Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

Tariff Schmariff. Keep Your Earnings and Avoid Sky-High Import Fees

By Quiet Light

Are you sick to death of US customs fees? Tariffs and duties are cutting into your margins, hiking up prices and diminishing ROI. Stop giving Uncle Sam more of your hard-earned revenue. Bobby Armijo, Cofounder of Baja Fulfillment, is here to turn you into a tariff renegade without the orange jumpsuit.

Avoid fees by fulfilling in Mexico

Using Section 321 to your benefit

How the process works without the BS fees

Three ways Section 321 benefits your business

Did you know that tariffs and other BS fees were some of the (many) causes of the American Revolution?

Citizens and merchants opposed the government sucking people dry with high fees to import goods.

Fast forward a few hundred years later, and business owners are still saddled with tariffs that chip away at their earnings.

And sure, tariffs are necessary to an extent, but they can demolish your ROI, especially in today’s competitive landscape.

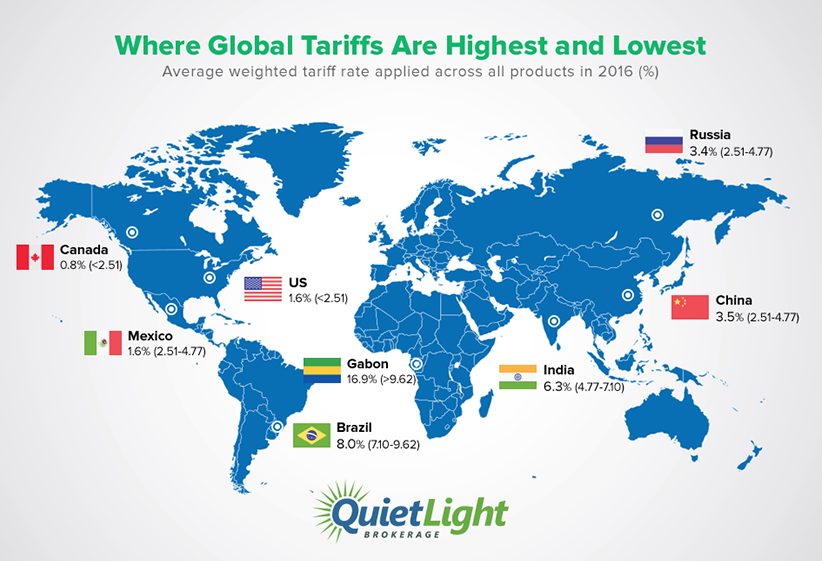

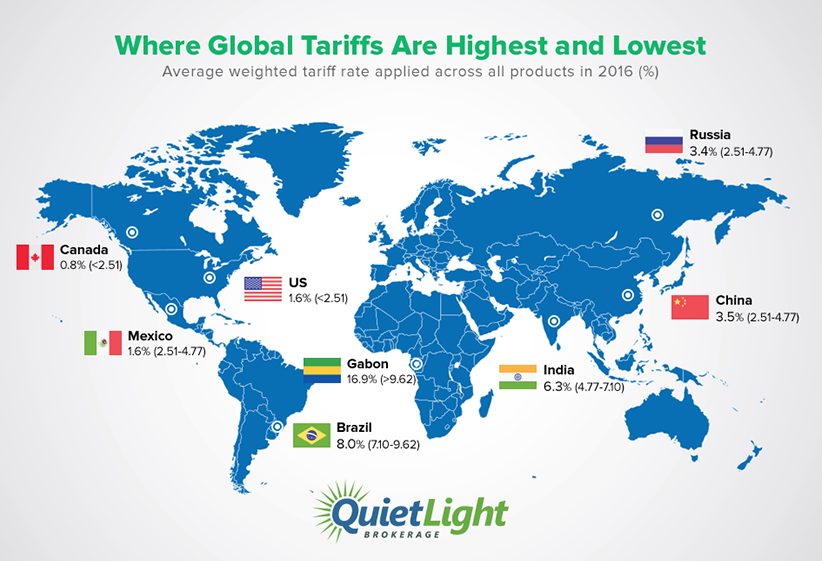

You can’t blame business owners for being annoyed with tariff hikes, either, courtesy of our current trade war with China.

Listen to the Source of this Post:

This blog post is based on a podcast episode that we recently recorded. Listen to the full episode here:Don’t you wish there were a way to make your import costs disappear?

…

Legally, of course?

Sure you do!

Quiet Light sat down with Bobby Armijo, who is a pro and, dare I say, magician when it comes to making tariffs go poof.

With Bobby’s process, you can avoid a lot of tariffs with a pinch of creativity.

Respectfully give the finger to super-high tariffs just like our founding fathers did.

You don’t have to throw tea into a harbor, either, which is a plus.

Legally and ethically reduce your tariffs to reinvest more cash into your eCommerce business.

Avoid fees by fulfilling in Mexico

Bobby is the cofounder of Baja Fulfillment, but his background is in financial planning.

He helped folks streamline their finances for over 15 years, so it only stands to reason that Baja Fulfillment helps businesses save money on US customs fees.

After dipping his toe in the deep pond of eCommerce, Bobby realized there was a lot of opportunity in the eCommerce space.

“Some time ago, I realized there were sales opportunities through eCommerce, but also through my friendships, partnerships, and clients,” he says.

Bobby partnered with John Borsini, who had been importing goods from China for the last 30 years, to make Baja Fulfillment a reality.

Today Baja Fulfillment works like a matchmaking service. It pairs eCommerce brands with fulfillment solutions.

Translation: Bobby helps brands (and big brands, I might add) save a ton of money on imports.

Baja Fulfillment imports goods primarily to Mexico, where they can help brands avoid the weird duties and tariffs that come with importing to the US.

Using Section 321 to your benefit

You might be thinking, “How in the hell is this allowed?”

Great question!

Bobby uses the boring-sounding-but-important Section 321 trade policy from the US Department of Homeland security.

Section 321 allows US citizens to bring $800-worth of goods per person, per day into the US from any country in the world.

It’s the reason you can buy huge bottles of liquor and perfume at the airport and bring them back to the US without paying duties.

Here’s the important part, though: eCommerce companies can get in on Section 321, too.

It’s not reserved just for people going on an international vacation.

This is a huge, huge deal if you’re running a B2C FBM eCommerce company that imports goods to the US.

You can use Section 321 as long as your average order value per customer is less than $800 retail.

Unless you’re selling some high-end goods, you probably fall into that category.

The limit used to be just $200, but it was increased to $800 in 2016. I guess people wanted to buy more hooch at the airport; who knows.

Even if the government decides to lower this limit in the future, it’s still likely that your average order value isn’t over $200, so you can still use this strategy.

“I still think most B2C companies don’t have an average order value of over $200,” Bobby says.

Who can’t use Section 321?

Remember, Bobby’s process won’t apply to every business. The government has rules and whatnot, which means you might still need to pay US customs fees.

Two potential sticking points can prevent you from using Section 321.

First, you can’t use Section 321 if your average order value is over $800. You need to stay well under $800 per customer per day to be compliant.

Second, you can’t use Bobby’s process (that I’m about to show you) if you’re using Amazon FBA.

“If you want to ship through an FBA fulfillment center, that wouldn’t qualify for Section 321. It’s only for B2C,” Bobby says.

That’s because Bobby’s process requires fulfilling your shipments in Mexico.

If you’re doing Amazon FBA, you’re letting Amazon handle the fulfillment.

There’s nothing wrong with doing FBA, but it means you won’t be able to use Bobby’s strategy to your advantage. Sorry.

How the process usually works

Let’s take a peek at how the import and fulfillment process usually works.

This is the long, drawn-out, and expensive option that most brands use because they don’t know any better.

Say you’ve got a performance apparel brand.

You’re paying tariffs and passing along duties to your customers.

If you order 10,000 pants from China, it’s put into a shipping container and eventually ends up in a port in the US.

You pay customs a tidy fee to release the products.

After you’ve released the products from customs, you take it to your 3PL, where you fulfill orders every day as they come in from your customers.

Sounds pretty normal, right?

The issue here is that US customs fees are bleeding your ROI.

The more fees you pay, the less money that goes in your pocket.

Worst of all, duties and tariffs also mean you have to increase prices, which can make you less competitive in eCommerce.

“You have a major competitive advantage from a revenue standpoint when you cut out the duties and tariffs,” Bobby says.

How the process works without the BS fees

Put on your Founding Father hat and realize that these fees are cutting into your business’s success.

Bobby’s fulfillment process uses Section 321 to avoid the fees and put more money in your pocket.

The best part? You don’t have to change your supply chain or manufacturer. This is only happening on the fulfillment side.

“With 321, you don’t interrupt the supply chain whatsoever. You still have the same manufacturers and factories. The only difference is when the container hits port,” Bobby says.

Here’s how it works.

Baja Fulfillment picks up your shipping container when it arrives at a US port from your manufacturer. They pick up the container through a bonded carrier.

This is an important distinction because bonded carriers can take the container without clearing US customs yet, which means you aren’t paying US customs fees.

At that point, Bobby takes the shipment down to his fulfillment facility in Tecate, Mexico, which is 2.5 hours from Long Beach, CA.

What happens in Mexico gets fulfilled in Mexico

The shipment crosses into Mexico, where Bobby doesn’t have to pay tariffs or duties thanks to his maquiladora license.

From there, Bobby unpacks the container at the 3PL in Tecate.

Now it’s back to business as usual: you wait for customers to make their orders.

You pack and label the shipments like normal.

You can send out orders every day as long as each customer’s order value is less than $800.

Unless they’re buying an ungodly number of yoga pants, you’re probably in the clear.

From there, the shipments are loaded on a specific Section 321 truck, which crosses back into the US to ship the goods.

Not too shabby, huh?

Bobby’s process requires rerouting the products a bit, but it’s worth the payoff.

You can legally get around tariffs and duties that otherwise cripple your earning potential.

Um, is this legit?

Yes, this is legit. Huge enterprise companies have been using this system for decades.

Bobby admits this system is nothing new and nothing he made up; it’s been going on for years.

“We’re not the only one doing it. It’s nothing we created,” he says.

He readily invites agents, brokers, and customs agents to inspect his facility.

He makes sure everything is being done to the letter of the law and hasn’t had a single problem.

Honestly, you’re fine as long as you aren’t doing weird shit like using fake names, phone numbers, or addresses.

That is, obviously, not cool.

“What customs is looking for is people trying to go under the radar,” Bobby says.

To reiterate: this isn’t some newfangled idea or magic loophole in the system.

Huge brands like Panasonic, Bose, and Walmart have been doing this for a very long time.

Bobby’s following the government’s playbook to help eCommerce brands avoid US customs fees—without shady backroom deals.

Three ways Section 321 benefits your business

Section 321 has three major benefits for eCommerce brands.

1. Save a ridonkulous amount of money

You’re in the business of earning money, right? Don’t you want to keep more of it?

The biggest benefit to Section 321 fulfillment is the financial savings.

The savings rate differs from company to company, but Bobby looked at his numbers for a recent client.

This brand was doing $30 million in revenue. Using Section 321, it saved 10% of its gross revenue, or $3 million.

Three million freakin’ dollars.

This savings is no small sum. It’s life-changing for your business.

Just look at your last 12 months of financial statements. What duties and tariffs are you paying?

Bobby’s process helps brands reduce that cost by 70% (Bobby takes the other 30% to implement the plan).

But still, a 70% reduction in tariffs is mind-numbing.

This is a brilliant strategy, no matter if you’re staying in your business for years or if you’re planning to exit.

Actually, Bobby loves this process so much that he flips businesses with Section 321.

He’ll buy a business, overhaul its fulfillment with his strategy, and sell it for an incredible return. For him, it’s a no-brainer.

If you want to 2X or 3X your brand in the next 12 months, you need to slash costs like a madman.

That means ditching US customs fees at the door.

Saving fat stacks with Section 321

Section 321 can help you do that.

Instead of cutting 10 cents off your packing costs, shave $10 off your cost per order. That’s what’s going to make a difference.

“If I save 40 cents for packing, that’s great. But if I’m saving $10 per item in duties, that moves the needle,” Bobby says.

Lower costs also mean that you have better margins than your competitors.

Even if their product is cheaper, you’ll still win because you’re paying less to put product in customers’ hands because of your margins.

“This is really important if you’re manufacturing in China because of heavy duties and punitive tariffs you’re paying right now,” John advises.

2. No difference in customer experience

“Will my customer service suffer if I fulfill in Mexico?” you might wonder.

“Is it going to take two weeks for a package to get from Mexico to Michigan? Won’t customers flip out?”

No!

There’s zero difference in customer experience when you choose to fulfill in Mexico.

Bobby negotiated good rates with FedEx and USPS.

He has a guaranteed three-day shipping time to anywhere in the US, which is comparable to fulfilling in the good ole US of A.

There’s zero disruption to the customer experience.

Hell, they probably won’t even realize that the product was fulfilled in Mexico, and they don’t even care.

They just want their stuff.

You don’t have to worry about pissing off your customers with this fulfillment option. Just continue delivering the same awesome service as always and no one will bat an eye.

3. Kick the can down the road

Remember how I said FBA businesses can’t use Section 321?

That’s true, but you can still use components of this fulfillment strategy for your business.

Bobby’s fulfillment strategy won’t help you avoid tariffs or duties, but it will help you kick the can down the road, so to speak.

That’s because you don’t owe duties or tariffs until the products cross back into the US.

You could ship your FBA goods temporarily to Mexico from China, hold them in Mexico for a bit, and then send them to Amazon.

You’ll still need to pay tariffs and duties, but you can delay the payment, getting a little more breathing room for your business.

If you notice cash flow is weird at times and paying these fees mucks up your numbers, you can delay payment a little while with this method.

Conclusion

The Founding Fathers had a point when they protested tariffs, taxes, and duties.

While it’s fine for everyone to pay their fair share, many of these fees feel punitive and downright un-American.

Fortunately, US business owners have an ace in the hole with Section 321 fulfillment options.

Avoid pricey US customs fees by fulfilling in Mexico.

You could save millions of dollars in the long run without any effect on the customer experience.

It might take a little extra time and planning, but isn’t your business worth that small investment?

Start a revolution of your own by saying “No thanks” to tariffs.

You might not be tossing tea into the harbor, but you’ll see sky-high improvements in your margins.

What will you do with an extra $3 million in your pocket?