note that typically you add EBITDA to Seller’s Discretionary Income when calculating value (unless using an EBITDA multiple). Additionally, a business Advisor can help you create a detailed add-back schedule which is also included in the valuation process.

Although each business model has unique qualities, EBITDA is important for each. Whether you own an ecommerce business, content site, or SaaS business, EBITDA is still a crucial metric to track.

Information You Need to Calculate EBITDA

To calculate EBITDA, you typically need to gather a few pieces of key business information. If your P&Ls are fully complete, they’ll contain the information you need. However, if you’re selling your business, you’ll also need to provide documentation for each item in the EBITDA formula.

These include:

- Profit and Loss Statements

- Interest expense documentation

- Tax documents

- Depreciation expense documentation

- Amortization expense documentation

Using Profit and Loss Statements to Calculate EBITDA

Typically, your Profit and Loss Statement (P&L) will include most if not all of the information required to calculate EBITDA.

Net income is the first number in the EBITDA equation. Generally, net income is the most all-encompassing representation of your business’s financial performance. In other words, it accounts for pretty much all income and expenses that your business generates or incurs. Your P&Ls capture everything from sales revenue, to inventory expense, to depreciation, to amortization.

Interest Expense

After determining your net income, you then add any interest expense to that number.

As the term implies, an interest expense is an expense related to borrowing money. There are a few common interest expenses that online businesses sometimes encounter:

- SBA loans

- Credit cards

- Lines of credit

- Bank loans

- Personal loans

If your business is paying interest on debt of any kind, you’ll need to identify that interest expense when calculating EBITDA. In accordance with GAAP, your debt holder should be able to provide third-party documentation specifying your interest payment history.

It’s important to note that if your business earns interest income, that income will also not be included when calculating EBITDA. In other words, you’ll need to subtract that income from your net income, just as you need to add interest expense.

Tax Documents

When calculating EBITDA, you do not account for any tax expense.

If you’re preparing to sell your business, it’s a good idea to gather your tax documents to show potential buyers. Tax documents are an important resource for verifying EBITDA, along with other key financial information in your business.

Depreciation and Amortization

If your business incurs depreciation or amortization expenses, you’ll need to add that to your net income when calculating EBITDA.

Depreciation is expensing fixed assets (i.e. a tangible asset) such as a vehicle, over its usable life. For example, if you make a capital expenditure to purchase a car and expense it to your business, each year you will attribute a portion of its expense for the duration of its life.

“If your business incurs depreciation or amortization expenses, you’ll need to add that to your net income when calculating EBITDA.”

Amortization is similar, except that it applies to an intangible asset.

It’s important to note that when calculating SDE, there are additional discretionary expenses (addbacks) that are also included.

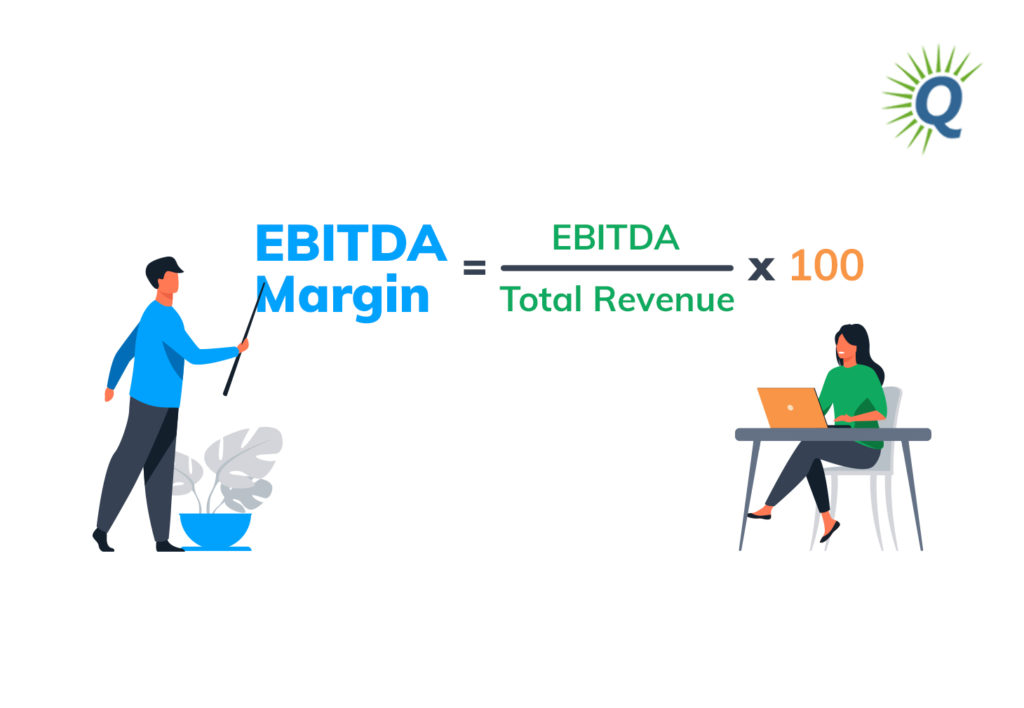

Basic Formula for Calculating EBITDA

The basic formula for calculating EBITDA is as follows:

Let’s break this down into each of its parts.

As mentioned above, your net income typically includes all income and expenses that your business generates. Also, net income is a highly standardized number, which makes it a great starting point when calculating EBITDA.

Once you establish your net income, you then must add a series of expenses.

Interest

Interest expenses are those incurred for borrowing money. For example, let’s say that your business takes out a $200,000 bank loan with an interest rate of 4%. Each month, you’ll be paying interest on that loan in addition to a portion of the loan amount. In this case, you should add your interest back to your net income.

The same would apply for interest paid with lease payments when purchasing a vehicle.

Taxes

Similarly, taxes should also not be factored into your EBITDA calculation.

Let’s say your business paid $150,000 in income tax in the previous year based on your net profit margin. Although this may affect your personal financial situation, it should not be factored into the calculation of EBITDA. The reason is simple: each owner’s taxes will be different, so it doesn’t make sense to account for taxes when establishing the earnings of your business. EBITDA should be as standardized as possible.

Depreciation and Amortization

Lastly, depreciation and amortization must also be added back to your net income when calculating EBITDA.

To use another example, let’s say that you purchased a vehicle and expensed it to your business. Even if you paid for the vehicle in one lump sum, you may still want to expense the vehicle over several years. Just like the previous expenses mentioned above, your depreciation and amortization should not be included when calculating EBITDA. Therefore, they must be added back to your net income found on your income statement or cash flow statement.

Hiring a Bookkeeper

Understanding EBITDA and other financial metrics yourself is important. However, it’s still usually a good idea to hire a professional bookkeeper. Doing so can help you track and manage key financial information in an organized and useful manner.

Many business owners choose to hire a bookkeeper who is knowledgeable about the business model they use. For example, if you own an Amazon business, it’s usually a good idea to work with someone who is familiar with ecommerce. Fortunately, there are many bookkeepers who specialize in working with various kinds of businesses.

“Many business owners choose to hire a bookkeeper who is knowledgeable about the business model they use.”

Not only can bookkeepers help you stay organized and serve as your ‘EBITDA calculator’, but they can also answer questions that come up. If you ever find yourself struggling to understand the differences between NOI versus EBITDA, they can help you out.

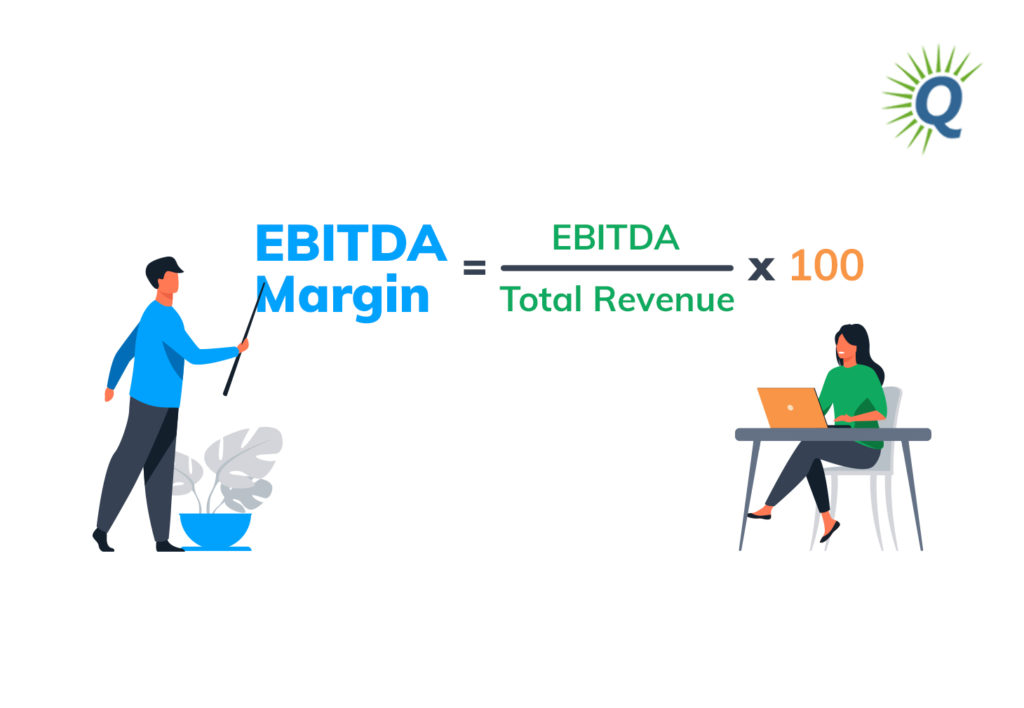

How to Calculate EBITDA Margin

To calculate your EBITDA margin, you divide EBITDA by your total revenue. Then, you multiply that number by 100 to arrive at your company’s profitability expressed as a percentage.

“To calculate your EBITDA margin, you divide EBITDA by your total revenue.”

Benefits of Understanding Your EBITDA Margin

There are a few key benefits to understanding your EBITDA margin, including:

- Allows you to view your business independent from non-operating income and expenses

- Enables you to understand how your business compares with others in your industry

- Allows you to make an accurate valuation of your business

Your EBITDA margin provides an accurate reflection of your business’s profitability. Unlike your net profit margin, your EBITDA margin doesn’t account for non-operating income or expenses, including non cash expenses. This makes it quite useful when trying to forecast SaaS metrics.

When you’re able to remove non-operating income and expenses, you’re able to view your business in isolation from other variables. This enables you to understand trends without getting confused by variables that aren’t relevant to your business’s operations.

For example, if you notice that your EBITDA margin and operating profit has decreased in the last month, you know that something has changed in your operational income or expenses. This allows you to dig deeper into the issue to identify what’s going on.

On the other hand, if you’re only looking at net profit, you’ll have a much more limited idea of what is causing a change in profitability. Maybe, an operating expense has changed or there was a dip in your operating revenue. Or, perhaps your business’s interest expense increased, thereby reducing your net profit. Your EBITDA margin will discern the difference between these two changes, while your net profit margin will not. Also, EBITDA is also used to calculate your adjusted EBITDA.

Comparing Your Business to Others in Your Industry

By removing non-operating income and expenses and looking at your EBITDA margin, you’re able to gain deeper insight into how your business compares to others in your industry.

If your EBITDA margin is lower than your competitor’s, it might make sense to explore opportunities to increase your margin. Perhaps, that means looking for ways to become more efficient with advertising. Or, maybe you want to consider increasing your prices. Whatever you choose, you’ll be more informed if you’re keeping a close eye on your EBITDA margin.

Lastly, since your EBITDA margin provides such an accurate picture of your business’s true profitability, buyers examine it closely when making purchasing decisions. If your EBITDA margin is strong and your trends are positive, buyers will more likely to express interest.

By understanding the drivers of EBITDA and your EBITDA margin, you’ll be well equipped to maximize the value of your business when it’s time to sell.

Thinking of Selling Your Business?

Get a free, individually-tailored valuation and business-readiness assessment. Sell when you're ready. Not a minute before.