Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

Everything You Need to Know About SBA Loan Requirements

By Quiet Light

Let’s talk about leverage…

If you’re planning to buy or sell a business in the near future, it’s worth considering now.

As Stephen Speer pointed out on the podcast last week, an SBA loan can be a critical tool.

And knowing the loan requirements for a business purchase in advance can give you a major leg up.

Leverage makes the world go ‘round.

Access to leverage in many cases accounts for the distinction between the haves and have-nots.

Which may seem counterintuitive, because people with cash in the bank aren’t supposed to need loans. But leverage is as much about power as it is about need.

Listen to the Source of this Post:

This blog post is based on a podcast episode that we recently recorded. Listen to the full episode here:Like most people I know, I’ve had experience with both sides of that have/have-not coin.

In 1999, when I got a loan to buy a rolling 75-acre property with a strong creek running through it, the process was like stepping up to an ATM machine.

The whole thing took about 15 minutes over the phone and required some money in the bank and a pulse.

In 2010, on the other hand, to buy the property we live on now, the process was more like complex espionage.

Weeks ran into months. I think I was given a code name.

Times Change.

Luckily these days, getting an SBA loan doesn’t have to be the struggle many assume it to be as long as you’re prepared.

The average time to close in Stephen Speer’s experience is just 43 days.

Even at its most fundamental, on the physical level, leverage equals straight-up power.

Have you ever been unable to find a can opener when you needed one? Suddenly your hands seem utterly ridiculous, and a simple task has become maddeningly completely impossible.

Which points to exactly what leverage of all kind does – it expands possibility.

Elon Musk recently discovered he can leverage the properties of plain old stainless steel to blast his latest rocket,

Starship, out of the atmosphere.

It’s a commonplace material compared to carbon fiber, and steel hasn’t been used for that purpose since the 50’s.

But because it’s lighter, stronger at frigid temperatures, and has a higher melting point, he thinks he can use it to break the Starship free of Earth’s gravity. And at just $3 a kilogram rather than $135 a kilogram for carbon fiber.

Imagine realizing you can build a stronger rocket to go further, faster, for 1/45th of the original cost.

Possibilities expand.

Imagine buying a business worth $1MM, with monthly cash flow of roughly $25K, for only 10% down.

Stephen Speer can imagine it easily. Last year at Ecommerce Lending he closed 41 deals totaling over $50MM, and his team is growing.

Speer is less banker and more ecommerce lending specialist who speaks our language and knows how to translate it for banks.

In this post, with his help, we’ll find out what lenders are looking for in a buyer, what loan requirements for an existing business look like right now, and how to go about getting SBA approved in 2019.

Why qualify your business as a seller, and what it takes

What the lender is really looking for

What it takes to qualify as a buyer

What to expect and what’s new in 2019

The advantage of a specialized lender

Why qualify your business as a seller, and what it takes

Stephen points out that, even in this market where buyers are prevalent, qualifying your existing business for an SBA loan makes perfect sense.

Even buyers with cash to spend right now will seek financing to avoid tying up that cash and to meet their larger business goals in an acquisition.

Whether it’s an owner-operator-type buyer or a portfolio buyer, financing the purchase with just 10-15% down is an attractive option.

As a seller, having your business pre-approved for SBA financing gives you a wider pool of potential buyers.

What are lenders like Stephen looking for in a business?

As Joe pointed out on the podcast last week, it’s not rocket science. Lenders “are betting on the future success of the business,” so for starters they, “want to see that the business is run properly.”

In terms of the financials, Stephen says he’s looking for 3 main things in 2019:

- Solid tax returns from 2017

- Solid year-end financials for 2018 (soon that’ll be tax returns as well)

- The indication of a strong trailing 12 months

And as Joe pointed out, lenders look beyond the financials to the operational aspects of the business. Stephen, for instance, considers in his assessment:

- The type of business (FBA or otherwise)

- The number of SKUs

- The types of products

He wants to avoid single-product businesses and other major risk factors.

He likes to see separate returns filed for the business being sold rather than the co-mingling of many businesses under one return.

What the lender is really looking for

If you hang around at Quiet Light often, you’ve heard this over and over again…running your business as if you’re going to sell it as early as possible is the best way to increase its value when the day comes that you’re ready to sell.

Conservative accounting, rather than the more creative accounting where you deduct every personal expense you can think of from your bottom line, becomes a part of that picture.

Banks are looking for a safe investment first and foremost.

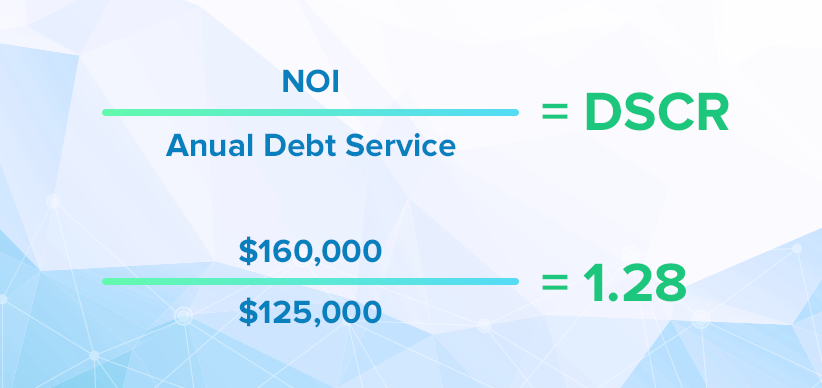

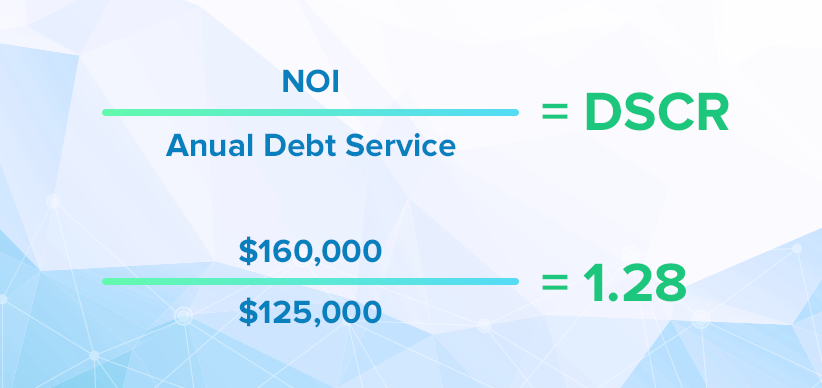

When asked for a single benchmark that SBA lenders value most to determine that, Stephen points to Debt Service Coverage.

Specifically, he’s looking for a Debt Service Coverage ratio of around 1.15.

He says, for example, that if the buyer’s annual obligation for the loan will be $100k, for a safe investment, “the bottom line on the tax return needs to reflect at least $115k.”

What about add-backs?

The standard add-backs apply:

- Interest

- Depreciation

- Amortization

Plus, some of the seller-discretionary add-backs might include expenses like:

- Rent

- Vehicle expenses

- One-time expenses (such as a marketing or consulting fee)

These expenses are added back to the bottom line number to determine Debt Service Coverage.

Basically, if the expense will occur post-acquisition, it’s not an add-back.

Besides the DSCR, Stephen says, banks will also want information about any blips in the financials or periods of declining revenue.

The key becomes to make sense of those for the lender, so that it’s clear to the bank that a new buyer can avoid the same mistakes.

Stephen’s most urgent message to sellers around accounting is this: hire a great CPA now, and despite the short-term expense, it’ll pay off big later.

What it takes to qualify as a buyer

SBA loan requirements for anyone looking to purchase a business will be similar to the requirements for a business itself in some ways:

Are you a good risk? Do you have experience and a track record of success as an entrepreneur?

Will you still have enough capital after closing on a loan to operate your life?

Will you have access to other sources of income?

Stephen points out that while your credit score will be one factor, it’s not the deciding factor by any means.

The first step Stephen takes in evaluating a buyer looking for an SBA loan is to interview that person.

He needs to know:

- Your experience (both direct online experience and indirect)

- What skill-set you have that’s transferable to the new business

- What your plan is to fill the void in areas you may be lacking experience

It’s also his job to assess your financial picture going into the deal and determine post-closing liquidity.

He says a lot of personal debt is usually a red flag, for instance, and also points out, “most of my buyers have what I call a day job.”

In other words, an outside source of income helps.

What to expect and what’s new in 2019

As I’ve mentioned before, things move fast in this seller’s market, and letting your broker know that you’ve qualified for a loan ahead of time gives you a definite advantage.

When you come across the right business, you want to move quickly.

Stephen describes a straightforward process for getting pre-qualified for an SBA loan as a buyer:

- Stephen interviews you to assess your experience and qualifications.

- You submit your personal financial statement.

- He issues a prequalification that lists the purchase price you can target in your search.

The typical loan covers the following:

- The value of the business

- Any on-hand inventory not covered in the purchase price

- Working capital (determined by working with the broker and including new inventory needs, marketing campaigns, etc.)

Stephen explains that most SBA loans entail just 10% down at an interest rate of Prime + 2 ¾.

If you haven’t looked into an SBA loan recently, this is what changed in 2018:

Instead of the 25% down payment that was required from both the buyer and any seller note, the overall minimum down payment now is just 10%.

A seller note is not necessarily required now, but he points out that it sometimes makes the loan easier to approve by promising adequate seller involvement in the transition stage.

The advantage of a specialized lender

According to Joe on the podcast last week, the advantage of having a lender with specific ecommerce business experience cannot be underestimated.

Stephen and other ecommerce specialists understand how online businesses of all types operate and what makes them profitable.

They get what it takes to scale an ecomm business – namely cash – and to build a portfolio of businesses – namely leverage.

They’re prepared to help entrepreneurs accomplish those goals by thinking outside the box when necessary.

Joe remembers a deal recently where Stephen did just that.

When a buyer’s debt-to-income ratio was off with 2 businesses under LOI, Stephen looked at the financials and found a solution.

By refinancing a staggering Amazon loan the buyer carried on another business, he effectively cut that business’s monthly debt service down from over $48k to just $2k and got the approval.

It’s that sort of problem-solving and deep analysis that traditional bankers without online experience might not bring to the table.

Essentially, SBA loan requirements for a business purchase boil down to two questions:

- Is the business on a path to success?

- Is the buyer the person to run that business?

And whichever side of the deal you’re on, the more you plan ahead, the more likely the answer to those questions will be yes.

Is SBA approval important?

You wouldn’t splash around with your bare hands, trying to row a boat without oars.

If you were Elon Musk, you wouldn’t design a rocket without using the toughest most lightweight metal available to carry it out of the atmosphere.

If you want to take advantage of the power of leverage and increase your chances of completing a deal, don’t ignore one of the best tools available to accomplish those goals.