Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

Selling An Amazon FBA Business: Everything You Should Know

By Quiet Light

An intriguing trend has steadily begun to emerge over the past 18 months. The number of FBA businesses for sale have increased dramatically, leading many sellers to ask, “should I sell my Amazon business?”

Here at Quiet Light Brokerage, we are very extremely busy dealing with a huge surge in requests from Amazon business sellers who are thinking of selling up. In our database of online business listings, an increasing percentage of them are primarily Amazon-based.

This trend is not just limited to Quiet Light Brokerage either. I’ve spoken to our competitors who are seeing a similar trend. I reached out to Jock Purtle from DigitalExits to confirm that his firm is seeing a similar trend. This is what he had to say:

We’ve seen a massive influx of valuations and also deals we have listed in Q1 of 2016. From what we can tell there were 15 transactions in 2015 of Amazon businesses. I feel we have already surpassed that amount to date this year and it will only grow in the years to come. I believe this has been caused by the Amazing Selling Machine course that was started in 2014 teaching private labels sellers how to sell on Amazon and we are starting to see that wave of companies come onto the market.

So why are Amazon businesses flooding the marketplace? In the past, any influx of sellers from one niche or category of businesses has been a classic warning sign that bad changes are coming to that niche. Is that the case here? Or are we just reading too much into it?

How a Flood Of Businesses For Sale Can Be a Warning Sign

Anyone who has followed my writing or attended any of my conference presentations has undoubtedly heard me tell this story (in fact, I mentioned it in last week’s blog post).

Several years ago I noticed an influx of website valuation requests for e-cigarette stores. To get a couple of requests in a month wouldn’t be that unusual, but now there were nearly half a dozen within a month. Sure enough, a little research found that the FDA was trying to regulate the industry and shut down existing retailers (especially those who marketed the devices as a smoking cessation device).

Added to which, this wasn’t the only time I’ve seen an influx in valuations for an industry in trouble.

So the question that looms with the increase of Amazon businesses for sale is: are they in trouble? Are Amazon business owners seeing the writing on the wall and cashing out while the money is good?

Reasonable Explanations Behind The Increase

I think there are several reasonable explanations for the increase we are seeing with regards to Amazon businesses for sale. The explanations below are based partly on existing data, as well as conjecture developed from speaking with dozens of Amazon sellers.

Theory 1 – Amazon Businesses Are Finally Old Enough

Although Amazon does not release specific details on how many sellers are participating in their sellers program, vendors program, or FBA programs, they do release enough details to know that growth has been significant over the past three years.

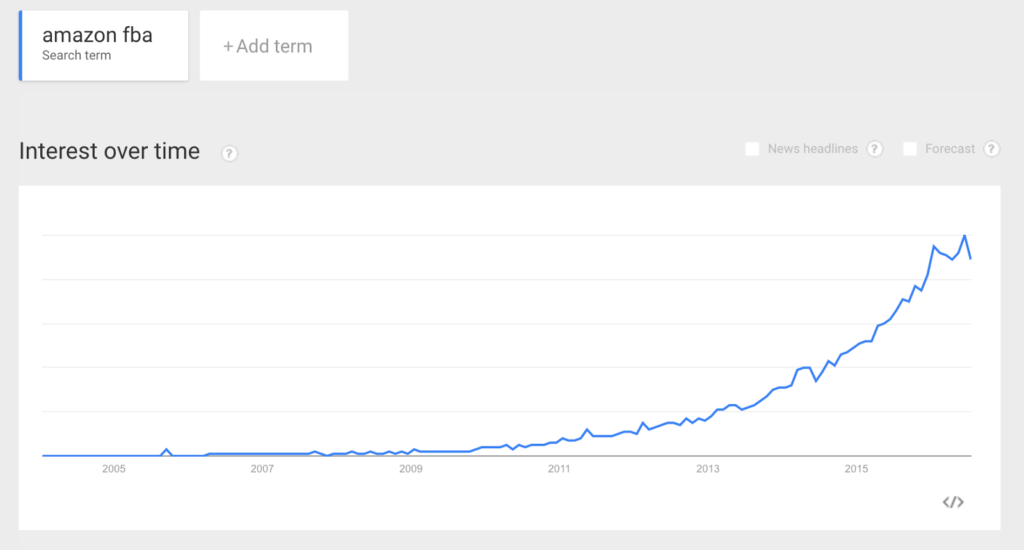

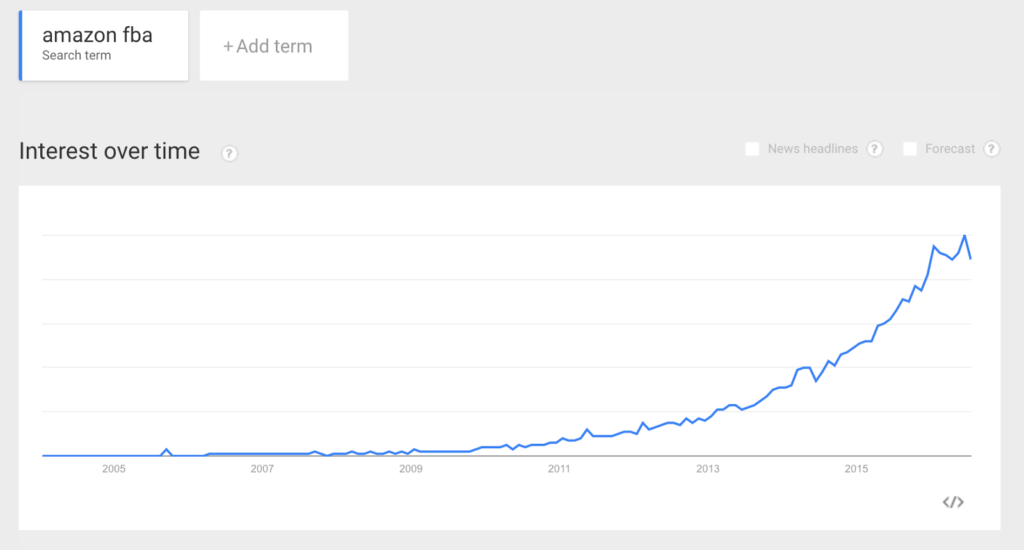

This graph from Google Trends gives us a glimpse of how the program has caught on since 2012 and 2013.

In addition, Amazon gave us a glimpse into their marketplace for 2015:

Although the Amazon marketplace started in 2006, it really increased in traction and widespread adoption from 2012 onwards.

This means that all the sellers who adopted the program in 2012 and 2013 are now coming upon their 3rd and 4th years of being on the Amazon platform. For the most part, serious entrepreneurs tend to consider selling after only a few years of being in business.

So it is possible that the influx of Amazon-based businesses is partly a result of these businesses coming of age.

Theory 2 – People Are Learning Amazon Businesses Can Be Sold

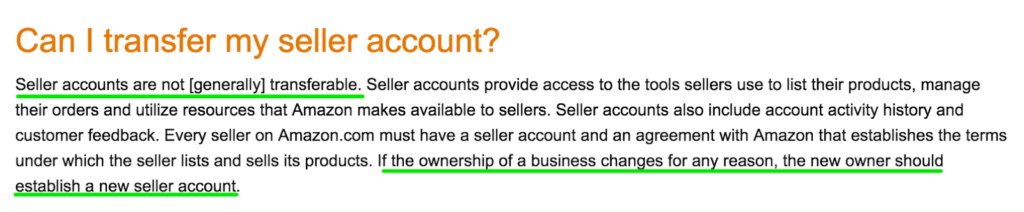

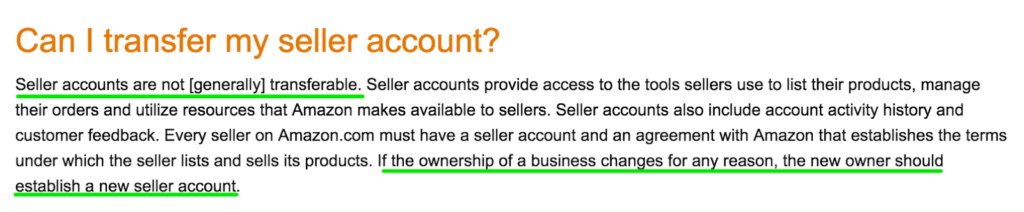

In March of this year, I spoke at the PROSPER show, a conference focused on Amazon selling. During my talk (which focused on creating a sellable Amazon business), I was interrupted more than once to address the elephant in the room – “doesn’t Amazon prohibit the transfer of Amazon seller accounts?”

Sure enough, Amazon has traditionally held a stance that seller accounts cannot be transferred. But this hasn’t stopped Amazon sellers from actually selling their stores. Most sellers and buyers realized through stock sales or other mechanisms, that selling and transferring an Amazon business wasn’t that difficult.

But this was always done with some discretion and a good amount of trepidation. It was, of course, concerning to us here at Quiet Light Brokerage. If Amazon was really against the sale and transfer of seller accounts, buyers were at risk of losing their investments if they were caught.

So to get in front of this issue, we encouraged our sellers to be honest and seek permission from Amazon. If Amazon gave their stamp of approval, buyers and sellers could breathe a little easier and become more comfortable participating in the sale.

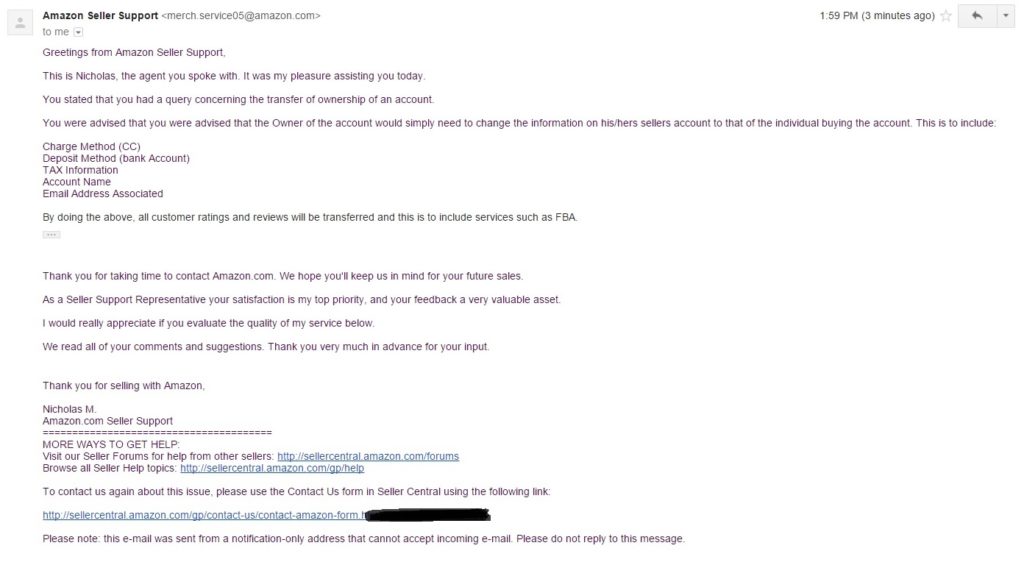

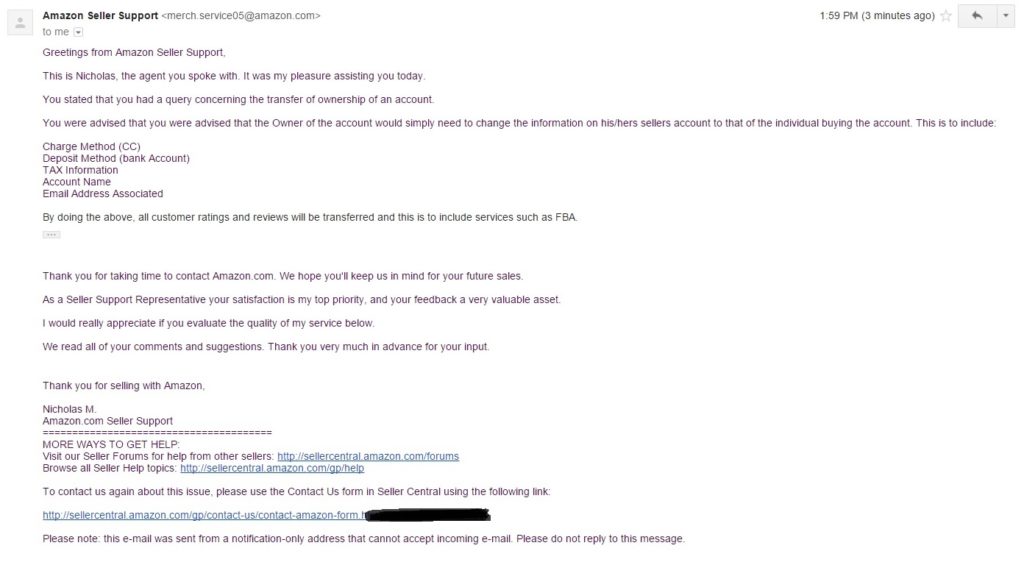

Below is an email from Amazon seller support authorizing the transfer of a seller account:

As more Amazon sellers learn that their business could actually be sold and transferred, a certain percentage of them will naturally explore that option.

Theory 3 – A Higher Percentage Of E-commerce Stores Have An Amazon Component

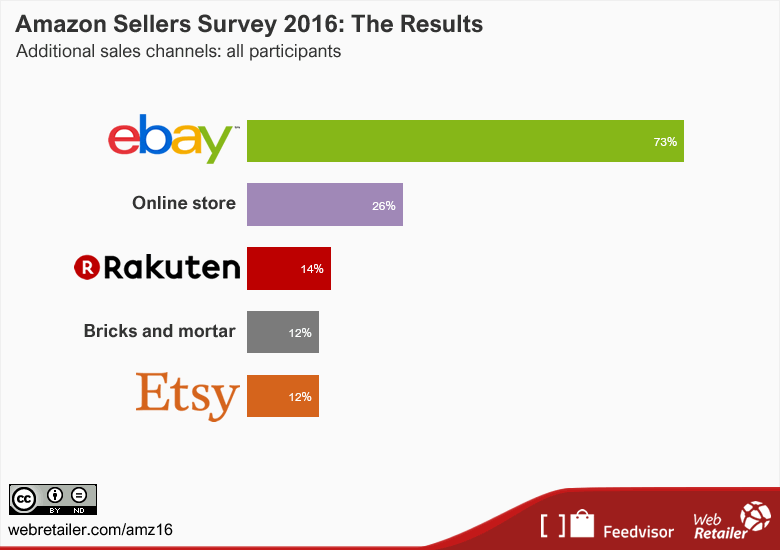

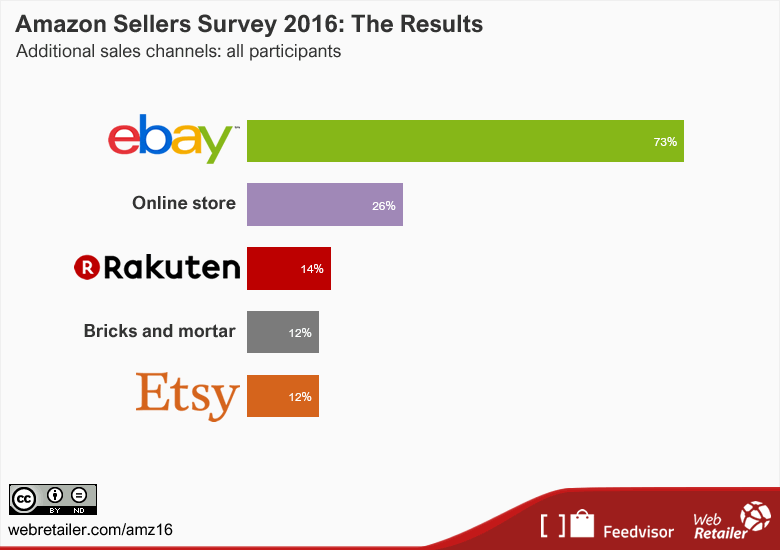

Most Amazon sellers stay on Amazon’s marketplace. However, nearly a quarter of Amazon sellers also have an online store.

If I had to make an educated guess, I would say that the number of Amazon sellers who have an online store is growing every year. From what we’ve seen at Quiet Light Brokerage, most Amazon stores that are for sale originated as e-commerce businesses with an independent online store.

At some point during the growth of those e-commerce stores, their owners added Amazon as an additional sales channel.

So rather than question why there are so many Amazon businesses for sale, it might be more logical to consider that more e-commerce stores for sale are participating in Amazon.

Amazon Seller Growth Is Consistent

If an entrepreneur added Amazon to their sales channels sometime between 2010 and 2013, they would have likely seen a rapid rise in their Amazon sales without having to do much independent work.

This is supported by Amazon’s reported data. In 2013 Amazon’s marketplace grew 40% to reach 1 billion items sold. In 2014, this number doubled to reach over 2 billion items old.

Although Amazon did not specify how many items were shipped in 2015, they did report that “sellers added more new selection and shipped more items than in any previous year”.

Need Capital for Growth?

Visit Our Partner Page to View a List of Growth Capital Firms We’ve Worked with Over the Years.

The Growth Of Amazon Businesses For Sale Has Many Reasons

There is no single reason leading to the growth of Amazon businesses for sale. More likely, the increase is just a combination of the reasons I’ve just stated and perhaps a few other factors I haven’t identified.

As a result, I do not believe this rise is necessarily driven by sellers seeing impending doom around the corner. It is more likely a result of the Amazon marketplace becoming such a dominant force in e-commerce, coming of age, and producing strong viable businesses.

https://www.youtube.com/watch?v=YE3pP5tREiE

Comments are closed.

Great article Mark. I’ve worked with many buyers and sellers with the process and agree…Amazon is a component of most ecommerce business sale/transactions today. While it is not online yet for easy access – anyone wishing to review our new ebook “10 Steps to Selling an Amazon Business”, they can send me an email at [email protected] and I’ll send it right away. It covers the process from planning, valuation and all the way through to transition and training. It’s a good read for sellers and buyers alike.

Thank you for another interesting post. As I see it verifiable and established trading records, plus an increasing cost of entry, make amazon businesses increasingly interesting. You mention ‘impending doom’ and give the example of e-cigarettes and the FDA. I have looked at some profitable smaller vendors whose limited products, I feel, could be picked off by bigger players or manufacturers. If you have time could you add other, specific or general, examples of ‘impending doom’?

Tom,

When specifically looking at the Amazon Marketplace and “impending doom”, I see the risk is more specific to competition creeping up if you don’t go beyond Amazon. I think Amazon is a GREAT place to start. But if you get big enough you’ll get noticed and then competition will rise up and eat into your revenues and profits. I’ve seen this first hand.

A recent client of mine launched a brand about three years ago. And for the first two years Amazon revenue rose daily like a rocket taking off. As Amazon entrepreneurs took notice one jumped in the game. They knocked off the product, gave away a lot of products at substantial discounts for reviews and rose in the rankings. This hurt my clients Amazon sales…a lot.

But…this client is very bright and not the least bit lazy or complacent. He made a specific effort to expand well beyond Amazon. Built a great looking website and grew a substantial B2B business with many recurring clients. Some orders were huge in comparison to the one offs sold on Amazon. Overall revenues were flat, but the risk associated with all revenues coming from one place was minimized.

So while the competitors rise up on Amazon, it is and should be considered a launching pad to many other sources of revenues such as:

Jet.com

B2B Sales

Walmart Marketplace

Daily Deal Sites

eBay

Your Own URL

Email campaigns

Affiliate Marketing

Brick and mortar retail

And so many more areas.

Rarely do I see an Amazon seller doing great on another 3rd party reseller site. Rarely do I see an eBay seller doing well on Amazon. Normally this has nothing to do with product or audience, and more to do with choice and effort.

Many…many entrepreneurs are “lifestyle” entrepreneurs. I am one of them. I’d rather make less money and have fewer headaches and work hours, then make 2-3x as much working longer hours and seeing my family less.

When buying a business all of the above should be considered. What type of lifestyle do you want to live? Are you comfortable out-sourcing to contractors? At what point does the work become work and no longer a goal oriented project?

Buying a business is not just buying a job. Rarely does a buyer want to keep revenues flat. Small goal oriented and risk averse growth can still pay huge dividends while keeping the “lifestyle” in check. And when it comes time to sell the same business in 3-5 years with revenues from multiple sources…the more valuable the business will be to a broader base of buyers.

Before making a move I’d take a hard look at 1) how Google has been playing with their SERPs for the past 12 months, removing the right column ads, placing a 4-pack of ads at the top of the SERPs – effectively pushing organic results “below the fold”; 2) organic traffic data/ trends for the business for the past 24 months, taking a hard look at link profiles (paid links, content placement, etc) for driving “free” visitors; 3) PPC bidding trends (keyword data and costs); 4) the need and costs of rebuilding a site to adapt to an increasingly mobile world; 5) the emergence of “systems/platforms” that are reducing the costs of entry of competitors; 6) emergence of competitors in the space; and more. I can see how owners are looking to take advantage of those looking to build “work at home” income streams, including many who either have been laid off or a looking for a “solution” to their need for a retirement income. A quick search on Google also popped up a few articles illuminating the opportunities for sellers, such as this from Entrepreneur.com in January 20 of this year. https://www.entrepreneur.com/article/269763

Great article Mark! One potential risk/reason for sale with some young Amazon-only companies is having material differences between their “paper profits” and their cash flow they have been able to extract from the business to date. The reason is usually a reasonable one – they have been growing quickly and plowing the profits back into funding inventory and self-financing the growth and now they may want to take some money off the table. Challenge then becomes the pricing multiple (i.e. a reasonable multiple on a “paper profit” basis could be much higher on a “cash flow” basis)

Good article, when I’ve inquired about Amazon businesses being sold they told me no. So a follow up article Id’ like to see is how to get permission or even contact the right person. Is it the seller. Also, be wary on any stock sale as that means you are assuming all past legal liabilities whether known or not.

The bottom line is that sellers don’t trust Amazon’s ranking for your business. One minute you can have great sales then the next they cut you off. People are selling while sales are good knowing that tomorrow they might be in the toilet

The reason is sellers don’t trust Amazon’s ranking for your

business. One minute you can have great sales then the next they cut you

off. People are selling while sales are good knowing that tomorrow they

might be in the toilet

As an Amazon seller involved in two separate $1M+ Amazon Seller accounts, my take is different:

#1 Amazon is EXTREMELY risky to Sellers. As someone else noted on these comments, your business can be gone in 1 day, literally. Sometimes, with no way of recovering it. A lot of the sellers out there (especially ones that signed up with the Amazon Selling Machine) are finally recognizing this and that years of hard work and an income source can evaporate in a day. They now understand this is not a reliable and predictable platform to base your entire business on. Hence they’re selling.

#2 Amazon has become increasingly more competitive for sellers both because they have raised their fba fees and because of the Amazing Selling Machine recruited 30,000+ new sellers with a specific private label approach. Profits for these type of sellers are under pressure. Another reason to sell.

#3 I concur with another writer here that Amazon should be viewed ONLY as a launch platform for products, and that unless there’s a wider channel strategy for sales including own e-commerce store, the risk factor remains very high (point #1).

#4 Additional risks with an Amazon-only business: 1) The customers are not yours. There are specific TOS that prohibits the seller to re-market to their own customers or contact them for anything other than customer service. 2) “Your” product listings are not really yours. They belong to Amazon who decides which sellers can in fact manage these listings, even if you are the one the created them. 3) As a result, there are such things as listing hijacking and other foul practices by other dishonest sellers.

#5 The Amazing Selling Machine sold the notion of “easy money” and didn’t teach participant much of internet marketing or how to grow the business on other channels. Some of these sellers are now finding the challenges in scaling their businesses beyond Amazon and realizing they have no skills to do so. Another reason for exit.

I would caution anyone looking at an Amazon business to consider the serious risks above. I would also caution any business broker to ensure prospective buyers are aware of these risks. I can see some law suits launched when a recent Buyer has their Amazon account shut down (in many cases for NO GOOD REASON) after just spending their life savings on acquiring the business. And finally, I’ve seen these businesses (Amazon-only sales) valued at 2-3 X EBITDA which to me is outrageous given the risks involved.

Great advice! Thanks for that!

Man oh man! Good heads up from a REAL Amazon seller!

Regarding Amazon’s terms of service stance on transferring Amazon FBA businesses to new ownership, Quietlight posted an article in late 2015 that covered this. The article then posted an addendum in February 2016 regarding the change in TOS on this topic. I’m not sure why Mark isn’t linking to this informative article which was written by James Thompson, former business head of amazonservices.com…

https://quietlight.com/buying-tips/amazon-fba-accounts

(scroll down the page to the February 2016 addendum)

[quote from article]

“Until late 2015, Amazon’s Terms of Services indicated that an Amazon seller account was not allowed to be transferred to a new owner (as Amazon did not want one seller’s sales history, feedback and product reviews to be transferred to a new owner that may not operate at the same performance level as the previous owner). However, at some point in late 2015, Amazon changed its Terms of Service, and now seller accounts are allowed to be openly sold/transferred across owners. Amazon now provides specific directions on how to make the following necessary changes to ensure the new owner’s credentials apply to the seller account (use the “Settings” tab on the right-hand side of the main page of Seller Central)..”

While I’m not countering the potential downsides of buying into a one-channel Amazon business and all that that entails, it would be a safe assumption that a big reason for the growing popularity of Amz FBA business sales has to do with Amazon’s TOS now explicitly approving the sale of Amazon seller accounts. When I was reviewing Amazon FBA business in early 2015, the potential issue of account transference was pretty much a non-starter for me given the multiples that were being asked for these businesses.

Maybe somebody knows, where I can buy successful Amazon Account?

Nathalie,

Check out our current listings here: https://quietlight.com/listings/