Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

4 Things To Ask For In a Business Transition

By Quiet Light

When you close on the acquisition of an online business, take a little time to celebrate your success. But don’t celebrate too long as you have critical work ahead of you.

Immediately after you close on your acquisition, you enter into the transition and training period. This 30-90 day period is crucial to your future success as you will try to learn in a relatively short period all of the information the seller learned over years of ownership.

https://www.youtube.com/watch?v=IZ2oxJIMt-c

So as you complete the due diligence on an acquisition, you should spend a time planning your transition and accounting for any possible problems. Here are five things I’d personally recommend.

A Training Manual

While this might seem reckless, he had an incredible track record of hugely successful acquisitions.

One thing he always requested from sellers: a training manual.

This buyer knew that once a seller reaches closing, their eyes are typically on their next project. Even though the vast majority of sellers will be helpful during the transition period, having a training manual was an added bit of insurance.

Of course, a seller doesn’t always know what you actually need in a training manual. What has become instinctive knowledge for most sellers might be a revelation to you.

So take this step a bit further.

Ask For Written Procedures

Asking for a manual is a very broad request. Instead, narrow it down by asking for a list of Standard Operating Procedures (SOP). This will likely prove to be an easier task for the seller.

Some procedures you may want to ask be included are :

- How refunds are handled

- How new content is published

- How products are added to the site

- How they split test landing pages

- How they rebill their clients (for subscriptions)

- How they cancel accounts

- How they handle returns

Create a Q&A

The SOP is not going to cover everything you need to know for an efficient transition. This is where the Q&A comes in.

A few items to include in a Q&A could be:

- Usernames and passwords for all financial accounts.

- Posting habits & approaches to social media accounts.

- Contact information for vendors and contractors.

- The most unusual business problem they had and how it was resolved.

Of course, you should always ask the seller to include questions that you should have asked, but forgot. Getting them started with a list of questions will help the seller think of more.

Ask For Videos

Writing everything down can be a major pain to complete. If the seller has numerous procedures to document, it can take a long time. Plus, they may not be as detailed as you’d like.

Instead, ask the seller to create videos. Creating a screencast is quick and easy, and there is plenty of free software that allow you to do this.

For a Mac, I use Screenium 3 for screencasts, although you can also use Quicktime. For Windows, Lightshot comes highly recommended.

Record Screenshares

Another idea is to ask the seller if you can record a screenshare. This will allow you to interact directly with them as they show you around systems and processes.

To record a screenshare, simply use a standard screenshare system then record using screencasting software.

To share screens, we use Uberconference, although there are cheaper or free options available.

Schedule In-Person Transition & Training

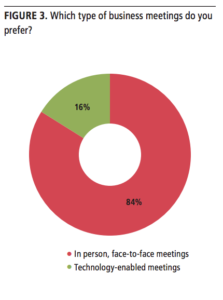

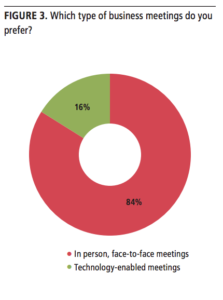

Training materials are an excellent permanent resource. But nothing beats spending time with the seller. You’ll learn things a lot faster, and, according to a study by Forbes, business owners prefer these types of meetings.

Why are face to face meetings so heavily preferred? According to PsychologyToday.com, over half of communication comes from nonverbal cues such as body language. Only 7% of communication are actual spoken words, 38% comes from tone of voice, and 55% through “non-verbal communication” (body language).

In other words, if you visit the seller for training, you’ll learn a lot more than just procedures and passwords. You’ll get a better sense for the business, and watch the seller interact with clients. You’ll learn things that you never expected to learn.

Secure A Consulting Contract With The Seller

If you create a training manual, you’ll greatly reduce your reliance on the seller. But a training manual can’t cover everything. Therefore, having the seller on call is an invaluable addition to any transition plan.

The catch though is that most purchase agreements only plan for a 30 day transition period. Very complex businesses may have a longer transition period, but most sellers will be anxious to move on to their next project.

While most sellers are happy to help and consult after the transition and training period is over, the amount of time they are willing to freely give decreases as they get involved in new projects.

So it makes sense to ask for an ongoing consulting agreement that gives you access to the seller after the planned transition period.

For example, a purchase agreement may allow for a 30-day transition and training window, but it could include a separate consulting agreement for six months after the 30-day period.

When crafting a consulting agreement, consider these points:

- Retainer vs. ongoing. Do you want to pay a flat, monthly retainer? Or does it make sense to sign an on-demand agreement? This should be partially decided on the seller’s future plans.

- Duties. Let the seller know upfront what you would want them for. Coding work? Meeting with vendors? Help out with a troublesome client? Or simply phone consultations?

- Time limitations. You shouldn’t ask a seller to spend 40 hours in one week troubleshooting your issues. Negotiate reasonable time limits so the seller knows they will be free to work on their next project.

Secure Any Staff Or Regular Contractors

The risk of losing key employees or contract workers is a distinct possibility. In fact, just losing one key employee could make a tremendous difference.

Knowing when you should approach employees or contractors about the acquisition is always difficult. Some sellers prefer to be upfront with their workers from the very beginning. Others prefer to keep things under wraps until a deal is signed.

Regardless of how the seller chooses to approach their key workers, you should make every attempt to retain key people for at least 3 months. It’ll take you a few months to learn enough about the business to make solid hiring and firing decisions.

Offer a 3 Month Mutual Trial Period

No one knows how well a transition will work for contractors and employees. They may not be happy with you, or you may not be happy with them. Or an employee may see the seller’s departure as a great time to leave themselves.

But losing key employees when you are transitioning a new business can leave you in a really bad spot.

So try to entice employees to stay for a minimum of 3 months by emphasizing the following:

- A Mutual Trial Period. Three months is a time for you to build a professional relationship. You have a duty to them just as they have a duty to you.

- A Bonus. Provide some incentive for key workers to stay for the entire three months. It doesn’t have to be a financial bonus, but make it tempting enough to persuade everyone to stay.

- Pay attention after 2 months. While the trial period may be 3 months, you need to review the situation after 2 months. If you don’t plan to keep key workers, you’ll need a plan for finding replacements.

- Offer long-term potential. One contributor to merger syndrome is uncertainty of the future. Let workers know that your hope is for a long-term relationship, and you’ll say that in writing.

Require a Small Holdback

The last contingency you should include when transitioning a business is a small financial holdback.

A holdback is when you and the seller agree to hold a small portion of the closing funds in escrow. This period is usually for 30 or 60 days, although the period can vary depending on the business.

For example, if you purchase a website for $500,000, $50,000 would be kept in escrow for 30 days after the closing.

There are two main purposes for a holdback:

- Discourage less-than-honest sellers. The vast majority of sellers are honest individuals. But for those few who might be tempted to walk before offering full transition assistance, a holdback provides the incentive to do a full and complete job.

- Cover incidental costs. If you are forced to cover expenses incurred by the previous owner, or process refunds from the previous owner’s time, those incidental costs can be covered by the holdback.

It is important you don’t use a holdback as a way to get more than you originally agreed to in your purchase agreement. Holdback funds should be held in escrow to help ensure both buyer and seller treat those funds honestly.

Bonus: Take Time To Plan Your Transition

If you do not plan the transition and training, this can easily become one of the most stressful moments in the buying process.

Worse yet, a botched transition can have consequences for months or even years after you acquire the business. A botched transition can also destroy any goodwill you worked to establish between yourself and the seller.

The seller will be anxious to move on to their next project, so the transition should be sensitive to those wishes.

Most importantly, take the time to build goodwill with the seller during the due diligence period. People like to help people they like, so make yourself likable.