Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

Selling Your Amazon FBA Business: A Complete Guide

For FBA businesses, history indicates that more than 50% of all the money you’ll ever make comes the day you sell your Amazon business. This is mainly true for young (< 4 years old) businesses having rapid growth because the majority of cash is tied up in inventory.

If this is true for you, learning the nuances of selling your Amazon business will help ensure you get the maximum value when eventually exiting.

How Can I Sell My Amazon Business?

Years ago, when the original version of this article was published, the question of whether or not you could sell an Amazon business was at the heart of the article. Now, with the rise of the aggregators, the question is not “can I”, but “how do I get maximum value and a first-rate contract structure when I sell my Amazon business”?

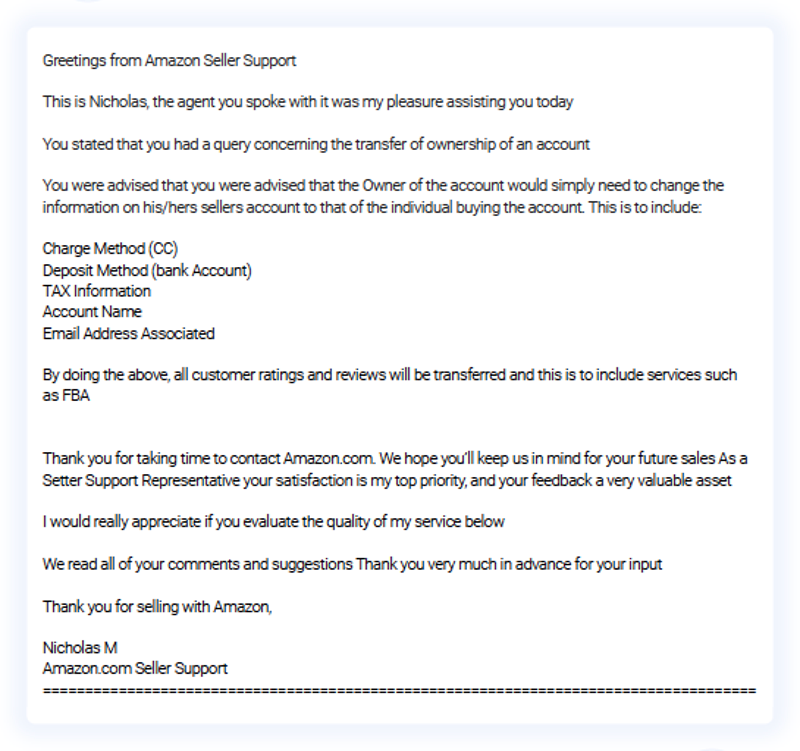

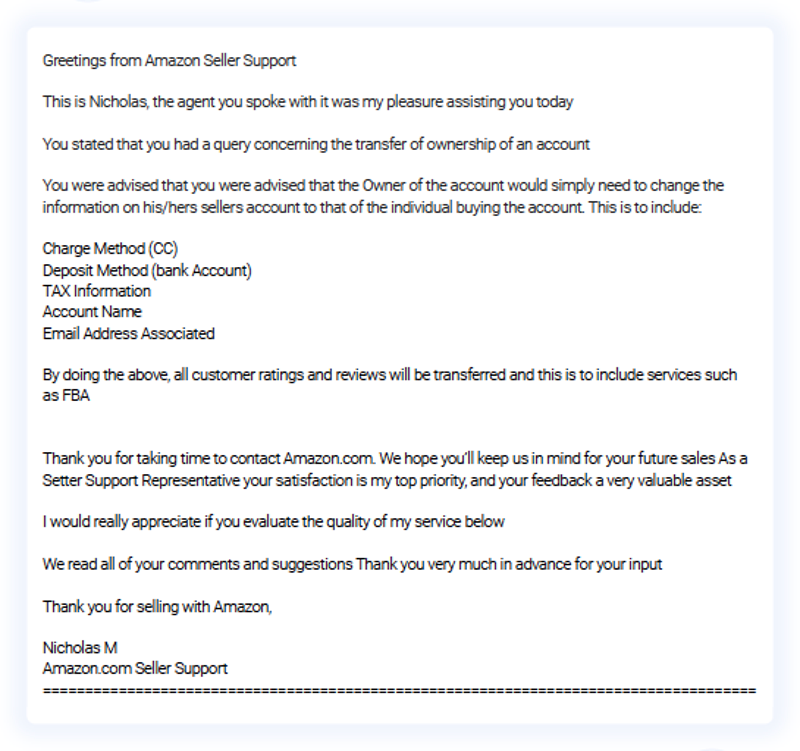

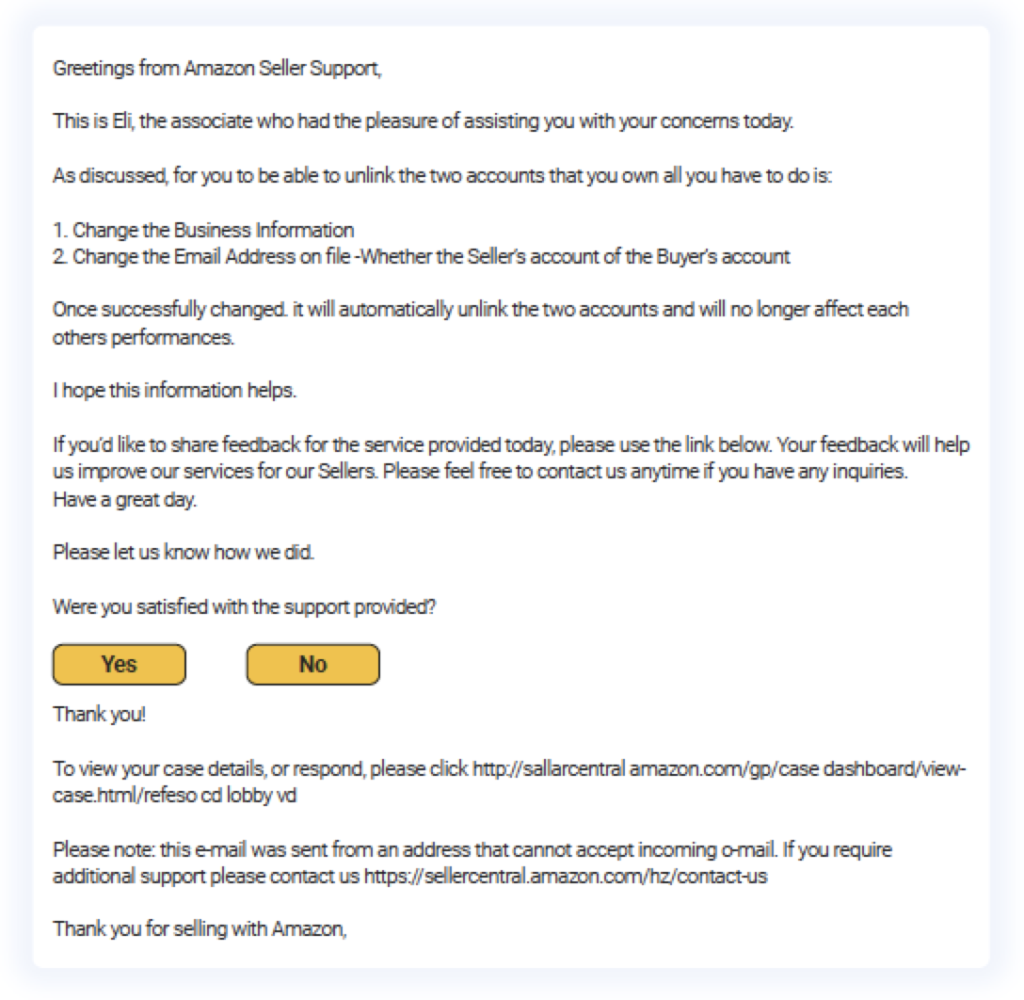

Still, the below email serves as reassurance that Amazon is aware of how common Amazon business ownership transference is (indeed, they have trained customer service representatives relevant to this).

Amazon Letter: How To Transfer a Seller Account

The email below is from an Amazon Seller Support Representative. It clearly shares the process of transferring ownership of an Amazon seller account. It also states “By doing this, all customer reviews and ratings will be transferred…”

This makes it clear that Amazon is politely acknowledging that owners can sell their Amazon business by transferring control of the Seller Account. Let’s go on to dispel another myth.

In the following video, seasoned online business broker Chuck Mullins sits down with Riverbend Consulting Co-Founder Lesley Hansell to discuss the correct process for transferring Amazon accounts.

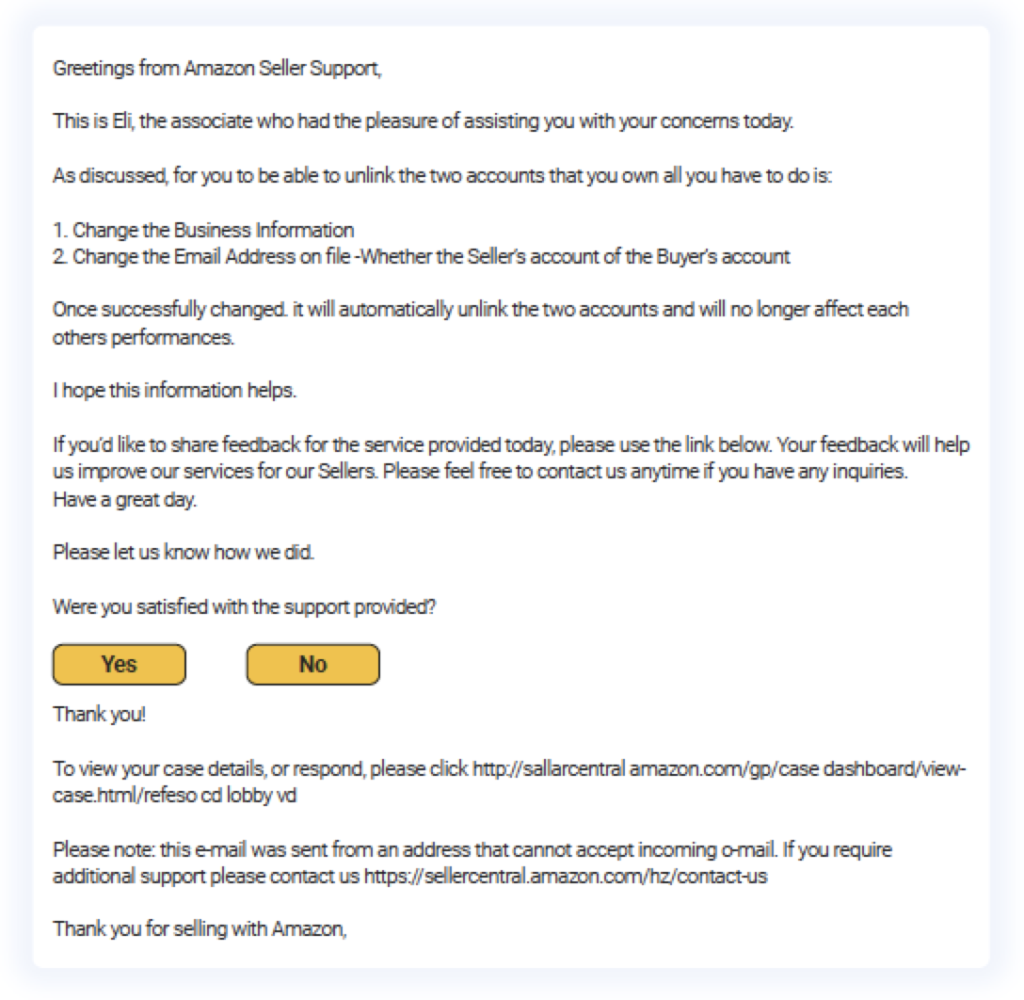

Dispelling Another Myth – Unlinking Accounts in Your Amazon Business

The letter below shows how to “unlink” accounts when you sell your Amazon business. This letter is in reference to a sale in which the seller had two Amazon Business accounts. The accounts sold two completely different types of products, but with all deposits going to the same bank account. We were enlisted to assist in selling both Amazon businesses.

In the process of selling these Amazon businesses, it was important to the seller, buyer, and Quiet Light, that the accounts were unlinked and completely separated from each other (with no future recourse from Amazon).

A Strong Market to Sell Your Amazon Business

Just a few years ago, the majority of online business buyers were hesitant to buy an Amazon business because of the potential risks associated with the 3rd party platform approach.

Today, the buying and selling of an Amazon business is becoming the most universal type of online business sale. Valuations are rapidly increasing due to greater competition among buyers.

Most likely, as an Amazon seller, you have probably received an email or two from buyers who wish to discuss the sale of your business. This can be exciting and flattering, but these solicitations generally are not offering the best terms and proposals.

In a recent transaction, we sold an Amazon business after aggregators (also called holding companies) like Thrasio, Perch, and Elevate Brands had reviewed the business material shared directly from the seller. The best offer she received on her own was $2,200,000.

When Quiet Light listed the business, many of the Thrasio types of FBA roll-up companies looked at the details, along with private individual buyers as well. This process reached a wider variety of buyers and created competition among them.

The end result was a sale for $5,500,000. More than 2x the offer that was received when responding to a “we want to buy your Amazon business” email.

If you want to sell your Amazon business for maximum value, following the 10 Steps to Sell My Amazon Business guide is critical and results in getting a better value for your business, which is likely your most valuable asset.

The following infographic summarizes all of the key steps. Below that, we’ll dive into more detail about each.

Provide Clear Financial Statements for Your Amazon Business

Perhaps you thought we would start with the value ranges of Amazon businesses, but this cannot be properly conveyed without having clear financials.

Accounting may make your eyes bleed, but not having accurate numbers could cost you hundreds of thousands of dollars when you sell your Amazon business. It’s best to get the details right.

Here’s an example:

Using cash accounting, Michael’s business was valued at $935,778, plus on-hand inventory at the time of closing.

Here’s the math:

$283,569 in Seller’s Discretionary Earnings (SDE)

X

A 3.3x multiple of SDE

=

A list price of $935,778, plus inventory on hand at the time of closing.

Pretty exciting right?

The sad part here is that Michael left $319,868 on the table and gave his buyers a substantial amount of instant equity!

Why It’s Essential to Use Accrual Accounting

When you sell your Amazon business, the correct method for presenting your P&L is the accrual method. This is critical for physical product businesses because so much cash is tied up in inventory. Cash accounting generally depresses your net income and SDE, sometimes by life-changing numbers.

Using accrual accounting, Michael’s Amazon business should have sold for $1,255,646, plus inventory on hand at the time of closing.

Here’s the right math:

$358,756 in Seller’s Discretionary Earnings (SDE)

X

A 3.5x multiple of SDE

=

A list price of $1,255,646, plus inventory on hand at the time of closing.

With accrual accounting, the SDE is actually $75,187 higher. Because the SDE is larger, it may demand a higher multiple as well.

Michael sold his Amazon business for $319,868 less than what it was worth, simply by using the wrong accounting method.

A note of caution – your CPA may say they are using accrual accounting by making annual inventory adjustments on your P&L for tax purposes. While this is great for filing taxes, it’s terrible when you want to sell your Amazon business.

It can be corrected in an exported P&L, but it takes time and increases the risk of errors. Having correct numbers is critical to safely moving through due diligence and all the way to closing.

We have a shortlist of ecommerce bookkeepers we trust. If you’d like an intro to a few of them – just shoot us an email at [email protected]. The initial conversations are free and the education is priceless.

If you Sell Your Amazon Business Without a Deep Dive into Add-Backs, you are Giving Your Buyer Instant Equity

Of the thousands of profit and loss statements we’ve reviewed, no two are ever alike. Entrepreneurs, bookkeepers, and CPAs are all doing things slightly-to-much differently, and the combination of variables means every P&L is unique and needs interpretation.

This warrants a thorough inspection of the financials with an expert eye, to ensure we aren’t overvaluing or leaving money on the table (which is usually the case).

What is the definition of an add-back?

An add-back is:

- An owner benefit

- Accounting (non-cash) expense

- One-time, non-recurring expenses that will not carry forward to the new owner.

- It could also be an adjustment that reflects the new normal that would be only partly reflected in the trailing twelve-month P&L.

Add-backs allow us to present the true, clear, and accurate Seller’s Discretionary Earnings of the business for potential acquirers. This is not EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). It’s more along the lines of Adjusted EBITDA because it takes into account single owner-operator salaries and perks, along with a host of other legitimate adjustments.

At Quiet Light, we have developed the Three Levels of Add-Backs to make sure there is never money left on the table at closing. Within each level, there are six core add-back areas we focus on. A series of conversations around this topic, along with a deep dive into the P&L may uncover additional add-backs as well.

Level One Add-Backs: The Obvious

- One Owner’s Salary

- Owner Health Insurance and Retirement Contributions

- Amortization

- Depreciation

- Charitable Contributions

- Interest Expenses

Level Two Add-Backs: The Not-So-Obvious

- Owner Payroll Tax Expense and Estimated Income Taxes

- Trademarks, Copyrights, Patents, Logo Design

- Legal Expenses

- New Bookkeeper

- Equipment Purchases

- Personal Miscellaneous

Level Three Add-Backs: Dig Deep and Pay Attention

- Website Redesign

- Masterminds

- Cash Back Credit Card Money or Converted Rewards

- Overpaid Relatives or Bookkeepers

- Reduced COGS in Trailing Twelve Months (TTM)

- Reduced Third-Party Fees or Packaging Costs in TTM

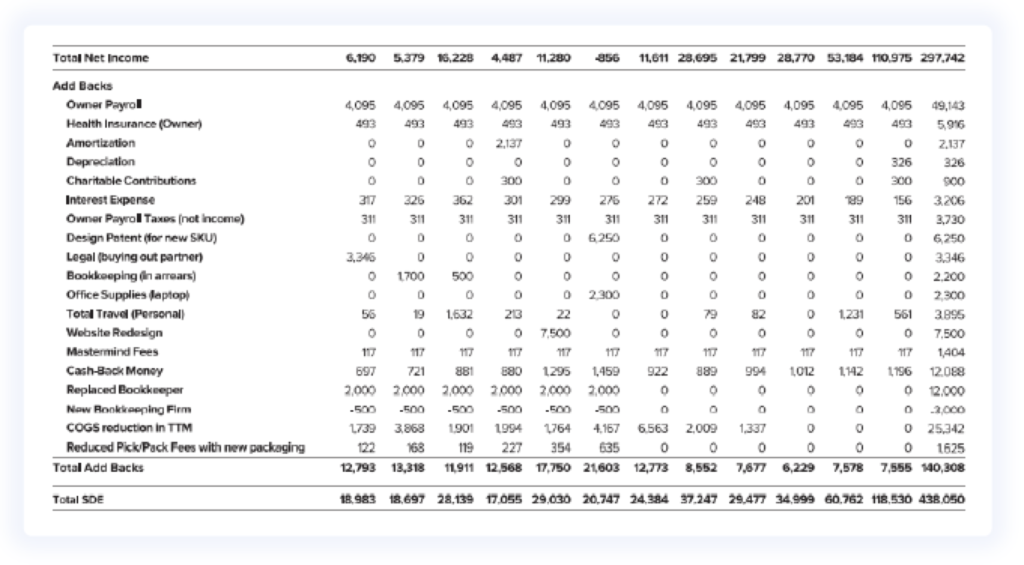

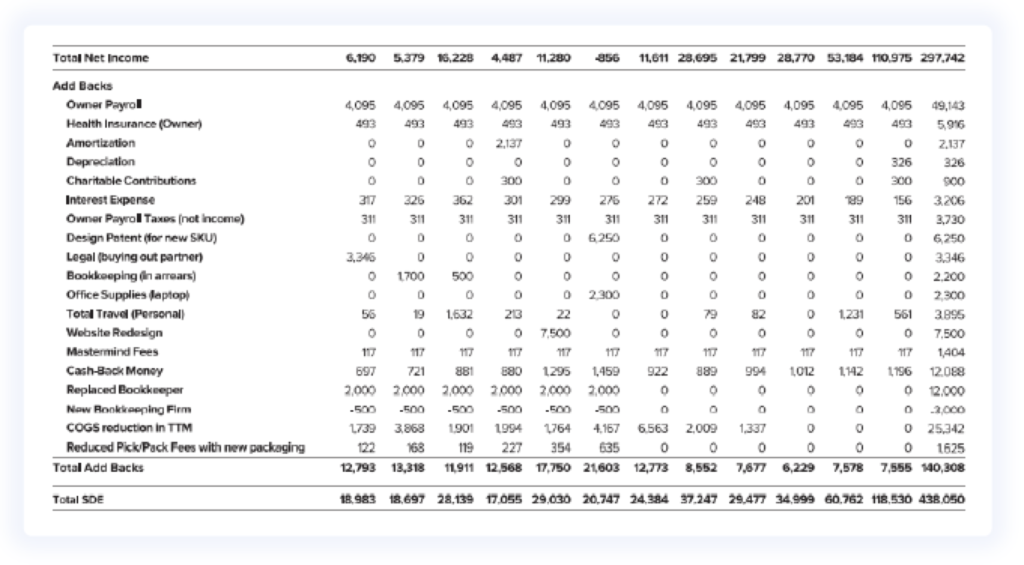

Here’s what an add-back schedule looks like if it were to include all 18 points within the Three Levels of Add-Backs:

In the above example, the add-backs change the SDE by $140,308. If the business sold for a 3.5x multiple, this makes a difference of $491,078.

Note: We rarely see all 18 add-backs in one add-backs schedule. The above is for demonstration purposes only.

If you are planning to sell your Amazon business on your own, be sure to dig deep on the add-backs to ensure you don’t leave significant equity on the table. If you want us to work with you on a business valuation and make sure you get the maximum value, use the button below for a free valuation.

Thinking of Selling Your Business?

Get a free, individually-tailored valuation and business-readiness assessment. Sell when you're ready. Not a minute before.

Can I Sell My Amazon Business after 12 Months?

It’s not advisable to sell an Amazon business that is only twelve months old. You just won’t get much money for it. As a rule of thumb, buyers like the twenty-four-month mark, at a minimum. There’s still some age and some stability, but there should be considerable growth as well.

There are exceptions to every rule, and businesses younger than twenty-four months are sellable, but they’re worth less money because of risks associated with the young age.

Know What Buyers Look For in an FBA Business?

Surprisingly, selling your Amazon business is actually not all about you. Your buyer may be making the biggest purchase of their life. They’re going to scrutinize every last detail and for good reason. Therefore, the purchase price is never a simple multiple of the Seller’s Discretionary Earnings.

Real-life variables sway the value of the business in either direction, and after more than a decade in this business, we’ve clearly seen that buyers have consistently focused on four categories: risk, growth, transferability, and documentation. These are the Four Pillars of Value that will either be a boost for your business or will make buyers think twice.

Don’t take them lightly just because it’s not math. These were developed through constant feedback from buyers…the ones who wire the funds and write the checks for your Amazon businesses!

Six Key Factors for the Risk Pillar

- Size and Age

- Defensibility

- Dependencies

- Channel

- Competition

- Obsolescence

Within the Growth Pillar, there are also six levels to think about:

- Top-line trends

- Bottom-line trends

- Timing

- Growth opportunities

- Built-in paths to growth

- Investments

Again, there are six layers to understanding the Transferability Pillar:

- Key personalities

- Key staff

- Manufacturers

- Contracts

- Workload

- Partners

Documentation comes in many forms, which we’ll cover in another six categories:

- Clear financials

- Accrual accounting

- Standard Operating Procedures (SOPs)

- Contracts

- Third-party reports

- Metrics

The Four Pillars of Value

Risk, growth, transferability, and documentation are the four pillars, or what buyers want (and fear) – and they are critical to focus on when first determining the amount at which you can sell your Amazon business.

There’s no actual fifth pillar, except there kind of is. It’s something very important that every buyer looks for, even if they can’t name it. This magical, intangible, fifth non-pillar is the person behind the business.

You are the fifth pillar.

Or at least the mortar that holds the four pillars together. Amazon businesses under LOI have fallen through because of the owners of those businesses. Other Amazon businesses have sold at higher values than they should have because of the owners of those businesses.

Your Amazon business is what it is, but only because you built it that way. If you want to sell it, you will be a factor in that deal. You need to be a professional. You need to be real and honest and trustworthy and likable and good. If you want to sell your Amazon business for maximum value, start by being a good human being.

Answer the Fundamental Question: How Much Can I Sell My Amazon Business For?

Now that you’ve done a full and deep dive into your add-backs, and offset fears by focusing on what buyers want, now is the only time when you can truly assess the value range of your Amazon business.

| Seller’s Discretionary Earnings (SDE) | Listing Multiple |

| <$100,000 | 2-3x |

| $100,000-$500,000 | 2-5x |

| $500,000-$1,000,000 | 3-6x |

| >$1,000,000 | 4+ |

In the above multiple ranges, things are not as simple as “the article says I get a 4+ multiple if my SDE is above $1 million.” If it were that simple you would not need Advisors to make sure you are not over-or under-valuing your business. Remember, SDE is not the end-all deciding factor for what multiple is applied to your Amazon business.

If you would like to review a deeper, in-depth view and analysis of determining the value range of an Amazon business, consider reading The Ultimate Guide to Website Value, written by Mark Daoust, the Founder, and CEO of Quiet Light.

No Two Amazon Businesses Are Alike

It is critically important to understand that no two Amazon businesses are alike when it comes to a valuation. A personal approach must be taken each time, and the goals of the owners have to be taken into account.

Business owners and Advisors must work together to determine the accurate value range when you sell your Amazon business. It should never be a one-sided conversation and it cannot take place in one phone call.

The value range has to work for both parties and an eventual buyer, or you’re just listing your business for sale and not actually selling it.

Establish Your Reasons for Selling Your Amazon Business

When you investigate the value of your Amazon business or decide it is time to sell, you should know without a doubt all of the financial factors involved. You should know the costs and benefits when selling, and also have a plan for after the sale.

Financial Factors – What Is Left Over After The Sale?

The financial costs involved in selling your Amazon business are generally these three, but with each business owner comes a different list:

- Advisor Fees

- Legal Fees

- Taxes

How Much Are Broker Fees When Selling Your Amazon Business?

At Quiet Light, we are “success-based” Advisors. This means we only get paid if we successfully sell your Amazon business.

We work on the Modern Lehman Scale, which means the larger the business is, the lower the fee. The fee starts at 10% on the first million and drops by 1% for every additional million down to 3% on anything above seven million.

If your business is valued at $1,000,000 with inventory, the fee would be an even 10%. If your business is worth $30,000,000, the fee would be just under 4%. We publish our fees and you can access them via the link below.

What are the Legal Fees when Selling an Amazon Business?

Once you’re partway through due diligence and feeling confident that the deal will close, it’s time to hire an attorney to firm up the asset purchase agreement (APA). Any sooner, and you may waste money hiring an attorney for the non-binding Letter of Intent (LOI). If you would like access to our Letter of Intent template, you can download it here.

We suggest you wait until you’re confident the deal will move forward, then lock in an agreement to hire a competent contract attorney who’s familiar with the online space – and more specifically, one who has contract experience related to the sale of an Amazon business.

If you are already under LOI on your own and don’t have an attorney, send us an email [email protected] and we’ll make 2-3 introductions and get out of the way. We do not earn referral fees for these intros, we’re just happy to help.

The cost of a good contract attorney will vary depending on the size and complexity of the transaction. For most transactions, this expense will run in the $5,000 to $15,000 range. While this may seem expensive, when you sell your Amazon business you’ll want peace of mind that you can move on safely with little to no risk. A good contract attorney will provide this for you and the money is well worth it.

What Are the Taxes When You Sell Your Amazon Business?

It’s not how much you sell your Amazon business for that matters most, it’s how much you keep.

Let’s assume you sell for $1,000,000 excluding any inventory. After a typical fee, you’ll end up with about $900,000 in taxable money. Because the sale of a business falls in the realm of capital gains rather than personal income, we can estimate roughly 25 percent in combined state and federal taxes.

That takes your million dollars down to a ballpark of $675,000 after taxes. Please keep in mind that the estimated 25 percent changes based on your actual income levels and geographic location.

Federal and State Taxes

On the federal side, it can currently go as low as 0 and up to 20 percent. On the state side, it’s all over the place depending on where you live. Some states have zero state income taxes, so depending upon where you live this figure could add an additional 5–13 percent or more.

Unfortunately, some states have incredibly high state income taxes, so that combined 25 percent could go up as well. You know where you live and should know the state income tax percentage.

This can have such a negative impact on what’s leftover after taxes that I’ve seen people plan their exit a few years in advance so they can move out of high-tax states to save that expense.

For an intro into a tax expert, shoot us an email at [email protected].

You have worked incredibly hard to grow and now sell your Amazon business. You’ve risked everything and now it’s time to cash in. You may not like studying taxes— very few people do. If you put just 1/100th of the effort into understanding your personal tax situation when selling that you have roperating it, you’ll find the payoff to be extraordinary.

If the numbers and math matter to you – and they do to most people when they sell an Amazon business – you may want to read Should you Sell or Hold your Business: A Data-Driven Answer by Mark Daoust.

Sign The Engagement Letter

Once you have determined that selling your Amazon business is worth the time, effort and financial reward, it will be time to review and sign an Engagement Letter with the Advisory firm you choose. Here are a few quick notes and highlights about Engagement Letters.

Exclusive Periods

Exclusive periods should not be too long. Ultimately the relationship between the Amazon business owner and the Advisor must be strong and mutually respectful. The Advisor cannot sell your Amazon business without the help of you, the owner, and vice versa.

At Quiet Light, our exclusivity period is only for 90-days. This is because the listings we accept are normally under LOI and/or sold within that time period. If the 90 day period passes and the business is still not sold, our Engagement Letter allows for a continued relationship in the same manner as the exclusive, if desired by the Amazon business owner. This is unless or until the owner decides to move on and engage another firm or simply pulls the listing and takes a break from selling.

Statistically well over 95% of Amazon businesses that we list sell, and just under 50% sell at or over the asking price. We find the best practice is to price the business at an attractive value for both the seller and buyer. When this happens it increases the chances of getting multiple offers and choosing your buyer, best price, and deal structure.

You can access and review our Engagement Letter template HERE.

Create Your Amazon Business Marketing Package

The two most work-intensive steps in selling any Amazon business are:

- Preparing the Marketing Package (details to present to potential buyers)

- Successfully managing the due diligence process.

A Marketing Package is what your Advisor puts together to present to potential buyers. It should be an in-depth overview of your Amazon Business. When and how it started, how it operates, what the workload entails, and what the growth opportunities are. No buyer sees the in-depth details of a Marketing Package without first signing a Non-Disclosure Agreement (NDA).

Due Diligence is the time period after signing a Letter of Intent. It is when a buyer investigates and reviews third-party verification of your financials, digs deeper into the threats and growth opportunities of the business, and gets to know you better.

The Client Interview

Before we approach potential buyers for your Amazon business, we put together a comprehensive Marketing Package. Within the Marketing Package is an extensive Client Interview. This is your opportunity to make a case as to why your business is worth buying, but it is also a chance to explain any problems, hiccups, or trouble spots.

No two client interviews are alike, just like no two Amazon businesses are alike.

With every aspect and detail of the Marketing Package comes a glimpse into the business itself. In the Client Interview, our job is to ask every question we think potential buyers will want to ask about your business and to get you to answer them in writing, in advance. This will not only save you an immense amount of time in the process of marketing your Amazon Business, but it also helps create buyer excitement and a vision of where the business has been and where it can go with new ownership.

Confidentiality is Key

Words like full disclosure, maturity, thoughtful, and honest cannot be emphasized enough. No, the Marketing Package is not a dating site profile, it is much more important and exposing.

That’s why we require all potential buyers to sign an NDA before they see any details of a Quiet Light listing. As you can see from the Amazon businesses for sale on our website, we give no details in the teaser that could enable a buyer to determine the exact business that is for sale.

Along with the all-important Client Interview, there will also be access to the Profit and Loss Statement in Excel format with monthly views, traffic trend graphs, images, and other important factors that show the history, trends, and growth opportunities of the business.

If you would like to view a full Marketing Package, visit our site and click on any of our listings to request more details. If you do not have an NDA on file, that will be the first step. Once that is done, you’ll have the opportunity to see how our Marketing Packages are put together.

Buy a Profitable Online Business

Outsmart the startup game and check out our listings. You can request a summary on any business without any further obligation.

Do Buyer Conference Calls Effectively

Conference calls between a buyer and seller are a “must do” before going under a Letter of Intent (LOI). Accepting an LOI without speaking to your buyer has you doing business with someone you don’t know. Not that you’ll “know” your buyer after one conference call, but you’ll certainly have a good feel for who they are, and if you feel confident in them as your buyer.

The conference call should be the last step before the LOI. However, before a conference call takes place, there should be substantial communication between the buyer and your Advisor, including at least one phone call. After that call, if the buyer still has a strong interest in the business, a conference call is arranged.

Often, a buyer will ask the seller questions they have already asked the Advisor. This gives them a chance to hear answers directly from you. On the conference call, your Advisor should make introductions, ask the buyer to give a background on themselves, and then step back and let the buyer ask their questions. The Advisor should be in the background (often on mute) listening to how the call progresses.

A LinkedIn profile of the buyer should be shared with the seller in advance, or some other alternative if a LinkedIn profile is not available. The objective of the conference call should be clear. It is for the buyer to make a decision about making an offer on the business. The reality though is that the buyer and seller must both feel comfortable with each other. No successful deal is one-sided.

How to Handle Buyer-Seller Conference Calls

- Be Yourself – Let your personality shine through and show the joy and enthusiasm you experience from your Amazon business!

- Be Honest – The more your buyer trusts you, the better offer and deal structure you’ll get. Again, selling an Amazon business is not all about the numbers.

- Don’t Take It Personally – If a buyer comes off as obnoxious, rude, or uninformed, avoid taking it personally. Listen to their entire thought, and if it’s wrong, politely explain that you understand their position, but respectfully disagree. Then explain why you disagree.

- Keep it Simple – Many potential buyers will not be intimately familiar with the Amazon business model. Avoid jargon and buzzwords. If the buyer shows a higher level of knowledge in the niche, you can get a bit more technical, but let the buyer take the lead on how technical the conversation becomes.

- Listen – Answer questions openly and concisely, and then turn the conversation back to the buyer with a question such as “Did that answer your question?” Then actively listen to what they are saying.

- Remember The Point – Though buyers will hurl numerous questions at you, they often do not remember many of the answers. The point of the call is, in large part, to determine if you are trustworthy and will follow through on commitments you make such as training the new owner. Remember to stay calm, relaxed, and friendly and demonstrate how you will help the buyer succeed.

- Build Goodwill – Offer to do more than what is contractually required to build goodwill. You will likely need a reservoir of goodwill during due diligence, so be sure to let the buyer know you care about the business and will do whatever is necessary to help continue its success.

- Avoid Being Baited – If a buyer asks what is the least you will accept, defer to your Advisor. It’s the Advisor’s job to be the negotiator and, if necessary, the bad guy. It’s your job to be helpful. You will have a relationship with the buyer after the sale, so keep it on a high level.

Receive a Letter of Intent

The Letter of Intent (LOI) is the first step in a written commitment from a buyer to purchase your business. It should lay out the basic terms of the offer and deal points. It is not a rock-solid guarantee that you have “sold” your business. Just like selling a house, the business must be “inspected” first.

In the vast majority of transactions, the LOI is not reviewed by an attorney. The language is simple and clear. A good LOI acts as a framework for the final and binding purchase agreement that will come towards the end of your deal.

It should contain the major pieces that need to be negotiated. The Letter of Intent, by its very nature, is a non-binding agreement that should be fully contingent on the buyer’s satisfaction with due diligence and a further detailed Asset Purchase Agreement.

A typical time period from the LOI to signing the Asset Purchase Agreement (APA) and closing is 30-45 days for cash deals and 60-90days for SBA deals. For cash transactions, we generally allocate about 2-3 weeks to due diligence, and 2-3 weeks for the drafting of the APA, editing, and signing. Then funding the escrow account and closing occurs.

Depending on the complexity of the transaction things could move slower or faster. Being prepared and well organized with the necessary documents proving your income and expenses helps speed up due diligence tremendously.

Complete Due Diligence for Your FBA Business Exit

Buyers often talk about doing due diligence when they are simply evaluating whether or not they want to buy a certain business. However, in our process, we refer to due diligence for an FBA business as the verification of information after the Letter of Intent has been signed.

The reason for this is that the due diligence process goes much deeper than a review of the Marketing Package, a buyer-seller conference call, and searching online to learn about the niche or industry that the Amazon business is in.

It allows for a deep dive into the financials to prove the revenues and expenses that are detailed in the Marketing Package are accurate. Fortunately, when you sell an Amazon business, you can also provide third-party reports from Amazon that help instill confidence.

What Is the Goal of Due Diligence?

The general goal of due diligence is to verify various key aspects of the business. The most common areas are listed below:

- Financial: You should provide enough information for a buyer to rebuild the profit and loss statement through at least the previous twelve months. This information should come entirely from 3rd party statements such as Amazon statements, bank statements, vendor invoices, merchant charge statements, and in some cases tax returns. Using these documents, your buyer should be able to verify your monthly P&Ls.

- Vendor and Contractors: Vendor and contractor relationships are vital to buying a business in an asset acquisition. Some vendors, when hearing that a client is being bought, try to negotiate new, more favorable terms (which may be less favorable for your buyer). It is important that your buyer get the same discounts, terms, and deals you have.

- Documentation: Buyers will also want to make sure your business is properly registered and doesn’t have outstanding litigation or actions taken against it, as this can, in rare cases, transfer over to a new owner. Be prepared to dig out your old incorporation papers and other documentation.

- Key Reports: Most Amazon businesses have various Key Performance Indicators (KPIs) which they track in their business. You may have used these KPIs in your Marketing Package – now is the time to prove them with 3rd party documentation.

If you are a buyer reviewing this article and want some help with due diligence, consider reaching out to the folks at centurica.com, we’ve worked with them in many transactions and they are true professionals.

Staying Organized Through Due Diligence

Amazon business owners should pull together the following documents and save them to PDF files in preparation for due diligence. The sooner one starts to prepare and save these documents the better. It eventually means you will have to cram less work into the short window of time you have when selling your Amazon business.

The best method for naming and saving the 3rd party documents is to name them in a manner so they are sorted by date (I.e. 1.2013 Amazon Statement, 2.2013 Amazon Statement, etc.). Your Advisor will create a Google Drive or Dropbox folder, and send an email to the buyer and seller inviting them to join the folder once all of the documents are in place.

Due Diligence Request List

Buyers generally prepare a “due diligence request list” with the help of the Advisor, their accountant, or some other guidance. If notes need to be added to the due diligence request list then a Google document is generally created with all questions and responses easily located in one place.

Being well organized is the key to a successful due diligence process. A massive data dump of files and hundreds of emails will only make getting to the details tougher for your buyer, and the process will drag on longer. The following items may be requested by the buyer, but the full due diligence list will likely be much longer.

- Amazon statements for at least 24 months.

- Bank statements for at least 24 months.

- Merchant statements for at least 24 months (if the product is sold through an ecommerce URL as well).

- Vendor invoices or proof of the cost of goods sold (COGs) for at least 24 months.

- A complete list of vendors with pertinent contact information. This may be withheld until the APA process has begun and trust has been further established.

You should expect due diligence to be invasive, detailed, and potentially exhausting. Your Advisor should be the funnel through which all communications flow and they should make sure all emotions are kept in check the entire time.

Dealing With Errors & Discrepancies

If the due diligence process turns up a $10,000 error on your part, effectively reducing your SDE from (i.e.) $500,000 to $490,000, the best approach for dealing with this is simple math and logic.

Your agreed-to-purchase-price is simply reduced by the $10,000 x the multiple the business went under the LOI for.

If your sale price was 3 times in the LOI then you would drop your price by $30,000 in the APA and sell the business for less.

Logic generally dictates at this stage of the process and is necessary to successfully get your Amazon business sold. You do, however, always have the option of saying no, but could be doing so at the risk of losing your buyer. Getting the numbers right (#1 Clear Financials) is critical to avoid renegotiating your purchase price.

Sign the Asset Purchase Agreement and Close the Deal

Just as with the Letter of Intent, Quiet Light can provide an asset purchase agreement (APA) template with specific edits for your transaction. Our APA starts out as a thirteen-page document but often has a few pages added.

More often than not our APA is used for sub-$250,000 transactions. When you sell your Amazon business at a value at or above this range, our advice is to spend the necessary money to hire a good contract attorney.

Given the sheer volume of Amazon businesses we’ve sold over the years, we have relationships with attorneys we can refer you to. Just reach out at [email protected] and we’ll make one. Again, we make no referral fees on these intros.

When you sell your Amazon business, the APA is the most important of all the documents you sign. It is the agreement between a buyer and a seller that finalizes the terms and conditions of the Letter of Intent. It’s important to note that an APA differs from a stock purchase agreement (SPA) where company shares, title to assets, and title to liabilities are also sold. In an asset sale, the assets are itemized in a schedule to the APA and you get to keep your entity after the transaction closes. Just the assets of your Amazon business transfer to the new owner.

How Do I Transfer Assets When I Sell My Amazon Business?

Typical assets that are transferred when an Amazon business is sold are:

- Website domains and URLs

- 3rd party Seller Accounts (Amazon, eBay, Etsy, etc.)

- Hosting accounts

- Domain name accounts

- Ecommerce platform accounts

- Website content and files

- Customer lists

- Marketing materials

- Vendor contacts

- Virtual assistants, employees, and contractors

- Social media accounts

- Policy and procedure documents/files

- Toll-free numbers associated with websites

- Email addresses associated with the website

- Registered or unregistered trademarks

- Contracts (written or verbal) with customers and suppliers

- Inventory on hand or on order at the time of closing

Excluded Assets

In an APA transaction, it is not necessary for the buyer to purchase all of the assets of the company. In fact, it’s common for a buyer to exclude certain assets in an APA.

We recently sold an Amazon business where the owner had a class B motor-home listed as an asset on its balance sheet. The business owner purchased the motor home to travel the country with and make some stops along the way to add to and boost her B2B revenues.

She had the logo of the business added to the motor home to make it official. The buyer had no interest in the motor home and felt it had little to no impact on the trailing twelve-month SDE. Therefore, when the purchase price for the business was negotiated, we made sure to exclude the motor home as an asset so she got to keep and enjoy it after the sale.

Other often-excluded assets

- Vehicles

- Furniture

- Fixtures

- Equipment

- Computers

- Leases

- Cash-on-hand or on deposit or in financial institutions (unless funds are a deposit or prepayment for undelivered goods or services of the business)

- Accounts receivable

- Prepaid taxes that pertain to any period after the closing

- Tax refunds or rebates

- Insurance premium refunds

- Mobile Phones

- Personal property

Once an APA has been edited and fully executed, funding the purchase occurs. This generally takes place within a day or two of signing the APA. The purchaser will wire funds to an escrow account held by an attorney or another 3rd party escrow service such as zoomescrow.com. Once the wire is received the transfer of assets can take place at any time.

Closing, Transition & Training

You set a goal to sell your Amazon business, listed it for sale, negotiated the price, and survived due diligence; the APA has been signed and the escrow account funded.

Now it is getting VERY real that you are in fact selling your Amazon business, versus listing it for sale. Unlike selling a house or a brick-and-mortar business where you all sit around a table and sign a stack of documents and walk away with keys, the “closing” in an online business sale is most often done remotely.

Defining “Closing” When Selling The Assets Of An Amazon Business

“Closing” simply means transferring control of all of the assets listed in an exhibit in the APA over to the buyer. In the case of an Amazon business that generally means the following happens: Log into the Amazon seller account and change:

- Admin username and password

- Credit card on file for Amazon charges

- Bank account on file for deposits

- Tax information (Employer Identification Number (EIN), also known as a Federal Tax Identification Number, is used to identify a business entity.)

- Email address associated with the account.

According to the Amazon Seller Support letter in the introduction:

“All customer ratings and reviews will be transferred”.

Since most Amazon business owners also have websites and vendor relationships, control of the additional assets listed in section nine also must transfer.

When you sell your Amazon business, the transfer of the assets can be done in as little as a few hours, or up to a week depending on the size and complexity of the transaction. Once the buyer has control of all assets, the escrow account holder is notified by both parties, and the funds are released to the seller.

Training & Transition When Selling Your Amazon Business

Now that the business transaction has closed, the training and transition period begins. The transition and training period is generally “up to 40 hours over the first 90 days”. This can change with each business as some are more complex, and others less.

The goal of each party in this phase should be a smooth and successful transition of the day-to-day operations, and an understanding of how to continue down the path of growth. Training and transition most often happen via the following methods and should always be scheduled:

- Telephone

- Zoom

- Face to face (rare)

We recommend that buyers and sellers both keep a journal of the time spent on the transition and training time so there are no disputes. Some well-organized sellers keep this journal on a Google Drive document that is shared with the buyer. In most cases, the 40 hours is not used by the buyer. This is due to the reality that running an Amazon business is generally uncomplicated, easy to manage, and easy to learn.

It is likely that a buyer may reach out to the seller after the first 90 days with a quick question or seek an opinion from the seller. If this happens, it is always advisable to do everything possible to respond to these questions in a timely manner and help your buyer become the successful new owner of your business.

Summary – How to Sell Your Amazon Business

Eight to ten years ago the idea of selling an Amazon business seemed unfathomable. Fast forward to today and we are working with multiple six, seven, and eight-figure Amazon business owners.

Our buyer database seems to clearly understand the value of an Amazon business and the benefits (and risks) associated with them. As always, regardless of whether you plan to sell your Amazon business today, next month, next year, or just want to explore your options, we are here to help.

Our valuation process involves absolutely no pressure to list your business. In fact, we suggest to the vast majority of our clients that they wait until the time is right for them to sell.

“The team at Quiet Light are the exception to the higher pressure tactic rule. I chatted with Joe for over a year before listing my business. He was patient, knowledgeable, and understanding of my anxiety, based on his own experience of selling his eCommerce business. I can’t imagine doing the deal without Joe. He is truly the best and I now count him as a friend, mentor, and confidant” ~Craig A.

Personalized Guidance

We offer guidance and share our own personal experiences. Each Advisor at Quiet Light has built, bought, or sold their own web-based business and has walked in all shoes. We have a unique perspective on the process and know what it is like to be a buyer, seller, and now as Advisors who enjoy crafting deals that benefit everyone involved.

If you want to sell your Amazon business – we’re here to help.

Would you like to receive a free valuation and sell-ability analysis of your Amazon business? Feel free to reach out to us for a complimentary review. In this review we will:

- Provide an estimated current market value

- Identify any elements which may be hurting your current value

- Help identify ‘low-hanging fruit’ which could increase the value of the business

To get your free website valuation click below or call (800) 746-5034

About the author: Ian Drogin is an entrepreneur and writer with a passion for helping business owners succeed. He has built and sold an FBA business, written numerous top-ranking business articles, and held multiple roles within marketing and sales.

As Quiet Light’s Content Director, Ian is intently focused on providing the most useful, up-to-date information available about buying, building, and selling online businesses. When he’s not working, Ian enjoys surfing, sailing, backpacking, and traveling.

Thinking of Selling Your Business?

Get a free, individually-tailored valuation and business-readiness assessment. Sell when you're ready. Not a minute before.