Topics:

Never Miss a Beat - Get Updates Direct to Your Inbox

FILTER:

Playing dumb with your sales tax? It’ll cost you—big time

By Quiet Light

It’s a topic that puts a pit in your stomach: sales tax. Nobody wants to think about the confusing labyrinth of Amazon sales tax, but it has big implications for your business. If you want to buy or sell your business online, you need to get square with Uncle Sam first. But don’t worry. Diane Yetter from the Sales Tax Institute is here to expel misinformation and help you get on the straight and narrow.

It all starts with a little thing called a nexus

The three nexuses that matter to you

Affiliate payments and the nexus

Loosy goosy laws and finding the truth

The magic of acquisition and sales tax

Understanding your sales tax risk

The big, bad penalties of getting your sales tax wrong

Our good friend Benjamin Franklin once said, “In this world nothing can be said to be certain, except death and taxes.”

We talk about taxes like they’re a black and white fact of life, but it’s a complicated story in the digital age.

With more and more entrepreneurs selling their wares online, taxes are a messy, horrible gray area.

Sales tax in particular is so ugly to deal with that many entrepreneurs … don’t deal with them.

They bury their heads in the sand, hoping forgiveness will be better than asking for permission.

We’ve got bad news, folks: the tax man is coming for you, whether you’re ready or not. Time to get your head out of the sand.

Quiet Light had the chance to sit down with sales tax consultant Diane Yetter to chat about all the ins and outs of sales taxes—both for infopreneurs and FBA product businesses.

Diane’s been around the block when it comes to sales Amazon sales tax. She’s the founder of Yetter Tax and the Sales Tax Institute, a sales tax consulting company for businesses.

If you have no clue what’s going on with your sales tax (and we don’t blame you there), the Sales Tax Institute has tons of tools to help you learn how to deal with sales tax for your situation.

Listen to the Source of this Post:

This blog post is based on a podcast episode that we recently recorded. Listen to the full episode here:Ignorance isn’t bliss

Playing dumb with Amazon sales tax is no joke. In the words of tax pro Diane, getting your taxes wrong “Could earn you an orange jumpsuit.”

Yikes.

Learn the ins and outs of sales tax so Uncle Sam won’t take you to the cleaners.

If you plan to sell your business online or buy a business, you’ll need to make sure the sales taxes are square before you even think about a business transaction.

It all starts with a little thing called a nexus

The issue with Amazon sales taxes is that the law is trying to catch up with how people do business in the modern world.

That means there are plenty of gray areas and loopholes. Do a quick Google search and you’ll find downright contradictory information about whether you owe and where you owe.

Most sales tax laws look to see if you have a nexus to determine whether you owe sales tax.

“Nexus” means that you have a taxable presence in a state. Now, what counts as a “taxable presence” is up for debate in many states, especially in the age of online shopping.

If you want to sell your business online, you need to know if your business has a nexus and where.

If you do have a nexus, you need to get square on your sales tax before selling your business.

As a buyer, you also want to make sure that the business you’re buying is up to date on Amazon sales tax if it has a nexus. This limits your liability moving forward.

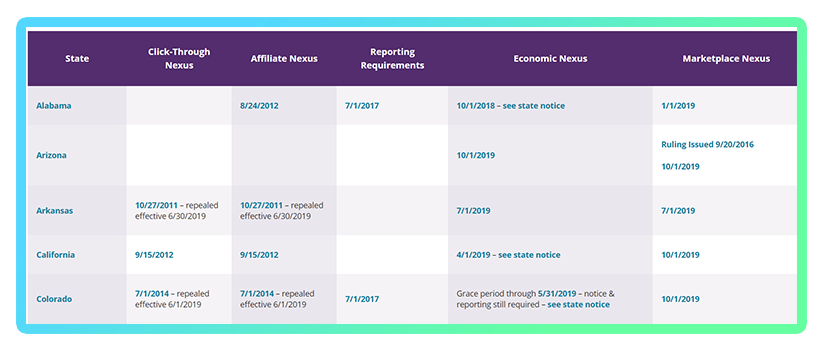

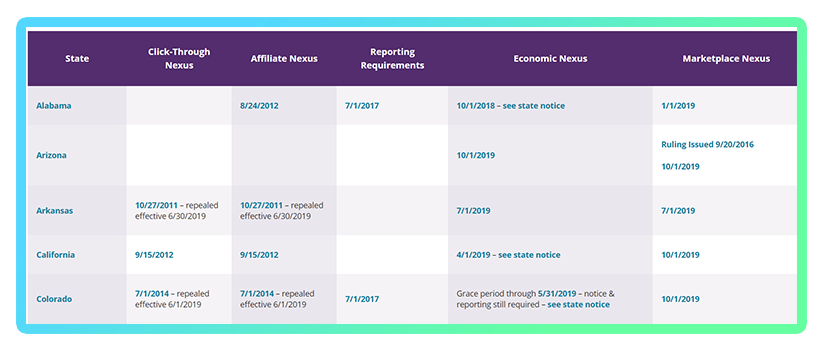

There are different types of nexuses, too. In our chat with Diane, she identified three nexuses that matter for digital entrepreneurs.

The three nexuses that matter to you

Physical nexus

You have a physical nexus if you have property or inventory in a state.

So if you do Amazon FBA, you have a nexus wherever your products are stored.

You also have a physical nexus if you have a store location.

Economic nexus

Physical nexus used to be the yardstick that the lawman used to determine if you owed sales taxes.

But businesses are more complicated today. That’s why you don’t have to set foot in a state to have a nexus there.

Every state sets its own threshold for economic nexus, but it means that you make enough sales to have an impact on the state’s economy.

Crafty lawmakers, eh?

Marketplace nexus

Do you make a living selling Amazon FBA? In some states, you might have a marketplace nexus and owe Amazon sales tax.

But don’t freak out. A marketplace nexus is actually a good thing.

“If you’re selling on a marketplace, there are less requirements that you need to worry about. That’s because the actual tax calculation is going to be handled by the marketplace,” Diane says.

A marketplace nexus puts the responsibility of collecting sales tax on a marketplace where you’re selling products.

So, if you only sell your products on Amazon, the responsibility would be on Amazon to pay taxes with a marketplace nexus, not you.

Now that we’ve squared away the terminology, let’s dive into the murky but important world of sales tax.

It’s pants-on-fire important for you to have a basic grasp of sales tax, whether you want to buy or sell your business online.

Fortunately, superwoman Diane from the Sales Tax Institute has the deets to help you stay compliant.

Affiliate payments and the nexus

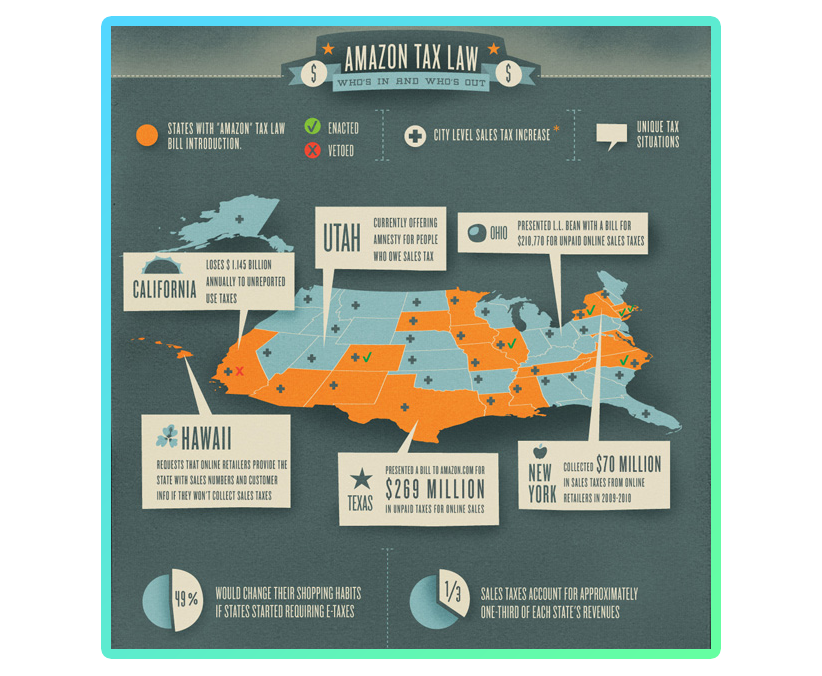

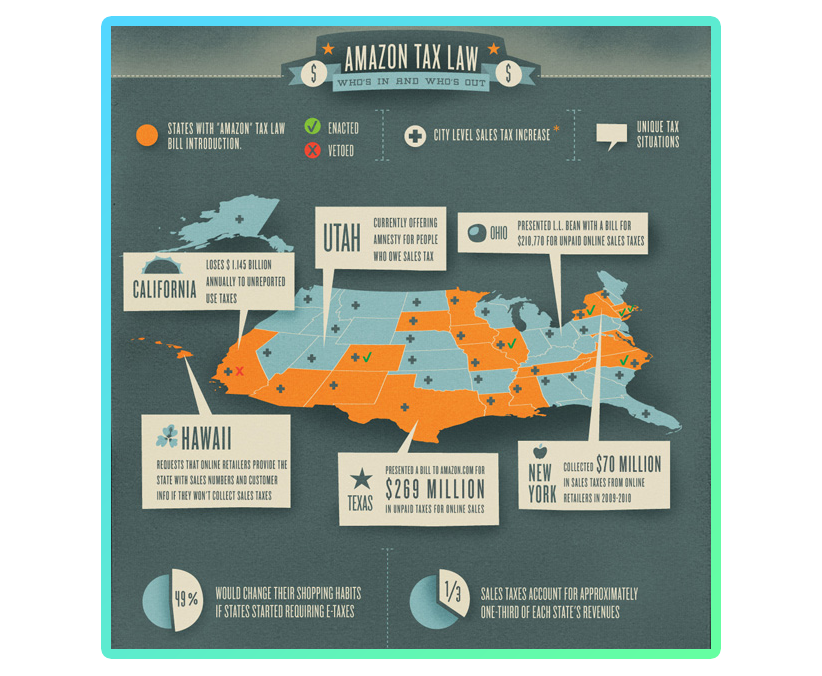

It was 2008 and Amazon had a teensy problem.

Amazon sold books online. People could use Amazon’s referral links to drive traffic to Amazon. Amazon would return the favor by giving affiliates a percentage of the sale.

No big deal, right?

The problem is that Amazon’s affiliate partnerships set up a click-through nexus by doing this.

Coined the “Amazon Tax,” lawmakers said that even though Amazon was an out-of-state business, it had to pay taxes in states where people referred Amazon business.

Although Amazon is based in Seattle, it has to pay sales tax when its affiliates refer people in, say, New York. Of course, Amazon has to reach each state’s limit to have this nexus, which is usually $10,000.

If you pay affiliates to promote your products, be careful. You could have a nexus in other states, which means paying a boatload more taxes.

Wait, what?

Yeah, my eyes are crossing, too. Let’s break it down.

If you have a physical presence in a state, you owe sales tax no matter what. That includes storing products in places like Amazon warehouses.

The Amazon sales tax refers to people who don’t have a physical presence and don’t sell physical products.

According to the Amazon sales tax, the person who owns the product pays the tax. So don’t worry; you don’t need to pay sales tax on your Amazon affiliate earnings.

However, if you’re running your own affiliate program, you’re the seller. That means you need to be paying sales taxes on that referred business.

Loosy goosy laws and finding the truth

Fortunately, the click-through nexus confusion could be cleared up soon enough.

The problem is that we have conflicting laws on the books that make it super hard to know where you need to cut a check.

The first problem was the Commerce Clause in the Constitution.

The Constitution was written to be vague enough to change, but it’s this willy nilly phrasing that confused everyone.

The Commerce Clause says that states can’t impose sales tax on out of state sellers, unless that out of state seller has a substantial presence in the state.

“Substantial presence” is, like you’ve probably guessed, up for debate.

IMAGE SUGGESTION: https://www.shutterstock.com/image-photo/gavel-on-laptop-computer-keyboard-concept-1043538001

The Quill case and National Bellas Hess Case clarified the Commerce Clause, saying companies need a substantial physical presence to owe sales tax.

With the physical requirement, digital brands could say, “I don’t have a physical presence in Iowa, so that means I’m not paying Iowa sales tax.”

This was a short-lived victory for content sites.

Wayfair v. South Dakota

With the mess of click-through and physical nexuses, a court case with the company Wayfair gives us a lot of clarity.

(Thank god.)

On June 21, 2018, the Supreme Court ruled that a physical presence was no longer required for a state to impose sales tax on an out of state business.

So that means you didn’t need to have a warehouse or storefront to pay sales tax anymore, effectively closing the “physical” loophole from the pesky Quill decision.

So what’s the rule now?

If you already had a physical nexus like a storefront or warehouse, this ruling doesn’t really affect you.

But what if you don’t have a physical nexus?

According to Diane, if there is no physical nexus, you need to see if you have an economic nexus.

Every state has a threshold for what an economic nexus is. In the case of Wayfair in South Dakota, the limit is $100,000 of sales or more than 200 transactions.

P.S. All states except Florida have economic nexus laws on the books. Gotta love weird Florida!

The magic of acquisition and sales tax

How does all of this affect your business?

First of all, you shouldn’t ignore sales tax, especially if you’re buying a business.

Quiet Light’s clients often ask, “How long will this deal take?” Biz owners are in a hurry, but you have to understand that businesses are complex entities.

Well, if you don’t ask a seller about sales tax, the sales process will take a lot longer.

Hell, if you want to sell your business online, you could risk losing the sale entirely over unpaid sales tax.

Speed up the acquisition process and have more confidence in the business you’re buying—get your hands dirty with sales tax, folks!

Understanding your sales tax risk

While you should have a general understanding of the Amazon sales tax, Diane isn’t saying every business owner should do sales tax themselves.

After all, if you’re a marketer, would you do your own bookkeeping for a seven-figure site?

No way!

For something like sales tax, don’t try to DIY unless you’re a pro. There’s no margin for error, and an honest slip-up can cost you your company.

With that said, let’s dive into the taxes you may or may not owe to Uncle Sam.

Are you selling on a marketplace?

Good news! Depending on your state, you might not need to collect sales tax if you sell on Amazon, eBay, or other marketplace platforms.

Some states are moving the burden of sales tax remittance to platforms. That saves Amazon sellers a lot of time and worry. Phew.

Okay, so that’s the good news. There’s also bad news.

Are you selling on a marketplace and your own site?

Most Amazon sellers are selling on both Amazon and your own website. This makes things a little more complicated for sales taxes.

Because of course it does.

First of all, both your Amazon and website sales count towards your economic nexus for a state.

Let’s say your state’s economic nexus threshold is $100,000. That’s a total threshold, not a threshold by platform.

So if you earned $50,000 on Amazon and $50,000 on your site, that counts as an economic nexus.

Second, you become the “marketplace” when you sell products on your website. That means you’re responsible for sales tax in this situation.

But fear not! There’s a software for that.

If you’re using Shopify for your site, it comes with tons of integrations to automatically deal with sales tax for you.

Check your eCommerce platform to see if it has sales tax software built in. You might need to upgrade to access the sales tax software, but it’s worth it.

Oh, crap, I have a nexus after all. How do I remit sales tax?

It sucks to realize you owe taxes, but paying them is 100% the right thing to do.

When it comes to collecting and paying sales taxes, you have a few options.

You could always learn how to do taxes and send it off yourself.

This would take forever, be incredibly boring, and comes with the risk of errors (and audits).

Don’t do that to yourself.

Sell your business online faster by hiring an experienced bookkeeper.

You’ll need to know about sales taxes generally to manage your bookkeeper, but you can let them handle the daily minutiae of sales tax.

If Uncle Sam demands money from you, you can pay with a check or a payment plan.

Tax attorneys can fight to lower the amount you owe in court if you’re patient enough.

The big, bad penalties of getting your sales tax wrong

Entrepreneurs are wily and rebellious.

Reading about the ins and outs of sales tax might have you wondering, “Yeah, but what if I just stay quiet and don’t pay sales tax?”

Or worst of all, you collect sales tax and “forget” to submit it to the state.

Diane says this is the worst thing you could possibly do. “You need to make sure you’re remitting the tax you collect,” she says.

When it comes down to sales tax, ignorance is not bliss. Ignorance is hefty fines and even a jail cell.

So, will the government catch you?

That depends. In the event of an audit or customer complaint, you would be totally screwed.

That’s why it’s best to just pay your taxes like a good little American and be rebellious elsewhere.

The state isn’t stupid, either. They’re using data analytics and subpoenas to identify sellers that meet their nexus threshold.

Now, if you have an economic nexus (no physical presence), you have about a 20% risk of the state coming after you for sales tax.

But if you’re, for example, an FBA seller with inventory in the state, you definitely owe taxes.

And the risk is pretty damn high because the state already knows about you.

What about sales tax and acquisitions?

Buying a business is a scary but exciting adventure.

While you’re entrenched in gross revenue and logistics, don’t forget to look at your soon-to-be company’s sales tax records.

Can you imagine the headache of buying a business that should be paying taxes, only to find it hasn’t?

If you want to sell your business online, not being up to date on taxes can cause the deal to fall through altogether.

Let’s say you buy a business for $3 million.

As it turns out, the seller had an economic nexus and didn’t pay a dime of taxes while they owned the company.

What happens to you as a buyer?

It really sucks, but the state probably won’t go after the seller first. They’re coming after you, New Owner.

“Unless you’re bankrupt, they’re going to take money from you first,” Diane advises.

Even if you pierce an LLC, the state has provisions to go after the owners whether a business is closed or not.

Thanks to a confusing thing called “successor liabilities,” the state can and will come after you if your new company hasn’t paid taxes.

Now, sometimes the state will go after the previous owner. It really depends on the state and the situation.

Ideally, you would notice the sales tax issue during the business sale.

Most states require you to notify them when you’re buying or selling a business.

As a buyer, try to get your hands on a tax clearance certificate. This tells the state that, as a buyer, you’re in the clear for sales tax.

And if the company hasn’t registered sales tax with the state, the state can tell you how much you owe.

You can then ask for that amount to be deducted from the purchase price of the business to get square with the state.

Tying up sales tax loose ends

Sales tax isn’t the sexiest topic in the world.

But if you’re out to sell your business online or you’re growing a business you’ve purchased, you need to be aware of how tax laws affect you.

Tax laws are thankfully getting cleared up by the courts, which means that entrepreneurs need to prepare to pay up as the days of the digital Wild West end.

You could write a book series on the intricacies of sales tax, though.

That’s why Diane put together this badass resource for entrepreneurs who want to learn more about sales tax. Check out her list of tax software, a nexus state guide, and more.

Knowledge is power and ignorance could put you in the poorhouse.

Instead of burying your head in the sand, address sales tax head-on to build a better business.