Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

How To Avoid Last Minute Buyer’s Remorse For Online Deals

By Jason Yelowitz

Any broker experienced in selling businesses, such as myself, will readily admit that last minute buyer’s remorse is a consistent challenge in getting deals closed. Whether it is an individual buyer or a larger company, many buyers experience a last minute case of the jitters.

One recurring theme, that has occurred in about half of the deals I have personally experienced, is what I call “The Eleventh Hour Freak Out”, otherwise known as “TEHFO.”

Generally a deal will close when the buyer feels :

- They have kicked the tires thoroughly.

- Verified important financial and business details.

- Tested the seller for errors and omissions.

- Got the sign-off from all associated decision-makers (partners, lenders, spouse, etc.)

- Come to ease with the fact they are spending a significant amount of money on a deal which is mostly goodwill with few tangible assets.

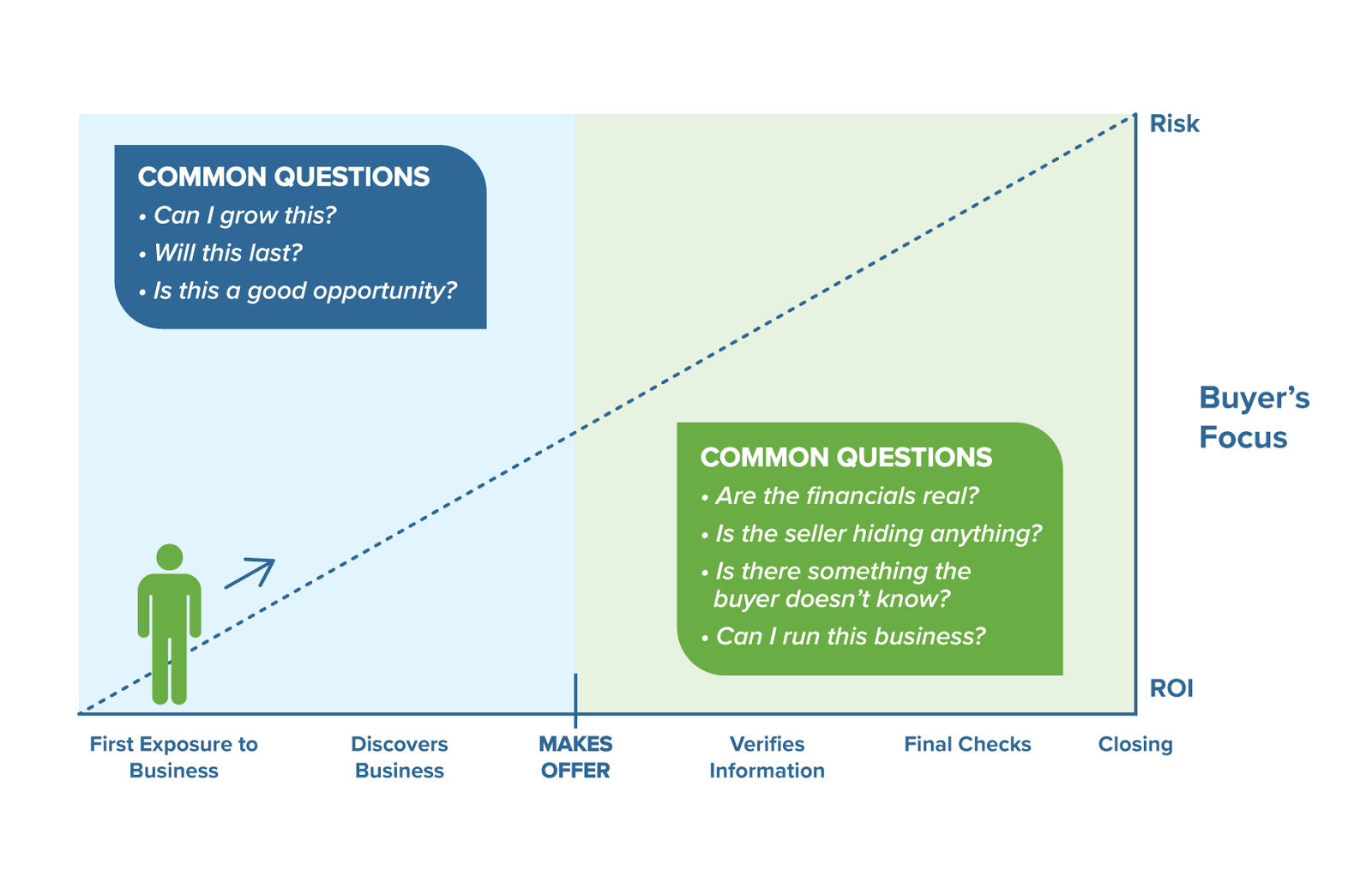

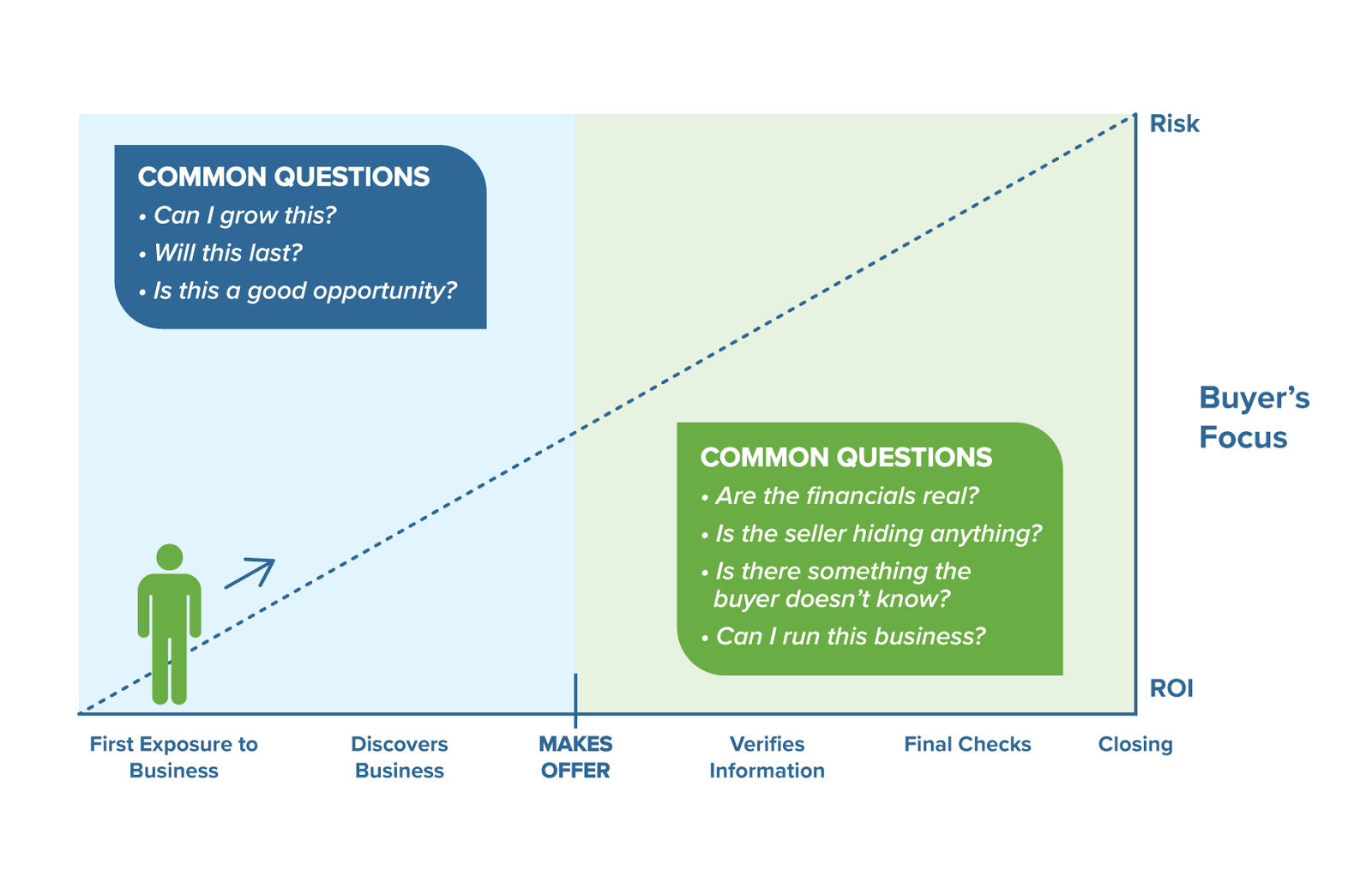

As Closing Gets Nearer, The Buyer Thinks More About The Risks

TEHFO, otherwise known as “early-onset-buyers’-remorse”, generally occurs when most of the due diligence has been covered. The buyer starts to take a more sober view of the risks involved in the anticipated purchase, not just the potential rewards they may have focused on during the bidding process.

Things that could ignite TEHFO include, but are by no means limited to:

- a failure to disclose a minor lawsuit from the past;

- speaking about concepts that make the buyer wonder if the seller will adhere to an agreed-upon non-compete clause;

- when the due diligence process turns up financial realities that are different from what the seller had disclosed up-front;

- When the seller cannot produce all the due diligence documents requested by the buyer.

You may wonder what makes TEHFO different from the usual due diligence problems. It all starts when I get a call from the buyer. It’s usually strewn with emotion and the feeling (on the part of the buyer) that the seller has intentionally tried to misrepresent the business.

Though intentional misrepresentation does sometimes occur, it’s actually pretty rare in my experience.

What’s much more common is the seller either thought something wasn’t a big deal and neglected to mention it, or they never thought much about selling their business before they listed it. Their last minute decision meant they had to quickly throw their financials together and may not have been 100% accurate in doing so.

In general, here are my tips for avoiding, and dealing with, The Eleventh Hour Freak Out from your buyer.

Disclose, Disclose, Disclose

Try to avoid TEHFO in the first place by disclosing ANYTHING you can think of that would give you pause if you were in the buyer’s shoes.

Though some business listings fly off the shelf with multiple offers, many have issues that would most likely make some buyers choose to take a pass.

That said, for virtually every profitable online business, there’s usually a combination of price and buyer profile that will get the deal done IF all the issues are disclosed up front. Avoid the temptation to “hide one little thing.” Get it all out there up front.

Say It First

If a buyer stumbles onto something unexpected, they will often assume the seller has lied. Therefore, by extension, they believe the seller is a liar and untrustworthy.

If, however, the seller discloses bad news up front, there are usually some buyers who can deal with it. So if your business is dependent on a continuity program, is in a grey-area vertical (weapons, marijuana, politics, etc.), has declining revenue, just lost placement on a great keyword on Google, and so on, just admit it upfront.

Such disclosure doesn’t necessarily prevent your business from selling, and the buyer will discover it eventually anyway.

Don’t Get Defensive

The buyer is taking a bigger risk than the seller in the form of putting down cold, hard cash for a deal. This is especially true when the seller lives in a different state or country.

So if the buyer starts questioning your business, your representations, what’s included in the transition training, etc., please take a deep breath and count to ten.

Discuss the matter with your broker, and try to stick to the facts in the event of a disagreement. Try to be reasonable, and remember that buyers are usually good people. But when TEHFO occurs, it’s usually a legitimate emotional reaction when they realize they’re about to spend a lot of money and learn the ins-and-outs of a business they didn’t originally start. Try to have empathy and understanding.

If you need to extend training, extend their due diligence period or in some other ways make adjustments to what you had previously agreed on in order to provide the buyer with a reasonable amount of comfort, it’s often worth it.

Renegotiate, If Warranted

It’s possible that during due diligence, the buyer discovers a “material misrepresentation.” This is a fancy way of saying the business doesn’t earn as much as the buyer expected, based on what was revealed up front. The buyer may therefore request a renegotiation of the purchase price or terms.

The seller may choose, at that point, to either entertain the renegotiation request, or exit the deal and seek a different buyer, especially if there were multiple offers on the business initially.

My advice is: Despite your gut reaction, think twice before making a hasty decision to exit the deal. Sleep on it and decide if the buyer has a point. Even if there were multiple offers, the other buyers would eventually likely reach the same conclusion as the first buyer about whatever is causing the potential renegotiation.

Make sure to coordinate with your broker in this instance; most seasoned brokers have a good sense of whether a buyer has a legitimate point or if they’re just fishing for a better deal. Buyers who use the tactic of backing out of a deal just to see if they can get better terms, can get blacklisted by brokers – including QLB .

De-Escalate

Both the buyer and seller invest a lot of time in due diligence, and sellers often put important business decisions on hold in anticipation of a deal closing.

Sometimes TEHFO occurs at a really bad time (such as after the buyer’s exclusivity on a listing has expired). The seller’s natural reaction might be that the buyer is in violation of the Letter of Intent and therefore would want to withhold the buyer’s deposit, lawyer up and try to force the buyer to complete the transaction.

My advice is to do exactly the opposite. I would advise that the seller recognize the buyer’s legitimate concerns, and offer them the opportunity to exit the deal, regardless of what the LOI says, at no cost and with no pressure.

Why? Because people usually cannot make rational decisions under immense pressure. By removing the pressure, the buyer will usually remember why they bid on the listing in the first place. And if not, then the seller can try again with a new buyer.

Trying to get a judge to order someone to purchase something they don’t want is a recipe for disaster. At QLB, we do not engage in high-pressure gotcha games. Instead we seek deals that are mutually-beneficial for both the seller and buyer.

Do Unto Others

I am not very religious, but if I could, I’d have the golden rule of “Do unto others as you’d have them do unto you” tattooed inside my eyelids.

I follow what author Robert Sutton has deemed “The No A**hole Rule.” I simply will not work with buyers or sellers whom I don’t like, whom I think are disrespectful or whom I think are trying to pull a fast one on the other. Life’s too short, and no amount of money will change this perspective.

If I wouldn’t trust someone to do business the ethical way on just a handshake, I still won’t trust them even with the most well-written, legally-enforceable contract. I seek clients who share this viewpoint.

TEHFO is a fact of life in many deals, but with the right expectations, tactics and frame of mind, it can usually be overcome and lead to a good outcome with an amicable solution and a happy buyer and seller.