Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

The Top Reasons You Should Invest in Amazon FBA

By Quiet Light

Fulfillment By Amazon is for more than just sellers. It can result in being a springboard for an entirely new investment model. If you play your cards right, it can pay off big.

Is Amazon FBA Worth an Investment in 2021?

Thanks to the coronavirus pandemic, the ecommerce space will never be the same. As noted by Digital Commerce 360, COVID-19 rocketed digital commerce to the forefront of retail. Consumer spending habits have irrevocably changed, with many retailers going bankrupt and many others seeing a massive surge in sales and revenue.

The Fulfillment by Amazon program was not immune to this market shift. A few months into the pandemic, Amazon left many retailers out in the cold by delaying shipments of nonessential items by up to a month. It was a stark demonstration that being a merchant on the Amazon marketplace is not without its weaknesses.

In light of this, you may wonder whether investing in an FBA business is still worthwhile. The short answer is yes.

The longer answer, however, is that it depends.

You need to be thoughtful when considering the pros and cons. Evaluate your investments carefully, examine the market, and spread them out among unique and defensible brands and SKUs. It’s a strategy closely aligned with one in the book, Buy Then Build, by our own Walker Deibel.

Known as the platform model of acquisition, this active investment strategy leverages and builds upon the existing infrastructure of acquired brands. One expands and improves upon what’s working and resolves what isn’t.

These small businesses can then be augmented with tools that may ordinarily be out of reach, such as big data analytics and marketing at scale.

Targeted investment isn’t the only thing you’ll need to do if you’re to successfully invest in Amazon FBA.

You will also need to understand what makes the Amazon marketplace different from traditional ecommerce. One of the most frequent mistakes we see owners making involves the failure to understand the core concepts of being an Amazon seller.

Before we start talking about the actual investment process, it’s in our best interest to review those concepts.

How Does Amazon FBA Work?

Essentially, FBA is an Amazon service that allows sellers to outsource shipping, order fulfillment, and returns. Although it’s not required that you list your products with Amazon to leverage their global fulfillment network, it’s strongly recommended. Simply by selling on Amazon, with its vast potential customer network, you will be formidably increasing your brand exposure. In addition to gaining brand exposure, being an FBA seller also boosts your position in the Buy Box Algorithm.

What is the Buy Box Algorithm?

When a user views an Amazon product listing, the website displays purchase options on the right side of the page. This is known as the Buy Box. This is the default method of purchasing an Amazon product and it accounts for approximately 82% of all sales on the site.

Meanwhile, the Buy Box Algorithm is how the website determines which seller’s product will be ordered when a user clicks “Add to Cart” or “Buy Now.” The core idea is that the algorithm will connect a customer with the best seller possible in both price and quality. In terms of how the algorithm qualifies this, there are a few elements at play.

Amazon Buy Box Eligibility

To be eligible for the Buy Box, a seller must:

- Have a Professional FBA account. This means that the business sells more than 40 items per month while also being subscribed to Amazon’s Professional seller’s tier.

- Have an order defect rate, cancellation rate, and late shipment rate all in good standing.

- Keep enough items in stock to offer fast fulfillment times.

How Amazon’s Buy Box Algorithm Works

In addition to the metrics described above, the following factors are used when determining if a product qualifies for Amazon’s Buy Box.

- Using Fulfillment by Amazon or Seller-Fulfilled Prime (SFP). A merchant subscribed to Amazon FBA receives perfect scores for several of the primary eligibility metrics. Amazon’s FBA provides an even greater boost.

- Competitive pricing. While a lower landed price (product price, plus shipping and taxes in some regions) gives a boost to a seller’s Buy Box rating, the lowest price doesn’t necessarily mean you’ll win.

- A good feedback rating. Your feedback rating is tallied over periods of 30, 90, and 385 days. More recent reviews have more impact on your rating.

- Seller efficacy. Fast shipping and fast responses to customer complaints are essential factors in a seller’s Buy Box position.

- Tracking rate. Essentially, this is a metric that measures the percentage of packages with a valid tracking number that the seller ships. You want this as close to 100% as possible.

What is a Suppressed Buy Box?

It’s important to note that there are a few scenarios where Amazon will either suppress or remove the Buy Box from a product listing.

- If Amazon believes a product’s price is too high or is sold for a significantly lower price elsewhere.

- If a product’s sales volume is too low.

- If a listing is low-quality, lacks decent photos, descriptive information, etc.

Why Invest In Amazon FBA?

The Benefits of Amazon FBA

Amazon takes all the complex parts of running a product-based business off your hands. With FBA, you don’t need to worry about details like warehousing and fulfillment. You also gain access to a built-in ad platform, managed customer service, and over 30 million of the highest converting consumers online.

This means you have the potential to run a seven- or eight-figure business on the platform without even hiring full-time staff. Moreover, fulfillment is often the most difficult part of running an ecommerce business. The fact that FBA takes that cumbersome, challenging process off your hands is a significant added value.

Additionally, because you’re already hosting your products on the world’s largest ecommerce marketplace, you don’t need to worry about customer acquisition costs. Amazon will naturally direct interested buyers to your products. All you need to do is ensure your product listings are well-written and include quality photos, and the marketplace will take care of the rest.

Lastly, FBA also provides merchants with a great deal of flexibility. If you want to set up your ecommerce website on Shopify, for instance, you are entirely free to do so. You’re able to leverage Amazon’s global fulfillment network across multiple sales channels.

As far as platform risk is concerned, it’s not something you can avoid online. We are ultimately all at the whims of market leaders. Amazon, Facebook, and Google can all make or break an ecommerce business, regardless of how or where it is set up. If the preceding arguments haven’t convinced you, you can instead put your trust in data.

The numbers support that an Amazon FBA business is a strong investment.

- From 2015-2017, when selling on Amazon, the number of small and mid-sized brands earning more than $100K in revenue doubled their earnings.

- In 2019, over 20,000 businesses earned more than $1 million in revenue.

- Currently, more than 50 percent of Amazon’s package volume comes from marketplace sellers.

However, you need to be careful that you don’t just blindly go out and acquire new FBA businesses. With so many sellers on the market, investments need to be made with caution.

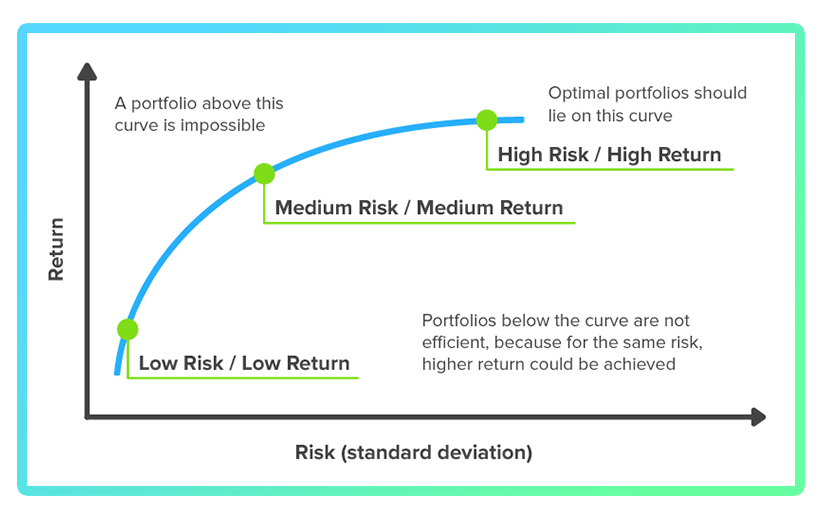

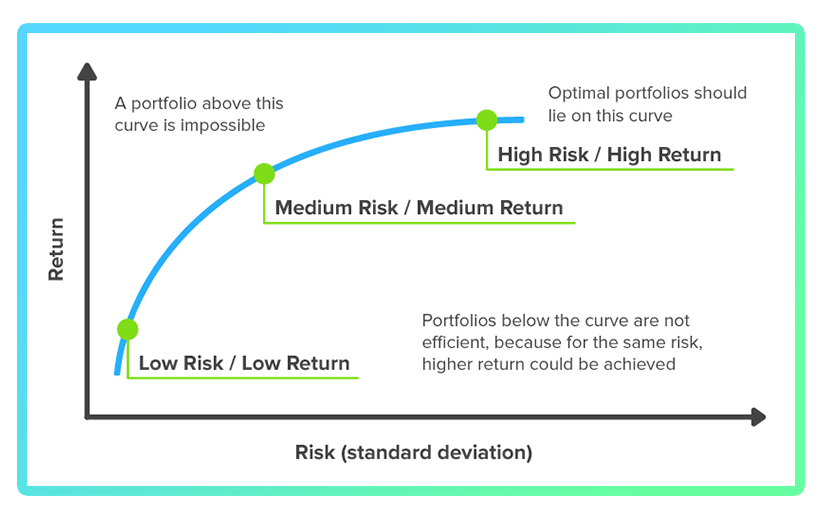

What is the Potential Return on Investment for Buying an Amazon FBA Business?

Even if you acquire an asset that looks good on paper, you are never entirely guaranteed to turn a profit. You must understand the costs of Amazon FBA and the risks associated with it. This will give you a clearer idea of what you should consider before finalizing an acquisition.

What Does Amazon FBA Cost?

Arguably the biggest drawback of selling on Amazon is the cost. Although it’s still less pricey than managing your own fulfillment network and marketing campaigns, the fees you must pay to operate on the marketplace tend to add up very fast. There are also multiple value-added services and optional programs that the current owner of a business may have added, and for which you’ll need to be aware prior to purchasing a business.

Amazon FBA Seller Fees

Information on the specific fee amounts for 2021 can be found in the knowledge base of Amazon Seller Central.

- FBA Fulfillment Fee. This fee covers everything involved in order processing and fulfillment, from packing through, to customer service and returns. As noted by Amazon Seller Central, fulfillment fees are calculated primarily based on the product category and size. They are also influenced by whether the product is sold on Amazon.

- Referral Fee. For each sale made on Amazon, the site takes a small percentage of the revenue. Depending on the type of product sold, this commission can be as low as 3% and as high as 45%.

- Returns Processing Fee. Amazon handles the return of some products free of charge. However, certain product categories may have a seller fee for processing the return and repackaging the product.

- FBA Professional Subscription Fee. For $39.99 a month (plus additional seller fees), this service qualifies a seller for top placement on product pages, grants access to advanced selling tools and metrics, allows sellers to advertise their products, and gives a seller access to restricted product categories.

Amazon FBA Optional Fees

- New Selection Program Fee. Launched in January 2021, Amazon’s FBA New Selection Program encourages sellers to expand into new products and product categories, offering benefits that include free monthly storage, free removal, and free returns processing.

- Storage Fees. Amazon charges a small fee for inventory storage. These fees are assessed monthly and increase depending on how long a product has been stored in the Amazon warehouse.

- Multi-Channel Export Fees. For most international orders made via Amazon, the seller pays no additional fees. An export fee is only applied if an international order is made via multi-channel fulfillment.

- Inventory Placement Fees. Per Amazon, when a seller creates a shipping plan, their shipment may be divided into multiple segments, each directed to a different fulfillment or receiving center. Instead, Amazon’s Inventory Placement service sends all products (if eligible) to a single fulfillment center for a nominal fee.

- Stock Removal Fees. A seller can choose to have unsold inventory removed from Amazon’s warehouses, at which point they will be charged a fee. This fee is also levied if the seller requests their products to be sent back to them.

What Should You Look for When Buying an Amazon FBA Business?

How Many Amazon FBA Businesses Fail?

As with any online business, building a successful Amazon FBA business is far from easy. In truth, we estimate that the majority of Amazon FBA businesses ultimately fail. The reasons are many and varied but often boil down to either mismanagement by the owner or unfavorable market conditions.

The good news is that once you have a trained eye, you’ll be able to recognize the characteristics of a successful Amazon FBA business just as readily as the warning signs of a struggling one.

Green Flags for an Amazon FBA Business

- Inventory that sells well. The majority of a healthy Amazon FBA business’s inventory shouldn’t be sitting in a warehouse for long periods. Instead, it should sell relatively quickly and regularly.

- Solid brand partnerships. Sourcing agreements are an excellent way to generate revenue through exclusive relationships, and their presence is often a positive for buyers — provided the partnerships transfer with ownership.

- Healthy gross margins and net margin. Self-explanatory. Does the business have a healthy bottom line, or does it regularly dip into the red?

- A favorable review structure. Product reviews are generally more critical than seller account reviews. Look for an FBA business with many positive reviews that far outweigh the negatives. Evaluate them on the following characteristics.

-

- Velocity. How quickly does a product or seller account accumulate reviews?

- Quality. How descriptive, helpful, and/or relevant are the reviews?

- Generation. Were reviews acquired in a way that does not violate Amazon’s terms of service?

-

- An intriguing business narrative. A great story is essential no matter what you’re selling, and storytelling is a potent business tool. This story should hit a few major beats.

-

- Motivation. Why did the original owner start an Amazon FBA account, and why are they now selling?

- Challenges. What personal or professional roadblocks to success has the owner encountered?

- Opportunities. How has the owner improved or expanded the business over the years?

Buy a Profitable Online Business

Outsmart the startup game and check out our listings. You can request a summary on any business without any further obligation.

- Potential for expansion. What growth opportunities exist in the current market? Is the FBA business well-positioned to expand into a new category/niche or gain further ground in existing ones?

- Evidence of recent growth. Is the FBA business experiencing an upward trend in sales, traffic, and/or revenue?

Red Flags for an Amazon FBA Business

- An overly complicated backend. Ease of use is one of the core benefits of Amazon FBA. If a business uses cumbersome ecommerce tools or is excessively reliant on its owner to operate, it may be better to walk away and find a different investment.

- A low-performing or unfamiliar niche. Specific niches simply don’t generate a great deal of profit, and any business that operates within them may struggle to make ends meet. Similarly, even a high-performing niche is no guarantee of success if you are entirely unfamiliar with it.

- Large spikes in traffic or revenue. Extremely sharp positive growth can be a sign of volatility. Declining revenue, meanwhile, can be an indicator of a failing business. This is why it’s advisable to request several years of financials before making your purchase. This enables you to compare year-over-year changes to determine if peaks and valleys are seasonal or a sign of something else.

- Products that are too easily copied. The Amazon marketplace is highly competitive. A seller that lacks any unique, quality products is not likely to succeed. Similarly, one that sells items that are easy to copy or duplicate is also likely to struggle.

- Bad account health. Even if a business looks good financially, pay attention to whether the account is in good standing. It doesn’t matter how profitable a business is if it ends up being blacklisted.

- Low review scores. This is a sign that an FBA business tends to sell large volumes of low-quality products.

- Bad branding/marketing. How does the prospective investment’s social media presence look? What sort of history does it have with advertising/promotions? Does it maintain active email lists?

Risk. Reward. Success.

While it does come with many unique risks, investing in an Amazon FBA business can pay off immensely in the long run. As long as you understand the platform and recognize the signs of a successful seller, the benefits far outweigh the drawbacks. As ecommerce grows increasingly popular in the coming years, this is highly unlikely to change.